D-Wave Quantum (QBTS) Stock Performance In 2025: Factors Contributing To The Fall

Table of Contents

Technological Hurdles and Development Delays

The path to commercially viable quantum computers is fraught with challenges. Developing and scaling these systems presents significant hurdles impacting D-Wave's stock performance.

Quantum Computing's Inherent Complexities

Quantum computing, while promising, faces numerous obstacles. These complexities directly influence investor confidence and stock valuation.

- High error rates: Qubits, the fundamental units of quantum information, are highly susceptible to errors, leading to inaccurate calculations.

- Qubit instability: Maintaining the delicate quantum states of qubits is extremely difficult, limiting the length of computations.

- Scalability limitations: Building larger, more powerful quantum computers with thousands or millions of qubits remains a major technological challenge.

- Error correction codes: Developing effective error correction codes is crucial for reliable quantum computation, and this is an area of ongoing intensive research.

These technological limitations can hinder D-Wave's progress and impact investor confidence, potentially leading to a stock price decline. The inability to deliver on promised performance benchmarks could significantly affect market perception.

Competition in the Quantum Computing Landscape

D-Wave isn't alone in the quantum computing race. Intense competition from other companies significantly shapes the market and affects D-Wave's market share.

- IBM: IBM is a major player with its own quantum computing platforms and a strong focus on cloud-based access.

- Google: Google has made significant strides in developing superconducting quantum computers and boasts impressive qubit counts.

- IonQ: IonQ utilizes trapped ion technology, offering a different approach to quantum computing with potential advantages in terms of qubit coherence.

The success of these competitors in developing more powerful, stable, and scalable quantum computers could directly erode D-Wave's market position and negatively impact its stock price. Any significant breakthroughs from rivals would likely put downward pressure on QBTS.

Market Sentiment and Investor Expectations

The quantum computing sector has experienced periods of both exuberance and disillusionment. Managing investor expectations and navigating economic headwinds are crucial for D-Wave's success.

Over-inflated Expectations and Reality Gap

Initial hype surrounding quantum computing has led to unrealistic expectations regarding its near-term capabilities.

- Promised capabilities vs. current limitations: The gap between the potential of quantum computing and its current limitations is significant. Many applications remain years away from practical realization.

- Investor disillusionment: As the reality of the technological challenges becomes apparent, investors may become disillusioned, leading to a sell-off.

This discrepancy between promise and reality can fuel a correction in market sentiment, contributing to a decline in D-Wave's stock valuation.

Economic Downturn and Risk Aversion

A broader economic downturn can significantly impact investor behavior, particularly for high-risk investments like quantum computing stocks.

- Shift towards less risky investments: During economic uncertainty, investors often move their capital to safer assets, such as bonds or government securities.

- Reduced appetite for high-growth stocks: High-growth, high-risk companies, such as D-Wave, are often the first to suffer during economic downturns.

This risk aversion could cause a significant sell-off in D-Wave's stock, even if the company's underlying technology continues to advance.

Financial Performance and Business Strategy

D-Wave's financial health and strategic partnerships are critical factors affecting its stock performance.

Revenue Generation and Profitability Challenges

Quantum computing is a capital-intensive industry, and generating significant revenue and achieving profitability remains a challenge for D-Wave.

- High research and development costs: The costs associated with researching, developing, and maintaining quantum computing infrastructure are substantial.

- Limited revenue streams: Finding commercially viable applications for quantum computing technology is an ongoing challenge.

The lack of significant revenue streams and the high costs associated with operation could negatively impact investor confidence and lead to a stock price decline.

Strategic Partnerships and Business Development

Strategic collaborations can significantly influence D-Wave's success, and setbacks in these partnerships could have negative repercussions.

- Success or failure of collaborations: The success of D-Wave's partnerships with other companies will be key to its market adoption and overall growth.

- Impact of partnership setbacks: Failed partnerships or delays in collaboration could negatively impact investor perception and lower the stock price.

Successful partnerships are crucial for D-Wave's growth, and any failures could significantly impact investor confidence and the stock's performance.

