Analyzing The GOP Tax Plan: The Truth About Deficit Reduction

Table of Contents

Projected Revenue Impacts of the GOP Tax Plan

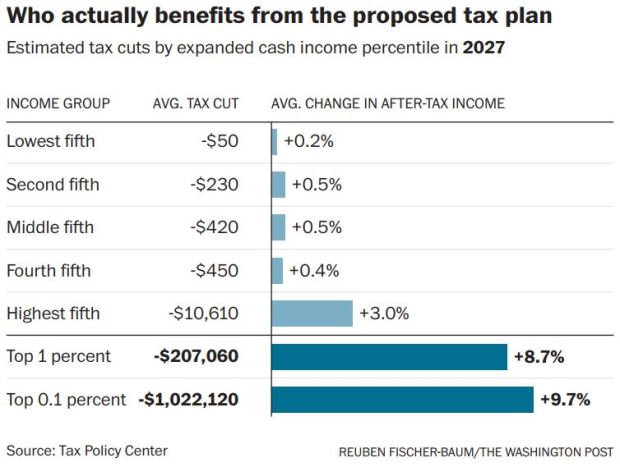

The GOP tax plan's core involved significant tax cuts for corporations and high-income earners. Understanding the projected revenue impacts requires careful analysis of various sources. The Congressional Budget Office (CBO) and the Tax Policy Center (TPC), for example, offer independent analyses, though their projections often differ due to varying methodologies.

- Tax cuts for corporations and high-income earners: These cuts significantly reduced corporate tax rates, leading to predictions of decreased revenue in the short term. Simultaneously, reductions in individual income tax rates and changes to brackets also affected revenue projections.

- Changes to individual income tax rates and brackets: The plan altered the tax brackets and rates, resulting in varied impacts across income groups. While some lower-income earners experienced minor tax relief, the largest benefits accrued to higher-income individuals and corporations.

- Impact on tax revenue projections over the short-term and long-term: Most projections showed a decrease in tax revenue in the short-term, followed by potentially higher revenues in the long-term, driven by anticipated economic growth stimulated by the tax cuts. However, the magnitude of this growth remains a point of contention.

- Potential economic growth spurred by the tax cuts (and counterarguments): Proponents argued the tax cuts would incentivize investment and job creation, leading to increased economic activity and ultimately higher tax revenues. Critics countered that this "trickle-down" effect is not guaranteed, and that the benefits would disproportionately favor the wealthy, leading to increased inequality and minimal impact on overall economic growth.

Spending Increases and Their Contribution to the Deficit

Analyzing the GOP tax plan's effect on the deficit requires considering not only revenue projections but also government spending. Increased spending can significantly offset any potential revenue gains from tax cuts, exacerbating the deficit.

- Analysis of the baseline budget and projections under the GOP tax plan: The CBO's baseline budget projections, which did not incorporate the tax plan, already showed a growing deficit. The addition of the tax cuts further widened the projected deficit, especially in the short-term.

- Impact of increased defense spending: The plan coincided with proposed increases in defense spending, adding another layer of complexity to deficit projections. Increased military expenditures further strained the budget.

- Potential effects on social programs and entitlement spending: While the GOP aimed to control spending in certain areas, the overall impact on social programs and entitlement spending remained unclear, with potential for cuts or freezes.

- The role of economic growth in offsetting increased spending: Proponents of the plan argued that the economic growth spurred by the tax cuts would offset the increased spending. However, this assumption is debatable and depends heavily on the actual rate of economic growth.

Dynamic Scoring vs. Static Scoring: Understanding the Discrepancies

Understanding the discrepancies in deficit projections requires understanding the methodologies used. The debate hinges on "dynamic scoring" versus "static scoring."

- Definition and explanation of static scoring: Static scoring assumes that tax cuts do not affect economic behavior. It simply calculates the direct impact of the tax changes on government revenue.

- Definition and explanation of dynamic scoring: Dynamic scoring incorporates the assumption that tax cuts stimulate economic activity, leading to increased tax revenues in the long run (although potentially reduced revenue in the short term). This method is more complex and involves numerous assumptions about economic behavior.

- Examples of how differing scoring methods yield different results: The choice of scoring method drastically influences the projected deficit. Dynamic scoring often yields more optimistic results, while static scoring paints a more pessimistic picture.

- Critical evaluation of the reliability of both methods: Both static and dynamic scoring methods have limitations and potential biases. The accuracy of dynamic scoring heavily depends on the reliability of the underlying economic assumptions.

Long-Term Economic Effects and Deficit Sustainability

The long-term consequences of the GOP tax plan are crucial to its overall assessment. Analyzing long-term economic effects on deficit sustainability is vital.

- Projections of national debt under different economic scenarios: Depending on economic growth, the national debt could increase dramatically or experience more moderate growth. Uncertainty regarding economic growth makes long-term projections highly speculative.

- Impact on interest rates and the cost of borrowing: Increased national debt could lead to higher interest rates, increasing the cost of borrowing for the government and potentially slowing economic growth.

- Analysis of long-term economic growth projections: The plan's long-term success hinges on its ability to stimulate sustainable economic growth. Disagreements exist on whether this growth will be sufficient to offset increased deficits.

- Assessment of intergenerational equity concerns: The potential for increased national debt raises concerns about the burden imposed on future generations, who will inherit a larger debt.

Conclusion: The Verdict on GOP Tax Plan and Deficit Reduction – A Call to Action

Analyzing the GOP tax plan's effect on deficit reduction is complex. While proponents highlight potential economic growth, opponents point to short-term revenue losses and increased spending. The choice of scoring method significantly impacts projections, with dynamic scoring offering a more optimistic—but arguably less reliable—view than static scoring. Ultimately, the long-term effects on the national debt and economic growth remain uncertain. It's crucial to stay informed, consult reputable sources like the CBO and TPC, and participate in discussions surrounding fiscal policy. Understanding the nuances of GOP Tax Plan Deficit Reduction is essential for informed civic engagement. Continue your research to form your own well-informed opinion on this vital aspect of our national economic policy.

Featured Posts

-

Jennifer Lawrence E O Misterio Do Segundo Filho Aparicao Recente Intriga Fas

May 20, 2025

Jennifer Lawrence E O Misterio Do Segundo Filho Aparicao Recente Intriga Fas

May 20, 2025 -

Mick Schumacher La Crisis Sentimental Del Piloto Y Su Aparicion En App De Citas

May 20, 2025

Mick Schumacher La Crisis Sentimental Del Piloto Y Su Aparicion En App De Citas

May 20, 2025 -

Hmrc To Implement Voice Recognition For Faster Call Handling

May 20, 2025

Hmrc To Implement Voice Recognition For Faster Call Handling

May 20, 2025 -

Complete Nyt Mini Crossword Solutions March 13 And Solving Tips

May 20, 2025

Complete Nyt Mini Crossword Solutions March 13 And Solving Tips

May 20, 2025 -

Zachary Cunhas New Role From Us Attorney To Private Practice

May 20, 2025

Zachary Cunhas New Role From Us Attorney To Private Practice

May 20, 2025

Latest Posts

-

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025 -

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025 -

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025 -

Quick Facts About Wayne Gretzky A Concise Biography

May 20, 2025

Quick Facts About Wayne Gretzky A Concise Biography

May 20, 2025 -

Wayne Gretzky Fast Facts Key Moments And Milestones In His Career

May 20, 2025

Wayne Gretzky Fast Facts Key Moments And Milestones In His Career

May 20, 2025