China's Push For US Drug Import Substitutes: A Deep Dive

Table of Contents

China's Strategic Initiatives in Pharmaceutical Development

China's rapid advancement in the pharmaceutical sector is not accidental; it's a result of carefully planned strategic initiatives. The government's commitment to fostering domestic pharmaceutical R&D is a cornerstone of this drive to create US drug import substitutes.

Government Funding and Incentives

The Chinese government has implemented various programs to bolster its pharmaceutical industry. Massive investments in research and development are coupled with attractive incentives for domestic companies.

- Significant Research Grants: Billions of dollars are allocated annually to support research in key therapeutic areas.

- Tax Breaks and Subsidies: Tax incentives and direct subsidies reduce the cost of drug development, making it more attractive for Chinese companies to invest in innovation.

- Special Economic Zones: Designated areas offer preferential policies to attract pharmaceutical companies, including streamlined regulatory processes and access to infrastructure.

- National Initiatives: The "Made in China 2025" initiative, for example, explicitly targets technological advancement in key sectors, including pharmaceuticals.

These government funding initiatives, combined with China's pharmaceutical policy, are creating a fertile ground for domestic drug development and the creation of US drug import substitutes.

Intellectual Property Strategies

China's approach to intellectual property rights (IPR) is a complex issue with significant implications for its pharmaceutical industry. While the government has made efforts to improve IPR protection, concerns remain regarding patent infringement and the unauthorized use of foreign pharmaceutical technologies.

- Patent Law Enforcement: While patent laws exist, their enforcement remains a challenge, leading to concerns about the potential for intellectual property theft.

- Licensing Agreements: Increased collaborations with international pharmaceutical companies involve licensing agreements, allowing Chinese firms to access and adapt existing technologies.

- Generic Drug Production: China is a major producer of generic drugs, often utilizing reverse engineering techniques. This contributes to the development of lower-cost alternatives to branded drugs, posing a direct challenge to US pharmaceutical companies' market share.

Navigating the landscape of intellectual property rights is key for understanding how China is developing its own versions of US drugs.

Collaboration and Joint Ventures

China actively encourages collaborations and joint ventures between Chinese and international pharmaceutical companies. This strategy provides access to advanced technologies and expertise while simultaneously fostering domestic innovation.

- Technology Transfer: These collaborations facilitate technology transfer, enabling Chinese companies to gain valuable knowledge and skills.

- Market Access: Joint ventures provide Chinese companies with access to international markets, bolstering their global competitiveness.

- Successful Partnerships: Numerous examples exist of successful collaborations between Chinese and multinational pharmaceutical firms, showcasing the effectiveness of this strategy.

These partnerships are instrumental in accelerating China's capability to produce substitutes for US drug imports.

Impact on the US Pharmaceutical Market

China's push to create US drug import substitutes has substantial ramifications for the American pharmaceutical landscape.

Price Competition and Market Share

The influx of lower-priced Chinese drugs has the potential to significantly increase competition and drive down prices in the US market.

- Generic Drug Competition: Chinese companies are aggressively entering the generic drug market, putting pressure on US manufacturers' profit margins.

- Price Reductions: The increased competition could lead to lower prescription drug costs for consumers, although the extent of price reductions remains to be seen.

- Market Share Shifts: US pharmaceutical companies could experience a decline in market share as Chinese competitors gain traction.

This heightened price competition is a defining characteristic of the changing dynamics.

Supply Chain Dynamics

China's growing role in pharmaceutical manufacturing affects the US supply chain. This creates both opportunities and potential vulnerabilities.

- Increased Reliance: The US pharmaceutical industry relies increasingly on China for the production of active pharmaceutical ingredients (APIs) and other components.

- Supply Chain Disruptions: Geopolitical tensions or disruptions to Chinese manufacturing could impact the availability of essential drugs in the US.

- Reshoring Initiatives: The US is exploring options to diversify its pharmaceutical supply chain and reduce its dependence on China.

Strengthening domestic manufacturing capabilities and diversifying sourcing are vital considerations for the future.

Quality and Safety Concerns

Concerns about the quality and safety of drugs manufactured in China have been raised in the past. However, it's important to note that significant progress has been made in regulatory oversight and quality control measures.

- FDA Approval: Drugs entering the US market must meet stringent FDA approval requirements regarding safety and efficacy.

- Quality Control Measures: Chinese pharmaceutical companies are increasingly implementing international quality standards to ensure the safety and reliability of their products.

- Regulatory Oversight: Both Chinese and US regulatory bodies are working to enhance oversight and address safety concerns.

While concerns remain, it's crucial to acknowledge ongoing efforts to improve quality and safety.

Geopolitical Implications and Future Outlook

China's efforts to create US drug import substitutes are deeply entwined with broader geopolitical considerations.

US-China Trade Relations

The competition in the pharmaceutical sector adds another layer of complexity to already strained US-China trade relations.

- Trade Disputes: Intellectual property disputes and trade imbalances related to pharmaceuticals could further exacerbate tensions between the two countries.

