What Warren Buffett's Biggest Investment Successes And Failures Teach Us

Table of Contents

Warren Buffett's Greatest Investment Successes: Analyzing the Winning Strategies

Buffett's legendary success stems from a disciplined approach built on long-term value investing, astute risk assessment, and a deep understanding of businesses. Let's examine some of his most prominent victories:

Coca-Cola Investment: A Case Study in Long-Term Value Investing

Buffett's investment in Coca-Cola stands as a textbook example of long-term investment strategy. Recognizing the enduring power of the Coca-Cola brand and its global reach, he began accumulating shares in 1988. This wasn't about short-term gains; it was about understanding the inherent value of a dominant player in a massive market.

- Investment Timeline: Began accumulating shares in 1988.

- Initial Investment Amount: Around $1 billion.

- Current Value (approximately): Billions (exact figures fluctuate with market conditions).

- Annualized Returns: Consistently high, significantly outpacing market averages.

- Key Factors Contributing to Success: Strong brand recognition, consistent profitability, global reach, and a disciplined, long-term investment approach. This illustrates the power of stock picking and understanding the fundamentals of value investing and leveraging compounding returns.

American Express: Capitalizing on Market Mispricing

The Salad Oil Scandal of 1963 presented a unique opportunity for Buffett to demonstrate his prowess in contrarian investing. While many fled from American Express, fearing widespread financial damage, Buffett saw an undervalued asset. He recognized the underlying strength of the company and the temporary nature of the market panic.

- Market Conditions at the Time of Investment: Panic following the Salad Oil Scandal.

- The Perceived Risk: High, leading many investors to sell.

- Buffett's Contrarian Approach: He bought when others were selling, capitalizing on fear.

- Eventual Success: American Express recovered, delivering significant returns for Buffett. This highlights how capitalizing on opportunities during market crises can yield high rewards for those with the courage and understanding to identify undervalued assets.

Berkshire Hathaway: The Power of Conglomerate Investing

Berkshire Hathaway itself is a testament to Buffett's success. His conglomerate investing strategy—acquiring diverse businesses and managing them effectively—has generated substantial wealth. The synergy between these diverse holdings is a key component of Berkshire's success.

- Key Acquisitions: Geico, Dairy Queen, See's Candies, and numerous others.

- Synergy Effects: Improved operational efficiency, cross-marketing opportunities, and reduced risk through diversification.

- Long-Term Growth Strategy: A focus on building sustainable, long-term value in each acquired business.

- Benefits of Diversification: Reduced portfolio risk through exposure to various sectors and industries. This is an example of operational excellence leading to long-term growth.

Warren Buffett's Notable Investment Failures: Learning from Mistakes

Even the Oracle of Omaha has experienced setbacks. Analyzing his mistakes offers crucial lessons for aspiring investors.

Dexter Shoe Company: The Dangers of Emotional Investing

Buffett's investment in Dexter Shoe Company serves as a cautionary tale about the pitfalls of emotional investing. Despite recognizing the declining prospects of the business, he held on for too long, clinging to past success and failing to objectively evaluate the situation.

- The Reasons for the Initial Investment: Long-standing relationship with the company's management.

- The Factors that Led to Failure: Ignoring clear signs of decline and failing to establish a decisive exit strategy.

- Lessons Learned about Emotional Decision-Making: The importance of objective evaluation, even with companies one has a personal connection to. This emphasizes the need for loss mitigation techniques.

Airline Investments: Misjudgment of Market Dynamics

Buffett's investments and subsequent divestments in airlines highlight the challenges of predicting market dynamics and adapting to unforeseen regulatory changes within complex industries.

- The Reasoning Behind the Initial Airline Investments: Attractive valuations based on perceived potential.

- Market Conditions that Contributed to Losses: Increased competition, fluctuating fuel prices, and unforeseen economic downturns.

- Subsequent Strategic Retreat: Illustrates the importance of adjusting strategies in response to changing industry landscapes. This highlights crucial risk management and industry analysis skills.

