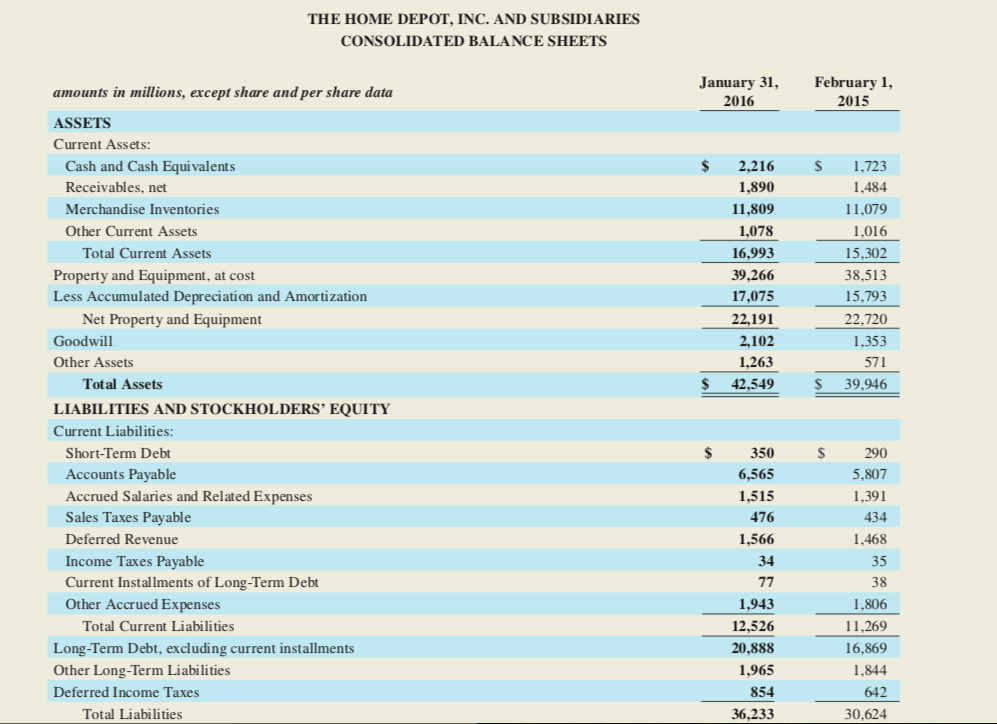

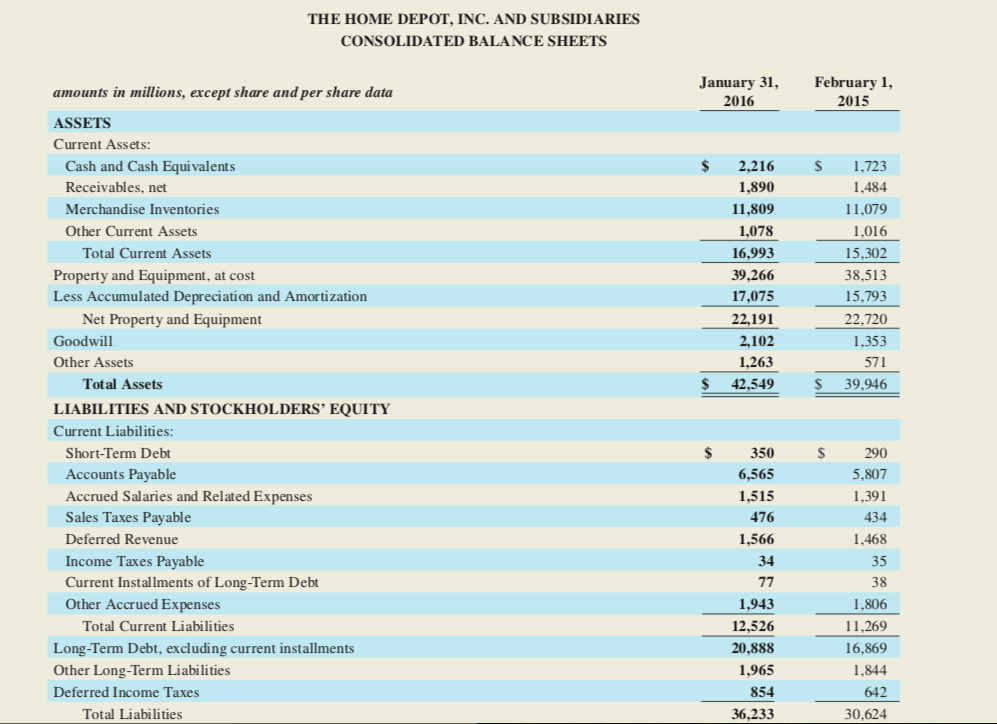

Home Depot Financial Report: Disappointing Performance Despite Tariff Guidance

Table of Contents

Lower-Than-Expected Sales Growth

The Home Depot's Q[Quarter] earnings report showed sales growth significantly below analysts' predictions. This underperformance can be attributed to several interconnected factors.

Impact of Inflation and Consumer Spending

Inflation significantly impacted consumer spending on home improvement projects. Higher prices across the board, coupled with increased interest rates, squeezed household budgets.

- Decreased discretionary spending: Consumers prioritized essential expenses, leading to a reduction in discretionary spending on home renovations and repairs.

- Higher interest rates impacting borrowing for renovations: The increased cost of borrowing made financing home improvement projects more expensive, deterring many potential customers.

- Postponement of projects: Faced with rising costs and economic uncertainty, many homeowners opted to postpone or cancel planned renovations, impacting Home Depot's sales volume.

These factors collectively contributed to a slowdown in sales growth, highlighting the sensitivity of the home improvement sector to macroeconomic conditions and the impact of inflation on consumer spending and discretionary income.

