CoreWeave Stock Update: Recent News And Trends

Recent CoreWeave News and Announcements

H3: Recent Funding Rounds and Investments: CoreWeave has secured substantial funding, fueling its ambitious growth trajectory and strengthening its position in the competitive GPU cloud computing market. These investments signal strong investor confidence in CoreWeave's technology and future prospects.

- Series C Funding (Example): In [Month, Year], CoreWeave announced a [Dollar Amount] Series C funding round led by [Lead Investor], with participation from [Other Investors]. This significant injection of capital will allow CoreWeave to expand its infrastructure, enhance its services, and accelerate its market penetration.

- Strategic Partnerships: The company has also forged strategic partnerships with key players in the technology industry, providing access to new markets and technologies. These alliances will be crucial in driving further growth and potentially impacting the CoreWeave stock price positively. Examples include [Partner Name 1] and [Partner Name 2], collaborations focusing on [Specific area of collaboration].

H3: New Product Launches and Service Expansions: CoreWeave continuously innovates, expanding its product portfolio and service offerings to meet the evolving needs of its customers. These launches strengthen its competitive advantage and broaden its revenue streams.

- Enhanced GPU Instances: CoreWeave recently launched new, more powerful GPU instances, designed to handle the increasingly demanding workloads of AI and machine learning applications. These enhanced instances provide superior performance and scalability, attracting a wider range of clients.

- Specialized AI Solutions: The company has introduced specialized solutions tailored for specific AI applications, simplifying deployment and improving efficiency for developers and researchers. This targeted approach demonstrates a keen understanding of market demands.

H3: Key Partnerships and Collaborations: Strategic partnerships are vital for CoreWeave's success. By collaborating with industry leaders, CoreWeave expands its reach, enhances its technology, and gains access to valuable resources.

- [Partner Name]: A collaboration with [Partner Name] has facilitated seamless integration with [Partner's Technology/Platform], providing CoreWeave customers with greater flexibility and a broader range of options.

- [Partner Name]: Partnership with [Partner Name] expands CoreWeave’s geographic reach and access to new customer segments.

Analysis of Current Market Trends Impacting CoreWeave Stock

H3: The Growing Demand for GPU Computing: The demand for GPU computing power is experiencing unprecedented growth, fueled by the rapid advancement of artificial intelligence, machine learning, and other data-intensive applications. CoreWeave is ideally positioned to capitalize on this trend.

- Market Growth Statistics: According to [Source], the GPU computing market is projected to reach [Dollar Amount] by [Year], representing a [Percentage]% CAGR.

- CoreWeave's Competitive Advantage: CoreWeave's scalable infrastructure, advanced technology, and commitment to innovation place it at the forefront of this rapidly expanding market.

H3: Competition in the GPU Cloud Computing Market: While CoreWeave operates in a competitive market, its unique strengths and strategic initiatives provide a competitive edge. Major players include [Competitor 1], [Competitor 2], and [Competitor 3], each with its strengths and weaknesses.

- Competitive Analysis: [Competitor 1] focuses on [Area of Focus], while [Competitor 2] excels in [Area of Focus]. CoreWeave differentiates itself through [CoreWeave's Differentiator].

- Market Share: While precise market share data is often proprietary, CoreWeave is gaining significant traction, particularly in the [Specific Niche] segment.

H3: Impact of Macroeconomic Factors: Broader economic conditions, such as inflation and interest rates, can influence investor sentiment and impact CoreWeave's stock price.

- Inflationary Pressures: Increased inflation can affect operating costs and potentially reduce profit margins, impacting investor confidence.

- Interest Rate Hikes: Rising interest rates can make borrowing more expensive, potentially hindering CoreWeave's expansion plans and affecting its valuation.

Predicting Future Trends and Potential for CoreWeave Stock Growth

H3: Growth Projections and Revenue Estimates: Based on current market trends and CoreWeave's performance, projections suggest significant growth potential. However, these are estimates, and actual results may vary.

- Revenue Projections: Analysts predict CoreWeave's revenue to reach [Dollar Amount] by [Year], driven by increased demand for its services and expansion into new markets. This is based on [Assumptions].

- Market Penetration: CoreWeave is expected to further increase its market share by leveraging its technological advantages and strategic partnerships.