Conclusion: Understanding the D-Wave Quantum (QBTS) Stock Dip in 2025

The hypothetical decline in D-Wave Quantum (QBTS) stock in 2025 could be attributed to a combination of factors: persistent technological challenges hindering development and scalability, intense competition from established players in the quantum computing field, shifting investor sentiment due to the gap between initial hype and current realities, and a broader economic downturn driving risk aversion. D-Wave's financial performance and the success of its strategic partnerships are equally critical.

Key Takeaways: The interplay between these factors creates a complex environment where a seemingly minor setback in one area could trigger a ripple effect, negatively impacting the overall stock performance.

Call to Action: Understanding the potential risks associated with investing in D-Wave Quantum (QBTS) stock requires thorough research and continuous monitoring of the quantum computing landscape. Stay informed about D-Wave's technological advancements, competitive positioning, financial performance, and strategic partnerships. Conduct in-depth analysis before making any investment decisions. Continue researching D-Wave Quantum (QBTS) stock, exploring further resources on quantum computing investment analysis, and making informed decisions based on a comprehensive understanding of the market dynamics.

Featured Posts

-

Predicting Rain Latest Updates On Shower And Storm Timing

May 20, 2025

Predicting Rain Latest Updates On Shower And Storm Timing

May 20, 2025 -

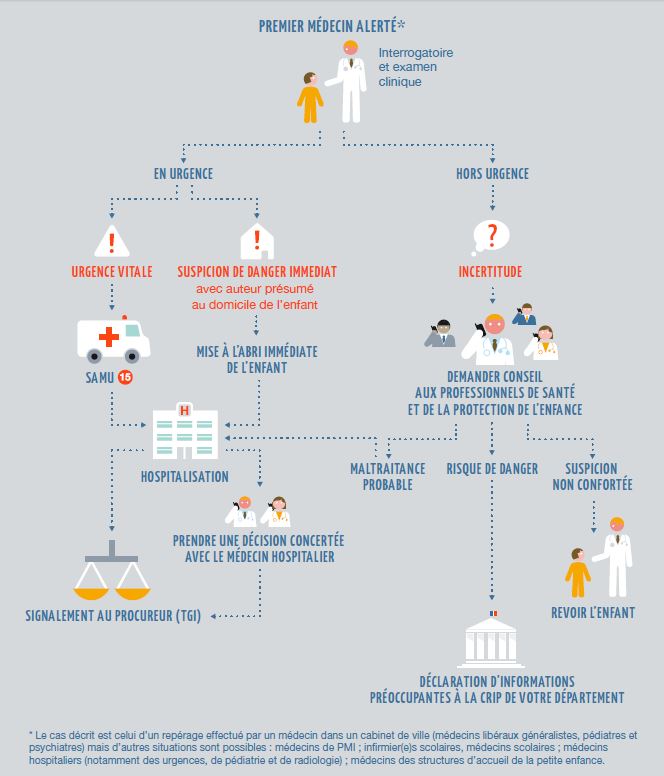

Fieldview Care Home Le Point Sur L Enquete Concernant Les Cas De Maltraitance Et D Abus Sexuels

May 20, 2025

Fieldview Care Home Le Point Sur L Enquete Concernant Les Cas De Maltraitance Et D Abus Sexuels

