Barrick Claims Mali's Gold Mine Acquisition Is Illegal

Table of Contents

Barrick's Accusations and Legal Basis

Barrick Gold's accusations center on the alleged illegality of the acquisition process surrounding its Loulo-Gounkoto gold mine, a significant asset in its West African operations. The company has released official statements and supporting legal documents outlining its case, alleging serious breaches of contract and due process. Barrick's arguments primarily hinge on:

-

Violation of Existing Contracts or Agreements: Barrick claims the acquisition directly violates pre-existing contracts and agreements governing the mine's ownership and operational rights. These agreements, they argue, were not properly adhered to during the acquisition process.

-

Lack of Proper Due Process or Legal Approvals: The company asserts that the acquisition lacked the necessary legal approvals and failed to follow established due process under Malian and potentially international law. This suggests a lack of transparency and potentially corrupt practices.

-

Allegations of Corruption or Bribery: While not explicitly stated in all released documents, Barrick's claim implies the possibility of corruption or bribery influencing the acquisition, further undermining the legitimacy of the process. This is a serious accusation with far-reaching consequences.

-

Disputes over Ownership or Mining Rights: The core of the dispute lies in the competing claims to ownership and the legal rights to operate the Loulo-Gounkoto gold mine. Barrick maintains its superior claim based on prior agreements and legal standing. The Loulo-Gounkoto mine is crucial to Barrick's production and profitability, making this dispute a high-priority matter.

Mali's Response and Counterarguments

The Malian government has responded to Barrick's accusations with a vigorous defense of the acquisition's legality. They have released their own statements and supporting documentation, attempting to counter Barrick's claims. Key elements of their counterarguments include:

-

Defense of the Legality of the Acquisition Process: Mali maintains that the acquisition process adhered to all relevant national laws and regulations, rejecting Barrick's accusations of irregularities.

-

Claims of Barrick's Non-Compliance with Malian Laws or Regulations: The Malian government may counter by highlighting alleged instances where Barrick itself failed to comply with Malian laws or regulations, potentially weakening their legal standing.

-

Presentation of Supporting Legal Documentation: To support their case, the Malian government is likely to present its own legal documentation demonstrating the legality of the acquisition and the validity of the new ownership.

-

Potential Accusations of Barrick Attempting to Manipulate the Legal Process: Mali might accuse Barrick of attempting to improperly influence or manipulate the legal process to its advantage, casting doubt on the company's motives.

International Implications and Investment Concerns

This legal battle between Barrick Gold and the Malian government extends far beyond the immediate parties involved. The dispute carries significant implications for foreign investment in Mali's mining sector and the wider West African region.

-

Deterrent Effect on Future Foreign Investment in Mining: The uncertainty generated by this dispute could deter future foreign investment in Mali's mining industry. Investors may be hesitant to commit capital in an environment perceived as legally unstable.

-

Damage to Mali's Reputation as a Stable Investment Destination: The dispute damages Mali's reputation as a stable and reliable destination for foreign investment, potentially impacting other sectors beyond mining.

-

Impact on the Global Gold Market and Gold Prices: While less direct, the outcome of this dispute could have ripple effects on the global gold market and potentially influence gold prices depending on the scale of the Loulo-Gounkoto mine's production.

-

Role of International Arbitration or Legal Bodies in Resolving the Dispute: The dispute may eventually involve international arbitration or legal bodies, adding another layer of complexity and potentially impacting the timeline for resolution.

The Role of International Law and Arbitration

The potential involvement of international legal frameworks and arbitration processes is crucial in resolving this complex dispute. International treaties and conventions related to mining and foreign investment will likely play a significant role. Precedents from similar international mining disputes could guide the legal proceedings and the eventual outcome. The specific treaties and conventions involved will depend on the bilateral agreements between Mali and Canada (where Barrick is based) and any relevant international investment agreements. This aspect of the case will be closely watched by international legal experts and organizations involved in mining and investment law.

Conclusion

The Barrick Gold Mali gold mine dispute highlights a significant clash over mining rights and legal processes in West Africa. Barrick's claims of an illegal acquisition are countered by Mali's defense of its actions. The international implications are substantial, affecting investor confidence and potentially influencing the global gold market. The outcome will set a precedent for future mining investments in the region. The potential involvement of international law and arbitration further complicates the situation.

