David Gentile's 7-Year Sentence For GPB Capital Fraud

Table of Contents

The GPB Capital Fraud Scheme

GPB Capital Holdings, once a prominent private equity firm, orchestrated a complex web of deceit that ensnared numerous investors. Their fraudulent activities primarily revolved around misrepresenting investments in healthcare and automotive dealerships. This sophisticated investment fraud, which exhibited characteristics of a Ponzi scheme, involved the systematic misrepresentation of assets and financial performance to lure in unsuspecting investors seeking high returns. The scheme utilized sophisticated financial structures, including shell companies, to obscure the true financial state of the company and conceal the diversion of investor funds. This constitutes serious securities fraud and a significant financial crime.

- Misrepresentation of assets and financial performance: GPB Capital consistently overstated the value of its assets and profitability, painting a rosy picture that didn't reflect reality.

- Diversion of investor funds: Instead of investing funds as promised, a substantial portion was diverted for purposes unrelated to the stated investments.

- Lack of transparency and disclosure: Crucial information about the company's financial health and investment strategies was withheld from investors, deliberately obscuring the truth.

- Use of shell companies and complex financial structures: A complex network of shell companies and opaque financial structures was used to mask the fraudulent activities and make it difficult to trace the flow of funds.

David Gentile's Role in the GPB Capital Fraud

David Gentile, as a principal in GPB Capital, played a crucial role in orchestrating and perpetuating the fraudulent scheme. He was not merely a passive bystander; evidence presented during the prosecution highlighted his active participation and oversight of the fraudulent activities. Gentile's actions as a key figure in this conspiracy involved approving false statements, misleading investors about the nature of their investments, and actively obstructing justice during the subsequent investigation. He was considered a co-conspirator and a principal orchestrator of the entire operation.

- Oversight of fraudulent activities: Gentile held a position of authority that allowed him to oversee and direct the fraudulent actions of others within the company.

- Approval of false statements: He knowingly approved and disseminated false information to investors, contributing to the deceptive nature of the scheme.

- Misleading investors: Gentile actively participated in misleading investors about the true nature of their investments and the financial health of GPB Capital.

- Obstruction of justice: He engaged in actions designed to impede the investigation into the fraudulent activities.

The Sentencing and its Implications

David Gentile's 7-year sentence, along with substantial financial penalties and restitution orders, serves as a stark warning against engaging in such egregious financial crimes. The sentencing reflects the severity of the white-collar crime and adheres to established sentencing guidelines for similar offenses. The judge's reasoning highlighted the significant harm inflicted upon investors and the deliberate nature of the fraud. This case sets an important legal precedent, influencing future prosecutions of similar financial crimes and emphasizing the consequences of engaging in fraudulent investment activities.

- Length of sentence: The 7-year federal prison sentence reflects the magnitude of the fraud and the harm caused to victims.

- Fines and restitution ordered: Significant fines and restitution were ordered to compensate the victims for their losses.

- Impact on other individuals involved: The case has far-reaching implications for other individuals implicated in the GPB Capital fraud scheme.

- Legal precedents set: The case sets a significant legal precedent for future prosecutions of similar white-collar crimes.

Impact on Investors and the Financial Market

The GPB Capital fraud resulted in substantial investor losses, impacting numerous individuals who had entrusted their savings to the firm. The scale of the losses eroded investor confidence and created instability within the financial markets. This highlights the urgent need for stronger investor protection measures. Although recovery efforts are underway to recoup some of the lost funds, many investors have suffered irreparable financial damage. Regulatory changes are likely to be implemented in response to this case to prevent similar fraudulent activities in the future.

- Total amount of investor losses: The total amount of investor losses runs into hundreds of millions of dollars.

- Impact on investor trust: The fraud significantly damaged investor trust, highlighting the need for increased transparency and accountability.

- Regulatory changes prompted by the case: The case is likely to prompt regulatory changes aimed at improving investor protection and preventing future investment fraud.

- Lessons learned for investors: Investors need to conduct thorough due diligence and exercise caution when making investment decisions.

Conclusion

David Gentile's 7-year sentence for his role in the GPB Capital fraud underscores the severity of this significant investment fraud case. His actions, along with the actions of others involved, resulted in substantial financial losses for countless investors. Understanding GPB Capital fraud and similar schemes is crucial for protecting oneself from future investment scams. This landmark case highlights the importance of investor due diligence and emphasizes the need for stronger regulatory oversight to prevent similar fraudulent activities from occurring. To protect yourself, learn more about identifying and avoiding investment schemes like GPB Capital, and always consult with a qualified financial professional before making any investment decisions.

