Chinese Stock Market Rebound: Assessing The Impact Of US Negotiations And Economic Indicators

Table of Contents

The Influence of US-China Trade Negotiations

The US-China trade war has been a major factor influencing the volatility of the Chinese stock market. The progress (or lack thereof) in trade negotiations directly correlates with market performance. Positive developments often lead to a stock market rebound, while escalating tensions trigger declines.

-

Analysis of past market reactions to trade announcements and escalations: Historically, announcements of new tariffs or trade restrictions have led to immediate drops in the Shanghai Composite Index and the Shenzhen Component Index. Conversely, positive news regarding trade talks, such as the signing of a "Phase One" trade deal, has been met with a noticeable market rally. This demonstrates the sensitive relationship between bilateral relations and investor sentiment.

-

Examination of specific sectors most affected by trade tensions (e.g., technology, manufacturing): Sectors heavily reliant on exports to the US, such as technology and manufacturing, have been particularly vulnerable to trade disputes. Companies in these sectors experienced significant stock price fluctuations as tariffs impacted their profitability and competitiveness.

-

Discussion of the potential for a positive market response following a trade deal resolution: A comprehensive trade agreement could lead to increased investor confidence, potentially triggering a sustained rebound in the Chinese stock market. Reduced uncertainty and improved business prospects would likely attract foreign investment and boost domestic consumption.

-

Exploration of alternative scenarios, including prolonged trade disputes and their potential consequences: Conversely, a prolonged trade war could severely dampen economic growth, leading to further market instability and potentially a prolonged downturn. This scenario would likely negatively impact various sectors and significantly reduce investment opportunities.

Key Economic Indicators Driving the Rebound

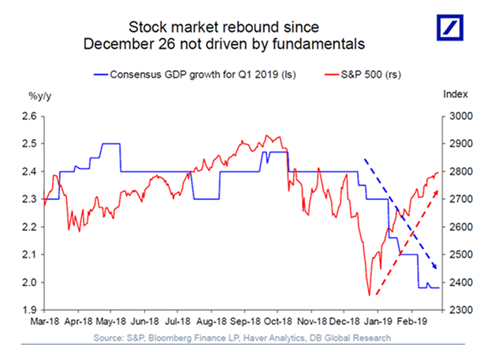

Beyond trade negotiations, several key economic indicators are driving the recent rebound in the Chinese stock market. Analyzing these indicators provides valuable insights into the health of the Chinese economy and future market prospects.

-

Examination of recent GDP growth figures and their implications for market confidence: Recent GDP growth figures, while showing some slowdown, have still generally remained within government targets, signaling relative stability and boosting investor confidence. Sustained growth is crucial for a healthy stock market.

-

Analysis of inflation rates and their potential impact on monetary policy: Moderate inflation rates provide the central bank with flexibility to maintain supportive monetary policies. High inflation could lead to interest rate hikes, potentially dampening economic growth and impacting stock market performance.

-

Assessment of consumer spending and industrial production data as indicators of domestic demand: Strong consumer spending and robust industrial production indicate healthy domestic demand, supporting economic growth and bolstering investor optimism. These figures are vital for understanding the resilience of the Chinese economy.

-

Discussion of the unemployment rate and its influence on investor sentiment: A low and stable unemployment rate signals a strong labor market, fostering consumer confidence and reducing economic uncertainty. Rising unemployment, conversely, can negatively impact investor sentiment and market performance.

-

Review of foreign direct investment flows and their contribution to market stability: Consistent inflows of foreign direct investment demonstrate confidence in the Chinese economy and contribute to market stability. This influx of capital strengthens the currency and supports overall growth.

Analyzing the Shanghai Composite and Shenzhen Component Indices

The Shanghai Composite Index (SSE) and the Shenzhen Component Index (SZSE) are the two major benchmarks for the Chinese stock market. Analyzing their performance provides crucial insights into overall market trends.

