400% XRP Increase: A Detailed Investment Analysis

Table of Contents

Analyzing the 400% XRP Price Surge

The sheer magnitude of the 400% XRP price increase demands a thorough analysis. We'll examine both the technical indicators and the fundamental factors that have contributed to this remarkable growth.

Technical Analysis of XRP's Chart

Technical analysis provides valuable insights into price trends. Examining XRP's chart reveals several key aspects:

- Support and Resistance Levels: Identifying key support and resistance levels helps predict potential price reversals or breakouts. Recent price action has broken through significant resistance levels, suggesting strong bullish momentum.

- Trading Volume: High trading volume accompanying the price surge confirms the strength of the move, indicating genuine buying pressure rather than a manipulated pump. Analyzing volume changes alongside price fluctuations is crucial.

- Candlestick Patterns: Specific candlestick patterns, such as bullish engulfing patterns or hammer formations, often precede significant price increases. Observing these patterns can provide further confirmation of the bullish trend.

- Indicators: Technical indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages (e.g., 50-day, 200-day) can help identify overbought or oversold conditions and potential trend reversals. While these indicators don't predict the future, they can provide valuable context.

- Short-term and Long-term Price Predictions: While predicting future prices is inherently speculative, technical analysis can suggest potential price targets based on chart patterns and indicator readings. It's crucial to remember that these are just predictions and not guarantees. (Note: Avoid making explicit price predictions without strong disclaimers.)

(Include relevant charts and graphs illustrating the points mentioned above. These visuals significantly enhance the article's appeal and understanding.)

Fundamental Factors Driving XRP's Growth

Beyond technical indicators, fundamental factors contribute significantly to XRP's price movement. Several key elements are fueling this growth:

- Ripple's Partnerships: Ripple's strategic partnerships with major financial institutions are boosting XRP's adoption for cross-border payments. These partnerships demonstrate real-world use cases and credibility.

- Increased Adoption: The growing adoption of XRP in cross-border transactions is a crucial factor. As more institutions and individuals utilize XRP for faster and cheaper international payments, demand increases.

- Positive News and Announcements: Positive news and announcements from Ripple Labs, such as technological advancements or new partnerships, often trigger price increases. Keeping abreast of Ripple's activities is crucial.

- Overall Market Sentiment: The positive sentiment surrounding the broader cryptocurrency market also plays a role. A bullish market generally supports the prices of most cryptocurrencies, including XRP.

- Ripple SEC Case Developments: The ongoing legal battle between Ripple and the SEC significantly impacts XRP's price. Positive developments in the case tend to boost investor confidence and drive prices higher. Negative developments can have the opposite effect.

Assessing the Risks and Rewards of Investing in XRP

While the 400% XRP increase is exciting, it's essential to acknowledge the inherent risks involved in cryptocurrency investments.

Volatility and Market Risk

Cryptocurrencies are notoriously volatile. The price of XRP, like other cryptocurrencies, can experience significant and sudden price drops.

- Price Swings: Be prepared for dramatic price fluctuations. Investing only what you can afford to lose is crucial.

- Diversification: Diversifying your investment portfolio across various asset classes, including other cryptocurrencies and traditional investments, is highly recommended to mitigate risk.

- Risk Tolerance: Assess your own risk tolerance before investing in XRP or any other cryptocurrency. High-risk investments are not suitable for everyone.

Regulatory Uncertainty

Regulatory uncertainty presents another significant risk. Governments worldwide are still grappling with how to regulate cryptocurrencies.

- Regulatory Changes: Changes in regulations can significantly impact XRP's price, potentially leading to sudden price drops.

- Jurisdictional Differences: Regulatory landscapes vary considerably across different jurisdictions. Understanding the regulatory environment in your region is essential.

- Government Policies: Government policies and actions can heavily influence cryptocurrency adoption and prices.

Comparing XRP to Other Cryptocurrencies

Understanding XRP's position within the broader cryptocurrency market requires comparing it to other major players.

XRP vs. Bitcoin (BTC)

- Market Capitalization: Bitcoin has a significantly larger market capitalization than XRP, making it less volatile in comparison.

- Price Volatility: XRP typically exhibits higher price volatility than Bitcoin.

- Use Cases: Bitcoin primarily functions as a store of value and a medium of exchange, while XRP is focused on cross-border payments.

XRP vs. Ethereum (ETH)

- Market Capitalization: Ethereum also has a larger market capitalization than XRP.

- Price Volatility: Similar to Bitcoin, Ethereum is comparatively less volatile than XRP.

- Use Cases: Ethereum is a platform for decentralized applications (dApps) and smart contracts, offering different functionalities from XRP.

XRP vs. Other Altcoins

XRP competes with other altcoins vying for market share in the payments sector and beyond. A comparative analysis of these competitors, considering features, adoption, and market capitalization, provides further context.

