Jim Cramer's Lone Wolf Prediction: CoreWeave (CRWV) As The AI Infrastructure Star

Table of Contents

CoreWeave's (CRWV) Competitive Advantage in the AI Infrastructure Landscape

CoreWeave (CRWV) is quickly establishing itself as a significant player in the fiercely competitive AI infrastructure sector. Its success hinges on several key competitive advantages.

Superior NVIDIA GPU Access & Scalability

CoreWeave boasts unparalleled access to NVIDIA's cutting-edge GPUs, the workhorses of modern AI. This access is crucial for handling the massive computational demands of training and deploying sophisticated AI models.

- Exclusive partnerships with NVIDIA: These partnerships guarantee CoreWeave a steady supply of the latest GPU technology, giving them a significant edge over competitors relying on less secure or less efficient supply chains.

- Scalable infrastructure to handle large-scale AI training and deployment: CoreWeave's infrastructure is designed to scale effortlessly, accommodating the ever-increasing needs of AI workloads. This scalability ensures clients can easily adapt their resources to meet fluctuating demands without performance bottlenecks.

- Superior performance compared to competitors: Benchmark tests consistently show CoreWeave’s infrastructure delivering superior performance in AI tasks, translating to faster training times, reduced costs, and improved model accuracy. This performance advantage attracts clients seeking efficiency and speed.

Focus on High-Performance Computing (HPC) for AI

CoreWeave's strategic focus on High-Performance Computing (HPC) is a key differentiator in the AI infrastructure market. HPC solutions are specifically designed for the demanding computational needs of artificial intelligence.

- Lower latency and faster processing speeds compared to cloud alternatives: CoreWeave's architecture minimizes latency, ensuring faster processing speeds crucial for real-time AI applications and intensive training sessions.

- Specialized solutions tailored for AI workloads, enhancing efficiency: They offer tailored solutions optimized for various AI frameworks and applications, maximizing efficiency and reducing operational overhead for their clients.

- Attracting a diverse clientele, from startups to large enterprises: This specialized approach attracts a wide range of clients, from agile startups needing scalable solutions to large enterprises requiring robust and secure infrastructure for their AI initiatives.

Analyzing Jim Cramer's Rationale Behind the CoreWeave (CRWV) Prediction

Understanding Jim Cramer's rationale requires examining his investment philosophy and the current market trends.

Cramer's Investment Philosophy & Risk Tolerance

Cramer is known for his aggressive, growth-oriented investment strategy. He often favors companies with high growth potential, even if they carry higher risk.

- His focus on growth potential and disruptive technologies: CoreWeave, operating in the rapidly expanding AI infrastructure sector, perfectly fits this criteria, aligning with Cramer's preference for companies poised for significant future growth.

- His history with recommending relatively high-risk, high-reward investments: CoreWeave, as a relatively young company in a competitive market, represents a higher-risk investment, reflecting Cramer’s typical approach.

- Potential reasons for his bullish outlook on CRWV: Cramer likely sees CoreWeave’s superior technology, strategic partnerships, and the explosive growth of the AI market as indicators of substantial future returns, outweighing the inherent risks.

Market Trends Supporting Cramer's CoreWeave (CRWV) Prediction

Several powerful market trends support Cramer's optimistic view of CoreWeave and the AI infrastructure sector as a whole.

- The explosive growth of the AI industry and its dependence on robust infrastructure: The AI industry's remarkable growth necessitates a corresponding expansion of robust and reliable infrastructure to support its computational demands.

- Increasing demand for GPU-accelerated computing: The reliance on GPUs for AI training and inference is driving an unprecedented surge in demand for GPU-accelerated computing resources.

- Limited supply of high-performance computing resources: The limited availability of high-performance computing resources creates a favorable environment for companies like CoreWeave, which can provide this crucial infrastructure.

Potential Risks and Challenges Facing CoreWeave (CRWV)

While the outlook is promising, CoreWeave faces significant challenges and potential risks.

Competition in the AI Infrastructure Market

The AI infrastructure market is intensely competitive, with established giants like AWS, Google Cloud, and Azure vying for market share.

- Price competition and market share battles: CoreWeave will likely face fierce price competition from these established players, potentially squeezing profit margins.

- The need for continuous innovation and adaptation to technological advancements: The rapid pace of technological change necessitates continuous innovation to maintain a competitive edge.

- Potential for consolidation in the industry: Further consolidation within the industry is possible, potentially leading to increased competition or even acquisition by larger players.

Financial Performance and Future Growth Projections

Assessing CoreWeave's long-term viability requires a thorough analysis of its financial performance and future growth projections.

- Revenue growth and profitability: Sustained revenue growth and achieving profitability are crucial for CoreWeave's long-term success. Investors need to carefully examine these metrics.

- Investor sentiment and market capitalization: Investor sentiment and the company's market capitalization are key indicators of investor confidence and future prospects.

- Potential for future funding rounds or IPO: The need for additional funding or the prospect of an Initial Public Offering (IPO) will also impact the company’s future trajectory and investor returns.

