High Stock Market Valuations: A BofA Analysis And Investor Reassurance

Table of Contents

BofA's Key Findings on Current Market Valuations

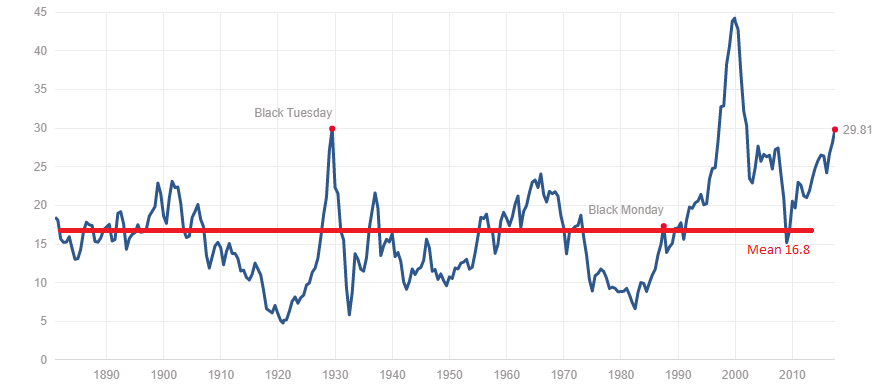

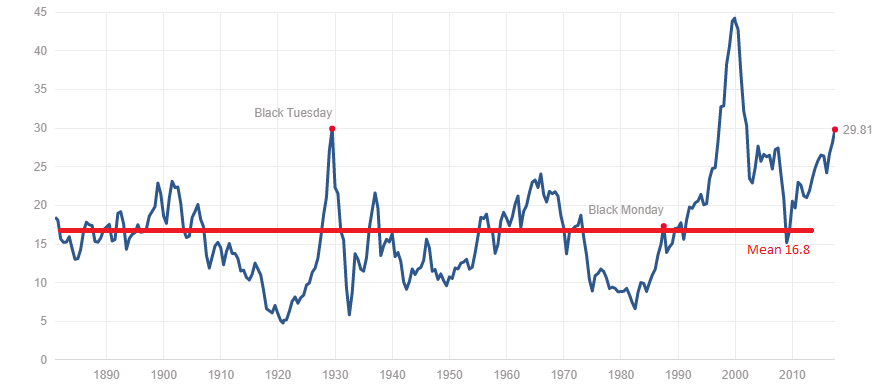

BofA's recent research offers a detailed assessment of current stock market valuations, comparing them to historical data and various economic indicators. While acknowledging that valuations are elevated compared to historical averages, their analysis suggests a more complex reality than a simple "overvalued" label. The firm employs a multifaceted approach, incorporating metrics like Price-to-Earnings (P/E) ratios, the cyclically adjusted price-to-earnings ratio (Shiller PE ratio), and sector-specific analyses to paint a comprehensive picture.

- Specific P/E ratio comparisons: BofA compares current P/E ratios to historical averages, adjusting for factors like interest rates and inflation. They highlight sectors where P/E ratios are significantly above historical norms and those trading at more moderate levels.

- Sectoral overvaluation/undervaluation: The analysis identifies specific sectors exhibiting signs of overvaluation (e.g., certain technology sub-sectors) and others potentially undervalued, offering investors opportunities for strategic portfolio adjustments.

- Economic indicators: BofA incorporates key economic indicators like GDP growth, inflation rates, and unemployment figures to contextualize its valuation assessment, demonstrating the interplay between macroeconomic trends and stock prices. Their methodology underscores the importance of considering these broader economic factors when evaluating market valuations.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current high stock market valuations. Understanding these factors is crucial for making informed investment decisions.

- Low interest rates: Historically low interest rates decrease the cost of borrowing for companies, boosting corporate earnings and making future cash flows more valuable in present value calculations. This has a direct impact on stock valuations.

- Strong corporate earnings: Many companies have reported robust earnings growth, fueled by technological advancements, increased consumer spending, and global economic expansion (prior to recent economic slowdown). This positive earnings momentum has supported higher stock prices and valuations.

- Inflation's impact: While inflation erodes the purchasing power of money, it can also lead to higher corporate pricing power, potentially offsetting the negative impact on investment valuations. However, high inflation is usually a cause for concern and often leads to higher interest rates to control it. This creates a more complicated picture.

- Technological advancements: Innovation in technology continues to drive growth in certain sectors, pushing valuations higher as investors bet on future growth potential.

