Choosing Between MicroStrategy And Bitcoin: Investment Strategy For 2025

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy's Business Model & Bitcoin Holdings

MicroStrategy (MSTR) is a publicly traded company specializing in business intelligence, analytics, and mobile software. However, its significant investment in Bitcoin has dramatically altered its profile and become a major factor influencing its stock price. MicroStrategy has amassed a substantial Bitcoin treasury reserve, making it one of the largest corporate holders of the cryptocurrency. This bold strategy, initiated in 2020, reflects a belief in Bitcoin's long-term value as a store of value and a hedge against inflation.

- MicroStrategy's Bitcoin Acquisitions: The company has consistently added to its Bitcoin holdings over the years, often purchasing during periods of market dips. This demonstrates a long-term commitment to Bitcoin.

- Rationale Behind the Strategy: MicroStrategy's adoption of Bitcoin aims to protect its balance sheet from inflation and potentially generate significant returns on investment. This strategy signals a shift towards integrating cryptocurrencies into traditional corporate finance.

- Risks and Rewards: While this strategy has generated significant attention and, at times, increased stock value, it also exposes MicroStrategy to the considerable volatility of the Bitcoin market. A sharp decline in Bitcoin's price could negatively impact MSTR's stock price.

Investing in MicroStrategy: Risks and Rewards

Investing in MicroStrategy stock (MSTR) offers indirect exposure to Bitcoin. The performance of MSTR is intrinsically linked to the price of Bitcoin, but also dependent on the success of its core business operations. This makes it a more complex investment than simply buying Bitcoin.

- Stock Market Volatility: MSTR's stock price is highly volatile, reflecting both the volatility of the Bitcoin market and the inherent risks in the technology sector.

- Potential for High Returns: If Bitcoin's price appreciates significantly, MSTR’s stock could experience substantial gains. However, this is dependent on various market factors.

- Risk Assessment and Diversification: Investing in MSTR requires careful consideration of your risk tolerance. While potentially rewarding, it's important to diversify your portfolio to mitigate risk. MSTR should not be your sole investment.

Investing Directly in Bitcoin

Bitcoin's Technological Foundation and Future Potential

Bitcoin is a decentralized digital currency, secured by blockchain technology. Its limited supply (21 million coins) and increasing adoption by institutions are factors contributing to its potential for long-term growth.

- Blockchain Technology: Bitcoin's foundation lies in blockchain, a secure and transparent distributed ledger technology. This ensures the integrity and immutability of transactions.

- Scarcity and Deflationary Nature: Bitcoin's fixed supply creates scarcity, potentially making it a hedge against inflation in the long run.

- Institutional Adoption: Growing acceptance by major corporations and institutional investors suggests increasing mainstream recognition and potential for increased value.

- Regulatory Landscape: The regulatory environment surrounding Bitcoin is constantly evolving, presenting both opportunities and challenges.

Direct Bitcoin Investment: Risks and Rewards

Investing directly in Bitcoin offers the potential for substantial gains but comes with significant risks.

- Volatility: Bitcoin's price is notoriously volatile, experiencing dramatic price swings in short periods.

- Security Risks: Storing and managing Bitcoin requires careful attention to security. Loss of private keys can result in irreversible loss of funds. Choosing reputable exchanges and secure wallets is crucial.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain in many jurisdictions, introducing potential risks.

- Market Manipulation: The Bitcoin market is susceptible to manipulation, and sudden price drops can occur.

Comparing MicroStrategy and Direct Bitcoin Investment

Risk Tolerance and Investment Goals

The choice between MicroStrategy and direct Bitcoin investment depends heavily on your individual risk profile and investment objectives.

- Risk-Averse Investors: Investing in MicroStrategy may be a more suitable option, offering indirect exposure to Bitcoin with some diversification through its core business.

- Risk-Tolerant Investors: Direct Bitcoin investment might be considered, acknowledging the substantially higher volatility and potential for larger gains or losses.

- Short-Term vs. Long-Term: Bitcoin is generally considered a long-term investment, while MicroStrategy stock might be more suitable for those with shorter-term investment horizons.

Diversification and Portfolio Management

Both MicroStrategy and Bitcoin can be part of a well-diversified investment portfolio, but their inclusion requires careful consideration.

- Balancing Risk: Investing in both MicroStrategy and Bitcoin could lead to a more balanced portfolio, but it increases the complexity of risk management.

- Asset Allocation: Both should only constitute a percentage of your overall portfolio, depending on your risk profile and investment goals.

- Diversification Strategies: Combining these investments with other asset classes, like stocks and bonds, is crucial for effective portfolio diversification.

Conclusion

The decision between investing in MicroStrategy or directly in Bitcoin for 2025 depends heavily on your individual risk tolerance, investment timeline, and overall portfolio strategy. Investing in MicroStrategy offers indirect exposure to Bitcoin, mitigated by the company's other business activities, while direct Bitcoin investment offers potentially higher returns but with significantly greater volatility. Carefully analyze your risk tolerance and financial goals before deciding which approach – or a combination of both – is best suited for your investment strategy. Remember to conduct thorough research and potentially consult a financial advisor before making any significant investment decisions related to MicroStrategy or Bitcoin. Start planning your optimal investment strategy involving MicroStrategy and Bitcoin today!

Featured Posts

-

Improving Wheelchair Access On The Elizabeth Line A Tf L Focus

May 09, 2025

Improving Wheelchair Access On The Elizabeth Line A Tf L Focus

May 09, 2025 -

Dijon Accident Rue Michel Servet Un Vehicule Percute Un Mur

May 09, 2025

Dijon Accident Rue Michel Servet Un Vehicule Percute Un Mur

May 09, 2025 -

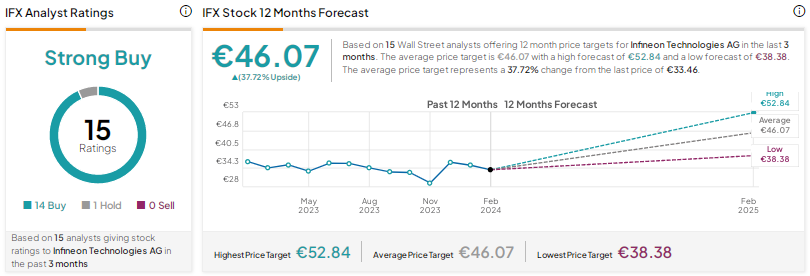

Infineon Ifx Sales Guidance Misses Estimates Amid Trump Tariff Uncertainty

May 09, 2025

Infineon Ifx Sales Guidance Misses Estimates Amid Trump Tariff Uncertainty

May 09, 2025 -

Uy Scuti Release Date Young Thug Offers Clues To New Album

May 09, 2025

Uy Scuti Release Date Young Thug Offers Clues To New Album

May 09, 2025 -

Harry Styles Devastated Reaction To Poor Snl Impression

May 09, 2025

Harry Styles Devastated Reaction To Poor Snl Impression

May 09, 2025