Condo Investment Concerns Rise In Canada: Market Analysis

Table of Contents

The Canadian condo market, once a beacon of consistent growth and attractive returns for investors, is facing a period of uncertainty. Recent data reveals a softening in prices in certain regions and a rise in vacancy rates in others, leading to significant Condo Investment Concerns in Canada. This article will analyze the current market landscape, exploring key factors contributing to these concerns and providing insights for potential investors. We will delve into the impact of rising interest rates, supply and demand imbalances, the influence of foreign buyers, and the increasing burden of property taxes and condo fees.

Rising Interest Rates and Their Impact on Condo Investment

Increased interest rates are significantly impacting the Canadian condo market, creating substantial challenges for investors. The Bank of Canada's efforts to curb inflation have resulted in higher borrowing costs, directly affecting the affordability and profitability of condo investments.

- Increased borrowing costs for investors: Higher interest rates translate to larger monthly mortgage payments, reducing the potential return on investment (ROI) for condo purchases.

- Reduced affordability for potential buyers, leading to lower demand: With higher mortgage rates, fewer individuals can afford to purchase condos, leading to a slowdown in sales and potentially impacting rental demand.

- Impact on rental yields and profitability: While rents may increase, the higher mortgage payments can offset these gains, potentially leading to lower or even negative cash flow for some investors.

- Potential for negative cash flow in some markets: In markets experiencing slower rental growth or an oversupply of condos, investors might find themselves facing negative cash flow, where monthly mortgage payments exceed rental income.

Statistics from the Canadian Real Estate Association (CREA) and the Bank of Canada show a clear correlation between interest rate hikes and a decrease in mortgage approvals and condo sales in several major cities. For example, [insert specific data on interest rate increases and their impact on condo sales in a specific city].

Supply and Demand Imbalances in the Canadian Condo Market

The Canadian condo market is experiencing significant regional variations in supply and demand. While some cities grapple with an oversupply of new condo units, others continue to face housing shortages.

- Analysis of new condo construction in major cities: Toronto, Vancouver, and Calgary have seen substantial new condo construction in recent years, leading to an oversupply in some areas, driving down prices and rental rates.

- Examination of vacancy rates across different regions: Vacancy rates are rising in certain areas with high condo supply, indicating a potential weakening in rental demand. Conversely, areas with limited supply still experience high occupancy rates.

- Discussion on the impact of immigration and population growth on demand: Continued immigration to Canada fuels housing demand, but this effect varies across different provinces and cities.

- Identify areas with high potential for appreciation and those with higher risk: Markets with strong population growth and limited condo supply generally offer higher potential for appreciation, while areas with oversupply present higher risk.

[Insert a chart or graph visually representing condo supply and vacancy rates across different Canadian cities].

The Influence of Foreign Buyers on the Canadian Condo Market

Foreign investment plays a significant role in the Canadian condo market, with both positive and negative consequences.

- Discuss government policies and regulations affecting foreign buyers: The Canadian government has implemented various measures to regulate foreign investment in real estate, aiming to curb speculation and ensure market stability. These policies vary over time and across provinces.

- Analyze the impact of foreign investment on pricing and market stability: Foreign investment can drive up prices in certain markets, but an overreliance on this investment can lead to volatility and increased risk.

- Discuss potential risks associated with over-reliance on foreign investment: A sudden decrease in foreign investment can destabilize the market, leading to price corrections and impacting investor returns.

- Mention specific examples of cities heavily influenced by foreign buyers: Vancouver and Toronto are known to have historically high levels of foreign investment in their condo markets.

[Cite relevant sources and reports on foreign investment in Canadian real estate.]

Other Emerging Concerns: Property Taxes and Condo Fees

Rising property taxes and condo fees significantly impact the overall return on investment for condo owners.

- Discuss the calculation of ROI considering these additional costs: These costs should be factored into the overall calculation of ROI to obtain a more accurate reflection of profitability.

