D-Wave Quantum (QBTS) Stock Plunge: Understanding Monday's Decline

Table of Contents

Analyzing the Market Conditions Surrounding the D-Wave Quantum (QBTS) Stock Drop

Several market factors contributed to the overall negative sentiment impacting D-Wave Quantum (QBTS) stock.

Broader Market Trends

Monday's market downturn wasn't isolated to D-Wave Quantum. The broader technology sector experienced a significant pullback, impacting many technology stocks.

- The Nasdaq Composite, a key indicator of the tech sector's performance, experienced a [insert percentage]% decline on Monday, reflecting a general negative investor sentiment towards growth stocks.

- Compared to similar quantum computing stocks and other technology companies focused on cutting-edge innovation, QBTS's performance mirrored the broader market trend, indicating a general risk-off sentiment rather than company-specific issues alone. This suggests that external forces played a significant role in the QBTS stock drop.

Investor Sentiment and Speculation

Investor sentiment and speculation played a crucial role in exacerbating the D-Wave Quantum (QBTS) stock plunge.

- There were reports of significant sell-offs driven by algorithmic trading and potentially triggered by the broader market downturn. This created a negative feedback loop, further depressing the QBTS stock price.

- Social media sentiment surrounding D-Wave Quantum displayed a surge in negative commentary following the price drop, fueled by speculation and concerns amplified by the broader market negativity. This amplified selling pressure contributed to the decline.

D-Wave Quantum (QBTS)-Specific Factors Contributing to the Decline

Beyond the broader market forces, several company-specific factors potentially contributed to the D-Wave Quantum (QBTS) stock decline.

Company News and Announcements

While no major negative news was released by D-Wave Quantum immediately before the stock drop, the absence of positive news in a volatile market can exacerbate existing negative sentiment.

- The absence of significant positive developments regarding partnerships, new product launches, or revenue updates in the lead-up to the decline could have fueled negative investor speculation.

- A lack of reassuring communication from D-Wave Quantum's management to address investor concerns in the face of a broader market downturn might have further fueled anxieties.

Financial Performance and Future Outlook

Concerns regarding D-Wave Quantum's financial performance and its long-term prospects in a competitive landscape might have contributed to the sell-off.

- While precise figures require detailed analysis of D-Wave Quantum's financial statements, any concerns about revenue growth, profitability, or increasing debt levels could have fueled investor anxieties. This is particularly relevant given the high-risk, high-reward nature of investments in the quantum computing sector.

- The competitive landscape within the burgeoning quantum computing industry is fierce. Any perception of D-Wave Quantum falling behind competitors in terms of technological advancements, market share, or securing strategic partnerships could trigger a negative reaction from investors.

Potential Long-Term Implications for D-Wave Quantum (QBTS) Stock

The D-Wave Quantum (QBTS) stock decline presents both challenges and opportunities for long-term investors.

Recovery and Growth Potential

Despite the recent plunge, several factors could drive future growth in D-Wave Quantum (QBTS) stock.

- Successful launches of new products or services, strategic partnerships, or positive developments in the broader quantum computing industry could act as catalysts for recovery and future growth. Significant advancements in the practical applications of quantum computing could greatly benefit the company.

- The long-term outlook for the quantum computing industry remains positive. As the technology matures and finds wider applications, companies like D-Wave Quantum are likely to benefit.

Risk Assessment for Investors

Investing in D-Wave Quantum (QBTS) stock carries significant risks, especially after this recent decline.

- The quantum computing sector is inherently volatile, with significant price fluctuations expected. Investors should be prepared for further price swings and potential losses.

- A thorough understanding of D-Wave Quantum's business model, financial performance, and competitive landscape is essential before investing. Due diligence is critical in this high-risk environment.

Conclusion

The D-Wave Quantum (QBTS) stock plunge on Monday highlights the volatile nature of the quantum computing market and the interconnectedness of market sentiment and company performance. Understanding the interplay of broader market conditions and company-specific factors is crucial for navigating future investment decisions regarding D-Wave Quantum (QBTS) stock. Before investing in D-Wave Quantum (QBTS) stock or any other quantum computing stock, conduct thorough research and consider seeking professional financial advice. Stay informed about future developments in D-Wave Quantum and the quantum computing sector to make well-informed decisions about your D-Wave Quantum (QBTS) stock portfolio.

