Addressing Investor Concerns About High Stock Market Valuations: BofA's Insight

BofA's Assessment of Current Market Conditions

BofA's assessment of current high stock valuations is nuanced. While acknowledging the elevated levels, they don't necessarily predict an immediate crash. Their analysis hinges on a careful examination of various valuation metrics and a consideration of the macroeconomic environment. The key arguments presented often involve a balancing act between acknowledging the risks associated with high P/E ratios and considering the potential for continued growth fueled by specific sectors and monetary policy.

-

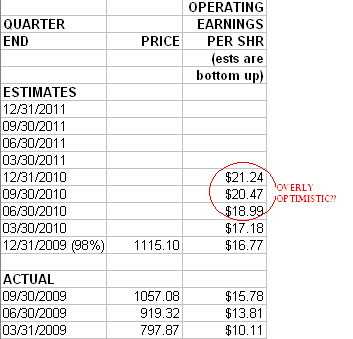

Summary of BofA's key findings regarding valuation metrics: BofA's reports often cite metrics like the Shiller PE ratio (CAPE) and traditional P/E ratios to assess market valuations relative to historical averages. While these metrics may suggest overvaluation in certain sectors, they also consider the impact of low interest rates on discount rates, which can inflate valuations.

-

Specific sectors or market segments: BofA's research often highlights specific sectors, such as technology or certain segments of the consumer discretionary sector, as potentially overvalued based on their growth prospects relative to their current valuations. Conversely, other sectors might be identified as potentially undervalued, presenting opportunities for selective investment.

-

Quantitative data and charts: BofA's research typically includes charts and graphs illustrating the historical context of current valuations, comparing current P/E ratios to historical averages and highlighting potential deviations from long-term trends. This visual data aids in understanding the magnitude of the current high stock market valuations.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current high stock market valuations. Understanding these factors is essential for interpreting BofA's analysis and forming a well-informed investment strategy.

-

Low interest rates and their impact: Historically low interest rates significantly impact stock valuations. When borrowing costs are low, companies can more easily finance growth, and investors are less inclined to seek higher returns in fixed-income markets, driving capital towards equities. This pushes up prices, contributing to higher valuations.

-

Quantitative easing and monetary policy: The significant quantitative easing programs implemented by central banks globally injected liquidity into the markets, further driving up asset prices, including stocks. This monetary policy has played a crucial role in creating the environment for high stock market valuations.

-

Strong corporate earnings and future growth expectations: Strong corporate earnings, particularly in certain sectors, support high valuations. Investors are also willing to pay higher multiples for companies expected to experience significant future growth, fueling further increases in stock prices.

-

Technological innovation and disruptive companies: The rapid pace of technological innovation and the emergence of disruptive companies continue to drive investment and inflate valuations in specific technology-related sectors. The promise of exponential growth can lead to higher price-to-earnings ratios compared to more established industries.

-

Geopolitical factors: Geopolitical events and global uncertainty can influence investor sentiment and risk appetite. Periods of relative stability, despite underlying geopolitical tensions, may contribute to higher risk tolerance and inflated valuations, though this is a double-edged sword, as shifts in the geopolitical landscape could rapidly change valuations.

BofA's Strategies for Navigating High Valuations

BofA typically advocates for a cautious yet opportunistic approach to navigating high stock market valuations. Their recommended strategies emphasize risk management and diversification.

-

Diversification strategies: BofA emphasizes the importance of diversification across asset classes and sectors to mitigate risk. This reduces exposure to any single sector that might experience a significant downturn.

-

Sector-specific recommendations: Based on their analysis, BofA may suggest overweighting undervalued sectors while underweighting or avoiding those deemed overvalued. This selective approach attempts to optimize returns while managing risk.

-

Long-term investment horizon: BofA often advises maintaining a long-term investment horizon. Short-term market fluctuations are less relevant in a long-term strategy, allowing investors to ride out periods of volatility.

-

Risk management strategies: This may include hedging strategies to protect against potential market declines or employing stop-loss orders to limit potential losses.

-

Investment products: BofA might suggest specific investment products, such as diversified mutual funds or exchange-traded funds (ETFs), that align with their recommended strategies for managing risk in a market with high stock market valuations.

Potential Risks and Future Market Scenarios

While BofA may not predict an imminent crash, they acknowledge the potential downside risks associated with high valuations.

-

Market corrections or downturns: The inherent risk of high valuations is the potential for a market correction or downturn. BofA's analysis likely includes scenarios exploring the potential magnitude and duration of such corrections.

-

Triggers for a market correction: Factors like rising interest rates, unexpected inflation surges, or significant geopolitical events could trigger a correction by altering investor sentiment and increasing risk aversion.

-

Future market performance predictions: BofA’s predictions for future market performance are likely to be presented with caveats and ranges, acknowledging the inherent uncertainty in forecasting. They might predict moderate growth tempered by potential corrections or volatility.

-

Unforeseen events: Unforeseen events like pandemics or major technological disruptions can significantly impact market valuations and are difficult to predict or quantify.

Conclusion

This article examined BofA's perspective on addressing investor concerns regarding high stock market valuations. We explored the factors contributing to these high valuations, BofA's strategies for navigating this market environment, and potential future scenarios. BofA’s analysis provides valuable insights for investors seeking to make informed decisions in a market characterized by elevated valuations. Understanding the complexities of high stock market valuations is crucial for informed investment decisions. Stay informed on market trends and consider consulting with a financial advisor to develop a strategy that addresses your specific risk tolerance and investment goals in light of the current situation regarding high stock market valuations. Learn more about BofA's research on high stock market valuations and other market analyses on their website.

