Chinese Stock Market's Positive Response To Renewed US Talks And Economic Data

Table of Contents

Renewed US-China Trade Talks Spark Market Confidence

The resumption of high-level dialogues between the US and China has significantly eased concerns about escalating trade tensions, a major factor impacting market sentiment. This renewed focus on trade negotiations is boosting investor confidence and leading to increased capital inflow into the Chinese stock market.

-

Reduced Uncertainty: The potential for breakthroughs in trade negotiations is lessening the uncertainty surrounding future tariffs. This is encouraging businesses to invest and expand, positively impacting stock market performance. Companies previously hesitant to invest due to tariff unpredictability are now feeling more confident.

-

Positive Developments: Recent reports indicate progress in specific areas, such as agricultural purchases and intellectual property protection. These positive developments, while perhaps incremental, send a strong signal of improved bilateral relations, further bolstering market confidence. For instance, the recent agreement on a significant purchase of US soybeans contributed to a noticeable rise in market optimism.

-

Improved Market Sentiment: The shift in market sentiment is evident in increased trading volumes and a rise in foreign investment. Analysts are reporting a considerable increase in positive forecasts for Chinese economic growth, directly linked to the progress in trade talks. This improved sentiment is crucial for sustained growth in the Chinese stock market.

Strong Economic Data Fuels Domestic Growth

Beyond external factors, strong domestic economic data is another key driver of the Chinese stock market's recent growth. Recent economic indicators have exceeded expectations, providing a solid foundation for continued upward momentum.

-

GDP Growth: China's GDP growth figures have consistently outperformed predictions, signaling a healthy and expanding economy. This robust growth provides a strong base for increased corporate profitability and investor confidence.

-

Consumer Spending: Robust consumer spending indicates strong domestic demand, a crucial component of economic health. This positive indicator demonstrates consumer confidence and fuels further economic expansion.

-

Industrial Production: Increases in industrial production demonstrate the strength of China's manufacturing sector, a significant contributor to overall economic growth and stock market performance. This indicates strong underlying economic activity.

-

Inflation Stability: Positive inflation figures demonstrate a stable economic environment, reducing investment risks. Controlled inflation indicates a healthy economy, free from the destabilizing effects of runaway price increases. This stability is a crucial factor for attracting both domestic and foreign investment.

Impact on Key Indices: Shanghai Composite and Shenzhen Component

The positive developments discussed above have had a direct and significant impact on key Chinese stock market indices.

-

Shanghai Composite Index: The Shanghai Composite Index has experienced a considerable percentage increase in recent weeks, reflecting the overall positive market sentiment. This demonstrates the broad-based nature of the growth, impacting a wide range of sectors.

-

Shenzhen Component Index: Similarly, the Shenzhen Component Index, which is more focused on technology and growth stocks, has also seen significant gains, indicating strong performance across various sectors of the Chinese economy.

-

Sectoral Performance: While the overall indices show positive performance, certain sectors, such as technology and consumer staples, have outperformed others, reflecting changing economic priorities and investment trends. This highlights the need for diversification in investment strategies within the Chinese stock market.

Potential Risks and Challenges Remain

While the current outlook is positive, it is crucial to acknowledge potential risks and challenges that could impact the Chinese stock market's performance.

-

Geopolitical Risks: Ongoing geopolitical tensions, both regionally and globally, could negatively impact market sentiment and investor confidence. Uncertainties surrounding international relations remain a factor to consider.

-

Market Volatility: While the current trend is upward, market volatility is inherent in any stock market. Unexpected events can trigger sharp corrections, even in the face of positive economic indicators.

-

Regulatory Changes: Changes in government regulations can significantly affect individual sectors and the overall market performance. Investors need to remain aware of potential regulatory shifts and their impact on their investments.

-

Economic Uncertainty: While current economic data is positive, future economic growth is never guaranteed. Unforeseen economic slowdowns or global economic shocks could negatively impact the Chinese stock market.

Conclusion

The current positive trend in the Chinese stock market is largely attributable to renewed US-China trade talks and strong domestic economic data. This has resulted in significant gains in key indices like the Shanghai Composite and Shenzhen Component. However, investors must remember that potential risks and challenges remain. The opportunities presented by the Chinese stock market are undeniable, but thorough research and a balanced perspective are vital. The current positive trend in the Chinese stock market, driven by renewed US talks and encouraging economic data, presents potential investment opportunities. However, it is crucial to conduct thorough research and consider the potential risks before making any investment decisions. Stay informed about developments in the Chinese stock market and consider consulting a financial advisor for personalized guidance.