-

Comparison of the performance of different sectors within the indices: While both indices generally move in tandem, performance variations across sectors (e.g., technology, financials, consumer staples) offer valuable clues about the overall economic landscape.

-

Identification of leading and lagging sectors within the rebound: Certain sectors may outperform others during a market rebound. Analyzing these leading and lagging sectors can help investors identify promising investment opportunities.

-

Discussion of market capitalization changes and their significance: Changes in market capitalization of listed companies reflect investor sentiment and valuations. Tracking these changes provides a valuable indication of market strength and potential future growth. The HSCEI (Hang Seng China Enterprises Index) also provides a useful metric for evaluating large-cap Chinese companies listed in Hong Kong.

Assessing Risk and Identifying Investment Opportunities

Investing in the Chinese stock market presents both opportunities and risks. Understanding these aspects is essential for making informed investment decisions.

-

Discussion of the inherent volatility of the Chinese stock market: The Chinese stock market is known for its volatility, influenced by both domestic and global factors. Investors should be prepared for significant price swings.

-

Strategies for mitigating risks associated with investing in the Chinese market: Risk mitigation strategies include diversification across different sectors and asset classes, utilizing stop-loss orders, and conducting thorough due diligence.

-

Identification of potential sectors poised for growth: Sectors like technology, renewable energy, and consumer goods often present growth potential, though careful research is crucial.

-

Advice on conducting thorough due diligence before making investment decisions: Before investing, investors should carefully research individual companies, considering their financials, competitive landscape, and regulatory environment.

Conclusion

The rebound in the Chinese stock market is a complex phenomenon influenced by both external factors, such as US-China trade relations, and internal factors, like key economic indicators. While the market presents significant opportunities, investors must carefully consider the inherent risks and volatility. Understanding the interplay between trade negotiations and economic data is crucial for informed investment decisions. The performance of indices like the Shanghai Composite Index and Shenzhen Component Index, alongside indicators like GDP growth and foreign investment, are all key factors to monitor.

Call to Action: Stay informed about the ongoing developments in the Chinese stock market and the related US negotiations to make well-informed decisions. Continue researching the latest economic indicators and consider consulting with financial advisors before making any investment in the Chinese stock market. Thorough due diligence and a clear understanding of the risks associated with Chinese stock market investment are crucial for success.

