China Regulator Approves Hengrui Pharma's Hong Kong Stock Listing

Table of Contents

Details of Hengrui Pharma's Hong Kong IPO

Hengrui Pharma's decision to list on the HKEX represents a strategic move to tap into a larger pool of international investors and bolster its global presence. Let's examine the key aspects of this significant IPO.

Expected Capital Raised

While the exact figure is yet to be officially confirmed, market analysts predict Hengrui Pharma aims to raise a substantial sum through its Hong Kong offering. This capital injection is expected to fuel further research and development (R&D) efforts, allowing the company to expand its portfolio of innovative drugs and bolster its global competitiveness. It could also support acquisitions and strategic partnerships, accelerating growth within existing and new markets. The implied valuation for the company post-IPO is another key aspect eagerly awaited by investors.

Share Offering and Pricing

The specifics regarding the number of shares offered and the pricing strategy are anticipated to be released closer to the official listing date. However, speculation suggests a significant number of shares will be made available, catering to both institutional and retail investors. The pricing strategy will likely consider Hengrui Pharma's strong market position and future growth potential, aiming for an attractive valuation for investors while securing the necessary capital for the company. The lead underwriters involved in this significant deal will also play a crucial role in determining the final price.

Timeline and Key Dates

- Expected Listing Date: [Insert date if available, otherwise state "to be announced"]

- Registration Deadline: [Insert date if available, otherwise state "to be announced"]

- Stock Code: [Insert code if available, otherwise state "to be announced"]

- Exchange: Hong Kong Stock Exchange (HKEX)

Implications for Hengrui Pharma

Hengrui Pharma's Hong Kong listing carries significant implications for its future growth and strategic positioning.

Access to International Capital

Listing in Hong Kong opens doors to a diverse range of international investors, offering access to a far larger capital pool than is currently available within the mainland Chinese market. This increased access to capital will be vital in supporting Hengrui Pharma's ambitious growth plans, particularly in R&D and global expansion.

Enhanced Brand Recognition and Market Presence

The high visibility of the HKEX and the strong reputation of Hong Kong as a global financial hub will significantly enhance Hengrui Pharma's brand recognition and market presence internationally. This increased visibility will attract potential partners and customers globally.

Strategic Advantages

- Diversification of funding sources: Reducing reliance on domestic markets.

- Enhanced corporate governance: Aligning with international best practices.

- Improved investor relations: Building relationships with global investors.

Impact on the Hong Kong Stock Market and Chinese Pharmaceutical Sector

Hengrui Pharma's listing is expected to have a ripple effect on both the Hong Kong stock market and the Chinese pharmaceutical sector.

Attracting Foreign Investment

The successful IPO of a major Chinese pharmaceutical company like Hengrui Pharma is likely to attract further foreign investment into both the HKEX and the Chinese pharmaceutical sector as a whole. This influx of capital can fuel further growth and innovation within the industry.

Boost to Market Liquidity

The addition of a large-cap pharmaceutical company to the HKEX will undoubtedly boost market liquidity in the healthcare sector, creating a more active and dynamic trading environment.

Competition and Market Dynamics

The entrance of Hengrui Pharma into the Hong Kong market will certainly impact the competitive landscape. It will introduce increased competition while simultaneously potentially stimulating innovation and improved offerings within the sector. This could lead to further consolidation or strategic partnerships within the market.

Conclusion: Hengrui Pharma's Hong Kong Listing – A Positive Sign for the Future

The CSRC's approval of Hengrui Pharma's Hong Kong stock listing represents a pivotal moment for both the company and the broader pharmaceutical industry. The anticipated capital raised, coupled with enhanced brand recognition and access to international markets, positions Hengrui Pharma for substantial future growth. The listing also promises to attract further foreign investment into Hong Kong and invigorate the Chinese pharmaceutical sector. This event underscores the increasing integration of the Chinese economy into the global financial system and holds significant long-term implications for the future of healthcare innovation in China. Stay informed about further developments regarding Hengrui Pharma's Hong Kong Stock Listing and the exciting developments within the Chinese pharmaceutical market. We encourage you to consult reputable financial news sources for the most up-to-date information. The future looks bright for Hengrui Pharma, and its success on the HKEX promises to be a landmark event.

