Decoding Market Signals: Understanding Professional Selling Pressure

Table of Contents

Identifying Indicators of Professional Selling Pressure

Professional selling pressure doesn't announce itself with a press release; it reveals itself through subtle yet significant market signals. By carefully analyzing these indicators, you can gain valuable insights into institutional investor behavior and market dynamics.

Volume Analysis

Unusually high trading volume, particularly during periods of declining prices, is a strong indicator of significant selling pressure. Volume spikes, exceeding typical trading volume for a given security, often signal that large institutional players are actively unloading their positions. This contrasts with periods of low volume, which might suggest a lack of significant selling pressure, or even consolidation.

- Analyze price-volume divergence: A classic sign is when the price of a stock declines despite increasing trading volume. This indicates that sellers are overpowering buyers, leading to a downward price movement fueled by professional selling pressure.

- Look for unusually large block trades: Reports of significant block trades (large transactions executed outside of the open market) appearing on exchanges can signify substantial institutional selling.

- Consider using technical indicators like On-Balance Volume (OBV): OBV is a cumulative indicator that assesses the strength of buying and selling pressure based on volume and price changes. A divergence between price and OBV can signal hidden professional selling pressure.

Unusual Price Action

Sudden and substantial price drops, especially those without clear news catalysts (like earnings reports or significant regulatory changes), can point to professional selling pressure. These drops often suggest a coordinated effort by large investors to offload their holdings.

- Understand the concept of "distribution" in price action: Distribution refers to the process by which large investors gradually sell their shares over a period, often disguised within seemingly normal price fluctuations.

- Examine candlestick patterns: Certain candlestick patterns, such as long bearish candles with high volume or multiple consecutive down days, can indicate significant selling pressure.

- Analyze the relationship between price movements and options trading activity: Unusual options activity, such as a large increase in put options (bets on price declines), can provide insights into the anticipation of professional selling pressure.

Analyzing Institutional Investor Activity

Accessing and interpreting data on institutional ownership and trading is crucial for understanding professional selling pressure. While it's not always easy, several resources can help.

- Scrutinize 13F filings (in the US): These quarterly filings disclose the equity holdings of institutional investment managers with over $100 million in assets under management. Analyzing changes in these holdings can reveal significant shifts in institutional positions.

- Utilize specialized financial data providers: Platforms like Bloomberg Terminal or Refinitiv Eikon offer in-depth data on institutional ownership, trading activity, and other relevant metrics.

- Acknowledge the limitations and potential biases in publicly available data: Remember that 13F filings are not real-time and represent snapshots of holdings, not ongoing trading activity. Data may also be subject to reporting lags.

Interpreting the Implications of Professional Selling Pressure

Identifying professional selling pressure is only half the battle; understanding its implications is equally important for effective stock market analysis and successful trading strategies.

Assessing Market Sentiment

Professional selling pressure can significantly impact overall market sentiment and investor confidence. Large-scale selling can trigger a cascade effect, leading to further declines as other investors react to the perceived negative signal.

- Analyze the impact on other related stocks or sectors: Selling pressure in one company can sometimes spread to related stocks or sectors, reflecting a broader market trend.

- Consider the broader macroeconomic context: Economic indicators, geopolitical events, and other macroeconomic factors can influence the impact of professional selling pressure.

- Monitor sentiment indicators such as the VIX (Volatility Index): Rising VIX levels often suggest increased fear and uncertainty in the market, which can be amplified by professional selling pressure.

Developing Trading Strategies

Understanding professional selling pressure can inform your trading strategies, but always prioritize responsible investing and risk management.

- Employ hedging strategies to mitigate potential losses: Hedging techniques, such as using options or shorting related securities, can help protect your portfolio from significant declines caused by professional selling pressure.

- Consider short-selling opportunities (with appropriate risk management): Short-selling can be profitable during periods of significant selling pressure, but it also carries significant risk.

- Always utilize stop-loss orders: Stop-loss orders automatically sell your shares when the price falls to a predetermined level, limiting potential losses.

Avoiding Common Pitfalls

Interpreting professional selling pressure is complex and requires caution. Several common mistakes can lead to poor investment decisions.

- Avoid over-reliance on single indicators: No single indicator provides a definitive picture; consider multiple factors for a more comprehensive analysis.

