What's Driving The Price Of Riot Platforms (RIOT) Stock?

Table of Contents

Bitcoin's Price and Mining Revenue

The most significant factor affecting Riot Platforms (RIOT) stock price is the price of Bitcoin itself. There's a direct correlation between the two.

Direct Correlation: Bitcoin's Price and RIOT's Profitability

A higher Bitcoin price directly translates to increased mining profitability and higher revenue for RIOT. Conversely, a lower Bitcoin price leads to decreased mining revenue and potential stock price decline. This relationship is fundamental to understanding RIOT's financial health.

- Increased Bitcoin price = Increased mining revenue. Higher Bitcoin prices mean each mined Bitcoin is worth more, directly boosting RIOT's revenue stream.

- Decreased Bitcoin price = Decreased mining revenue and potential stock price decline. Lower Bitcoin prices reduce profitability, potentially impacting RIOT's stock price negatively.

- Hashrate and difficulty adjustments impact profitability. The Bitcoin network's hashrate (computing power) and difficulty adjustments influence the rate at which Bitcoin is mined, affecting overall profitability. A higher hashrate increases competition, potentially reducing individual miners' rewards.

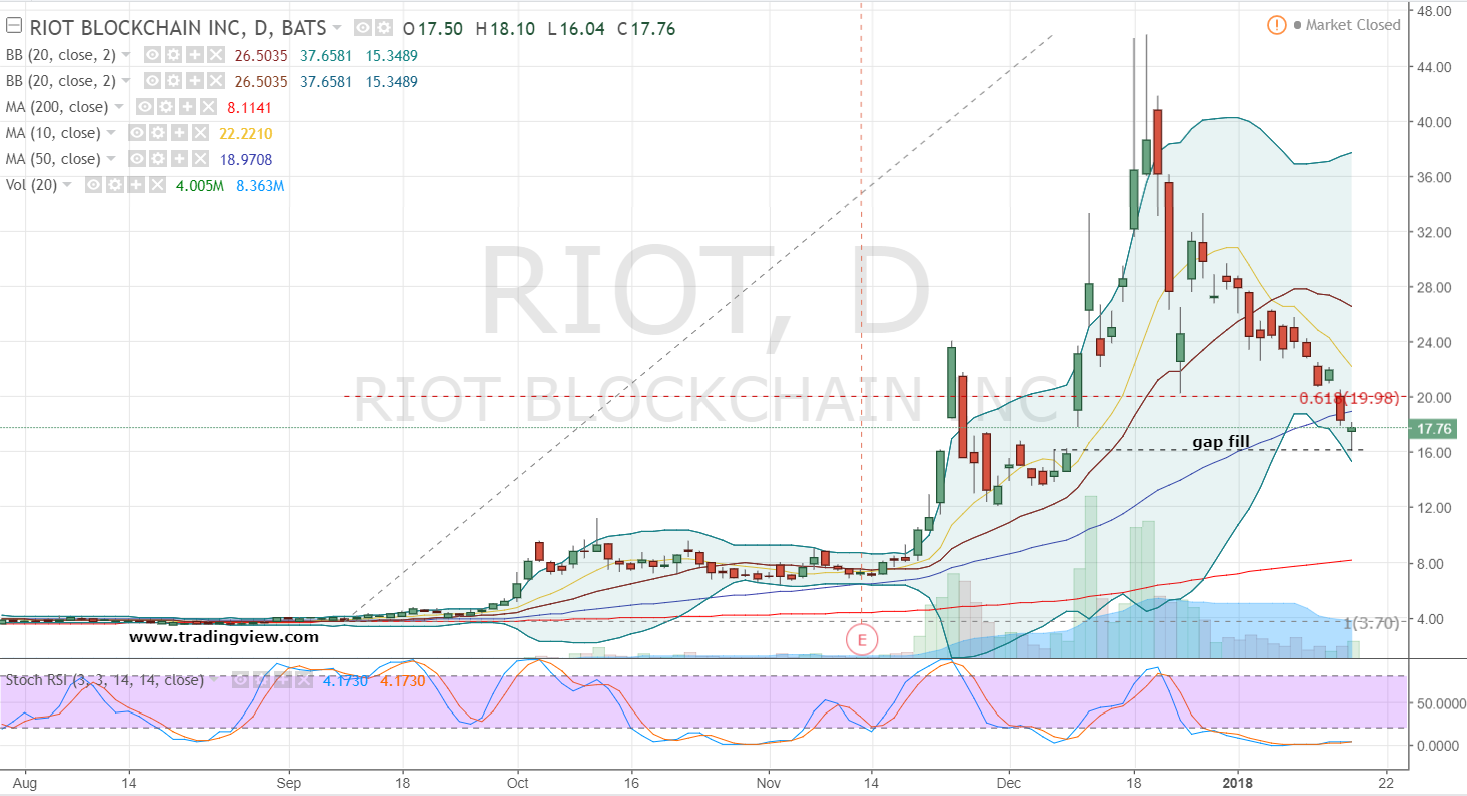

