Check Today's Personal Loan Interest Rates: Best Deals Available

Table of Contents

Understanding Personal Loan Interest Rates

Before diving into finding the best rates, let's clarify some key terms. The Annual Percentage Rate (APR) is the total cost of borrowing, including the interest rate and any fees. Always compare loan offers using the APR, not just the interest rate itself, for an accurate reflection of the overall cost.

Personal loans typically offer two types of interest rates: fixed and variable. A fixed interest rate remains the same throughout the loan term, providing predictable monthly payments. A variable interest rate, on the other hand, fluctuates based on market conditions, leading to potentially unpredictable payments. Choose the type of rate that best suits your risk tolerance and financial planning.

Your credit score is a significant factor influencing your interest rate. Lenders use your credit score to assess your creditworthiness and risk.

- Higher credit scores typically result in lower interest rates. A good credit score demonstrates responsible financial behavior to lenders.

- Improving your credit score before applying can save you money. Addressing any negative marks on your report can significantly impact your eligibility for lower rates.

- Check your credit report for errors before applying for a loan. Errors can negatively impact your score and your chances of getting a favorable interest rate.

Factors Affecting Your Personal Loan Interest Rate

Several factors influence the interest rate you'll receive on a personal loan. Understanding these elements is crucial for securing the best possible terms.

The loan amount itself impacts the interest rate. Larger loan amounts often come with slightly higher interest rates due to the increased risk for the lender.

The loan term (the length of the loan) affects both your monthly payments and the total interest you pay. A shorter loan term means higher monthly payments but significantly less interest paid overall. A longer term means lower monthly payments but substantially more interest paid over the life of the loan.

Your income and debt-to-income (DTI) ratio play a crucial role. Your DTI ratio shows the percentage of your monthly income that goes towards debt repayments. A lower DTI ratio indicates a stronger financial position, making you a less risky borrower and increasing your chances of securing a better interest rate.

- Larger loan amounts may come with higher interest rates. Consider borrowing only what you truly need.

- Shorter loan terms mean higher monthly payments but less interest paid overall. Carefully balance affordability with long-term cost savings.

- A lower debt-to-income ratio improves your chances of securing a better interest rate. Manage your debts effectively to strengthen your application.

How to Find the Best Personal Loan Interest Rates

Finding the best personal loan interest rates requires diligent research and comparison. Utilize online comparison tools; these services allow you to quickly compare rates from multiple lenders simultaneously. Don't limit yourself to online lenders; check with traditional banks and credit unions as well – they often offer competitive rates.

Remember to carefully read the fine print of any loan offer. Pay close attention to all associated fees, such as origination fees, late payment fees, and prepayment penalties, as these can significantly impact your overall cost.

- Compare APRs, not just interest rates. The APR provides a complete picture of the loan's cost.

- Be wary of lenders offering unusually low interest rates. Such offers may come with hidden fees or unfavorable terms.

- Consider pre-qualification to check your eligibility without impacting your credit score. This allows you to explore options without harming your credit report.

Tips for Securing a Lower Personal Loan Interest Rate

Improving your credit score is a proactive step toward securing a lower interest rate. Pay all your bills on time, consistently reduce your debt, and avoid applying for multiple loans simultaneously. This shows lenders you are a responsible borrower.

Negotiating with lenders is another effective strategy. Once you've received a loan offer, don't hesitate to contact the lender and inquire about the possibility of a lower interest rate. Highlight your strong financial profile, emphasizing aspects like consistent income and low DTI ratio. Comparing offers from multiple lenders strengthens your negotiating position.

- Maintain a good credit history. A strong credit score is your biggest asset.

- Negotiate with lenders for a better rate. Don't be afraid to ask!

- Provide a strong financial profile to demonstrate creditworthiness. Highlight factors that showcase your financial stability.

Conclusion: Make Informed Decisions When Checking Today's Personal Loan Interest Rates

Securing a favorable personal loan interest rate depends on various factors, including your credit score, loan amount, loan term, and income. By understanding these factors and diligently comparing rates from different lenders, you can significantly reduce your borrowing costs. Remember, comparing today's personal loan interest rates isn't just about finding the lowest number; it's about finding the best overall deal that aligns with your financial goals and capabilities. Don't delay – start checking today's personal loan interest rates and secure the best possible terms for your needs. Use online comparison tools to find the best personal loan interest rates and low personal loan interest rates available to you today! [Link to a relevant comparison tool here]

Featured Posts

-

Cuaca Bandung Besok 26 3 Peringatan Hujan Di Jawa Barat

May 28, 2025

Cuaca Bandung Besok 26 3 Peringatan Hujan Di Jawa Barat

May 28, 2025 -

Welcome To Wrexham Accommodation Restaurants And Things To Do

May 28, 2025

Welcome To Wrexham Accommodation Restaurants And Things To Do

May 28, 2025 -

Barrick Claims Malis Gold Mine Acquisition Is Illegal

May 28, 2025

Barrick Claims Malis Gold Mine Acquisition Is Illegal

May 28, 2025 -

Nadals Last Roland Garros Sabalenka Secures The Title

May 28, 2025

Nadals Last Roland Garros Sabalenka Secures The Title

May 28, 2025 -

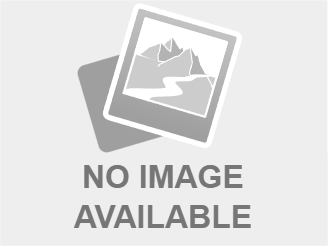

Kanye West And Bianca Censori The Truth Behind His Departure

May 28, 2025

Kanye West And Bianca Censori The Truth Behind His Departure

May 28, 2025

Latest Posts

-

Pasxalines Tileoptikes Metadoseis 2024 E Thessalia Gr

May 30, 2025

Pasxalines Tileoptikes Metadoseis 2024 E Thessalia Gr

May 30, 2025 -

Kalyteros Odigos Gia Tis Tileoptikes Metadoseis Toy Pasxa

May 30, 2025

Kalyteros Odigos Gia Tis Tileoptikes Metadoseis Toy Pasxa

May 30, 2025 -

Manitoba And Nunavuts Kivalliq Hydro Fibre Link Forging A New Economic Partnership

May 30, 2025

Manitoba And Nunavuts Kivalliq Hydro Fibre Link Forging A New Economic Partnership

May 30, 2025 -

Dorean Online Metadoseis Pasxa E Thessalia Gr

May 30, 2025

Dorean Online Metadoseis Pasxa E Thessalia Gr

May 30, 2025 -

Plires Programma Tileoptikon Metadoseon 19 4 M Savvato

May 30, 2025

Plires Programma Tileoptikon Metadoseon 19 4 M Savvato

May 30, 2025