$3 Billion Loan Cancellation: Trump Administration's Decision Impacts Sunnova Energy

Table of Contents

The $3 Billion Loan Guarantee Program and its Purpose

The $3 billion Loan Guarantee Program, a key component of the Obama administration's efforts to stimulate the renewable energy sector, aimed to accelerate the growth of clean energy projects across the United States. Its primary goals included:

- Supporting Renewable Energy Projects: Providing financial backing for large-scale solar, wind, and other renewable energy initiatives.

- Stimulating Economic Growth: Creating jobs and boosting economic activity in communities across the country through renewable energy development.

- Enhancing Energy Independence: Reducing reliance on fossil fuels and strengthening America's energy security.

The program funded a variety of projects, including:

- Large-scale solar power plants

- Offshore wind farms

- Geothermal energy facilities

- Advanced biofuel production plants

Early successes and positive outcomes predicted by proponents included significant job creation, reduced carbon emissions, and a boost to domestic manufacturing in the clean energy sector. The program was touted as a crucial catalyst for the transition to a cleaner energy future, leveraging government incentives for solar energy and other renewable sources. Keywords like Renewable Energy Loan Guarantee Program, Clean Energy Financing, and Government Incentives for Solar Energy were frequently associated with the program's initial rollout.

Sunnova Energy's Involvement and Reliance on the Loan Guarantee

Sunnova Energy, a leading residential solar energy provider, had planned to leverage the loan guarantee program to fuel significant expansion and development. The loan guarantee was integral to Sunnova's financial strategy, enabling them to:

- Secure financing for large-scale solar installations.

- Expand its customer base and market reach.

- Invest in research and development of advanced solar technologies.

The cancellation directly impacted several key projects Sunnova had planned, including:

- Expansion of solar panel manufacturing facilities.

- Development of large-scale community solar projects.

- Investment in innovative solar energy storage solutions.

The anticipated benefits—increased revenue, job creation, and market leadership—were jeopardized by the sudden loss of this crucial financial support. Keywords such as Sunnova Energy Stock, Sunnova Financial Performance, Solar Energy Investments, and Project Financing became central to understanding the company's predicament.

The Trump Administration's Decision to Cancel the Loan Guarantee

The Trump administration cited various reasons for canceling the loan guarantee program, primarily focusing on:

- Budget Constraints: The administration argued that the program was fiscally irresponsible and diverted funds from other priorities.

- Policy Shifts: The administration’s focus shifted towards fossil fuels, reducing the emphasis on renewable energy initiatives.

However, critics argued that the cancellation:

- Sent a negative signal to the renewable energy sector.

- Undermined investor confidence in clean energy projects.

- Hindered the nation's progress towards its climate goals.

The decision involved key players within the Trump administration, including officials from the Department of Energy and the Office of Management and Budget. The political context was characterized by a broader shift towards deregulation and a rollback of environmental protection measures. Keywords like Trump Administration Policy, Energy Policy Changes, Government Spending Cuts, and Political Impact on Renewable Energy capture the political complexities surrounding the cancellation.

The Impact on Sunnova Energy: Financial and Operational Consequences

The cancellation of the $3 billion loan guarantee program had a significant negative impact on Sunnova Energy's financial and operational performance. The company experienced:

- Reduced access to capital for expansion projects.

- Increased borrowing costs due to a loss of government backing.

- Project delays and potential cost overruns.

Sunnova was forced to make strategic adjustments, including:

- Restructuring existing projects to secure alternative financing.

- Prioritizing smaller-scale projects with less reliance on external funding.

- Implementing cost-cutting measures to mitigate financial losses.

While precise figures on job losses are difficult to ascertain, the cancellation undoubtedly slowed hiring and possibly led to layoffs in some areas. The visual representation of the financial impact through charts and graphs (if available) would further clarify the severity of the blow to Sunnova. Keywords including Sunnova Energy Financial Report, Impact of Loan Cancellation on Business, and Solar Energy Market Volatility are crucial for understanding Sunnova’s post-cancellation state.