Featured Posts

-

The Stephen King Connection Comparing Stranger Things And It

May 10, 2025

The Stephen King Connection Comparing Stranger Things And It

May 10, 2025 -

X Blocks Jailed Turkish Mayors Facebook Page Opposition Protests Trigger Action

May 10, 2025

X Blocks Jailed Turkish Mayors Facebook Page Opposition Protests Trigger Action

May 10, 2025 -

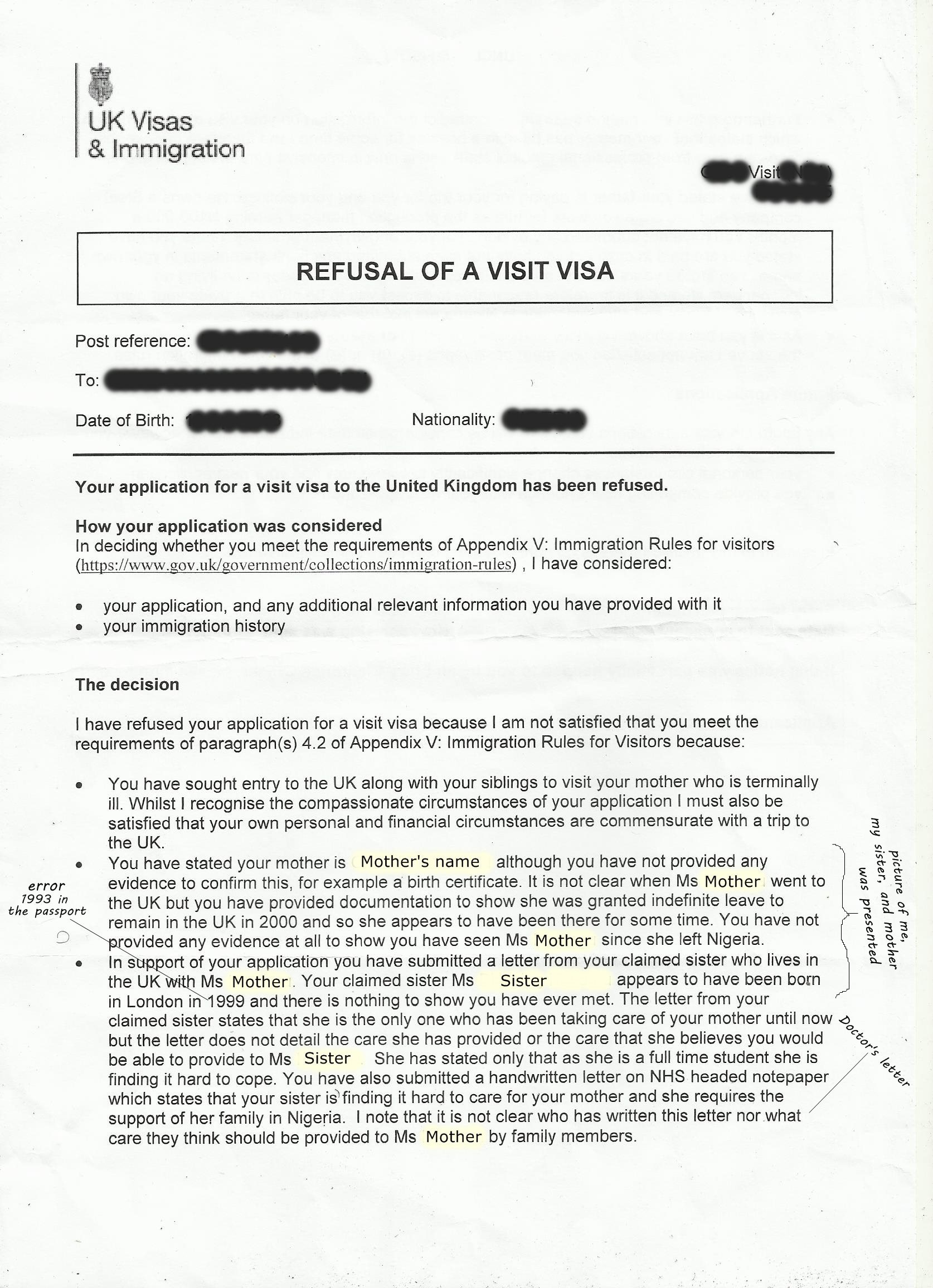

New Report Potential Changes To Uk Visa Application Process For Selected Countries