Call to Action: Stay updated on the evolving legal battle surrounding Barrick's claim of an illegal acquisition of its Mali gold mine. Follow our site for ongoing updates on this significant development in the global mining industry and its impact on international investment. Continue to research the implications of this Barrick Gold Mali gold mine dispute for the future of mining in the region.

Featured Posts

-

J Lo To Host American Music Awards May Ceremony Announcement

May 28, 2025

J Lo To Host American Music Awards May Ceremony Announcement

May 28, 2025 -

Late Game Heroics Stowers Grand Slam Delivers Marlins Win Against Athletics

May 28, 2025

Late Game Heroics Stowers Grand Slam Delivers Marlins Win Against Athletics

May 28, 2025 -

Sinner Faces Stiff Competition Analysis Of The French Open Draw

May 28, 2025

Sinner Faces Stiff Competition Analysis Of The French Open Draw

May 28, 2025 -

40 Yasindaki Ronaldo Hala Zirvede

May 28, 2025

40 Yasindaki Ronaldo Hala Zirvede

May 28, 2025 -

Man Uniteds Summer Pursuit Of Rayan Cherki Transfer Speculation

May 28, 2025

Man Uniteds Summer Pursuit Of Rayan Cherki Transfer Speculation

May 28, 2025

Latest Posts

-

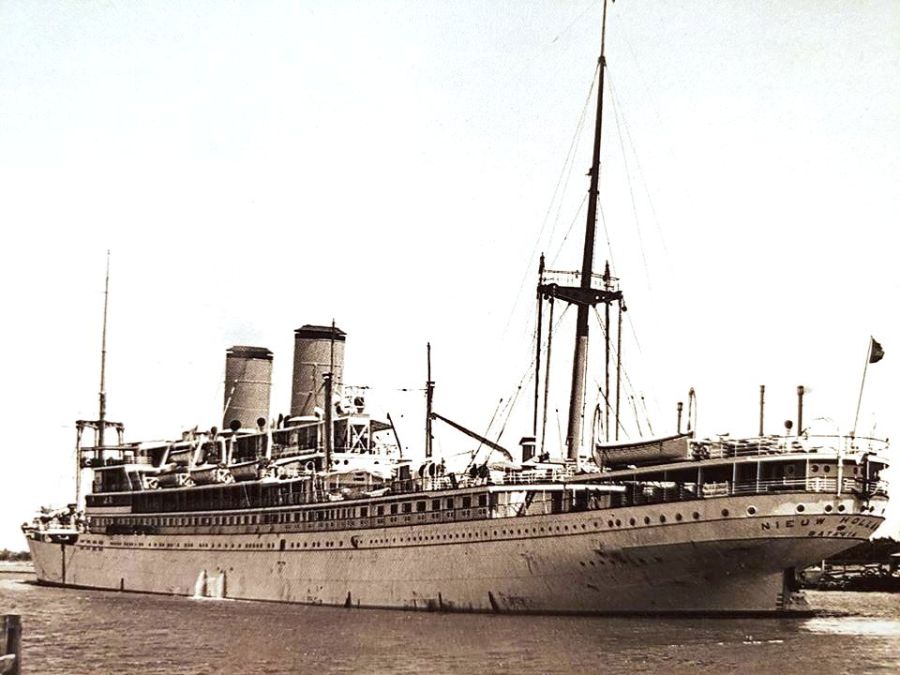

Fincantieri Secures New Cruise Ship Order From Tui Ag For Marella Cruises

May 29, 2025

Fincantieri Secures New Cruise Ship Order From Tui Ag For Marella Cruises

May 29, 2025 -

The Nieuw Statendams Impact On Invergordons Cruise Season

May 29, 2025

The Nieuw Statendams Impact On Invergordons Cruise Season

May 29, 2025 -

Nieuw Statendam Invergordons First Major Cruise Ship Of The Season

May 29, 2025

Nieuw Statendam Invergordons First Major Cruise Ship Of The Season

May 29, 2025 -

Easter Ross Port Of Invergordon Sees Arrival Of Nieuw Statendam

May 29, 2025

Easter Ross Port Of Invergordon Sees Arrival Of Nieuw Statendam

May 29, 2025 -

Invergordon Welcomes Nieuw Statendam Easter Ross Cruise Season Underway

May 29, 2025

Invergordon Welcomes Nieuw Statendam Easter Ross Cruise Season Underway

May 29, 2025