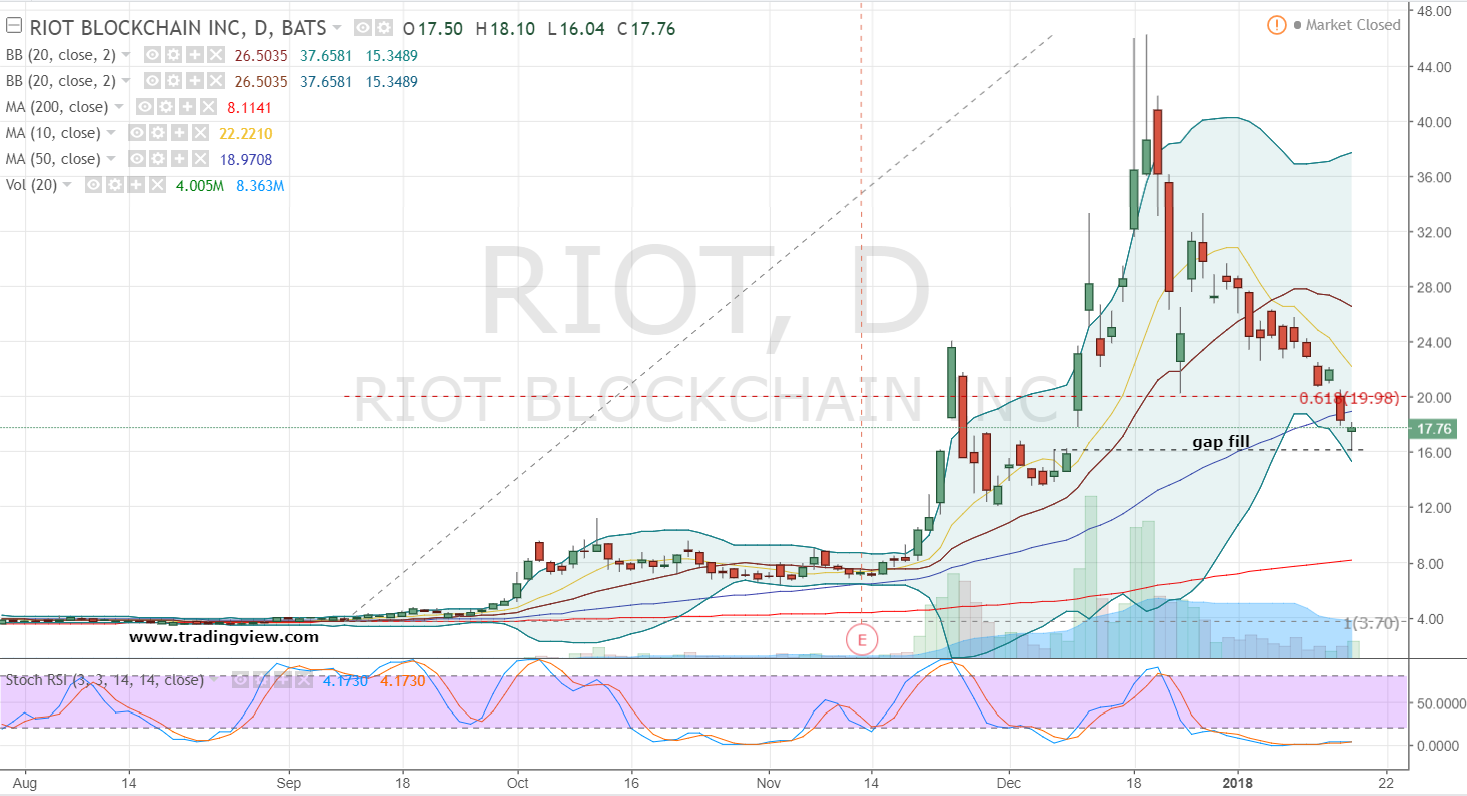

Details: Historical data clearly demonstrates a strong positive correlation between the Bitcoin price and RIOT's stock performance. When Bitcoin's price surges, RIOT's stock tends to follow suit, and vice-versa. However, the volatility of Bitcoin introduces considerable risk, impacting RIOT's financial stability. Investors must consider this inherent risk when evaluating RIOT as an investment. Analyzing charts comparing Bitcoin's price to RIOT's stock price over time reveals this relationship vividly.

Energy Costs and Operational Efficiency

Energy costs are a substantial expense for Bitcoin mining operations, significantly impacting Riot Platforms' profitability and, consequently, its stock price.

Impact of Energy Prices on Riot Platforms' Profitability

Higher energy prices directly reduce mining margins, as electricity consumption is a major operational cost for Bitcoin mining.

- Energy costs represent a major expense for Bitcoin mining operations. Electricity accounts for a significant portion of RIOT's operating expenses.

- Location of mining facilities and energy contracts significantly affect profitability. RIOT's strategic location of facilities and securing favorable energy contracts are crucial for maintaining cost-effectiveness.