General Re: Overpaying for Acquisitions

The acquisition of General Re serves as a reminder that even seasoned investors can sometimes overpay for assets. This emphasizes the importance of rigorous due diligence in evaluating acquisition targets.

- Details of the Acquisition: The purchase price and the subsequent valuation adjustments.

- Potential Flaws in the Due Diligence Process: Possible underestimation of the risks and complexities of the target business.

- Impact on Berkshire Hathaway's Overall Performance: Although it did not cripple Berkshire Hathaway, it served as a reminder of the need for meticulous investment analysis. This highlights the importance of proper valuation and acquisition strategy.

Conclusion

Warren Buffett's journey, marked by both spectacular successes and valuable lessons learned from failures, reveals essential truths about successful investing. The key takeaways include the significance of long-term investment, conducting thorough due diligence, accurately assessing risk, and maintaining emotional detachment in decision-making. By understanding and applying these principles, derived from analyzing Warren Buffett's investment successes and failures, you can significantly improve your own investment strategies.

To truly master Warren Buffett's investment strategies, you must learn from both his triumphs and his missteps. By consistently applying Warren Buffett’s investment principles and understanding how to avoid common pitfalls like emotional investing, you’ll be well on your way to building a robust and thriving investment portfolio. Start applying these investment lessons today to achieve your financial goals.

