China-US Trade Soars Ahead Of Trade Truce Deadline

Table of Contents

Pre-Truce Trade Volume Increase

The increase in China-US trade volume leading up to the deadline is substantial. Preliminary data suggests a double-digit percentage growth in bilateral trade compared to the same period last year. This growth isn't evenly distributed across all sectors. Analysis shows a particularly significant boost in technology-related imports from China into the US, alongside a notable increase in agricultural exports from the US to China.

- Specific figures: While precise figures are still being finalized, early estimates indicate a 15% increase in total trade volume, with imports to the US from China rising by 18% and US exports to China growing by 12%.

- Significant product growth: Semiconductors, electronic components, and agricultural products like soybeans and cotton witnessed some of the most dramatic increases in trade volume.

- Trade Imbalance: Despite the growth, the US continues to experience a significant trade deficit with China. However, the recent surge in exports suggests a narrowing of this gap, which could have significant implications for future trade negotiations.

Factors Contributing to the Trade Surge

Several factors are likely contributing to this unexpected surge in China-US trade. The global economic recovery following the pandemic has played a vital role, driving increased demand for goods in both countries. However, other key factors are at play.

- Post-pandemic recovery: The robust post-pandemic recovery in both the US and China fueled higher consumer and industrial demand, leading to increased import and export activities.

- Anticipation of future tariffs: Businesses may be rushing to complete transactions before potential increases in tariffs take effect, further boosting the current trade volume.

- Supply chain adjustments: Companies are actively working to optimize their supply chains, potentially leading to increased trade activity as they adapt to the current geopolitical climate.

- Existing and anticipated trade agreements: While no major new trade agreements were signed recently, the ongoing discussions might be influencing businesses to maintain or increase their trade activities with China.

Implications for the Trade Truce Negotiations

The surge in China-US trade ahead of the deadline significantly impacts the ongoing negotiations. This unexpected increase could alter the negotiating positions of both sides.

- Possible scenarios: If a trade truce is reached, the existing momentum could be maintained, leading to further growth. Conversely, a failure to reach an agreement could lead to a sharp decline in trade as new tariffs are implemented.

- Negotiating positions: The increased trade volume could embolden either side, depending on the perspective of their specific gains or losses in trade volume. China, with a potentially increased trade surplus, might adopt a stronger negotiating stance. The US, while still experiencing a deficit, might be less inclined to impose further punitive tariffs due to the existing increase in export volumes.

- Geopolitical implications: The outcome of the negotiations and the subsequent impact on China-US trade will have far-reaching geopolitical implications for the global economic order.

Potential Impact on Global Markets

The increased China-US trade has broader ramifications for the global economy. The surge in demand for commodities, driven by the trade increase, could impact global commodity prices and contribute to inflationary pressures. Disruptions to global supply chains, however, are less likely considering the current surge represents a streamlining of existing networks.

- Commodity prices: Increased demand for raw materials to fulfill the trade surge could lead to higher prices for certain commodities, impacting global inflation.

- Global inflation: This increased trade volume, coupled with other global economic factors, could exert upward pressure on global inflation.

- Supply chain disruptions: While the trade surge itself might not directly cause new supply chain disruptions, the potential for future trade restrictions could still create instability in global supply chains.

Conclusion

The unexpected surge in China-US trade ahead of the trade truce deadline is a significant development. The increase reflects a complex interplay of global economic recovery, anticipated tariff changes, and ongoing trade negotiations. The implications are far-reaching, impacting both bilateral relations and the global economy. This unexpected upswing raises questions about the future trajectory of this critical bilateral relationship and its global repercussions. Stay updated on China-US trade to understand the full implications of this development and its effects on global markets. Follow the latest developments in US-China trade relations and learn more about the implications of the China-US trade truce to make informed business decisions.

Featured Posts

-

Le Pens Rally A Disappointing Turnout For The National Rally In France

May 24, 2025

Le Pens Rally A Disappointing Turnout For The National Rally In France

May 24, 2025 -

How To Get Bbc Radio 1 Big Weekend 2025 Tickets Full Lineup Confirmed

May 24, 2025

How To Get Bbc Radio 1 Big Weekend 2025 Tickets Full Lineup Confirmed

May 24, 2025 -

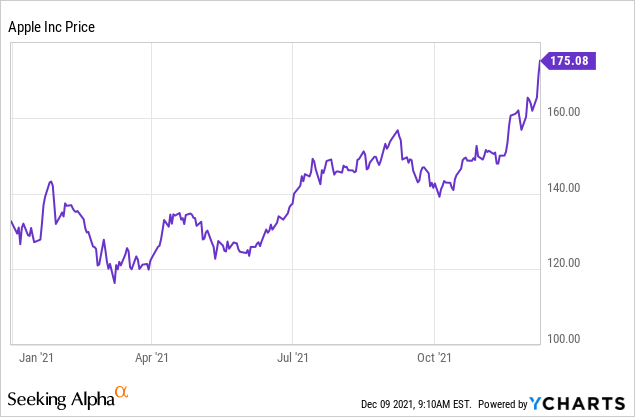

Apple Stock Forecast Navigating The Tariff Impact

May 24, 2025

Apple Stock Forecast Navigating The Tariff Impact

May 24, 2025 -

Hangi Erkek Burclari En Cok Baglanti Kurar

May 24, 2025

Hangi Erkek Burclari En Cok Baglanti Kurar

May 24, 2025 -

Strengthening Ties Bangladesh And Europe Collaborate For Growth

May 24, 2025

Strengthening Ties Bangladesh And Europe Collaborate For Growth

May 24, 2025

Latest Posts

-

Jonathan Groff Could He Win A Tony Award For Just In Time

May 24, 2025

Jonathan Groff Could He Win A Tony Award For Just In Time

May 24, 2025 -

Broadways Just In Time Star Studded Opening Night For Jonathan Groff

May 24, 2025

Broadways Just In Time Star Studded Opening Night For Jonathan Groff

May 24, 2025 -

Married Couples Fight Joe Jonass Unexpected Reaction

May 24, 2025

Married Couples Fight Joe Jonass Unexpected Reaction

May 24, 2025 -

Jonathan Groffs Just In Time Opening Night Lea Michele Daniel Radcliffe And More In Attendance

May 24, 2025

Jonathan Groffs Just In Time Opening Night Lea Michele Daniel Radcliffe And More In Attendance

May 24, 2025 -

Jonathan Groffs Just In Time Celebrity Friends Show Their Support

May 24, 2025

Jonathan Groffs Just In Time Celebrity Friends Show Their Support

May 24, 2025