Cenovus Prioritizes Organic Growth, Dimming Prospects Of MEG Bid

Table of Contents

Cenovus's Renewed Emphasis on Internal Expansion

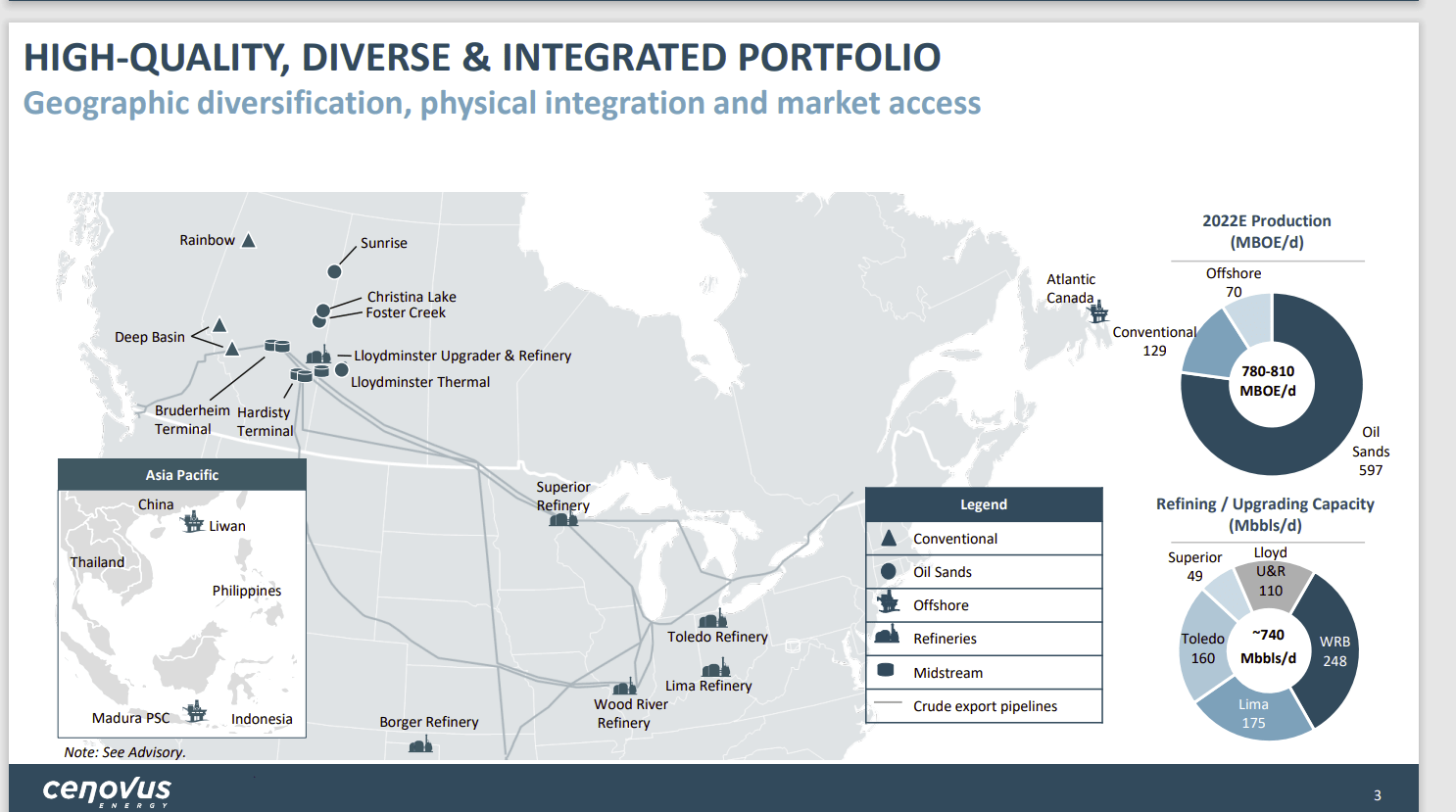

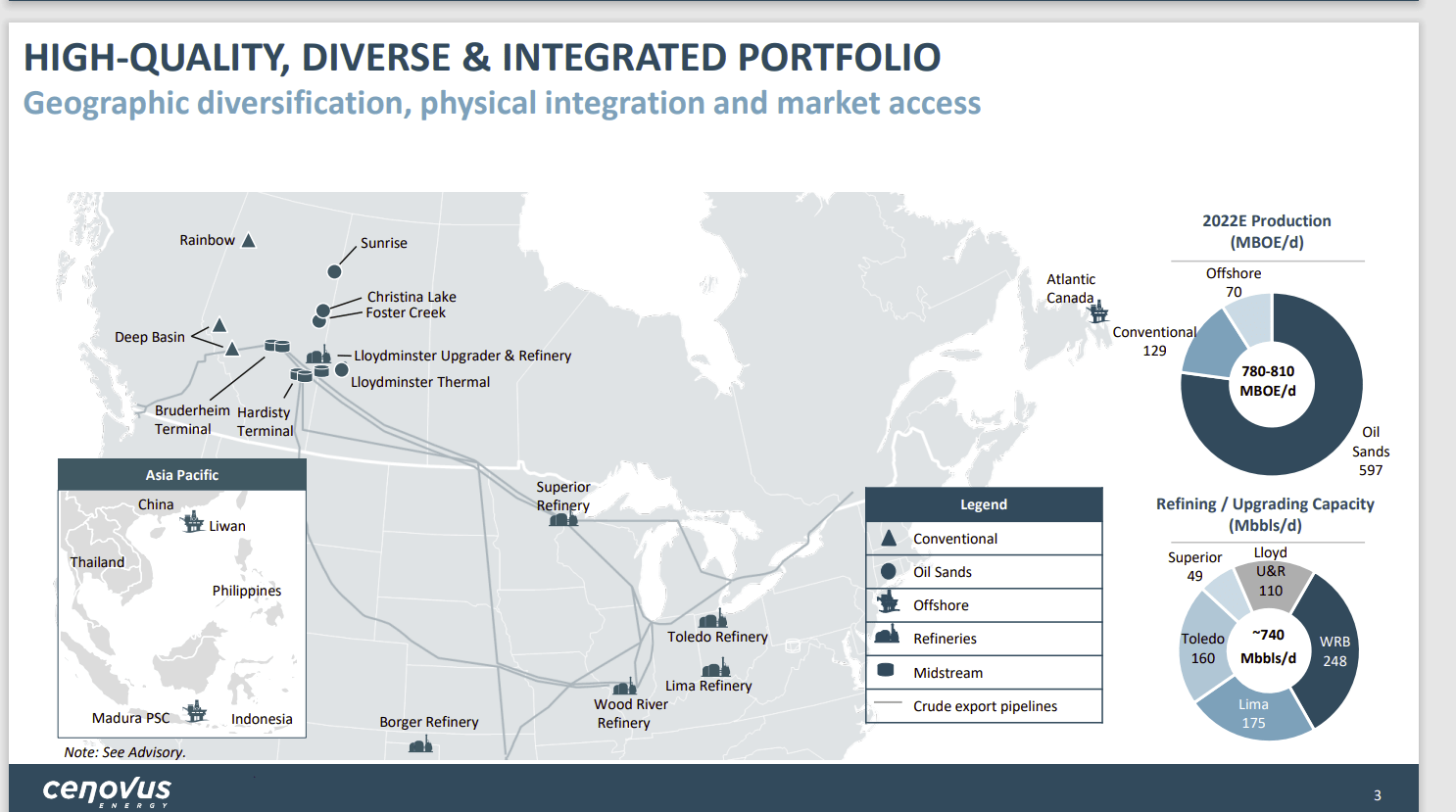

Cenovus, a major player in Canadian oil sands and upstream operations, is prioritizing organic growth over external acquisitions. This strategic realignment involves several key initiatives designed to enhance profitability and long-term sustainability.

Strengthening Existing Assets & Operations

Cenovus is committed to maximizing the potential of its current assets through operational efficiency improvements. This includes:

- Upgrading existing facilities: Investing in modernizing refineries and processing plants to enhance production capacity and reduce operational costs.

- Implementing advanced technologies: Utilizing cutting-edge technologies like artificial intelligence and machine learning to optimize production processes and improve recovery rates. This includes predictive maintenance to minimize downtime and maximize production optimization.

- Streamlining operations and cost reduction: Implementing rigorous cost-cutting measures across the entire value chain, focusing on achieving economies of scale and reducing capital expenditures. This focus on capital allocation aims to maximize returns on existing investments.

Exploration and Development of New Resources

Cenovus is actively exploring and developing new resources in areas with high growth potential. This involves:

- Expanding exploration activities in the Western Canadian Sedimentary Basin: Focusing on proven hydrocarbon reserves to ensure a steady supply of resources for future production.

- Investing in greenfield projects: Developing new oil sands projects with a focus on environmental stewardship and sustainable resource management. This includes exploring innovative technologies to minimize environmental impact.

- Strategic partnerships: Collaborating with other companies to access new resources and leverage expertise in exploration and production.

Strategic Investments in Renewable Energy

Cenovus recognizes the importance of the energy transition and is actively investing in renewable energy sources to diversify its portfolio and meet growing ESG (Environmental, Social, and Governance) expectations. This includes:

- Investing in solar and wind power projects: Diversifying its energy portfolio to reduce carbon emissions and create new revenue streams.

- Developing carbon capture, utilization, and storage (CCUS) technologies: Implementing technologies to reduce greenhouse gas emissions from its operations.

- Exploring opportunities in green hydrogen: Investing in research and development for low-carbon hydrogen production, aligning with the broader global push towards cleaner energy.

Diminished Prospects for a MEG Energy Bid

The shift towards organic growth significantly reduces the likelihood of Cenovus pursuing an acquisition of MEG Energy.