- Trade Negotiations: Pharmaceutical trade will likely be a key issue in future trade negotiations between the US and China.

- National Security Concerns: The US government is increasingly concerned about its reliance on China for essential pharmaceuticals, raising national security considerations.

The future of US-China trade hinges on the resolution of these tensions.

Future Projections for the Pharmaceutical Market

The future of the US pharmaceutical market will be significantly shaped by China's continued growth in the sector.

- Increased Competition: Expect intensified competition, driving innovation and potentially leading to lower drug prices.

- Regulatory Changes: Regulatory adaptations in both the US and China will be crucial in navigating the evolving landscape.

- Market Consolidation: Consolidation among both Chinese and US pharmaceutical companies is likely, impacting market dynamics.

A more competitive and dynamic pharmaceutical landscape awaits us.

Conclusion: Navigating China's Growing Influence on US Drug Imports

China's strategic push to develop substitutes for US drug imports presents both opportunities and challenges for the US pharmaceutical market. The increased competition will likely lead to lower prices for some drugs, benefiting consumers. However, it also raises concerns about supply chain vulnerabilities, intellectual property rights, and the need for continued vigilance in maintaining high quality and safety standards for all medications. Understanding China's strategic moves in the pharmaceutical sector is crucial for navigating the evolving landscape of US drug imports. Stay informed about industry developments and prepare for a more competitive future, focusing on innovation, diversification of supply chains, and robust regulatory oversight in the face of this changing global pharmaceutical market and the rise of China's pharmaceutical influence.