May 20, 2025 -

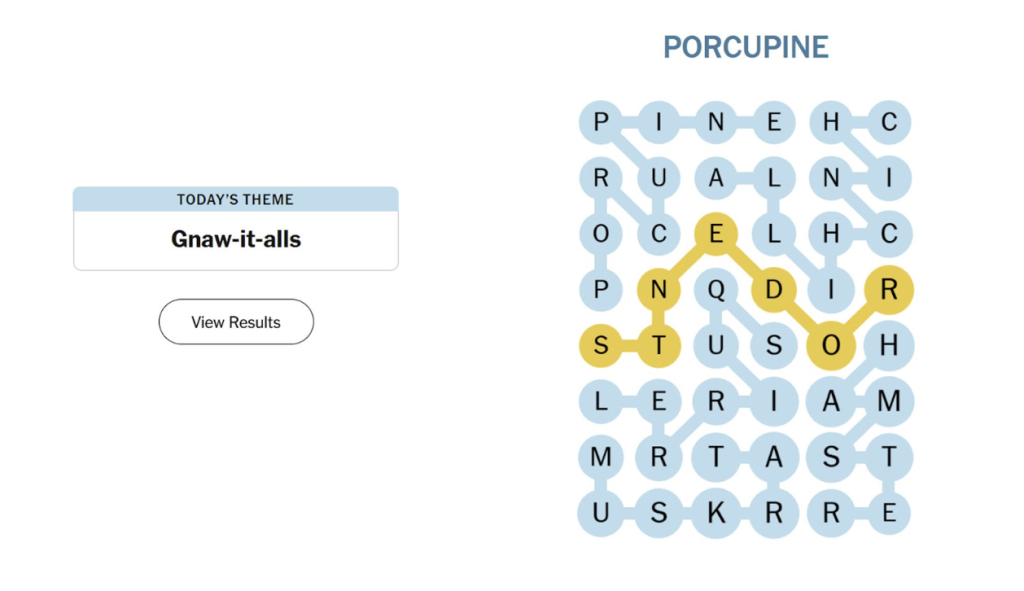

Marvel The Avengers Crossword Clue Nyt Mini Crossword Answers May 1st

May 20, 2025

Marvel The Avengers Crossword Clue Nyt Mini Crossword Answers May 1st

May 20, 2025 -

Wayne Gretzky Fast Facts And Career Highlights

May 20, 2025

Wayne Gretzky Fast Facts And Career Highlights

May 20, 2025 -

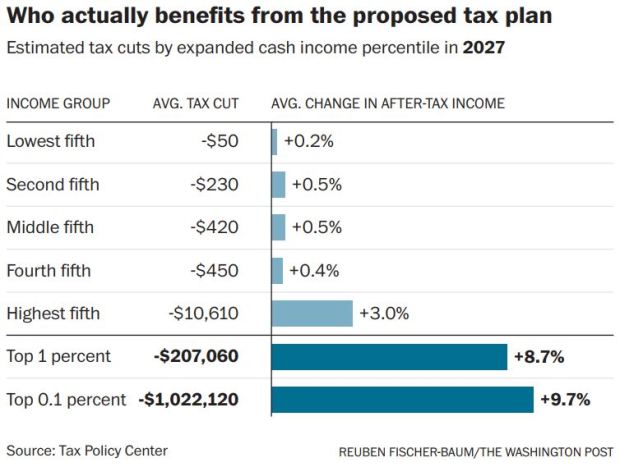

Analyzing The Gop Tax Plan The Truth About Deficit Reduction

May 20, 2025

Analyzing The Gop Tax Plan The Truth About Deficit Reduction

May 20, 2025

Latest Posts

-

Wwe Speculation Ronda Rouseys Future Logan Pauls Next Move Jey Uso And Big Es Engagement

May 20, 2025

Wwe Speculation Ronda Rouseys Future Logan Pauls Next Move Jey Uso And Big Es Engagement