Featured Posts

-

Quiz Loire Atlantique Histoire Gastronomie Culture

May 21, 2025

Quiz Loire Atlantique Histoire Gastronomie Culture

May 21, 2025 -

Big Bear Ai Stock Current Market Conditions And Investment Implications

May 21, 2025

Big Bear Ai Stock Current Market Conditions And Investment Implications

May 21, 2025 -

Los 5 Mejores Podcasts De Terror Misterio Y Suspenso

May 21, 2025

Los 5 Mejores Podcasts De Terror Misterio Y Suspenso

May 21, 2025 -

The Future Of Abc News Shows A Look At Recent Layoffs

May 21, 2025

The Future Of Abc News Shows A Look At Recent Layoffs

May 21, 2025 -

Good Morning America Staff Anxiety Rises Over Potential Layoffs

May 21, 2025

Good Morning America Staff Anxiety Rises Over Potential Layoffs

May 21, 2025

Latest Posts

-

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Latest

May 22, 2025

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Latest

May 22, 2025 -

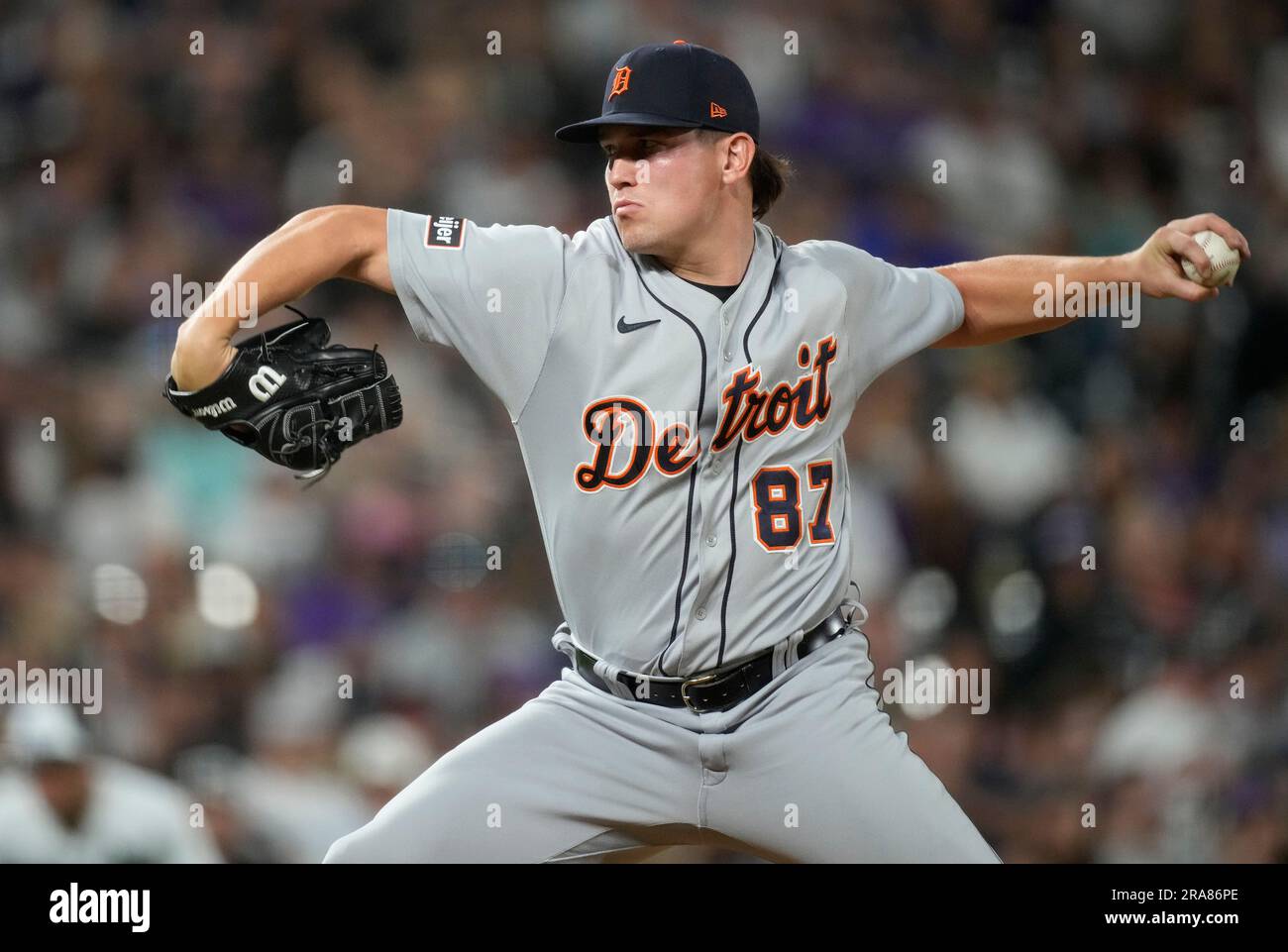

Colorado Rockies Vs Detroit Tigers 8 6 Upset

May 22, 2025

Colorado Rockies Vs Detroit Tigers 8 6 Upset

May 22, 2025 -

Racial Hatred Tweet Ex Tory Councillors Wife Faces Appeal Delay

May 22, 2025

Racial Hatred Tweet Ex Tory Councillors Wife Faces Appeal Delay

May 22, 2025 -

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Wait Continues

May 22, 2025

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Wait Continues

May 22, 2025 -

Racial Hatred Tweet Former Tory Councillors Wifes Appeal Delayed

May 22, 2025

Racial Hatred Tweet Former Tory Councillors Wifes Appeal Delayed

May 22, 2025