Assessing Risk and Opportunities in a High-Valuation Market

Investing in a high-valuation market presents both risks and opportunities. It's essential to carefully consider these factors before making investment decisions.

- Potential for correction: High valuations increase the potential for a market correction or downturn. This risk necessitates a prudent approach to investment.

- Higher volatility: High-valuation markets tend to be more volatile, meaning greater price swings. This requires investors to be comfortable with potential short-term losses.

- Sector-specific risks: Not all sectors are equally valued. Some sectors might be significantly overvalued while others remain undervalued, requiring careful sector analysis.

Risk Mitigation Strategies:

- Diversification: Diversifying across asset classes (stocks, bonds, real estate, etc.) and sectors reduces overall portfolio risk.

- Value investing: Focusing on undervalued stocks or sectors can potentially offer better risk-adjusted returns.

- Long-term investment horizon: Taking a long-term perspective reduces the impact of short-term market fluctuations.

Opportunities:

- Growth stocks in emerging technologies: Despite high overall valuations, specific growth stocks in innovative sectors may still present attractive long-term opportunities.

- Value stocks in cyclical sectors: Cyclical sectors showing signs of recovery may offer value investment opportunities, as their valuations may not yet reflect their future potential.

BofA's Recommendations for Investors

BofA generally advocates for a cautious yet opportunistic approach to investing in the current environment of high stock market valuations. They emphasize the importance of a well-diversified portfolio tailored to individual risk tolerance and financial goals.

- Portfolio adjustments: BofA may recommend adjusting portfolio allocations to reduce exposure to overvalued sectors and increase exposure to potentially undervalued ones.

- Alternative investment options: Exploring alternative investments like real estate or infrastructure could complement a stock portfolio, further diversifying risk.

- Disciplined investment approach: Maintaining a disciplined investment approach, avoiding emotional decision-making, and sticking to a long-term strategy is crucial in navigating market volatility.

Making Informed Decisions about High Stock Market Valuations

BofA's analysis highlights that while high stock market valuations are a cause for caution, they don't necessarily signal an imminent crash. A balanced perspective, considering both risks and opportunities, is key. Understanding the macroeconomic factors influencing valuations and implementing risk mitigation strategies is crucial for navigating this market environment. Remember, the key to success is a personalized investment strategy aligned with your individual risk tolerance and long-term financial objectives. Consult with a qualified financial advisor to develop a strategy that addresses your unique needs in this landscape of high stock market valuations. Further research using resources like BofA's reports can also aid in making informed investment decisions.

Featured Posts

-

Broken Promises How Election Pledges Contribute To Budget Deficits

Apr 25, 2025

Broken Promises How Election Pledges Contribute To Budget Deficits

Apr 25, 2025 -

Basel Secures Funding For Eurovision Village 2025

Apr 25, 2025

Basel Secures Funding For Eurovision Village 2025

Apr 25, 2025 -

Dallas Cowboys 2024 Draft Matthew Goldens Potential Impact

Apr 25, 2025

Dallas Cowboys 2024 Draft Matthew Goldens Potential Impact

Apr 25, 2025 -

Kot Kellog Posetit Ukrainu 20 Fevralya Podrobnosti Ot Smi I Politikov

Apr 25, 2025

Kot Kellog Posetit Ukrainu 20 Fevralya Podrobnosti Ot Smi I Politikov

Apr 25, 2025 -

Canadians Rethink Condo Investments Amidst Market Downturn

Apr 25, 2025

Canadians Rethink Condo Investments Amidst Market Downturn

Apr 25, 2025

Latest Posts

-

Harry Styles Snl Impression The Devastating Result

May 10, 2025

Harry Styles Snl Impression The Devastating Result

May 10, 2025 -

The Snl Impression That Left Harry Styles Dejected

May 10, 2025

The Snl Impression That Left Harry Styles Dejected

May 10, 2025 -

Farcical Misconduct Nottingham Families Urge For Proceedings Delay

May 10, 2025

Farcical Misconduct Nottingham Families Urge For Proceedings Delay

May 10, 2025 -

Nottingham Families Fight Farcical Misconduct Proceedings Seek Delay

May 10, 2025

Nottingham Families Fight Farcical Misconduct Proceedings Seek Delay

May 10, 2025 -

Nottingham Families Demand Delay Of Farcical Misconduct Proceedings

May 10, 2025

Nottingham Families Demand Delay Of Farcical Misconduct Proceedings

May 10, 2025