Aaron Judges Wife Samantha Gives Birth First Look At Their Baby

Aaron Judges Wife Samantha Gives Birth First Look At Their Baby

Boston Red Sox Doubleheader Lineup Changes Under Cora

Boston Red Sox Doubleheader Lineup Changes Under Cora

Aaron Judge And Wife Welcome First Child

Aaron Judge And Wife Welcome First Child

Shedeur Sanders Cleveland Browns Draft Pick

Shedeur Sanders Cleveland Browns Draft Pick

Zyart Qayd Eam Shrtt Abwzby Wtfqd Aleml Khlal Almnawbat

Zyart Qayd Eam Shrtt Abwzby Wtfqd Aleml Khlal Almnawbat

Navigating The China Market Case Studies Of Bmw Porsche And Others

Navigating The China Market Case Studies Of Bmw Porsche And Others

The China Market Hurdle Bmw Porsche And The Future Of Auto Sales

The China Market Hurdle Bmw Porsche And The Future Of Auto Sales

Chinas Impact On Bmw And Porsche Are Other Automakers Facing Similar Problems

Chinas Impact On Bmw And Porsche Are Other Automakers Facing Similar Problems

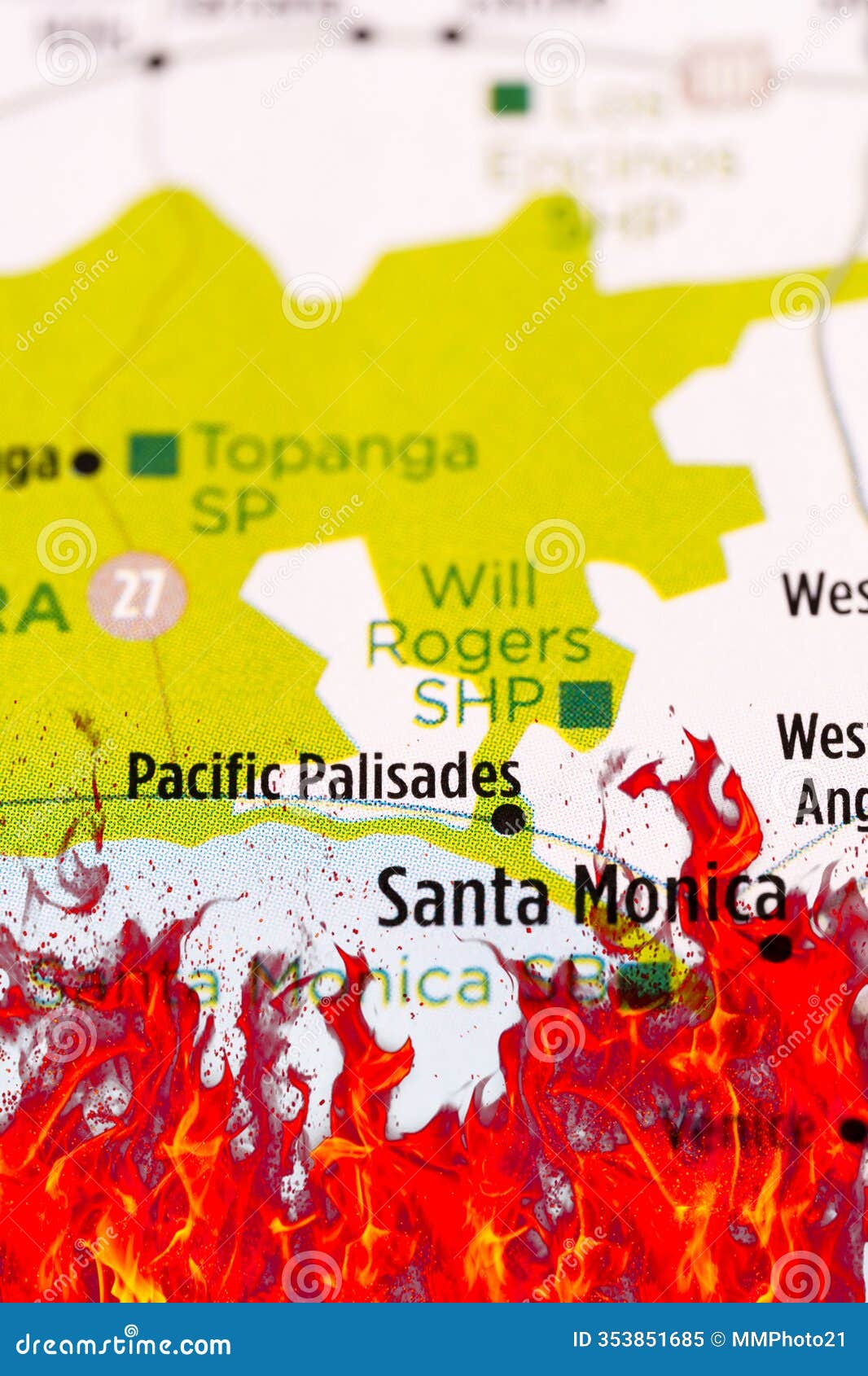

Wildfire Speculation Examining The Market For Los Angeles Disaster Bets

Wildfire Speculation Examining The Market For Los Angeles Disaster Bets

Najib Razak And The 2002 French Submarine Scandal New Allegations From Prosecutors

Najib Razak And The 2002 French Submarine Scandal New Allegations From Prosecutors