Should You Buy XRP After A 400% Price Jump? Risk And Reward Assessment

Table of Contents

Understanding the Recent XRP Price Surge

XRP's price has experienced a significant 400% jump, leaving many wondering about the underlying causes. Several factors contributed to this dramatic increase.

Ripple Lawsuit Update

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) significantly impacts XRP's price. Recent positive developments in the case have fueled optimism amongst investors.

- Key legal arguments: Ripple's defense centers around the argument that XRP is not a security, unlike other cryptocurrencies. The SEC argues that XRP was sold as an unregistered security.

- Potential outcomes (positive and negative): A favorable ruling for Ripple could lead to a substantial increase in XRP's price, while an unfavorable outcome could trigger a sharp decline. Legal experts offer varied opinions, highlighting the uncertainty surrounding the case.

- Expert opinions: While some legal experts predict a positive outcome for Ripple, others remain cautious, emphasizing the complexities of the case and the potential for unexpected developments.

Market Sentiment and Speculation

Hype and speculation played a crucial role in XRP's price increase. Positive news, social media buzz, and influencer endorsements significantly impacted market sentiment.

- Social media trends: Increased discussions and positive sentiment surrounding XRP on platforms like Twitter and Telegram amplified the price surge.

- News articles: Favorable news coverage and analyses contributed to the overall positive market perception of XRP.

- Influencer opinions: Endorsements from prominent cryptocurrency influencers further fueled speculation and investor interest.

- Impact of broader crypto market trends: The overall positive trend in the broader cryptocurrency market also contributed to XRP's price appreciation.

Technical Analysis of XRP

Technical analysis suggests potential future price movements, but it's crucial to remember its limitations. Chart patterns and support/resistance levels offer insights, but they are not foolproof.

- Chart patterns: Analysis of price charts can reveal potential trends, support levels, and resistance levels, providing clues about potential future price movements.

- Support/resistance levels: Identifying these levels can help in predicting potential price reversals or breakouts.

- Disclaimer: Technical analysis is not a perfect predictor, and it's essential to consider it alongside fundamental analysis and other factors.

Assessing the Risks of Buying XRP Now

Despite the recent surge, buying XRP now carries substantial risks. The cryptocurrency market's inherent volatility and regulatory uncertainty should not be overlooked.

Volatility and Price Corrections

Cryptocurrencies are notoriously volatile, and XRP is no exception. A significant price correction following such a substantial increase is highly probable.

- Historical price volatility of XRP: XRP has a history of experiencing sharp price swings, highlighting its inherent risk.

- Potential for a "pump and dump" scenario: The rapid price increase raises concerns about a potential pump-and-dump scheme, where the price is artificially inflated before a sudden crash.

- Risk tolerance assessment: Investors should carefully assess their risk tolerance before investing in XRP, considering the potential for significant losses.

Regulatory Uncertainty

The regulatory landscape surrounding XRP remains uncertain, posing a significant risk to investors.

- SEC regulations: The ongoing lawsuit with the SEC casts a shadow over XRP's future, with potential implications for its legality and usage.

- International regulations: Regulatory developments in different jurisdictions could also impact XRP's adoption and price.

- Potential for future regulatory crackdowns: The possibility of stricter regulations cannot be ruled out, potentially impacting the price negatively.

Competition in the Crypto Market

XRP faces intense competition from other cryptocurrencies in the rapidly evolving digital asset market.

- Competing cryptocurrencies: Numerous cryptocurrencies offer similar functionalities to XRP, creating a competitive landscape.

- Technological advancements: Continuous technological advancements in the crypto space can quickly render older technologies obsolete.

- Market share: XRP's market share relative to other cryptocurrencies needs careful consideration.