May 20, 2025 -

Ronda Rousey Logan Paul Jey Uso And Big E The Latest Wwe Rumors

May 20, 2025

Ronda Rousey Logan Paul Jey Uso And Big E The Latest Wwe Rumors

May 20, 2025 -

Wwe Rumors Ronda Rousey Logan Paul Jey Uso And Big Es Engagement

May 20, 2025

Wwe Rumors Ronda Rousey Logan Paul Jey Uso And Big Es Engagement

May 20, 2025 -

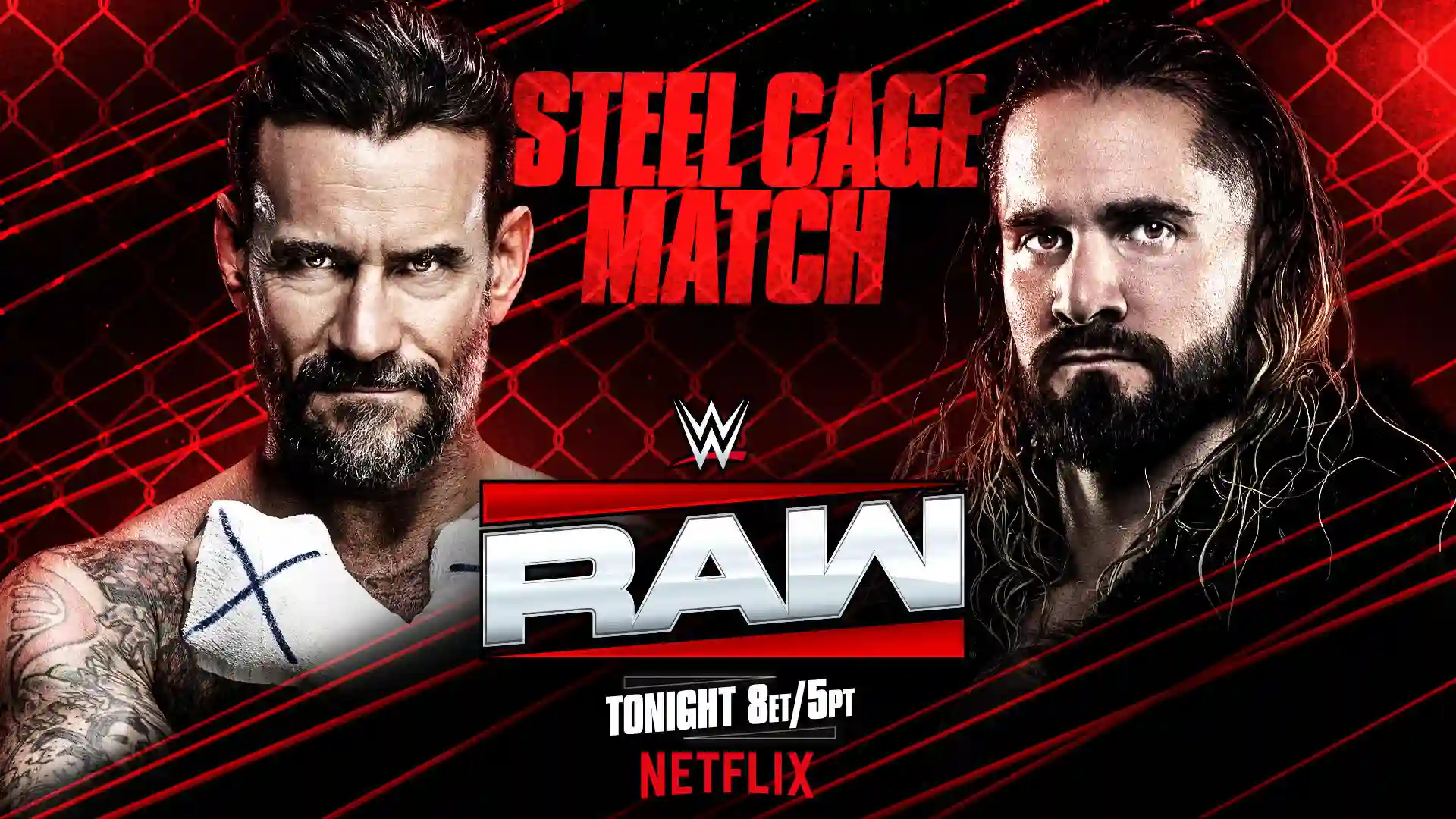

Wwe Raw Results And Grades May 19 2025

May 20, 2025

Wwe Raw Results And Grades May 19 2025

May 20, 2025 -

Tyler Bate And Pete Dunne Reunite On Wwe Raw

May 20, 2025

Tyler Bate And Pete Dunne Reunite On Wwe Raw

May 20, 2025