Chocolate Cravings And Global Inflation: The Unexpected Connection

Table of Contents

The Rising Cost of Cocoa and its Impact on Chocolate Prices

The price of cocoa beans, the fundamental ingredient in chocolate, has been steadily climbing in recent years. Several factors contribute to this increase:

- Climate Change: Erratic weather patterns, including droughts and floods, severely impact cocoa crop yields in major producing regions like West Africa.

- Cocoa Crop Diseases: Diseases such as black pod rot and frosty pod rot can decimate cocoa plantations, further reducing supply.

- Geopolitical Instability: Political unrest and conflict in cocoa-producing countries often disrupt harvests and transportation, leading to supply shortages.

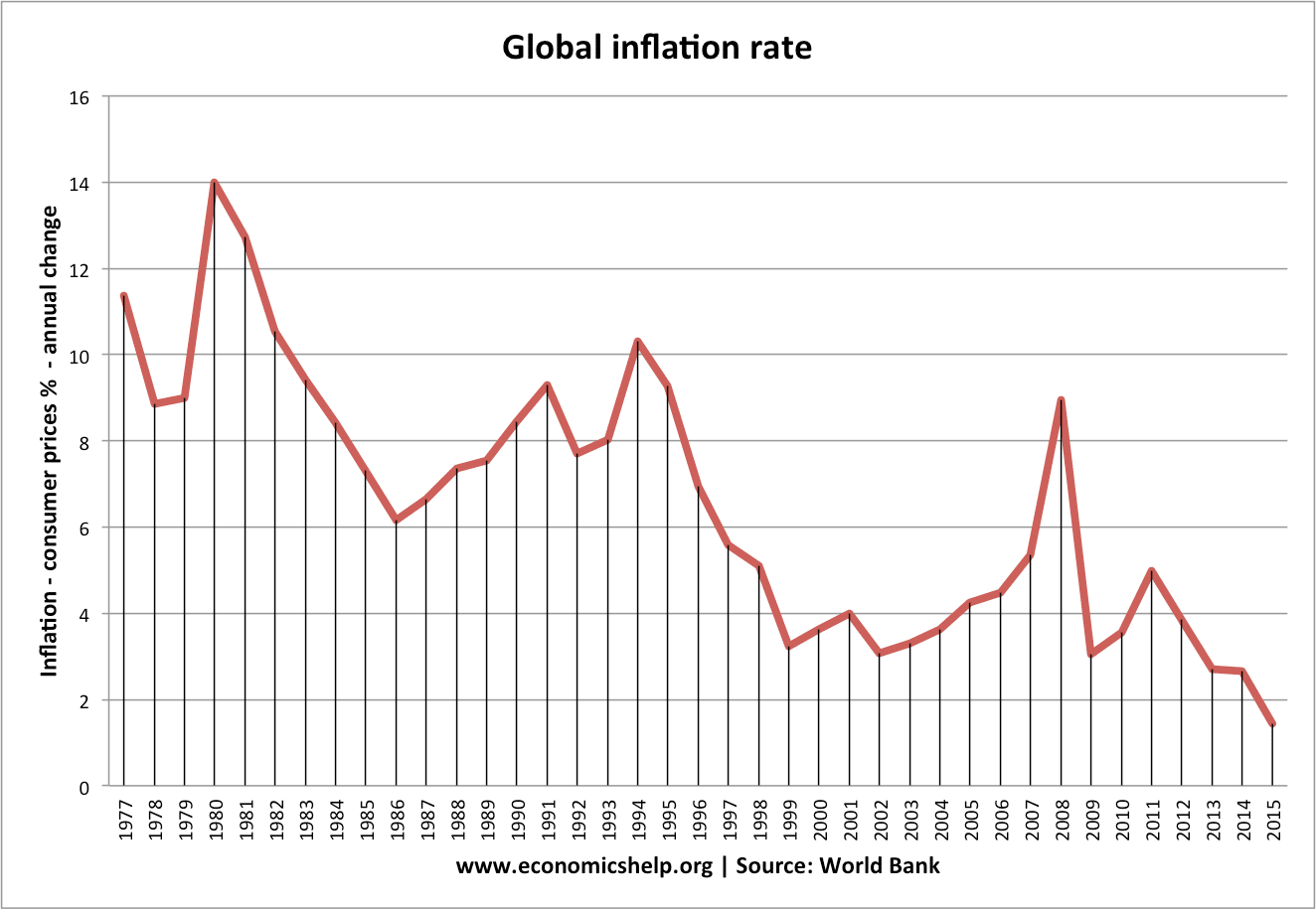

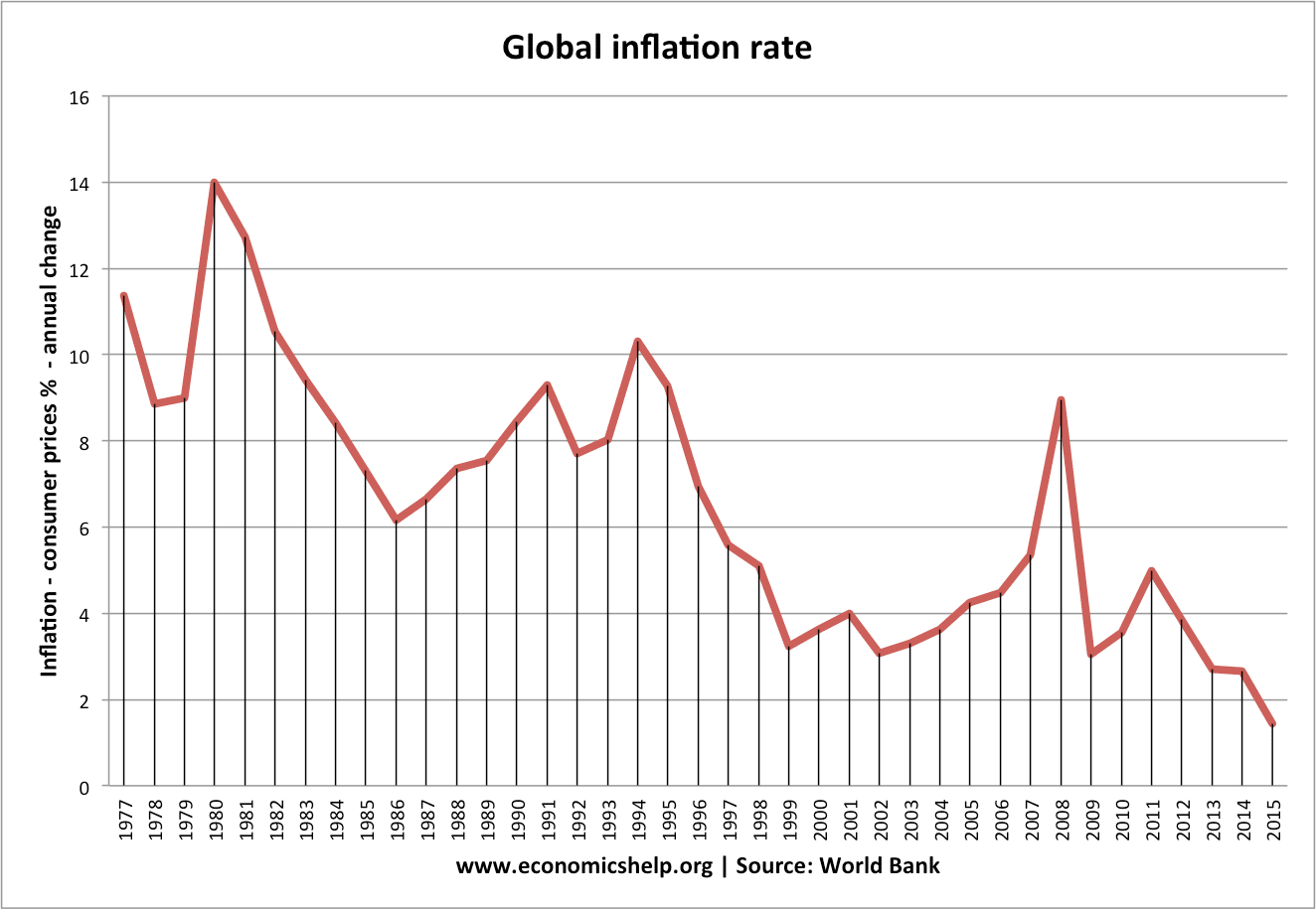

These challenges have resulted in significant price increases:

- 2020: Cocoa prices saw a moderate rise due to initial pandemic-related disruptions.