Financial Considerations

A MEG Energy acquisition would have significant financial implications for Cenovus:

- Increased debt levels: A large acquisition would necessitate substantial borrowing, potentially impacting the company's debt-to-equity ratio and credit rating.

- Market capitalization considerations: The current market conditions and valuation of MEG Energy may not be favorable for a strategic acquisition by Cenovus. The current market capitalization of both companies needs to be carefully considered.

- Impact on shareholder value: The potential returns from an acquisition might not justify the financial risks and the impact on shareholder value in the short term.

Strategic Realignment

Cenovus's focus on organic growth aligns perfectly with its long-term strategic priorities:

- Improved operational efficiency: Internal improvements lead to better control over costs and production.

- Enhanced shareholder value: Organic growth offers more predictable and sustainable returns.

- Reduced acquisition risk: Avoiding the complexities and uncertainties associated with large mergers and acquisitions.

Alternative Growth Avenues

Organic growth offers several advantages over acquisitions for Cenovus:

- Greater control: Internal expansion provides more control over development timelines, costs, and operational decisions.

- Higher potential return on investment: Strategic investments in existing and new assets have the potential to deliver higher returns compared to an acquisition.

- Sustainable development: Organic growth contributes to the long-term sustainability and resilience of Cenovus's business model.

Industry Analysis and Market Outlook

Cenovus's strategic decisions are shaped by the prevailing market conditions and competitive landscape.

Oil Price Volatility and its Impact

The current oil market is characterized by significant price volatility, impacting Cenovus's decision-making:

- Hedging strategies: Cenovus employs hedging strategies to mitigate the impact of fluctuating commodity prices on its profitability.

- Capital expenditure adjustments: Investment plans are adjusted based on the outlook for oil prices and market demand.

- Focus on operational efficiency: In volatile markets, maximizing operational efficiency is crucial to ensure profitability.

Competitor Strategies

Cenovus carefully monitors the strategies of its main competitors in the energy sector:

- Competitive landscape analysis: Cenovus assesses the strategies of its peers to maintain a competitive advantage.

- Market share considerations: Maintaining and expanding market share is a key goal for Cenovus.

- Benchmarking and best practices: The company continuously benchmarks its performance against industry leaders.

Conclusion: Cenovus Prioritizes Organic Growth Over MEG Acquisition

Cenovus Energy's strategic shift towards organic growth represents a deliberate choice to prioritize internal expansion and sustainable development over external acquisitions like a potential MEG Energy bid. This decision is driven by financial considerations, strategic realignment, and a desire for greater control and higher potential returns on investment. The focus on operational efficiency, exploration and development of new resources, and strategic investments in renewable energy ensures long-term value creation for shareholders and positions Cenovus for success in a dynamic energy landscape. Stay informed about Cenovus Energy's progress in organic growth and its future strategies by visiting [link to Cenovus website].

Featured Posts

-

Analyzing The Success And Downfall Of Michelle Mone

May 27, 2025

Analyzing The Success And Downfall Of Michelle Mone

May 27, 2025 -

Primaires Ps Faure Et Bouamrane Illustrent La Durete De La Competition

May 27, 2025

Primaires Ps Faure Et Bouamrane Illustrent La Durete De La Competition

May 27, 2025 -

Analyzing The Impact Of The State Of Emergency On Port Of Spain Commuters

May 27, 2025

Analyzing The Impact Of The State Of Emergency On Port Of Spain Commuters

May 27, 2025 -

Asasinarea Lui Robert Kennedy O Revizuire A Cazului In Lumina Noilor Documente

May 27, 2025

Asasinarea Lui Robert Kennedy O Revizuire A Cazului In Lumina Noilor Documente

May 27, 2025 -

El Peso De Osimhen En El Galatasaray Analisis De Un Comentarista Turco

May 27, 2025

El Peso De Osimhen En El Galatasaray Analisis De Un Comentarista Turco

May 27, 2025

Latest Posts

-

Mibot Kg Motors Bid To Dominate Japans Ev Sector

May 30, 2025

Mibot Kg Motors Bid To Dominate Japans Ev Sector

May 30, 2025 -

Can Kg Motors Mibot Electrify Japans Car Market

May 30, 2025

Can Kg Motors Mibot Electrify Japans Car Market

May 30, 2025 -

Kg Motors And The Mibot Japans Electric Vehicle Future

May 30, 2025

Kg Motors And The Mibot Japans Electric Vehicle Future

May 30, 2025 -

Trump Administrations Rejection Of Sunnova Energys 3 Billion Loan Application

May 30, 2025

Trump Administrations Rejection Of Sunnova Energys 3 Billion Loan Application

May 30, 2025 -

3 Billion Loan Cancellation Trump Administrations Decision Impacts Sunnova Energy

May 30, 2025

3 Billion Loan Cancellation Trump Administrations Decision Impacts Sunnova Energy

May 30, 2025