Supply Chain Disruptions

Lingering supply chain issues continue to plague the retail industry, and Home Depot is no exception. These disruptions significantly affected sales and inventory levels.

- Delays in receiving materials: Difficulties in sourcing and transporting building materials led to project delays and reduced product availability on shelves.

- Increased costs associated with shipping and logistics: Higher transportation expenses added to the cost of goods sold (COGS), further compressing profit margins.

- Impact on product availability: Limited inventory resulted in lost sales opportunities and frustrated customers, negatively affecting customer satisfaction and future sales.

The ongoing supply chain challenges underscore the importance of robust logistics and strategic sourcing for retailers operating in the volatile global market.

Compressed Profit Margins

The combination of lower sales growth and increased costs led to significantly compressed profit margins for Home Depot in Q[Quarter].

Impact of Increased Costs

Rising costs of materials and labor severely impacted profitability.

- Increased raw material prices: The surge in raw material costs, driven by global supply chain disruptions and inflation, significantly increased the cost of goods sold.

- Higher transportation expenses: Increased fuel prices and logistical bottlenecks added to the overall cost of getting products to Home Depot stores.

- Wage inflation: Home Depot, like many other companies, faced upward pressure on wages, adding to its labor costs.

- Impact on margins: The combined effect of these increased costs directly reduced the company's profit margin, despite efforts to adjust pricing.

Pricing Strategies and Effectiveness

Home Depot implemented pricing strategies to offset increased costs, but their effectiveness was limited.

- Price increases passed to consumers: The company attempted to mitigate the impact of higher costs by passing some price increases to consumers.

- Impact on sales volume: However, these price increases likely contributed to the slowdown in sales volume, as consumers became more price-sensitive.

- Competition in the home improvement market: The competitive landscape in the home improvement market limited Home Depot's ability to pass on all cost increases without impacting sales.

Tariff Mitigation Strategies and Their Effectiveness

Home Depot implemented various strategies to mitigate the negative effects of tariffs, but their overall impact remained limited in this quarter.

Assessment of Tariff Impact

Home Depot's efforts to offset tariffs included:

- Sourcing strategies: The company explored alternative sourcing options to reduce reliance on tariff-affected goods.

- Diversification of supply chains: Home Depot attempted to diversify its supply chains to reduce vulnerability to disruptions in any single region.

- Cost-saving measures: The company implemented cost-cutting measures throughout its operations to offset the impact of tariffs and other increased costs.

- Effectiveness of mitigation efforts: While these strategies offered some level of protection, they were not sufficient to fully offset the negative impact of tariffs and other economic headwinds.

Future Outlook on Tariff Related Concerns

The company's future plans regarding tariffs and global trade remain uncertain, given the dynamic global economic environment.

- Potential future tariff impacts: The risk of future tariff increases or trade disputes remains a significant concern.

- Strategies for managing future trade uncertainties: Home Depot will likely need to continue refining its strategies for managing future trade uncertainties and global supply chain disruptions.

- Adaptation to changing market conditions: The company must adapt to changing market conditions and consumer behavior to remain competitive in the long term.

Conclusion

The Home Depot financial report highlights a challenging Q[Quarter] marked by lower-than-expected sales growth and compressed profit margins, despite implemented tariff mitigation strategies. Inflation, supply chain disruptions, and rising costs significantly impacted performance. While the company’s efforts to manage these challenges are commendable, the results underscore the inherent volatility within the retail and home improvement sectors. Understanding the interplay of these factors is crucial for investors and industry analysts alike.

Call to Action: Stay informed on future Home Depot financial reports and analyses to understand the ongoing impact of economic factors on the home improvement retail sector. Continue to monitor the company's response to challenges and its long-term strategic planning, paying close attention to the evolving landscape of tariffs and global trade to better assess future Home Depot performance. Follow [link to your website/blog] for more insights on Home Depot financial reports and related market analysis.

Featured Posts

-

Concert Hellfest Mulhouse Accueille L Evenement

May 22, 2025

Concert Hellfest Mulhouse Accueille L Evenement

May 22, 2025 -

Australian Foot Race Man Sets Record For Fastest Crossing

May 22, 2025

Australian Foot Race Man Sets Record For Fastest Crossing

May 22, 2025 -

First Images Released For Echo Valley Thriller Starring Sydney Sweeney And Julianne Moore

May 22, 2025

First Images Released For Echo Valley Thriller Starring Sydney Sweeney And Julianne Moore

May 22, 2025 -

Taylor Swift And Blake Livelys Friendship A Rift Caused By Legal Troubles

May 22, 2025

Taylor Swift And Blake Livelys Friendship A Rift Caused By Legal Troubles

May 22, 2025 -

The Goldbergs Behind The Scenes And Production Details

May 22, 2025

The Goldbergs Behind The Scenes And Production Details

May 22, 2025

Latest Posts

-

Major Fire Damages Dauphin County Apartment Complex

May 22, 2025

Major Fire Damages Dauphin County Apartment Complex

May 22, 2025 -

Thunderstorm Watch In Effect South Central Pennsylvania

May 22, 2025

Thunderstorm Watch In Effect South Central Pennsylvania

May 22, 2025 -

Lancaster County Pa Police Investigating Recent Shooting

May 22, 2025

Lancaster County Pa Police Investigating Recent Shooting

May 22, 2025 -

Dauphin County Apartment Fire Residents Evacuated After Overnight Blaze

May 22, 2025

Dauphin County Apartment Fire Residents Evacuated After Overnight Blaze

May 22, 2025 -

Severe Weather Alert Thunderstorm Watch Issued For South Central Pa

May 22, 2025

Severe Weather Alert Thunderstorm Watch Issued For South Central Pa

May 22, 2025