- 2021: Prices experienced a more substantial jump, reflecting the compounding effects of climate change and supply chain issues.

- 2022-Present: Continued volatility and upward pressure on cocoa bean prices persist, directly impacting the cost of chocolate production and the final price on store shelves.

These rising cocoa prices translate directly into higher prices for chocolate bars, cocoa powder, and other chocolate products, making that satisfying chocolate craving a more expensive indulgence for consumers. The inflation impact on chocolate is undeniable.

Supply Chain Disruptions and Their Role in Increased Chocolate Costs

The global chocolate supply chain, like many others, has been severely disrupted in recent years. These disruptions significantly affect both the availability and the cost of chocolate:

- Increased Transportation Costs: Fuel prices have soared, increasing the cost of shipping cocoa beans from farms to processing plants and finished products to retailers.

- Port Congestion and Delays: Global port congestion continues to cause significant delays in shipping, leading to shortages and higher costs.

- Labor Shortages: Labor shortages in various stages of the supply chain, from farming to manufacturing, have added further strain and increased costs.

These bottlenecks ripple through the entire chocolate industry, from farmers to manufacturers and retailers, ultimately impacting the price consumers pay. The chocolate supply chain's vulnerability to global disruptions highlights the interconnectedness of the global economy.

Changing Consumer Behavior in Response to Inflation and Chocolate Prices

Facing higher chocolate prices, consumers are adapting their purchasing habits:

- Downsizing: Many are opting for smaller chocolate bars or sharing larger ones to manage costs.

- Brand Switching: Consumers are increasingly switching from premium brands to more affordable options.

- Reduced Consumption: Some are reducing their overall chocolate consumption due to budget constraints.

- Trade-offs: Consumers may be substituting chocolate for other treats or snacks.

These changes reflect a broader trend of consumers adjusting their spending habits in response to rising inflation. The impact of inflation on consumer spending is significant, and the chocolate industry is no exception. The demand for affordable chocolate is on the rise.

The Psychology of Chocolate Cravings and Inflation's Influence

The psychology behind chocolate cravings is complex. While enjoying the taste and texture plays a role, emotional factors are often at play. The stress and anxiety associated with economic uncertainty, particularly during times of high inflation, can exacerbate these cravings:

- Stress Eating: Chocolate often serves as a comfort food, potentially leading to increased consumption during stressful periods.

- Emotional Regulation: Some individuals may turn to chocolate as a way to cope with the emotional burden of financial worries.

Research suggests a correlation between stress levels and increased consumption of comfort foods like chocolate. While more research is needed to specifically link inflation anxiety and chocolate cravings, the anecdotal evidence is compelling.

Conclusion: Understanding the Interplay Between Chocolate Cravings and Global Inflation

The seemingly simple act of indulging in chocolate is intricately linked to complex global economic forces. Rising cocoa prices, driven by climate change, disease, and geopolitical instability, combined with supply chain disruptions and increased transportation costs, have significantly increased the price of chocolate. This, in turn, has led to shifts in consumer behavior and potentially intensified chocolate cravings due to the stress of economic uncertainty. Understanding the relationship between chocolate cravings and global inflation can help you make informed purchasing decisions. Stay informed about global inflation and its effects on your favorite treats, and remember that even your chocolate cravings are impacted by broader economic trends.

Featured Posts

-

Should You Buy Xrp After A 400 Price Jump Risk And Reward Assessment

May 01, 2025

Should You Buy Xrp After A 400 Price Jump Risk And Reward Assessment

May 01, 2025 -

Lich Thi Dau Chinh Thuc Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025 10 Tran Dau Hap Dan

May 01, 2025

Lich Thi Dau Chinh Thuc Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025 10 Tran Dau Hap Dan

May 01, 2025 -

La Controverse Des Celebrations Aux Armes A Feu D Une Star Nba

May 01, 2025

La Controverse Des Celebrations Aux Armes A Feu D Une Star Nba

May 01, 2025 -

Analyzing Ongoing Nuclear Litigation Trends And Predictions

May 01, 2025

Analyzing Ongoing Nuclear Litigation Trends And Predictions

May 01, 2025 -

Bed Hdf Haland Mn Ytsdr Qaymt Hdafy Aldwry Alinjlyzy

May 01, 2025

Bed Hdf Haland Mn Ytsdr Qaymt Hdafy Aldwry Alinjlyzy

May 01, 2025