Client Withdrawals Hit Schroders: Q1 Asset Decline

Table of Contents

- Magnitude of the Q1 Asset Decline at Schroders

- Analyzing the Driving Force: Client Withdrawals

- Market Volatility and Investor Sentiment

- Performance of Schroders' Funds

- Competition in the Investment Management Industry

- Economic Factors

- Schroders' Response to the Asset Decline

- Conclusion: Understanding the Impact of Client Withdrawals on Schroders' Future

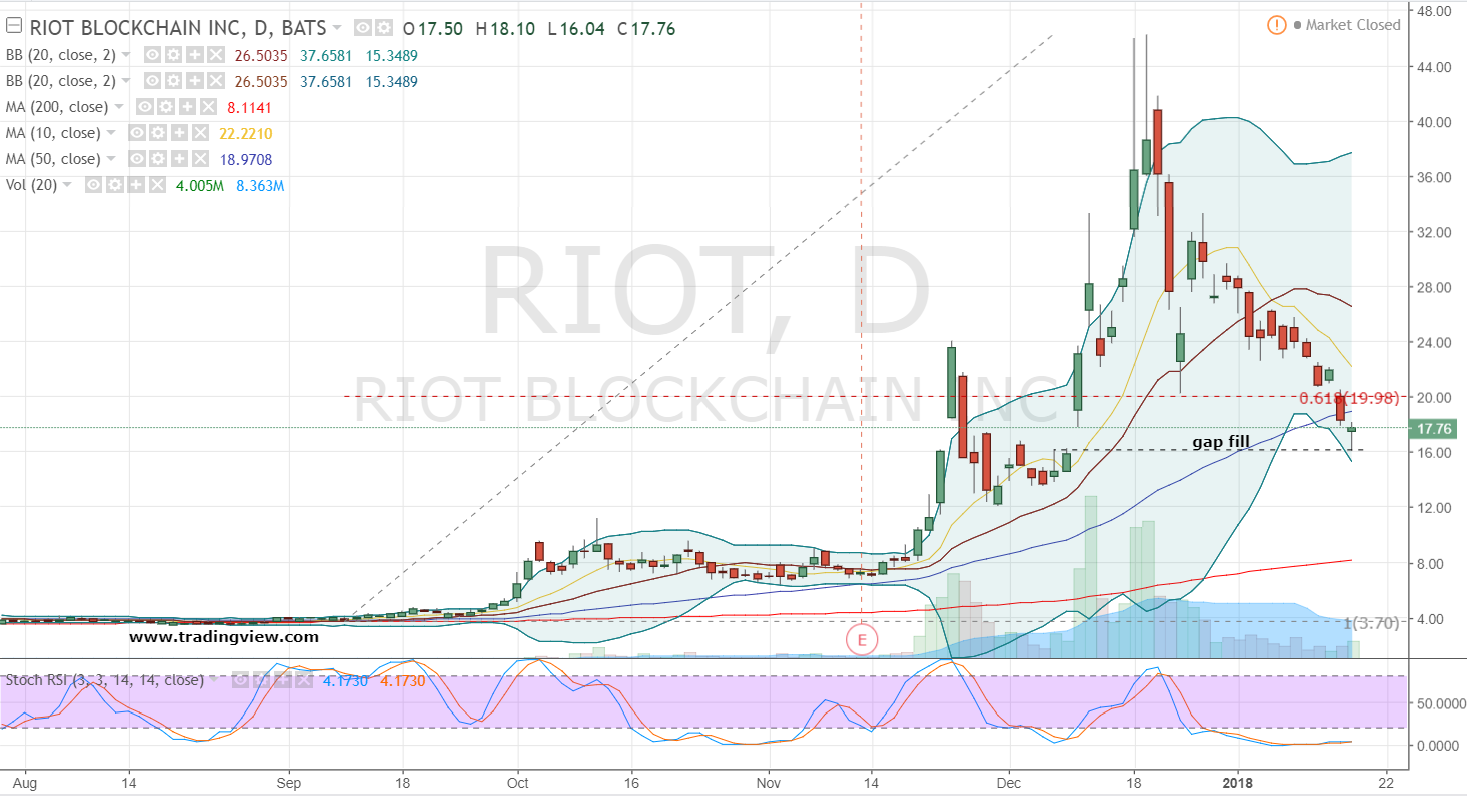

Magnitude of the Q1 Asset Decline at Schroders

Schroders experienced a notable decrease in AUM during Q1, with figures revealing a [insert exact percentage or monetary value]% drop. This represents a considerable decline compared to previous quarters, where AUM growth was [insert data for previous quarters' performance]. Furthermore, this performance lags behind the industry average for Q1, which saw a [insert industry average AUM change]% change.

The following chart visually represents the dramatic shift in Schroders' AUM:

[Insert Chart/Graph showing AUM decline visually]

This significant drop in Schroders AUM highlights the impact of market volatility and the challenges faced by even established investment management firms. Keywords like Schroders AUM decline, Q1 performance, Asset Under Management, and Investment losses underscore the severity of the situation.