Long-Term Implications for the Renewable Energy Sector

The cancellation of the loan guarantee program sent a chilling effect across the renewable energy sector. Investor confidence in large-scale renewable energy projects waned, leading to:

- Increased risk premiums for renewable energy investments.

- Reduced private sector funding for clean energy initiatives.

- Slowed progress towards national renewable energy goals.

The decision also raised concerns about the stability and predictability of government support for the clean energy transition. The experience served as a cautionary tale, highlighting the challenges of navigating fluctuating government policies. By examining similar situations and lessons from previous government interventions, the industry could adapt to such future uncertainties. Keywords like Renewable Energy Investment, Future of Solar Energy, Government Regulation of Renewable Energy, and Clean Energy Transition are vital to analyzing this long-term impact.

Conclusion

The $3 billion loan cancellation had a profoundly negative impact on Sunnova Energy and the broader renewable energy sector. The Trump administration's decision underscored the volatility of government support for clean energy initiatives and the significant risks associated with relying heavily on government funding for large-scale projects. This event demonstrated the importance of diversification and resilience in navigating the complexities of the energy market.

Call to Action: Learn more about the ongoing effects of the $3 Billion Loan Cancellation on the renewable energy industry and how this event shapes future investment strategies in clean energy. Stay informed on the latest developments in renewable energy financing and policy by following [link to relevant resource]. Understand the long-term implications of this pivotal decision regarding $3 Billion Loan Cancellations and its effect on businesses like Sunnova Energy.

Featured Posts

-

The Ultimate Bargain Hunt A Comprehensive Guide To Saving Money

May 30, 2025

The Ultimate Bargain Hunt A Comprehensive Guide To Saving Money

May 30, 2025 -

Experience The Epcot International Flower And Garden Festival

May 30, 2025

Experience The Epcot International Flower And Garden Festival

May 30, 2025 -

San Diego Aircraft Accident Runway Lights Out Weather System Down Initial Findings

May 30, 2025

San Diego Aircraft Accident Runway Lights Out Weather System Down Initial Findings

May 30, 2025 -

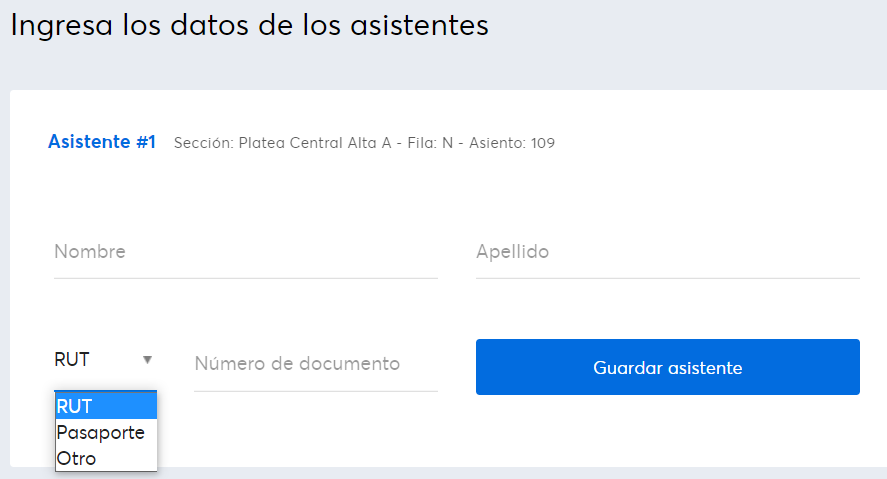

Virtual Venue De Ticketmaster Compra De Entradas Reimaginada

May 30, 2025

Virtual Venue De Ticketmaster Compra De Entradas Reimaginada

May 30, 2025 -

Air Jordan Release Calendar June 2025 Must Have Sneakers

May 30, 2025

Air Jordan Release Calendar June 2025 Must Have Sneakers

May 30, 2025