Conclusion

The 400% XRP increase is a significant event, driven by a combination of technical factors (breakthroughs in support/resistance, positive candlestick patterns, and bullish indicators) and fundamental factors (Ripple's partnerships, increased adoption, positive news, and overall market sentiment). However, the inherent volatility of cryptocurrencies and regulatory uncertainties pose considerable risks. Remember that while the potential rewards are substantial, so are the potential losses.

While a 400% XRP increase is impressive, remember that cryptocurrency investments are inherently risky. Conduct thorough due diligence, diversify your portfolio, and consider seeking advice from a qualified financial advisor before making any investment decisions. Learn more about navigating the world of XRP and understanding the potential of a 400% XRP increase by [link to further resources/another article]. Don't miss out on the potential of XRP – continue your research and make informed decisions regarding XRP investment.

Featured Posts

-

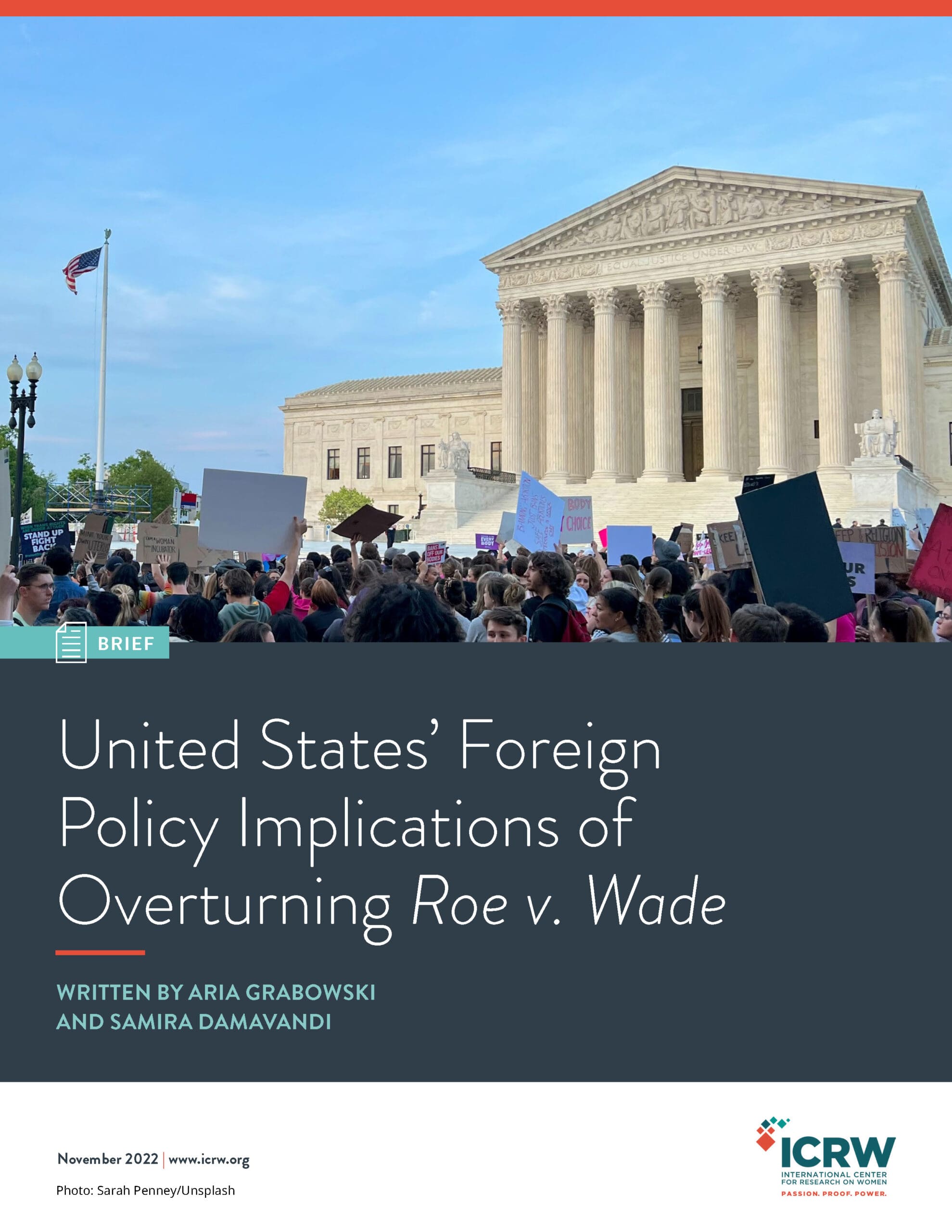

Over The Counter Birth Control Increased Access And Its Implications Post Roe V Wade

May 07, 2025

Over The Counter Birth Control Increased Access And Its Implications Post Roe V Wade