Analyzing the Driving Force: Client Withdrawals

The primary driver behind Schroders' Q1 asset decline is undeniably the substantial increase in client withdrawals. Several factors contributed to this outflow:

Market Volatility and Investor Sentiment

Global market fluctuations and rising investor anxieties significantly impacted client decisions. Increased uncertainty surrounding [mention specific market events like inflation, geopolitical tensions, etc.] led to a risk-averse sentiment among investors, prompting them to withdraw funds from various investment vehicles, including those managed by Schroders. Keywords such as market volatility, investor sentiment, and risk aversion are crucial in understanding this aspect.

Performance of Schroders' Funds

The performance of specific Schroders funds also played a role. While some funds performed in line with expectations, others underperformed benchmarks, leading to client dissatisfaction and withdrawals. For example, [mention specific underperforming funds and their impact if data is publicly available]. This highlights the importance of fund performance, underperformance, and effective investment strategies in retaining client trust.

Competition in the Investment Management Industry

The highly competitive investment management landscape also contributed to client withdrawals. Schroders faces stiff competition from other major players offering similar products and services. Aggressive marketing strategies and competitive pricing from rivals may have influenced some clients to switch managers. Understanding the dynamics of investment management competition, market share, and competitor analysis provides context to this challenge.

Economic Factors

Broader economic factors, such as rising inflation and recession fears, exacerbated the situation. These macroeconomic uncertainties instilled apprehension among investors, prompting them to seek safer investment options or reduce their overall exposure to riskier assets, leading to further withdrawals from Schroders' funds. Inflation, recession fears, and economic uncertainty are key considerations in this context.

Schroders' Response to the Asset Decline

In response to the Q1 asset decline, Schroders has undertaken several strategic initiatives. These include [mention specific actions taken by Schroders such as cost-cutting measures, restructuring, new investment strategies etc.]. [Insert quotes from Schroders' management or official statements if available]. The effectiveness of these responses will be crucial in determining Schroders' future performance and ability to regain lost investor confidence. Analyzing Schroders' response, cost-cutting, strategic initiatives, and future outlook is essential for understanding the longer-term implications.

Conclusion: Understanding the Impact of Client Withdrawals on Schroders' Future

The significant Q1 asset decline at Schroders, primarily driven by client withdrawals, underscores the challenges faced by investment management firms in a volatile market. Multiple factors, including market volatility, underperformance of some funds, intense competition, and broader economic concerns, contributed to this outflow. Schroders' response, encompassing cost-cutting and strategic adjustments, will be crucial in determining its future trajectory. Understanding the reasons behind these client withdrawals is vital for predicting future trends in the investment management industry. Follow Schroders' Q2 results to understand the ongoing impact of client withdrawals and monitor future developments in the investment management sector to assess the evolving challenges related to client withdrawals and their impact on the overall AUM.

Whats Driving The Price Of Riot Platforms Riot Stock

Whats Driving The Price Of Riot Platforms Riot Stock

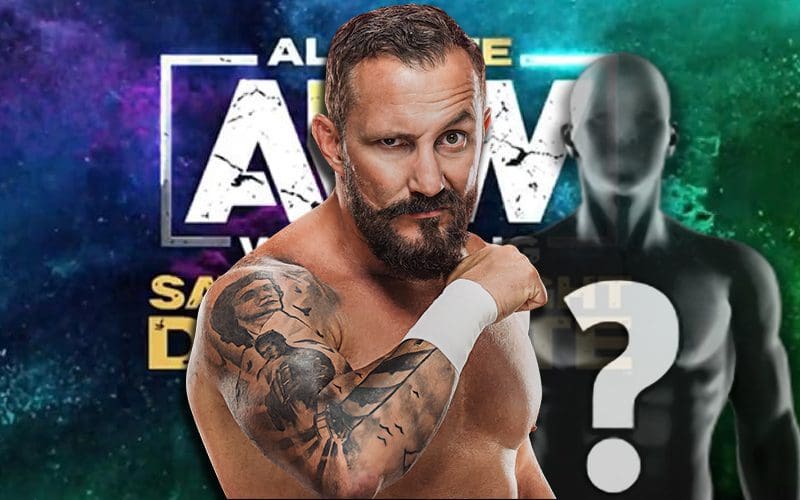

Mlw Battle Riot Vii Bobby Fish Joins The Fray

Mlw Battle Riot Vii Bobby Fish Joins The Fray

Battle Riot Vii Bobby Fish Among Announced Participants

Battle Riot Vii Bobby Fish Among Announced Participants

A Travelers Guide To This Country

A Travelers Guide To This Country

Epic Games And Fortnite A New Lawsuit Over In Game Store Purchases

Epic Games And Fortnite A New Lawsuit Over In Game Store Purchases