H3: Risk Factors and Potential Challenges: Investing in CoreWeave stock involves inherent risks. Potential challenges include intense competition, rapid technological advancements, and economic downturns.

- Competitive Landscape: The GPU cloud computing market is highly competitive, with established players and new entrants constantly innovating.

- Technological Disruption: Rapid technological change could render existing technologies obsolete, impacting CoreWeave's competitiveness.

H3: Investment Considerations: Investing in CoreWeave presents both opportunities and risks. Investors should carefully consider their risk tolerance and investment goals before making any decisions.

- Potential Returns: The potential for high returns is significant, given the growth of the AI and GPU computing market.

- Risk Assessment: However, the market's volatility and the competitive landscape require a thorough risk assessment.

Conclusion

This CoreWeave stock update highlights the company's impressive growth trajectory, fueled by strong funding, strategic partnerships, and the surging demand for GPU computing. While significant opportunities exist, investors should be aware of potential risks. To stay informed about CoreWeave stock and its performance, monitor the company's news releases, follow industry trends, and conduct thorough due diligence before making any investment decisions. Stay updated on CoreWeave's progress and learn more about investing in CoreWeave by conducting further research and analysis. The future of CoreWeave stock holds significant potential, but it also comes with inherent volatility.

First Images Released For Echo Valley Thriller Starring Sydney Sweeney And Julianne Moore

First Images Released For Echo Valley Thriller Starring Sydney Sweeney And Julianne Moore

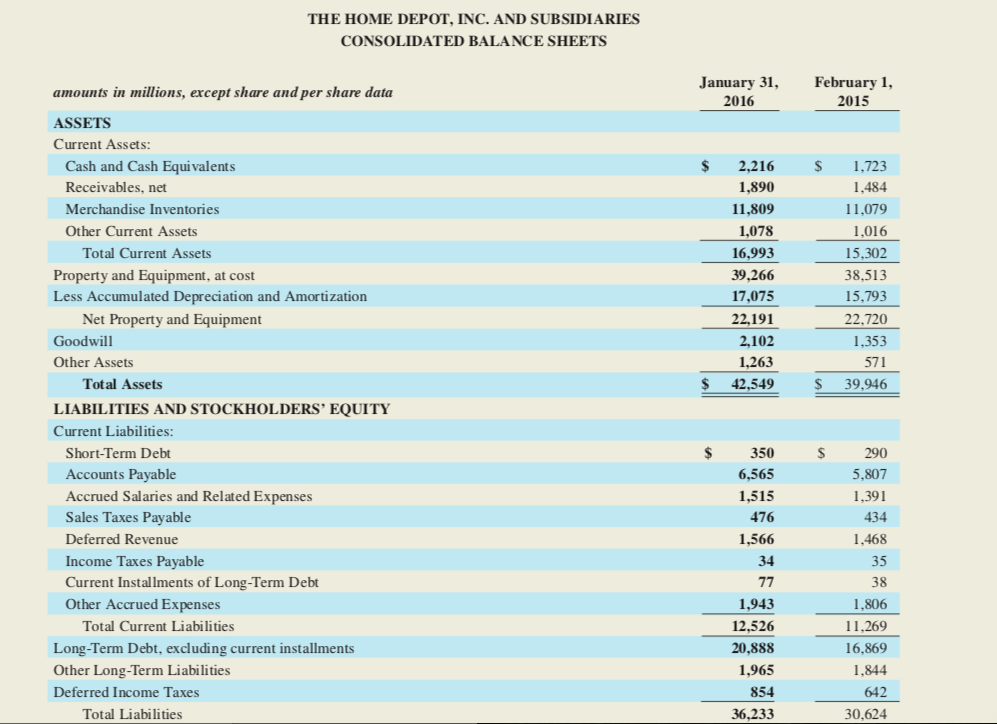

Home Depot Financial Report Disappointing Performance Despite Tariff Guidance

Home Depot Financial Report Disappointing Performance Despite Tariff Guidance

The Downfall A Ceo Love Story Gone Wrong

The Downfall A Ceo Love Story Gone Wrong

Bgt Special Unveiling The Blockbusters

Bgt Special Unveiling The Blockbusters

Gasoline Prices Surge In Mid Hudson Valley

Gasoline Prices Surge In Mid Hudson Valley