Featured Posts

-

The Impact Of Tariff Uncertainty On U S Company Spending

Apr 29, 2025

The Impact Of Tariff Uncertainty On U S Company Spending

Apr 29, 2025 -

Podsumowanie Testu Porsche Cayenne Gts Coupe Czy Spelnia Oczekiwania

Apr 29, 2025

Podsumowanie Testu Porsche Cayenne Gts Coupe Czy Spelnia Oczekiwania

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets Where To Buy And What To Expect

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Where To Buy And What To Expect

Apr 29, 2025 -

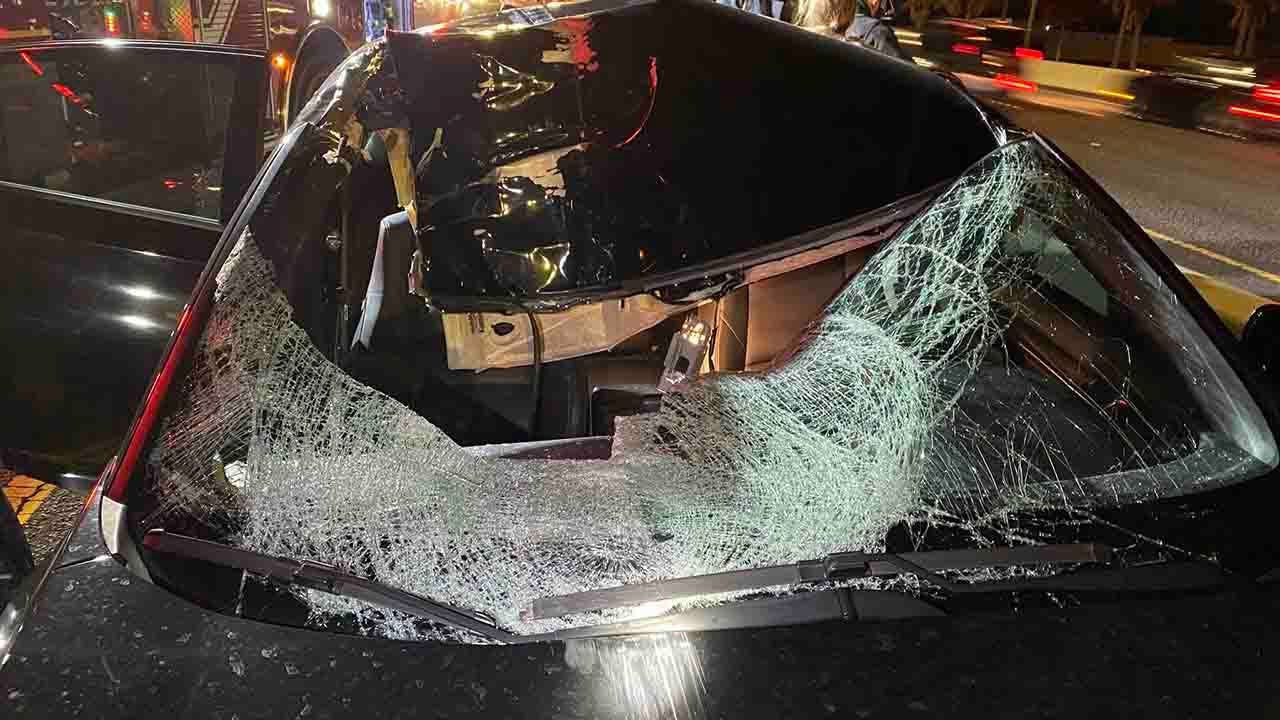

One Killed Several Hurt In Clearwater Ferry Collision

Apr 29, 2025

One Killed Several Hurt In Clearwater Ferry Collision

Apr 29, 2025 -

La Efectividad Goleadora De Alberto Ardila Olivares Datos Y Estadisticas

Apr 29, 2025

La Efectividad Goleadora De Alberto Ardila Olivares Datos Y Estadisticas

Apr 29, 2025