Apple Stock Forecast: Navigating The Tariff Impact

Table of Contents

Understanding the Tariff Impact on Apple's Supply Chain

Tariffs on goods manufactured in China directly affect Apple's production costs, a key element of any Apple stock prediction. A significant portion of Apple's products are assembled in China, making the company heavily reliant on this manufacturing hub. Increased import costs resulting from tariffs translate directly into higher production costs for Apple. This impacts profit margins and could potentially lead to price increases for consumers, affecting sales and subsequently impacting the Apple stock forecast.

- Increased manufacturing costs in China due to tariffs: Tariffs increase the cost of components and labor sourced from China, eating into Apple's already tight margins.

- Potential relocation of manufacturing to mitigate tariff impacts: Apple has been exploring diversification of its manufacturing base, moving some production to countries like India and Vietnam to reduce its dependence on China and lessen the blow from tariffs. This is a significant factor in any long-term Apple stock prediction.

- The ripple effect on Apple's product pricing strategy: Higher production costs may force Apple to increase product prices, potentially impacting consumer demand and sales figures, which are crucial elements of any Apple stock forecast.

- Analysis of Apple's diversification efforts to reduce reliance on Chinese manufacturing: The success of Apple's diversification strategy will be a major factor influencing the Apple stock forecast in the coming years. The speed and efficiency of relocation will directly impact its ability to mitigate tariff-related costs.

Analyzing Apple's Financial Performance in Relation to Tariffs

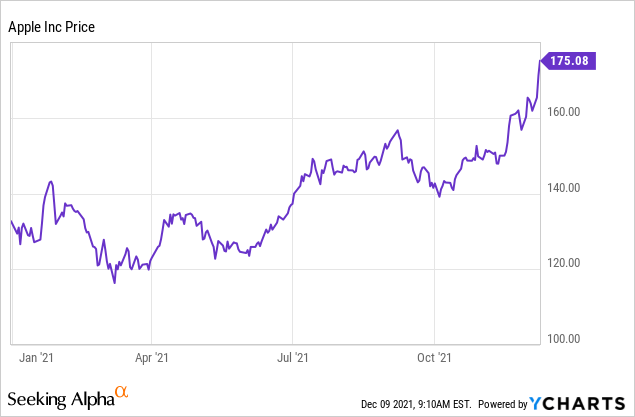

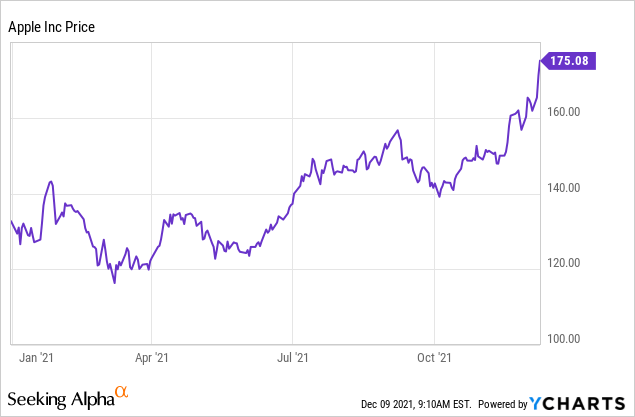

Analyzing Apple's recent financial reports provides crucial insights into the actual impact of tariffs on its bottom line. Examining key metrics like revenue growth, earnings per share (EPS), and gross/net profit margins helps to paint a clearer picture of the current financial health of the company and how it’s responding to trade tensions.

- Review of Apple's recent quarterly earnings reports: Scrutinizing Apple's quarterly reports allows investors to track the financial performance, identify trends, and assess the actual impact of tariffs on its revenue streams.

- Analysis of revenue streams affected by tariffs: Specific product lines heavily reliant on Chinese manufacturing may be disproportionately affected by tariffs, offering valuable data for any serious Apple stock prediction.

- Impact of tariffs on Apple's gross and net profit margins: Reduced profit margins due to increased production costs are a clear signal of the tariff’s impact. This crucial information is a major component of forecasting Apple stock price movements.

- Discussion of any changes in Apple's financial guidance related to tariffs: Apple's management commentary regarding tariffs in their financial reports provides valuable insights into their assessment of the situation and its expected future impact.

Predicting Future Apple Stock Performance Based on Tariff Scenarios

Predicting future Apple stock performance requires considering various tariff scenarios and their likely impact. Uncertainty surrounding trade policy creates volatility in the market. Therefore, understanding different potential outcomes is crucial for any investor looking at an Apple stock prediction.

- Scenario 1: Continued tariff escalation and its impact on Apple stock: Further escalation would likely put downward pressure on Apple's stock price, due to increased costs and reduced profitability.

- Scenario 2: Tariff reduction or removal and its positive impact on Apple stock: A reduction or removal of tariffs would likely boost Apple's stock price, resulting from lower production costs and increased profitability.

- Scenario 3: Status quo and its potential implications for Apple stock: A continuation of the current situation could lead to market uncertainty and volatility, making it difficult to make precise Apple stock predictions.

- Risk assessment and diversification strategies for investors: Investors should perform a thorough risk assessment and consider diversifying their portfolios to mitigate the impact of tariff-related uncertainty on their Apple investments.

Alternative Investment Strategies Considering Tariff Risks

The uncertainty surrounding tariffs introduces significant risk for investors holding Apple stock. Diversifying your investment portfolio is a key strategy to mitigate this risk.

- Diversifying investments across different sectors: Spreading investments across various sectors reduces the impact of any single sector's underperformance, offering a more stable overall portfolio.

- Exploring other tech companies less exposed to tariffs: Investigating tech companies with less reliance on Chinese manufacturing can provide a hedge against tariff-related risks.

- Considering hedging strategies to mitigate potential losses: Employing hedging strategies, such as options trading, can help reduce potential losses due to negative market movements.

- Assessing the overall market risk and investor's risk tolerance: A thorough assessment of your risk tolerance is critical in making investment decisions in this volatile market environment.

Conclusion

This article analyzed the influence of tariffs on the Apple stock forecast. We examined the impact on Apple's supply chain, financial performance, and potential future stock price, presenting various scenarios and alternative investment strategies. Understanding these factors is crucial for informed investment decisions.

Call to Action: Stay informed about the latest developments in trade policy and their potential impact on Apple's performance. Continue to monitor the Apple stock forecast and adjust your investment strategy accordingly to navigate the complexities of the tariff impact effectively. Conduct thorough research and consider seeking professional financial advice before making any investment decisions regarding Apple stock or any other securities.

Featured Posts

-

Successfully Negotiating A Final Job Offer Tips And Strategies

May 24, 2025

Successfully Negotiating A Final Job Offer Tips And Strategies

May 24, 2025 -

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Koerswijziging

May 24, 2025

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Koerswijziging

May 24, 2025 -

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

Dayamitra Mtel Dan Merdeka Battery Mbma Prospek Investasi Usai Masuk Msci

May 24, 2025

Dayamitra Mtel Dan Merdeka Battery Mbma Prospek Investasi Usai Masuk Msci

May 24, 2025 -

The Ultimate Guide To Escaping To The Country

May 24, 2025

The Ultimate Guide To Escaping To The Country

May 24, 2025

Latest Posts

-

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025 -

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025 -

Revised Italian Citizenship Law Great Grandparent Lineage And Eligibility

May 24, 2025

Revised Italian Citizenship Law Great Grandparent Lineage And Eligibility

May 24, 2025 -

Italian Citizenship New Rules For Claiming Through Great Grandparents

May 24, 2025

Italian Citizenship New Rules For Claiming Through Great Grandparents

May 24, 2025