Evaluating the Potential Rewards of Buying XRP

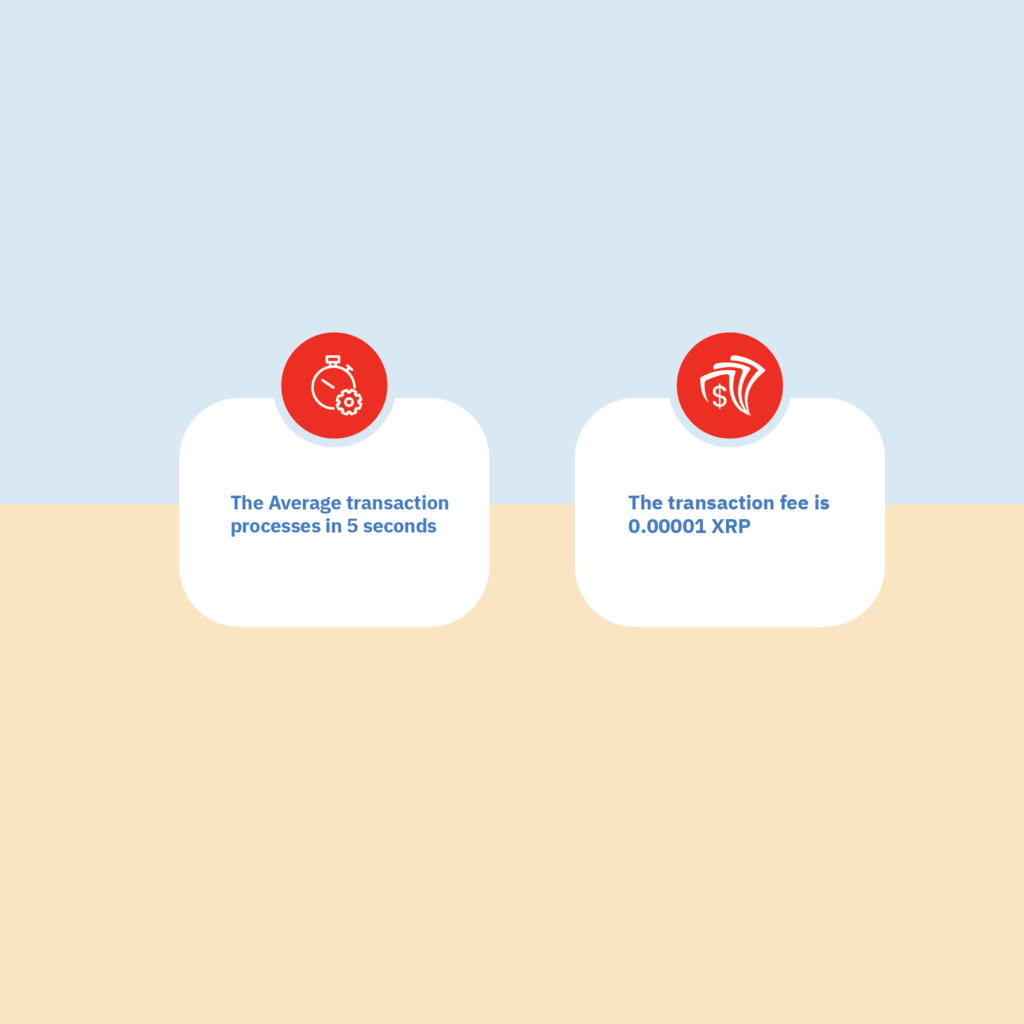

Despite the risks, XRP holds potential long-term rewards, driven by its use case in cross-border payments and technological advantages.

Long-Term Growth Potential

XRP's potential for long-term growth is based on its adoption by financial institutions and ongoing technological developments.

- Adoption by financial institutions: Increased adoption by financial institutions for cross-border payments could significantly boost XRP's demand.

- Partnerships: Strategic partnerships with financial institutions can further drive growth and adoption.

- Future technological developments: Further improvements and upgrades to XRP's technology could enhance its efficiency and appeal.

Diversification Benefits

XRP can contribute to a diversified investment portfolio, reducing overall risk.

- Risk mitigation strategies: Adding XRP to a diversified portfolio can help mitigate the risk associated with investing in a single asset class.

- Asset allocation: Strategic asset allocation should consider XRP's risk profile relative to other assets.

- Comparison to other crypto assets: XRP's risk and reward profile should be compared with other cryptocurrencies before making investment decisions.