May 10, 2025

New Report Potential Changes To Uk Visa Application Process For Selected Countries

May 10, 2025 -

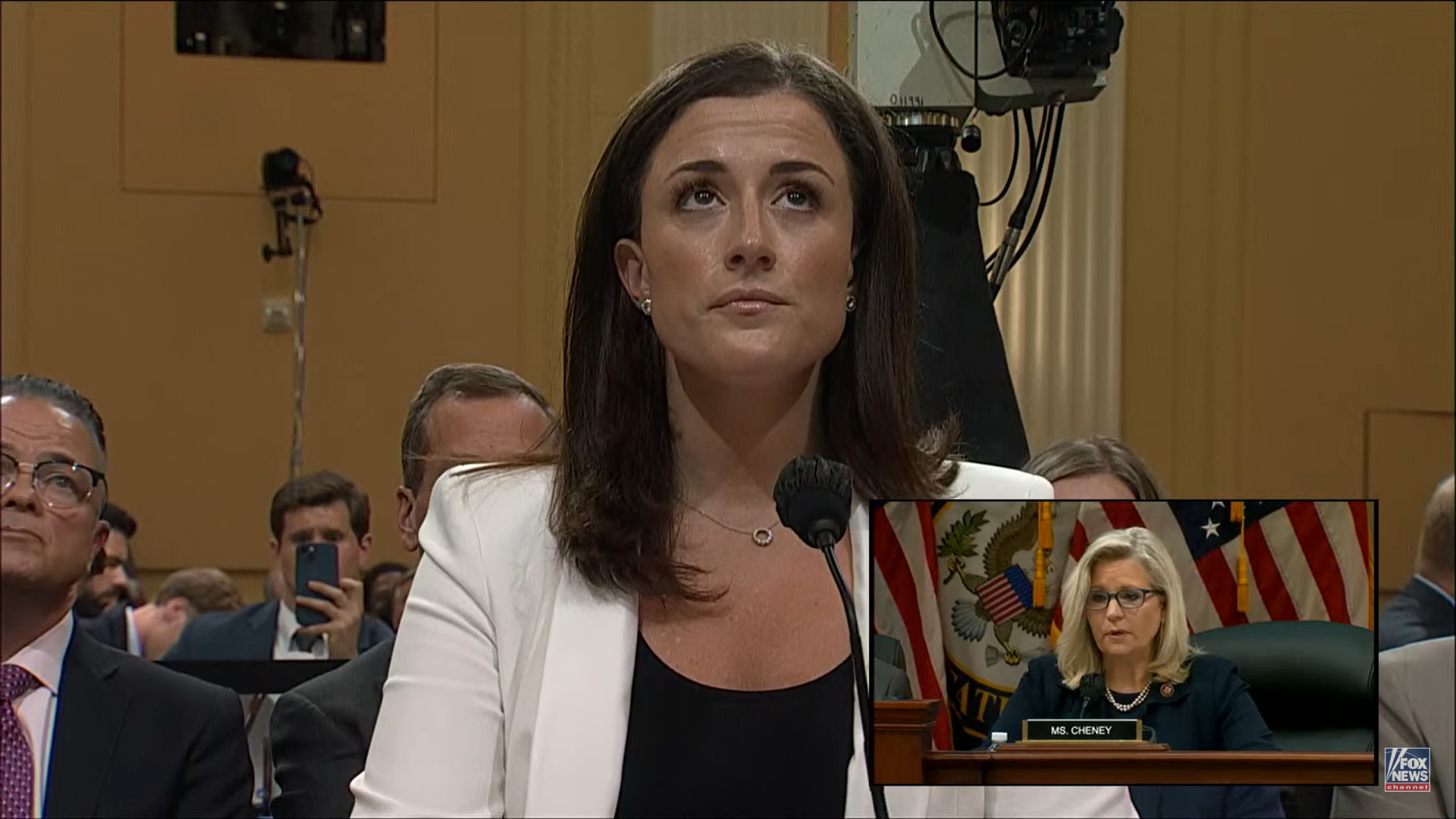

Cassidy Hutchinson Memoir A Deeper Look At The January 6th Attack

May 10, 2025

Cassidy Hutchinson Memoir A Deeper Look At The January 6th Attack

May 10, 2025 -

Did Ag Pam Bondi Possess The Jeffrey Epstein Client List An Examination Of Claims

May 10, 2025

Did Ag Pam Bondi Possess The Jeffrey Epstein Client List An Examination Of Claims

May 10, 2025