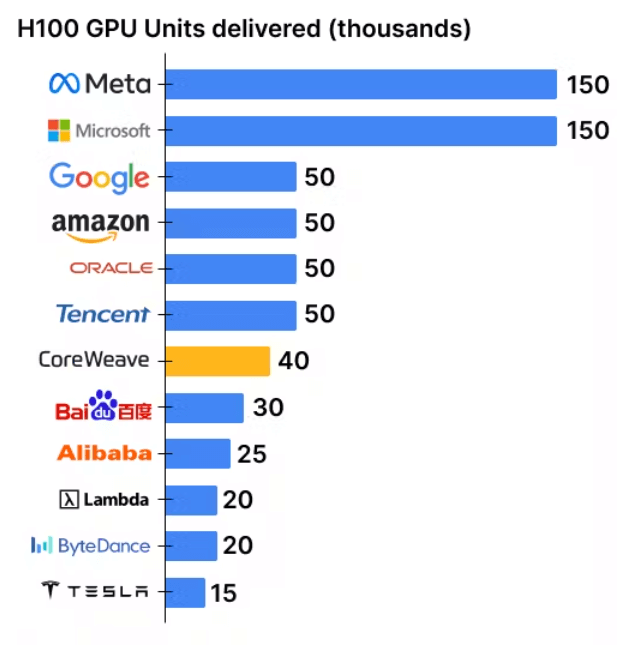

CoreWeave (CRWV) Stock's Thursday Drop: Market Reactions And Implications

Table of Contents

Analyzing the Causes Behind CoreWeave (CRWV) Stock's Thursday Decline

Several factors likely contributed to CoreWeave (CRWV) stock's significant Thursday decline. Understanding these contributing elements is crucial for investors seeking to navigate this volatility.

Broader Market Sentiment

The overall market environment on Thursday played a role in CRWV's fall. A general sense of uncertainty and risk aversion permeated the market.

- The Dow Jones Industrial Average experienced a [insert percentage]% decrease, while the Nasdaq Composite fell by [insert percentage]%.

- Concerns about rising interest rates and persistent inflation likely contributed to investor apprehension, leading to widespread selling across various sectors.

- Geopolitical tensions and other macroeconomic factors also likely played a subtle role in dampening investor enthusiasm.

Specific News or Announcements Impacting CoreWeave (CRWV)

While no major company-specific announcements directly preceded the CRWV stock plunge, several subtle factors could have contributed:

- A lack of significant positive news or catalysts in the lead-up to Thursday's trading could have left the stock vulnerable to broader market pressures.

- Potential whispers of slower-than-expected growth in the cloud computing sector in the near term could have contributed to investor hesitation.

- An absence of strong guidance or upbeat projections from CoreWeave management for upcoming quarters may have impacted investor confidence.

Technical Factors Contributing to the CRWV Stock Price Drop

Technical analysis suggests several factors may have contributed to the sharp CRWV stock price drop:

- A bearish reversal pattern may have triggered algorithmic trading, leading to a cascade of sell orders.

- Increased short selling activity might have amplified the downward pressure on the stock price, as short sellers profited from the decline.

- Technical indicators like the Relative Strength Index (RSI) might have signaled overbought conditions prior to the drop, suggesting a potential correction was overdue.

Market Reactions and Investor Sentiment Following the CoreWeave (CRWV) Stock Fall

The market's reaction to the CRWV stock fall revealed a complex interplay of investor sentiment and speculative trading.

Immediate Investor Response

The immediate response to the CRWV price drop was characterized by:

- A significant spike in trading volume, indicating heightened investor activity and uncertainty.

- Sharp price fluctuations throughout the day, reflecting the rapid shifts in investor sentiment.

- Negative sentiment dominating social media discussions about CRWV, further exacerbating the sell-off.

Analyst Ratings and Predictions

Analyst opinions on CRWV stock following the decline were mixed:

- Some analysts maintained their "buy" ratings, highlighting CoreWeave's long-term growth potential in the cloud computing market.

- Others lowered their price targets, reflecting concerns about short-term volatility and the impact of the Thursday drop on investor confidence.

- A consensus view on the stock’s immediate future remains elusive, calling for continued market observation.