- Be mindful of the difficulty of predicting precise timing: While identifying potential selling pressure is valuable, predicting the exact timing of market moves is inherently challenging.

- Resist the urge of emotional decision-making: Panic selling or impulsive trading based on perceived professional selling pressure can lead to significant losses.

Mastering Market Signals: Utilizing Professional Selling Pressure Insights

In conclusion, recognizing professional selling pressure involves analyzing key indicators: high trading volume during price declines, unusual price action devoid of news catalysts, and shifts in institutional ownership revealed through resources like 13F filings. Understanding the implications of these signals – impacting market sentiment and influencing trading strategies – is critical. Responsible investing and robust risk management remain paramount. By diligently studying market signals and honing your understanding of professional selling pressure, you can enhance your ability to navigate market volatility and make more informed investment choices.

Featured Posts

-

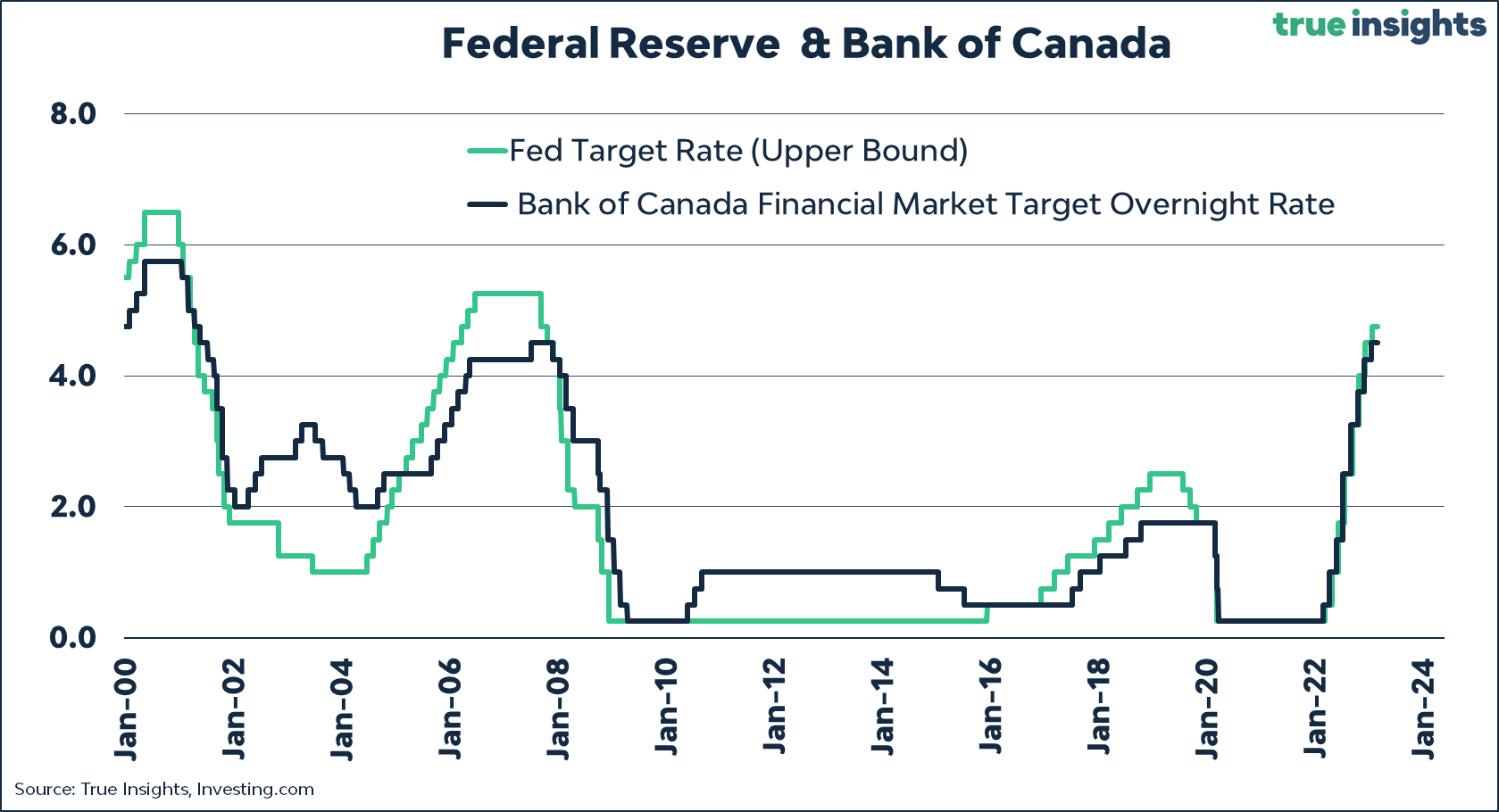

Retail Sales Slump Will The Bank Of Canada Reverse Course On Interest Rates

Apr 28, 2025

Retail Sales Slump Will The Bank Of Canada Reverse Course On Interest Rates

Apr 28, 2025 -