Featured Posts

-

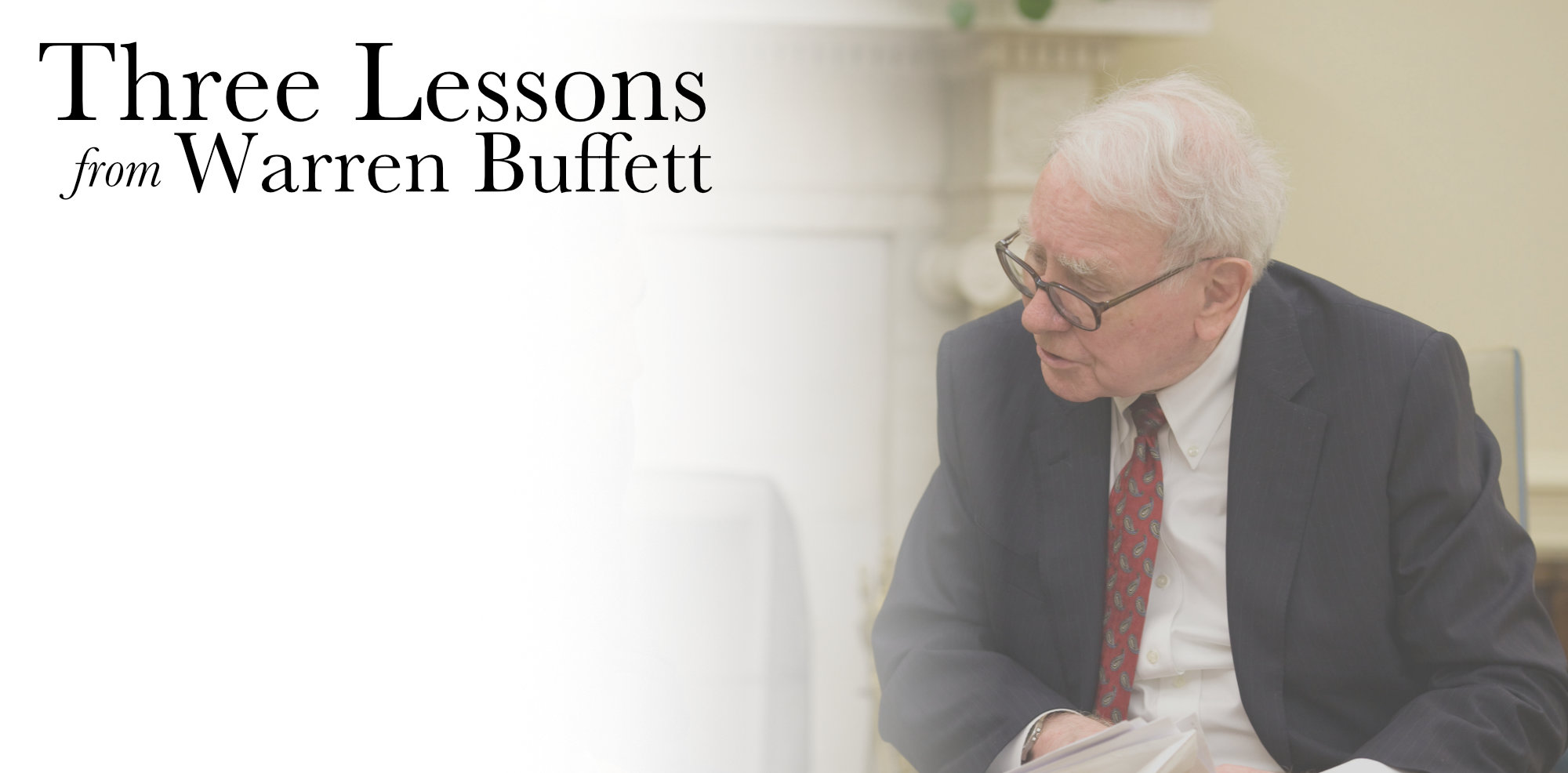

Navigating The Chinese Automotive Market Lessons From Bmw And Porsches Experiences

May 06, 2025

Navigating The Chinese Automotive Market Lessons From Bmw And Porsches Experiences

May 06, 2025 -

Google Faces Potential Breakup U S Demands Restructuring Of Advertising Business

May 06, 2025

Google Faces Potential Breakup U S Demands Restructuring Of Advertising Business

May 06, 2025 -

Budget Friendly Products You Ll Love

May 06, 2025

Budget Friendly Products You Ll Love

May 06, 2025 -

Patrick Schwarzenegger Addresses Nepotism Claims Following White Lotus Casting

May 06, 2025

Patrick Schwarzenegger Addresses Nepotism Claims Following White Lotus Casting

May 06, 2025 -

Middle Managers The Unsung Heroes Of Company Productivity And Employee Development

May 06, 2025

Middle Managers The Unsung Heroes Of Company Productivity And Employee Development

May 06, 2025

Latest Posts

-

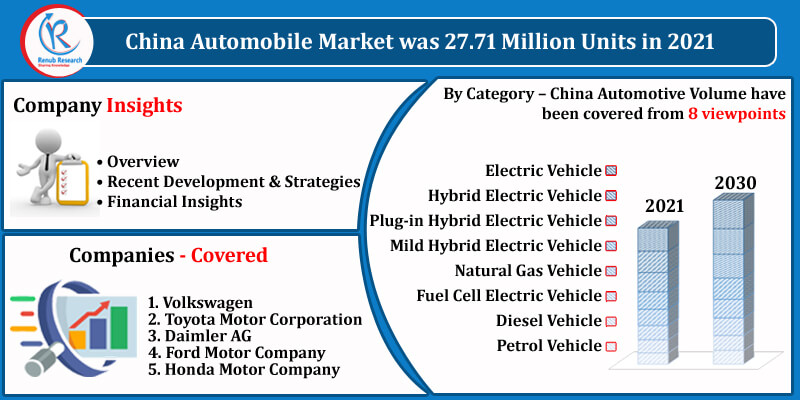

Superman Casting Patrick Schwarzeneggers Near Miss

May 06, 2025

Superman Casting Patrick Schwarzeneggers Near Miss

May 06, 2025 -

Schwarzeneggers Superman Audition What Went Wrong

May 06, 2025

Schwarzeneggers Superman Audition What Went Wrong

May 06, 2025 -

Analysis Copper Prices React To Chinas Us Trade Talk Consideration

May 06, 2025

Analysis Copper Prices React To Chinas Us Trade Talk Consideration

May 06, 2025 -

Us China Trade Uncertainty Drives Copper Market Volatility

May 06, 2025

Us China Trade Uncertainty Drives Copper Market Volatility

May 06, 2025 -

The Copper Market And The Us China Trade Dynamic

May 06, 2025

The Copper Market And The Us China Trade Dynamic

May 06, 2025