Impact on Competitor Stocks

The CRWV stock drop did not significantly impact its main competitors:

- Competitors like [Competitor A] and [Competitor B] experienced only minor fluctuations, suggesting the decline was largely specific to CoreWeave.

- This suggests the market may not perceive the Thursday drop as a systemic issue within the broader cloud computing sector.

Long-Term Implications of the CoreWeave (CRWV) Stock's Thursday Drop

The long-term effects of the CRWV stock price volatility remain uncertain.

Potential for Recovery

CoreWeave has the potential to recover from this drop:

- Strong quarterly earnings reports and positive updates on key projects could help to rebuild investor confidence.

- Strategic partnerships and successful product launches can act as catalysts for a rebound.

- The continued growth of the cloud computing market offers inherent support for CRWV’s long-term prospects.

Impact on Future Investment Decisions

This event could influence future investment in CRWV and the cloud computing sector:

- Some investors might view the drop as a buying opportunity, taking advantage of the lower price to accumulate shares.

- Others may remain cautious, preferring to wait for further clarity before investing in CRWV.

- The broader market will continue to assess the fundamental strengths and growth trajectory of CoreWeave.

Lessons Learned from the CRWV Stock Price Volatility

The CRWV stock price volatility provides crucial lessons for investors:

- Diversification is essential to mitigate risk across investments.

- Thorough due diligence, including an understanding of both fundamental and technical aspects, is crucial before making investment decisions.

- A long-term perspective and resilience are key to navigating short-term market fluctuations.

Conclusion: Navigating the Aftermath of the CoreWeave (CRWV) Stock Plunge

The CoreWeave (CRWV) stock's Thursday drop highlights the inherent volatility of the tech market and the importance of careful risk management. While the immediate cause of the decline may remain unclear, the analysis suggests a combination of broader market sentiment, lack of immediate positive catalysts for CRWV, and potential technical factors contributed to the significant sell-off. Understanding the factors behind the CoreWeave (CRWV) stock’s Thursday drop is crucial for making informed investment decisions. Continue to monitor CRWV stock and other market indicators, conduct your own thorough research, and make investment choices that align with your risk tolerance and investment goals to successfully navigate this dynamic market. The long-term prospects of CoreWeave and the broader cloud computing sector remain positive, but careful market analysis is crucial for investors.

Featured Posts

-

Shifting Gears The Future Of Otter Management In Wyoming

May 22, 2025

Shifting Gears The Future Of Otter Management In Wyoming

May 22, 2025 -

S Sh A Gotovyat Novye Sanktsii Protiv Rossii Reaktsiya Senata

May 22, 2025

S Sh A Gotovyat Novye Sanktsii Protiv Rossii Reaktsiya Senata

May 22, 2025 -

Peppa Pigs Parents Gender Reveal Party Details And Photos

May 22, 2025

Peppa Pigs Parents Gender Reveal Party Details And Photos

May 22, 2025 -

Analyzing Recent Developments In Core Weave Stock

May 22, 2025

Analyzing Recent Developments In Core Weave Stock

May 22, 2025 -

Tesla Ceo Musk Focusing On Business Stepping Back From Politics

May 22, 2025

Tesla Ceo Musk Focusing On Business Stepping Back From Politics

May 22, 2025

Latest Posts

-

Freddie Flintoffs Crash A Disney Documentary Tells The Story

May 23, 2025

Freddie Flintoffs Crash A Disney Documentary Tells The Story

May 23, 2025 -

The Art Of Cricket Bat Making Interview With A Master Craftsman

May 23, 2025

The Art Of Cricket Bat Making Interview With A Master Craftsman

May 23, 2025 -

Cricket Bat Master A Tradition Of Excellence

May 23, 2025

Cricket Bat Master A Tradition Of Excellence

May 23, 2025 -

Freddie Flintoff Confirms Disney Documentary On Near Fatal Crash

May 23, 2025

Freddie Flintoff Confirms Disney Documentary On Near Fatal Crash

May 23, 2025 -

Ecb Cricket Latest Scores Fixtures And News From England And Wales

May 23, 2025

Ecb Cricket Latest Scores Fixtures And News From England And Wales

May 23, 2025