May 07, 2025 -

Karate Kid 6 And Beyond Ralph Macchio On Returning And Reviving Other Films

May 07, 2025

Karate Kid 6 And Beyond Ralph Macchio On Returning And Reviving Other Films

May 07, 2025 -

April 15 2025 Daily Lotto Winning Numbers Announced

May 07, 2025

April 15 2025 Daily Lotto Winning Numbers Announced

May 07, 2025 -

Steelers Hold Onto George Pickens Insider Reveals Reasons Behind Non Trade

May 07, 2025

Steelers Hold Onto George Pickens Insider Reveals Reasons Behind Non Trade

May 07, 2025 -

Ralph Macchio On My Cousin Vinny Reboot Update And Joe Pescis Involvement

May 07, 2025

Ralph Macchio On My Cousin Vinny Reboot Update And Joe Pescis Involvement

May 07, 2025

Latest Posts

-

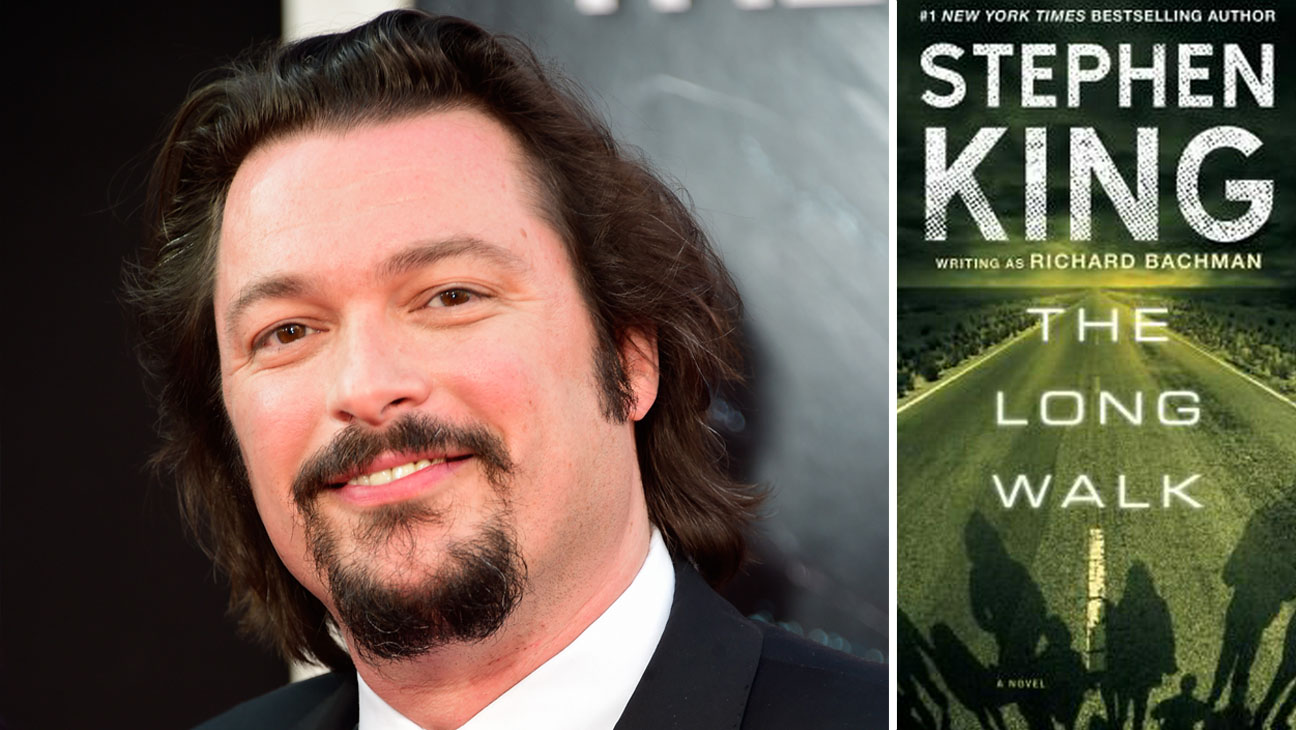

New Dystopian Horror Movie Based On Stephen King First Trailer Unveiled

May 08, 2025

New Dystopian Horror Movie Based On Stephen King First Trailer Unveiled

May 08, 2025 -

Stephen Kings Underrated Novel Gets Dystopian Horror Treatment First Trailer Released

May 08, 2025

Stephen Kings Underrated Novel Gets Dystopian Horror Treatment First Trailer Released

May 08, 2025 -

First Trailer Dystopian Horror From Hunger Games Director Based On Stephen King

May 08, 2025

First Trailer Dystopian Horror From Hunger Games Director Based On Stephen King

May 08, 2025 -

The Long Walk 2023 Trailer Impressions And Expectations

May 08, 2025

The Long Walk 2023 Trailer Impressions And Expectations

May 08, 2025 -

Stephen Kings The Long Walk Movie Adaptation A Terrific First Look

May 08, 2025

Stephen Kings The Long Walk Movie Adaptation A Terrific First Look

May 08, 2025