Featured Posts

-

The Last Of Us Isabela Merced Reacts To A Significant Change

May 07, 2025

The Last Of Us Isabela Merced Reacts To A Significant Change

May 07, 2025 -

Steelers Insider Reveals Insights Into George Pickens Potential

May 07, 2025

Steelers Insider Reveals Insights Into George Pickens Potential

May 07, 2025 -

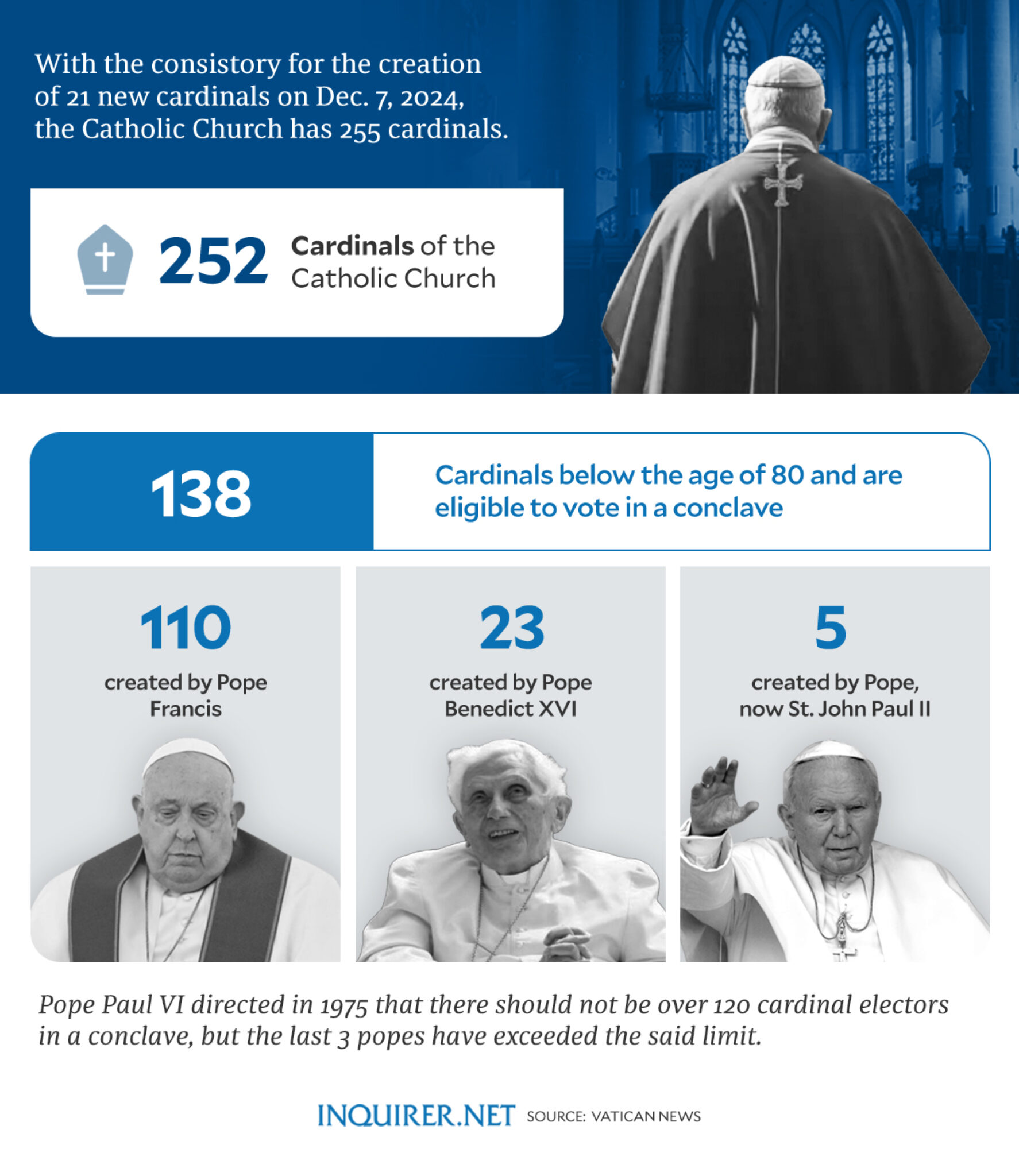

The Conclave Selecting The Next Pope A Step By Step Guide

May 07, 2025

The Conclave Selecting The Next Pope A Step By Step Guide

May 07, 2025 -

Met Gala 2023 Rihanna Announces Third Pregnancy

May 07, 2025

Met Gala 2023 Rihanna Announces Third Pregnancy

May 07, 2025 -

Indian Bourse Bse Share Price Surge On Positive Earnings

May 07, 2025

Indian Bourse Bse Share Price Surge On Positive Earnings

May 07, 2025

Latest Posts

-

Dame Laura Kenny Welcomes Baby Daughter

May 07, 2025

Dame Laura Kenny Welcomes Baby Daughter

May 07, 2025 -

Xrp Investment Analysis Considering The Recent 400 Jump

May 07, 2025

Xrp Investment Analysis Considering The Recent 400 Jump

May 07, 2025 -

Xrp Price Prediction Whale Buys 20 Million Tokens Whats Next

May 07, 2025

Xrp Price Prediction Whale Buys 20 Million Tokens Whats Next

May 07, 2025 -

400 Xrp Increase A Detailed Investment Analysis

May 07, 2025

400 Xrp Increase A Detailed Investment Analysis

May 07, 2025 -

20 M Xrp Purchased Whale Activity Signals Potential Price Surge

May 07, 2025

20 M Xrp Purchased Whale Activity Signals Potential Price Surge

May 07, 2025