- Highlight potential strategies for mitigating these costs: Investors should thoroughly research potential properties to understand the likely tax and fee burdens.

- Mention the differences in these costs across various cities and condo complexes: Property taxes and condo fees can vary significantly depending on the location and amenities offered.

Conclusion:

Understanding the current landscape of condo investment concerns in Canada is crucial for navigating the market effectively. Rising interest rates, supply and demand imbalances, the influence of foreign buyers, and escalating property taxes and condo fees all contribute to a complex investment environment. While opportunities exist, thorough due diligence is paramount. Before investing in Canadian condos, conduct comprehensive research, analyze market trends in specific locations, and consider seeking professional financial advice to mitigate potential risks. Successfully navigating the Canadian condo market requires a careful evaluation of these factors and a proactive approach to risk management. Understanding condo investment concerns in Canada is crucial for successful real estate investing.

Featured Posts

-

Is Ashton Jeanty The Chicago Bears 2025 Nfl Draft Target Analyzing The Hype

Apr 25, 2025

Is Ashton Jeanty The Chicago Bears 2025 Nfl Draft Target Analyzing The Hype

Apr 25, 2025 -

Chicago Bears Great Steve Mc Michael Dead At 67 Als Takes Hall Of Famer

Apr 25, 2025

Chicago Bears Great Steve Mc Michael Dead At 67 Als Takes Hall Of Famer

Apr 25, 2025 -

Desain Meja Rias Minimalis Modern Di Rumah Tren 2025

Apr 25, 2025

Desain Meja Rias Minimalis Modern Di Rumah Tren 2025

Apr 25, 2025 -

Your Comprehensive Guide To The Winter Weather Timeline

Apr 25, 2025

Your Comprehensive Guide To The Winter Weather Timeline

Apr 25, 2025 -

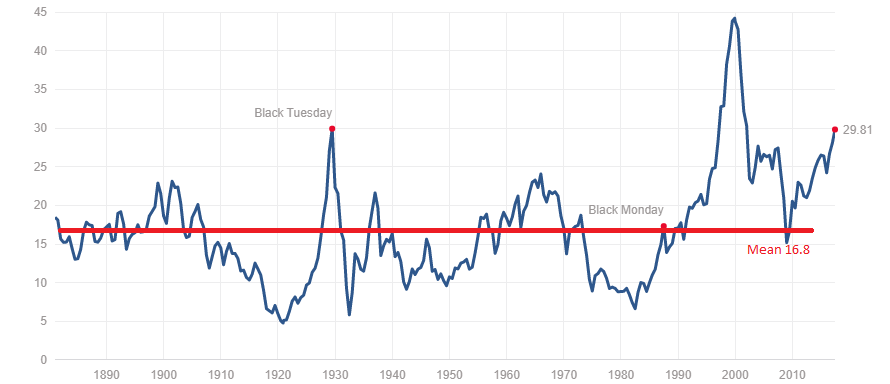

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

Apr 25, 2025

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

Apr 25, 2025

Latest Posts

-

Benson Boone Addresses Harry Styles Copying Claims

May 10, 2025

Benson Boone Addresses Harry Styles Copying Claims

May 10, 2025 -

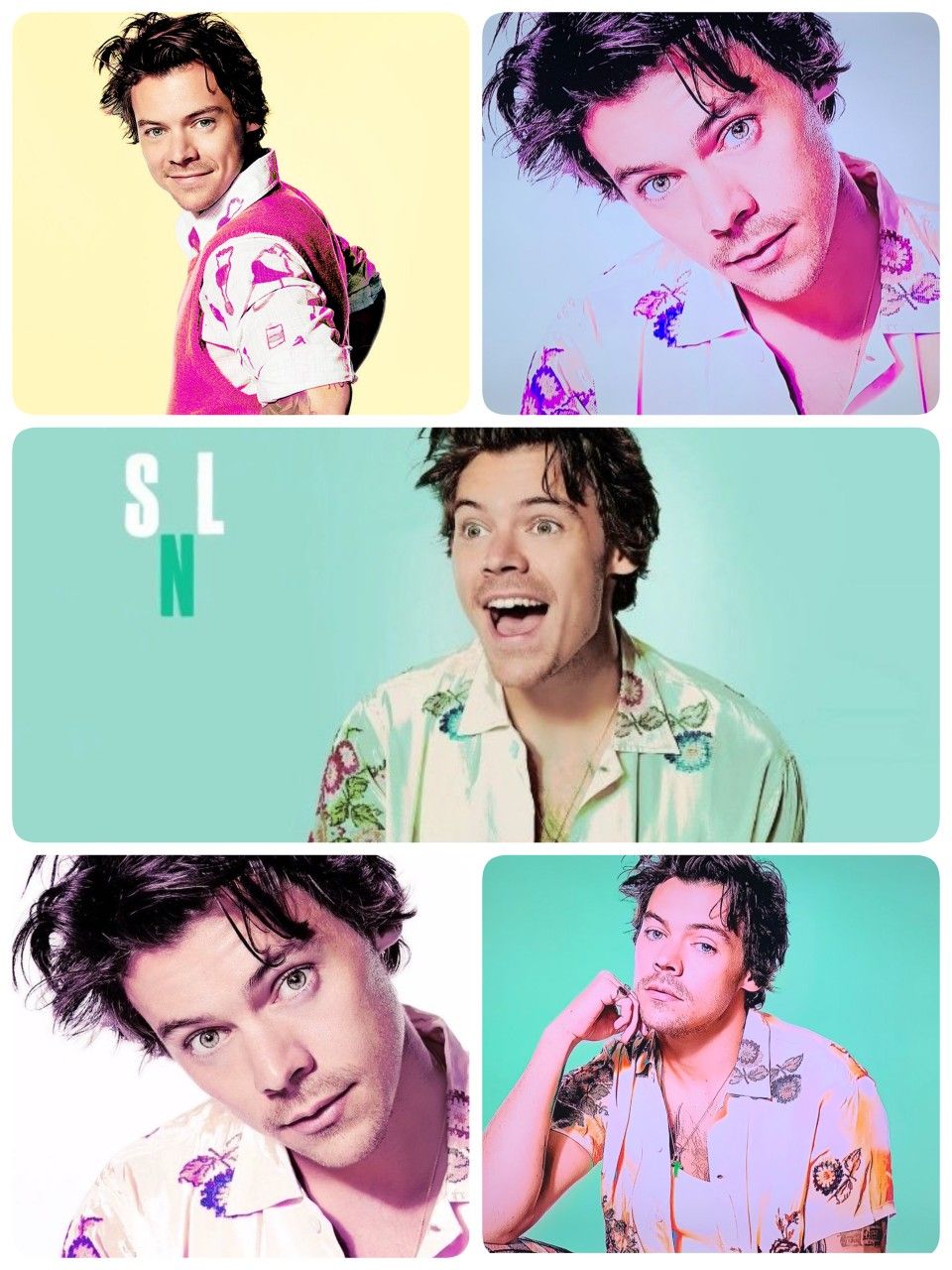

How Harry Styles Reacted To That Awful Snl Impression Of Him

May 10, 2025

How Harry Styles Reacted To That Awful Snl Impression Of Him

May 10, 2025 -

Harry Styles Responds To A Hilariously Bad Snl Impression

May 10, 2025

Harry Styles Responds To A Hilariously Bad Snl Impression

May 10, 2025 -

Snls Failed Harry Styles Impression His Reaction Will Shock You

May 10, 2025

Snls Failed Harry Styles Impression His Reaction Will Shock You

May 10, 2025 -

Harry Styles Snl Impression The Reaction That Broke The Internet

May 10, 2025

Harry Styles Snl Impression The Reaction That Broke The Internet

May 10, 2025