Featured Posts

-

Dalys Late Show Steals Six Nations Victory For England

May 01, 2025

Dalys Late Show Steals Six Nations Victory For England

May 01, 2025 -

Kampen Start Kort Geding Tegen Enexis Stroomnetaansluiting In Het Geding

May 01, 2025

Kampen Start Kort Geding Tegen Enexis Stroomnetaansluiting In Het Geding

May 01, 2025 -

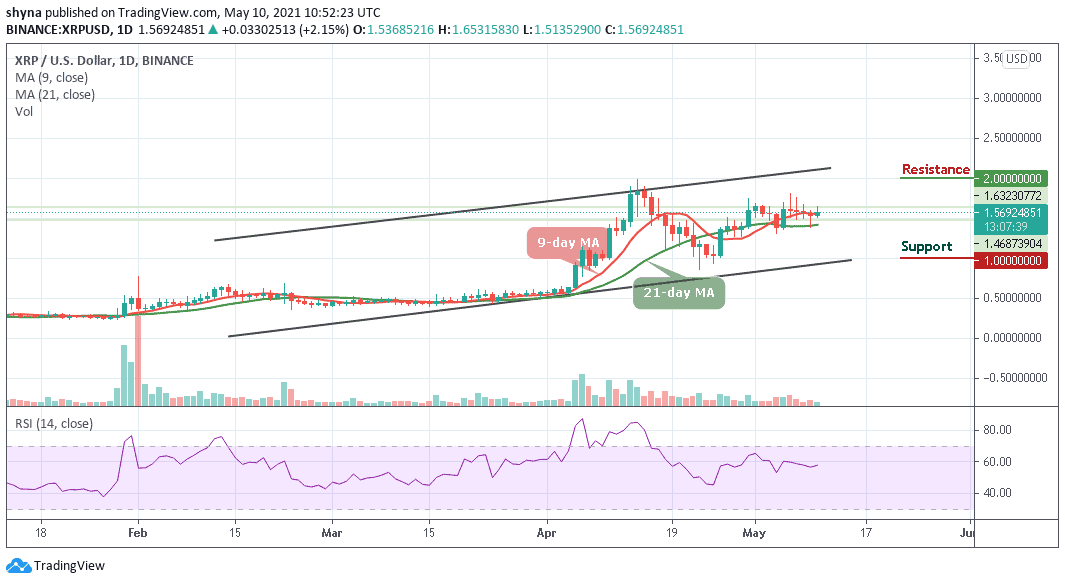

Should I Buy Xrp Ripple While Its Below 3 A Prudent Investors Guide

May 01, 2025

Should I Buy Xrp Ripple While Its Below 3 A Prudent Investors Guide

May 01, 2025 -

Mercks 1 Billion Investment A New Us Factory For Key Drug Production

May 01, 2025

Mercks 1 Billion Investment A New Us Factory For Key Drug Production

May 01, 2025 -

High Stock Market Valuations A Bof A Analysis For Investors

May 01, 2025

High Stock Market Valuations A Bof A Analysis For Investors

May 01, 2025

Latest Posts

-

Canadas Economic Future Challenges For The Incoming Prime Minister

May 01, 2025

Canadas Economic Future Challenges For The Incoming Prime Minister

May 01, 2025 -

The Automobile Industrys Resistance To Ev Mandates Grows

May 01, 2025

The Automobile Industrys Resistance To Ev Mandates Grows

May 01, 2025 -

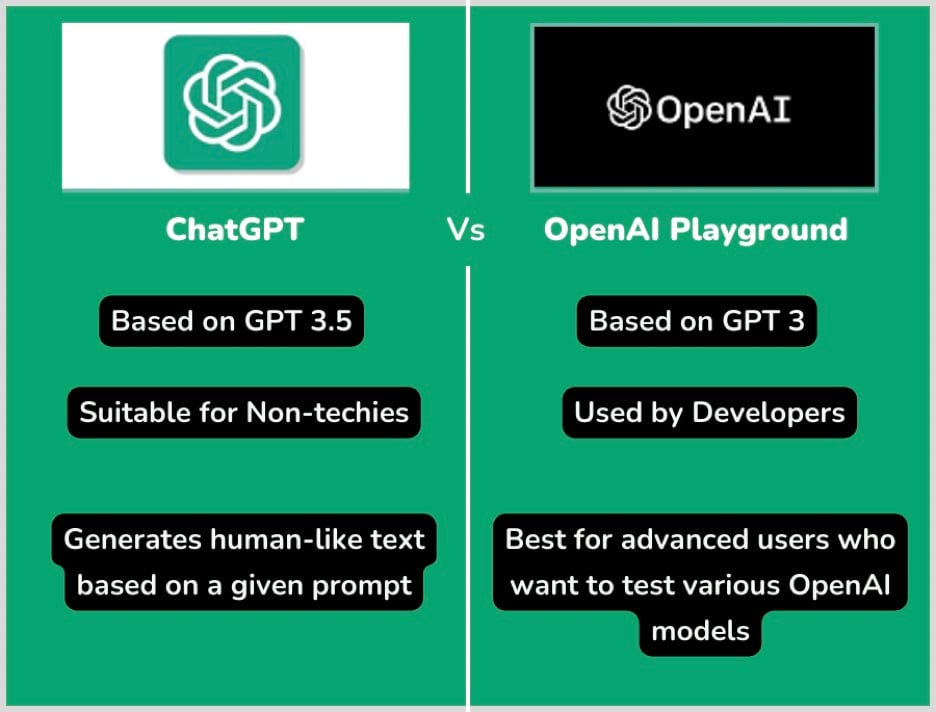

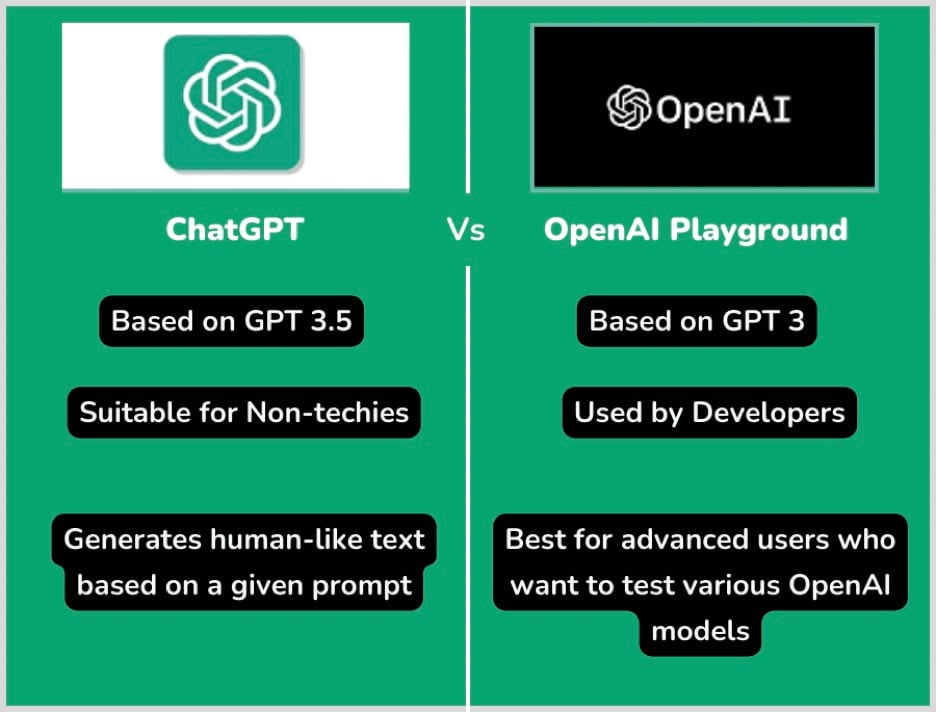

Shopping With Chat Gpt Open Ais Direct Challenge To Google Search

May 01, 2025

Shopping With Chat Gpt Open Ais Direct Challenge To Google Search

May 01, 2025 -

Prioritizing Economic Issues A Mandate For Canadas Next Pm

May 01, 2025

Prioritizing Economic Issues A Mandate For Canadas Next Pm

May 01, 2025 -

Chat Gpt Vs Google Shopping Open Ais Latest Challenge

May 01, 2025

Chat Gpt Vs Google Shopping Open Ais Latest Challenge

May 01, 2025