China's Tariff Policy Shift: Implications For US Businesses

Table of Contents

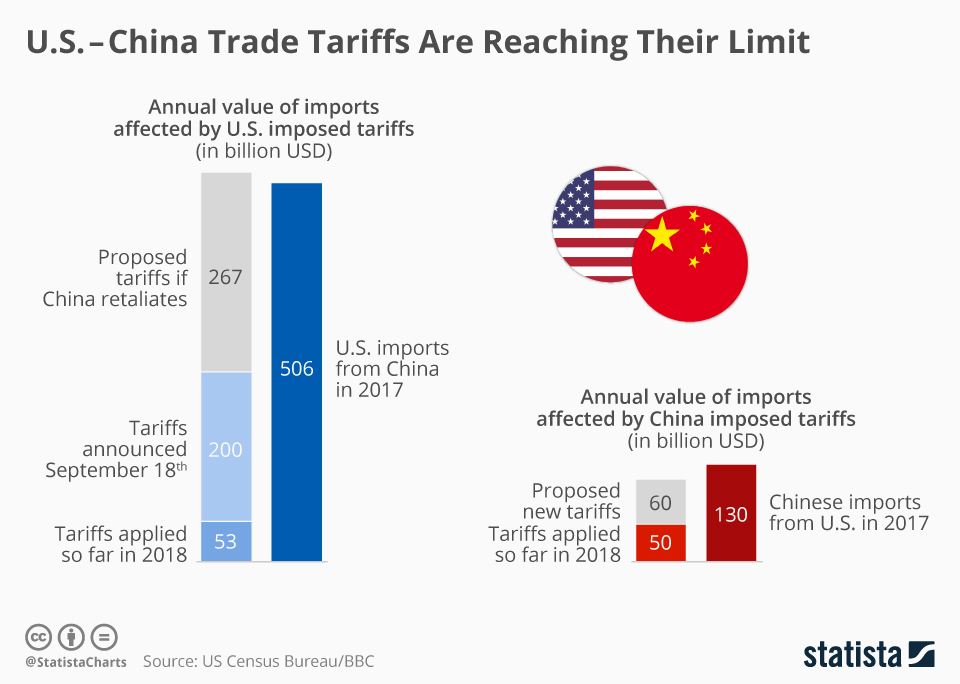

The fluctuating landscape of China's tariff policy presents a significant challenge and opportunity for US businesses. The historical context of the US-China trade war, marked by tit-for-tat tariff increases, has given way to a period of more nuanced adjustments, creating both uncertainty and potential for strategic maneuvering. Understanding these shifts is crucial for US companies seeking to maintain competitiveness and profitability in the vast Chinese market. This article delves into the recent changes in China's tariff policy and their implications for US businesses across various sectors.

Understanding the Recent Changes in China's Tariff Policy

Recent announcements from the Chinese government regarding tariffs reflect a complex interplay of economic and geopolitical factors. While some tariffs have been reduced, others remain in place, creating a dynamic environment that necessitates constant monitoring. These changes impact a wide range of goods, including agricultural products (soybeans, corn), manufactured goods (electronics, textiles), and technology products (semiconductors, software).

- Specific examples of tariff reductions or increases: In early 2023, China announced reductions on certain import tariffs on goods like some agricultural products, potentially benefiting US exporters. Conversely, certain technology-related imports might still face higher tariffs. Specific details vary and require continuous monitoring of official announcements.

- Mention any new regulations or policies related to tariffs: Beyond simple tariff adjustments, China has also introduced or refined regulations surrounding customs procedures and import/export licensing, impacting operational efficiency for US businesses.

- Reference official Chinese government sources (if available): The Ministry of Commerce of the People's Republic of China website (mofcom.gov.cn) is the primary source for official tariff announcements. However, navigating this information requires expertise in Chinese language and trade regulations.