Featured Posts

-

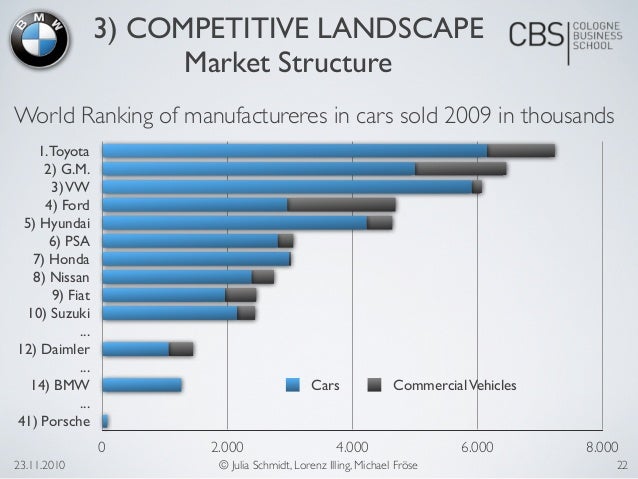

Chinas Impact On Bmw And Porsche Sales Market Analysis And Future Outlook

May 07, 2025

Chinas Impact On Bmw And Porsche Sales Market Analysis And Future Outlook

May 07, 2025 -

Nba Playoffs Cavaliers First Round Opponent Revealed

May 07, 2025

Nba Playoffs Cavaliers First Round Opponent Revealed

May 07, 2025 -

Multiple Injured In Arizona Restaurant Shooting Police Investigating

May 07, 2025

Multiple Injured In Arizona Restaurant Shooting Police Investigating

May 07, 2025 -

Analyzing The Carney Trump Meeting Potential Impacts And Implications

May 07, 2025

Analyzing The Carney Trump Meeting Potential Impacts And Implications

May 07, 2025 -

Parents Of Twins Killed In San Carlos Street Race Driver Sentenced To Eight Years

May 07, 2025

Parents Of Twins Killed In San Carlos Street Race Driver Sentenced To Eight Years

May 07, 2025

Latest Posts

-

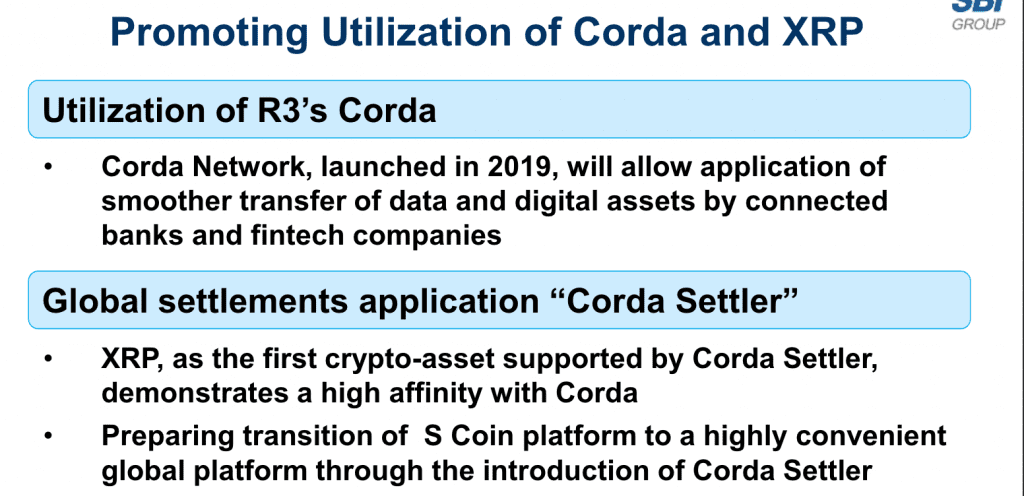

Ripple Xrp And Sbi Holdings Shareholder Rewards Program Announced

May 07, 2025

Ripple Xrp And Sbi Holdings Shareholder Rewards Program Announced

May 07, 2025 -

British Cycling Stars Celebrate Birth Of Daughter Following Fertility Challenges

May 07, 2025

British Cycling Stars Celebrate Birth Of Daughter Following Fertility Challenges

May 07, 2025 -

Xrp Distribution To Shareholders Latest Ripple Xrp News From Sbi Holdings

May 07, 2025

Xrp Distribution To Shareholders Latest Ripple Xrp News From Sbi Holdings

May 07, 2025 -

Kenny Couple Welcomes Daughter After Fertility Struggles

May 07, 2025

Kenny Couple Welcomes Daughter After Fertility Struggles

May 07, 2025 -

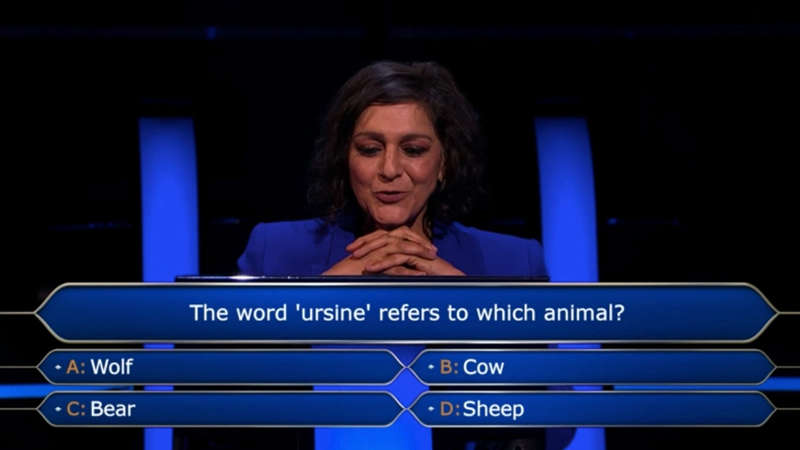

Easy Question Costs Who Wants To Be A Millionaire Contestant Viewers Approval

May 07, 2025

Easy Question Costs Who Wants To Be A Millionaire Contestant Viewers Approval

May 07, 2025