- RIOT's strategies for managing energy costs (e.g., renewable energy sources). The company's commitment to sustainable energy sources can reduce long-term energy costs and improve investor sentiment.

Details: RIOT's energy sourcing strategies are key to its long-term success. Securing long-term contracts at competitive prices is vital. The company's progress towards utilizing renewable energy sources, such as hydropower, can reduce its vulnerability to volatile energy markets and improve its ESG (Environmental, Social, and Governance) profile, attracting environmentally conscious investors. Fluctuations in energy prices pose a consistent threat to RIOT's profit margins, affecting its stock price.

Regulatory Landscape and Industry Trends

The regulatory landscape surrounding cryptocurrencies significantly influences Riot Platforms and its stock price.

Government Regulations and Their Impact

Changes in mining regulations at the local, national, and international levels can directly impact RIOT's operations and profitability.

- Changes in mining regulations (local, national, and international) can affect operations. Stringent regulations could increase operating costs or limit mining activities.

- Environmental regulations related to energy consumption. Growing concerns about the environmental impact of Bitcoin mining are leading to stricter regulations on energy consumption, potentially affecting RIOT's operations.

- Tax policies impacting corporate profitability. Changes in tax policies can impact RIOT's profitability and overall attractiveness to investors.

Details: The evolving regulatory environment is a major uncertainty for RIOT. Changes in regulations, particularly those related to environmental sustainability and taxation, can have a substantial impact on the company's operational costs and profitability, directly influencing the Riot Platforms (RIOT) stock price. Understanding potential future regulatory changes and their impact is crucial for investors. ESG factors are increasingly important to investors, and RIOT's commitment to sustainable practices will influence its appeal.

Competition and Market Share

Riot Platforms operates in a competitive Bitcoin mining landscape. Its market position significantly influences its stock price.

Competitive Landscape in Bitcoin Mining

RIOT faces competition from other large-scale Bitcoin mining companies. Its market share and growth strategies are vital to its long-term success.

- Competition from other large-scale Bitcoin mining companies. RIOT competes with other major players in the industry, battling for hash rate dominance.

- Market share and growth strategies. RIOT's ability to expand its mining capacity and maintain a competitive market share will impact its profitability and stock price.

- Technological advancements and their impact on competition. Continuous technological advancements in mining hardware influence the efficiency and competitiveness of different mining operations.

Details: Analyzing RIOT's performance against competitors involves comparing mining capacity, energy efficiency, and operational costs. Its ability to innovate and adopt new technologies, alongside its strategic expansion plans, will be key determinants of its future market share and stock price.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation significantly influence the volatility of RIOT's stock price.

Influence of Market Trends on RIOT Stock Price

Broader market trends, investor confidence in Bitcoin, and news events all shape investor perception of RIOT.

- Overall market trends (bull vs. bear markets). During bull markets, investors are generally more willing to invest in riskier assets like RIOT stock.

- Investor confidence in the future of Bitcoin and cryptocurrencies. Positive sentiment toward Bitcoin and the cryptocurrency market generally benefits RIOT's stock price.

- News and events impacting investor perception of RIOT. Positive news, such as successful expansion projects or increased mining efficiency, can boost the stock price, while negative news can have the opposite effect.

Details: Analyst ratings, news coverage, and overall market sentiment play a significant role in shaping investor perceptions and driving fluctuations in the Riot Platforms (RIOT) stock price. Understanding these influences helps in assessing the potential risks and rewards associated with investing in RIOT.

Conclusion

The price of Riot Platforms (RIOT) stock is a complex interplay of factors: Bitcoin's price, energy costs, regulatory environments, competition, and overall market sentiment are all key drivers. Understanding these dynamics is crucial for making informed investment decisions regarding Riot Platforms (RIOT) stock. To stay updated on the latest developments affecting the Riot Platforms (RIOT) stock price, continue researching industry news and financial analysis. Further investigate the factors discussed here to form your own informed opinion on the future of Riot Platforms (RIOT) stock.

Featured Posts

-

England Stars Emotional Tribute After Kendal Girls Fatal Accident

May 02, 2025

England Stars Emotional Tribute After Kendal Girls Fatal Accident

May 02, 2025 -

Kshmyr Ykjhty Ka Ealmy Dn Azhar Ykjhty Awr Mtalbh Hq Khwd Aradyt

May 02, 2025

Kshmyr Ykjhty Ka Ealmy Dn Azhar Ykjhty Awr Mtalbh Hq Khwd Aradyt

May 02, 2025 -

Improving Mental Health Literacy Through Education

May 02, 2025

Improving Mental Health Literacy Through Education

May 02, 2025 -

Poppy Atkinson Funeral Held For Young Manchester United Fan

May 02, 2025

Poppy Atkinson Funeral Held For Young Manchester United Fan

May 02, 2025 -

Channel 4s Million Pound Giveaway Christopher Stevens Verdict

May 02, 2025

Channel 4s Million Pound Giveaway Christopher Stevens Verdict

May 02, 2025