Impact on Import Costs for US Businesses

The modifications in China's tariff policy directly influence the cost of importing goods from China into the US. This impacts pricing strategies, profitability, and the competitiveness of US businesses.

- Examples of specific products and the resulting price changes: The impact of tariff changes on specific products varies greatly. For instance, a decrease in tariffs on certain agricultural goods might lead to lower import costs for US food companies, improving profit margins. Conversely, persistent tariffs on certain manufactured goods increase import costs, potentially forcing price hikes or reduced profit margins.

- Analysis of the competitiveness of US-made goods versus Chinese imports: Depending on tariff levels, US-made products might become more competitive relative to their Chinese counterparts. This presents opportunities for domestic production and reshoring.

- Discussion of potential cost-saving strategies for US businesses: Businesses can employ various strategies to mitigate increased import costs, including exploring alternative sourcing options, negotiating better terms with suppliers, and optimizing their supply chain logistics.

Impact on Export Opportunities for US Businesses

Changes in China's tariff policy also affect US export opportunities to China. Some sectors might see enhanced market access, while others face increased challenges.

- Specific sectors potentially benefiting or suffering from the changes: Agricultural exports might see increased opportunities due to tariff reductions. However, technology companies might continue to face hurdles due to existing or new regulatory and tariff barriers.

- Analysis of market access and competitiveness for US exporters: The competitiveness of US exports depends on many factors, including tariff levels, quality, pricing, and market demand in China. Detailed market research is crucial for navigating this complex landscape.

- Discussion of potential strategies to leverage new opportunities: US businesses should analyze sector-specific changes and adapt their export strategies accordingly. This might involve exploring new market niches, enhancing product features to increase competitiveness, or investing in local partnerships to improve market access.

Implications for US Supply Chains and Manufacturing

China's tariff policy adjustments have significant ripple effects on US supply chains, prompting many companies to reassess their strategies. This includes considerations of relocation, diversification, and nearshoring.

- Examples of companies adjusting their supply chain strategies: Many companies are diversifying their sourcing to reduce reliance on China, exploring options in Southeast Asia, Mexico, or even reshoring production to the US.

- Discussion of the costs and benefits of reshoring or nearshoring: Reshoring can reduce transportation costs and lead to improved control over quality and production timelines but comes with potentially higher labor costs. Nearshoring offers a middle ground.

- Analysis of the impact on employment in both the US and China: While reshoring might create jobs in the US, it could lead to job losses in China. The overall economic impact is complex and multifaceted.

Navigating Increased Bureaucracy and Regulatory Complexity

The shifting tariff landscape in China is often accompanied by increased bureaucracy and regulatory complexity. This poses significant challenges for US businesses.

- Examples of new bureaucratic hurdles: Changes in customs procedures, licensing requirements, and import/export regulations can create delays and increase compliance costs.

- Discussion of compliance costs and the need for expert advice: Navigating these complexities often requires specialized expertise in Chinese trade law and regulations. Engaging legal and consulting firms with experience in this area is crucial.

- Mention resources and support available to US businesses: The US government provides resources and support to businesses navigating international trade through agencies like the US Department of Commerce's International Trade Administration.

Investment Implications for US Businesses in China

China's tariff policy shifts significantly affect foreign direct investment (FDI) from US companies into China. The attractiveness of the Chinese market for US investors is directly influenced by these changes.

- Discussion of the attractiveness of the Chinese market for US investors: Despite the challenges, China remains a significant market with immense growth potential. However, investors need to carefully assess the risks and rewards.

- Analysis of potential risks and rewards for US businesses investing in China: The potential risks include tariff fluctuations, regulatory uncertainty, and intellectual property protection concerns. The rewards involve access to a large consumer market and potentially lower production costs.

- Mention specific sectors affected by the tariff changes: Sectors heavily impacted by tariff changes require a thorough assessment of their long-term investment viability in China.