Walk Off Win For Pirates Against Yankees After Extra Innings

Apr 28, 2025

Walk Off Win For Pirates Against Yankees After Extra Innings

Apr 28, 2025 -

Chaos And Confusion Before Shooting Lapd Releases Videos Of Weezer Bassists Wife Incident

Apr 28, 2025

Chaos And Confusion Before Shooting Lapd Releases Videos Of Weezer Bassists Wife Incident

Apr 28, 2025 -

High Stock Market Valuations Why Bof A Remains Optimistic

Apr 28, 2025

High Stock Market Valuations Why Bof A Remains Optimistic

Apr 28, 2025 -

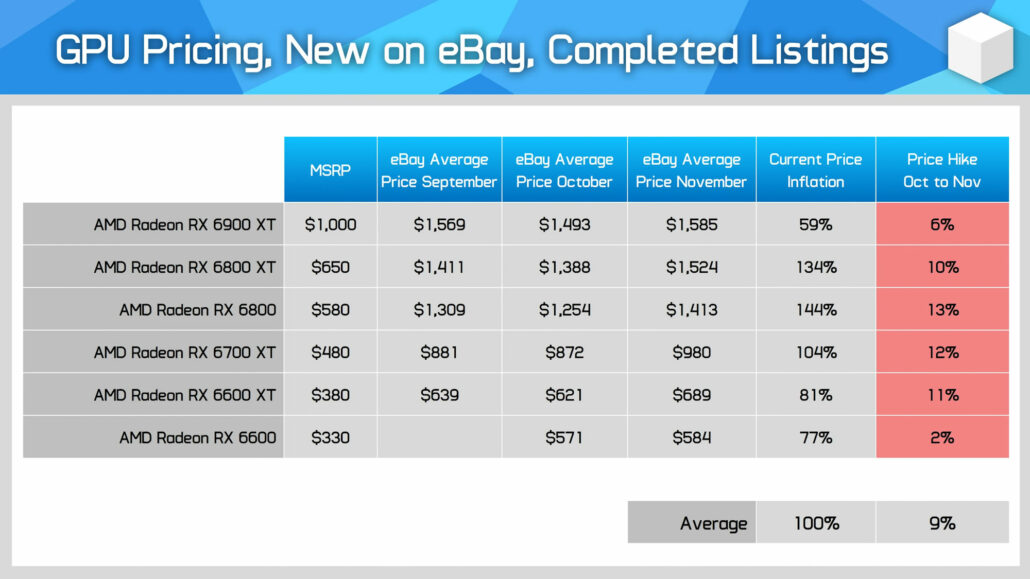

Rising Gpu Prices What To Expect In The Coming Months

Apr 28, 2025

Rising Gpu Prices What To Expect In The Coming Months

Apr 28, 2025

Latest Posts

-

Red Sox Lineup Adjustment Coras Game 1 Strategy

Apr 28, 2025

Red Sox Lineup Adjustment Coras Game 1 Strategy

Apr 28, 2025 -

Red Sox 2025 Espns Unexpected Outfield Forecast

Apr 28, 2025

Red Sox 2025 Espns Unexpected Outfield Forecast

Apr 28, 2025 -

Alex Cora Tweaks Red Sox Lineup For Doubleheader Opener

Apr 28, 2025

Alex Cora Tweaks Red Sox Lineup For Doubleheader Opener

Apr 28, 2025 -

Analyzing Espns Outfield Projection For The 2025 Red Sox

Apr 28, 2025

Analyzing Espns Outfield Projection For The 2025 Red Sox

Apr 28, 2025 -

Could Espns 2025 Red Sox Outfield Prediction Come True

Apr 28, 2025

Could Espns 2025 Red Sox Outfield Prediction Come True

Apr 28, 2025