Conclusion

Jim Cramer's prediction regarding CoreWeave (CRWV) is intriguing but requires careful consideration. While CoreWeave possesses significant competitive advantages in the rapidly growing AI infrastructure market, including superior access to NVIDIA GPUs and a focus on HPC, it also faces considerable challenges, including intense competition and the need for sustained financial performance. The explosive growth of AI undeniably presents a huge opportunity, but investing in CoreWeave (CRWV) involves substantial risk.

Is CoreWeave (CRWV) the next big thing in AI infrastructure? Do your research and decide for yourself. Remember to conduct thorough due diligence and assess your own risk tolerance before investing in this potentially high-growth, high-risk sector. Understanding the nuances of the AI infrastructure market and CoreWeave's position within it is critical before making any investment decisions.

Featured Posts

-

Taylor Swift Text Leak Allegation Blake Livelys Lawyer Under Scrutiny

May 22, 2025

Taylor Swift Text Leak Allegation Blake Livelys Lawyer Under Scrutiny

May 22, 2025 -

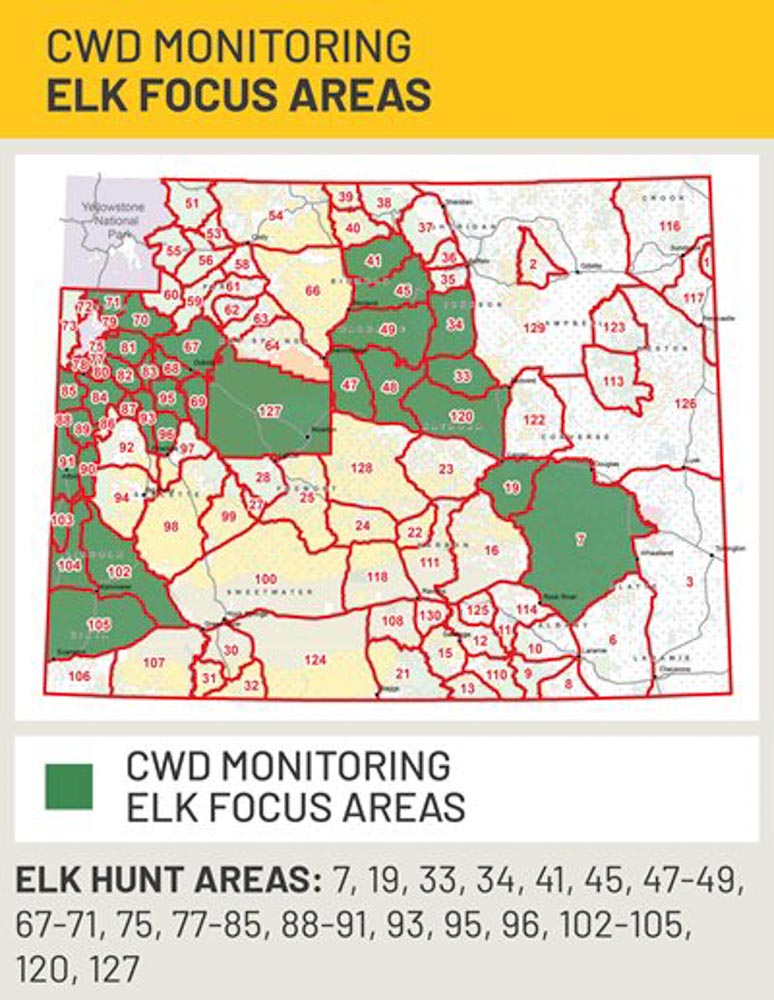

Shifting Gears The Future Of Otter Management In Wyoming

May 22, 2025

Shifting Gears The Future Of Otter Management In Wyoming

May 22, 2025 -

Beenie Man Announces New York Takeover What To Expect From The It A Stream Event

May 22, 2025

Beenie Man Announces New York Takeover What To Expect From The It A Stream Event

May 22, 2025 -

The Impact Of Self Love On Vybz Kartels Skin Bleaching Decision

May 22, 2025

The Impact Of Self Love On Vybz Kartels Skin Bleaching Decision

May 22, 2025 -

International Condemnation Mounts Switzerland Joins In Denouncing Pahalgam Attack

May 22, 2025

International Condemnation Mounts Switzerland Joins In Denouncing Pahalgam Attack

May 22, 2025

Latest Posts

-

Todays Wordle Puzzle March 26 Nyt Wordle Solution

May 22, 2025

Todays Wordle Puzzle March 26 Nyt Wordle Solution

May 22, 2025 -

Solving Todays Nyt Wordle March 26 Hints And Answer

May 22, 2025

Solving Todays Nyt Wordle March 26 Hints And Answer

May 22, 2025 -

Todays Wordle March 26 Nyt Wordle Answer And Hints

May 22, 2025

Todays Wordle March 26 Nyt Wordle Answer And Hints

May 22, 2025 -

March 26 Wordle Answer Todays Nyt Wordle Word

May 22, 2025

March 26 Wordle Answer Todays Nyt Wordle Word

May 22, 2025 -

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025