Conclusion

China's evolving tariff policy presents both challenges and opportunities for US businesses. Understanding the implications on import and export costs, supply chain dynamics, investment decisions, and regulatory complexities is crucial. The changes necessitate a proactive approach to managing risk and capitalizing on emerging opportunities. US businesses must carefully analyze the specific impacts on their sectors and adapt their strategies accordingly.

To effectively manage China tariffs and optimize your approach to China's tariff policy, stay informed on China's tariff policy and seek expert advice to navigate this complex environment. Proactive adaptation of your China trade strategy is essential to ensuring continued success in this dynamic market. Don't hesitate to seek professional guidance to adapt your business strategies and thrive in the evolving landscape of China's tariff policy.

Featured Posts

-

Boston Red Sox Coras Minor Lineup Adjustments For Doubleheader

Apr 28, 2025

Boston Red Sox Coras Minor Lineup Adjustments For Doubleheader

Apr 28, 2025 -

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025 -

The U S Dollar And Presidential Economic Policy A Case Study Of The Nixon Administration And Beyond

Apr 28, 2025

The U S Dollar And Presidential Economic Policy A Case Study Of The Nixon Administration And Beyond

Apr 28, 2025 -

Red Sox And Blue Jays Game Preview Lineups Buehlers Role And Outfielder Return

Apr 28, 2025

Red Sox And Blue Jays Game Preview Lineups Buehlers Role And Outfielder Return

Apr 28, 2025 -

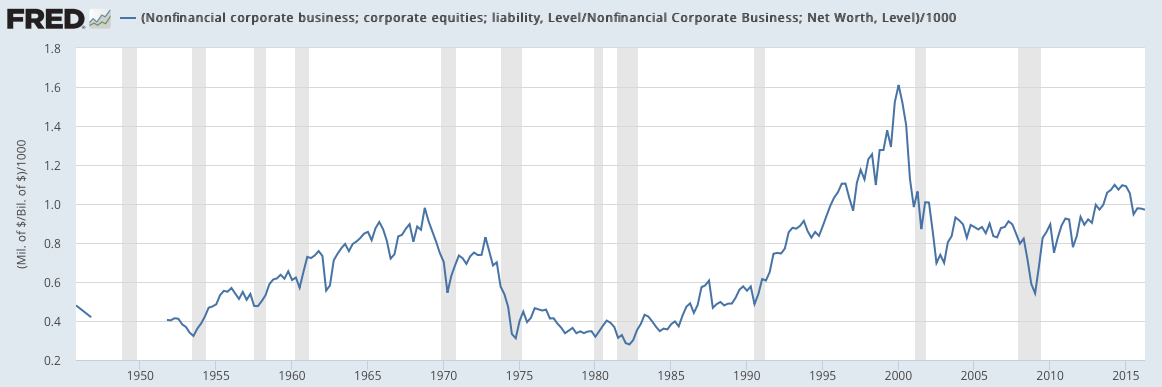

Addressing Investor Concerns About High Stock Market Valuations Bof As Insight

Apr 28, 2025

Addressing Investor Concerns About High Stock Market Valuations Bof As Insight

Apr 28, 2025

Latest Posts

-

Former Nba Player Jj Redick Endorses Espns Decision On Richard Jefferson

Apr 28, 2025

Former Nba Player Jj Redick Endorses Espns Decision On Richard Jefferson

Apr 28, 2025 -

Mike Breen On Marv Albert A Legacy Of Great Basketball Announcing

Apr 28, 2025

Mike Breen On Marv Albert A Legacy Of Great Basketball Announcing

Apr 28, 2025 -

Is Marv Albert The Greatest Basketball Announcer Mike Breen Weighs In

Apr 28, 2025

Is Marv Albert The Greatest Basketball Announcer Mike Breen Weighs In

Apr 28, 2025 -

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025 -

Le Bron James Comments On Richard Jeffersons Espn News Segment

Apr 28, 2025

Le Bron James Comments On Richard Jeffersons Espn News Segment

Apr 28, 2025