Potential for Further Price Appreciation

While possible, predicting further price appreciation is highly speculative and depends on the factors discussed previously. The cryptocurrency market remains highly unpredictable.

Conclusion

The decision of whether or not to buy XRP after a 400% price jump is complex, balancing significant potential rewards with substantial inherent risks. Remember that cryptocurrency investments are inherently risky, and you should only invest what you can afford to lose. This analysis provides insights into the factors influencing XRP's price, but it's crucial to conduct thorough research and consider your own risk tolerance before making any investment decisions regarding XRP. Carefully assess the risks and rewards of XRP investment before proceeding.

Featured Posts

-

Former Wkrn Anchors Nikki Burdine And Neil Orne Announce New Ventures

May 01, 2025

Former Wkrn Anchors Nikki Burdine And Neil Orne Announce New Ventures

May 01, 2025 -

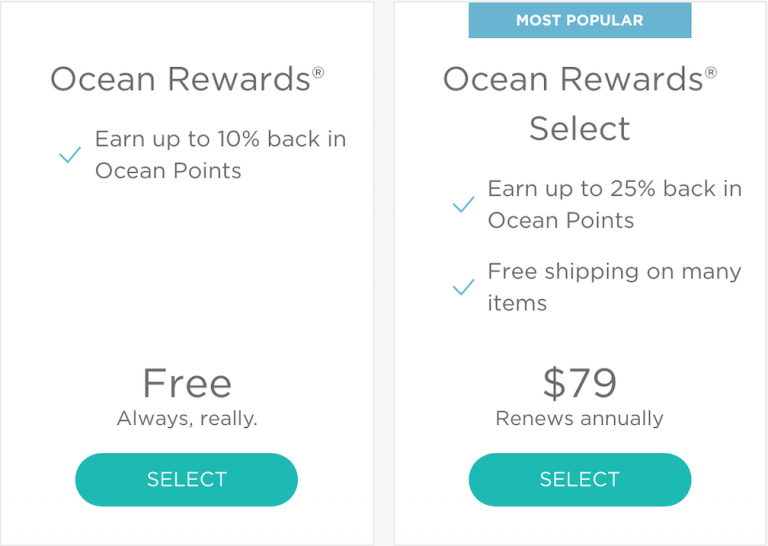

New Cruise Rewards Program From Cruises Com How To Maximize Your Points

May 01, 2025

New Cruise Rewards Program From Cruises Com How To Maximize Your Points

May 01, 2025 -

Doctors Urgent Warning This Food May Be Killing You

May 01, 2025

Doctors Urgent Warning This Food May Be Killing You

May 01, 2025 -

Canadas Conservative Leader Pierre Poilievre Unexpected Election Defeat

May 01, 2025

Canadas Conservative Leader Pierre Poilievre Unexpected Election Defeat

May 01, 2025 -

125 Murid Asnaf Sibu Terima Bantuan Kembali Ke Sekolah Tabung Baitulmal Sarawak 2025

May 01, 2025

125 Murid Asnaf Sibu Terima Bantuan Kembali Ke Sekolah Tabung Baitulmal Sarawak 2025

May 01, 2025

Latest Posts

-

Cruises Com Revolutionizes Cruise Rewards With Points Based System

May 01, 2025

Cruises Com Revolutionizes Cruise Rewards With Points Based System

May 01, 2025 -

New Cruise Rewards Program From Cruises Com How To Maximize Your Points

May 01, 2025

New Cruise Rewards Program From Cruises Com How To Maximize Your Points

May 01, 2025 -

Seven Carnival Cruise Line Updates Revealed Next Month

May 01, 2025

Seven Carnival Cruise Line Updates Revealed Next Month

May 01, 2025 -

Dissenting Voice Pushes For Sweeping Changes At Parkland School Board

May 01, 2025

Dissenting Voice Pushes For Sweeping Changes At Parkland School Board

May 01, 2025 -

Earn More Cruise More Cruises Coms Industry First Rewards Program

May 01, 2025

Earn More Cruise More Cruises Coms Industry First Rewards Program

May 01, 2025