Cenovus CEO Rules Out MEG Bid, Prioritizes Organic Growth

Table of Contents

Cenovus CEO's Statement and Rationale

Cenovus's CEO publicly announced the company's decision to not pursue an acquisition of MEG Energy, citing several key factors. The statement emphasized a focus on maximizing shareholder value through a different approach. The primary reasons given included:

-

Valuation Concerns: The CEO expressed concerns about the perceived valuation of MEG Energy, suggesting that the asking price did not align with Cenovus's assessment of its intrinsic value. Acquiring MEG at the proposed price was deemed too expensive and potentially dilutive to Cenovus shareholder returns.

-

Debt Reduction: Cenovus is prioritizing a strategic reduction in its debt load. A significant acquisition like MEG would have increased the company's debt burden, potentially hindering its long-term financial flexibility and growth. This commitment to financial prudence underscores Cenovus’s conservative financial approach.

-

Emphasis on Internal Projects and Organic Growth Opportunities: The core rationale behind rejecting the MEG bid is Cenovus's strong belief in the potential of its existing assets and ongoing internal projects. The company sees more significant value creation in focusing resources on these initiatives.

Cenovus's Commitment to Organic Growth

Cenovus's organic growth strategy is multifaceted and encompasses several key initiatives:

-

Exploration and Production in Existing Assets: Cenovus plans to increase oil and gas production from its existing assets through enhanced exploration and improved recovery techniques. This includes optimizing well performance and expanding production capacity in key operational areas.

-

Operational Efficiency Improvements: Cenovus is committed to streamlining its operations, reducing costs, and improving efficiency across its value chain. This involves optimizing processes, investing in technology, and improving supply chain management to enhance profitability.

-

Technological Advancements to Improve Production: Investing in cutting-edge technologies, such as advanced analytics and automation, is crucial to Cenovus's organic growth plan. These technologies will aid in boosting production, lowering operational costs, and enhancing environmental sustainability.

This commitment to organic growth aligns perfectly with Cenovus's long-term strategy of sustainable and profitable expansion. The benefits of this approach include lower risk compared to acquisitions, greater control over project execution, and the potential for higher returns over time.

Implications for MEG Energy

Cenovus's decision leaves MEG Energy in a somewhat uncertain position. The rejection of the bid has potentially impacted MEG Energy's stock price, though the market reaction is complex and dependent on various factors including prevailing oil prices and investor sentiment.

-

Potential Alternative Buyers or Strategic Partnerships: While Cenovus is out of the picture, other potential buyers or strategic partners might still emerge. The oil and gas industry is dynamic, and MEG Energy's assets might attract interest from competitors looking for expansion opportunities.

-

Challenges for MEG Energy: Without a takeover by Cenovus, MEG Energy faces the challenge of continuing to operate independently and compete effectively in a challenging market environment. They will need to focus on internal growth initiatives and cost optimization to enhance their position.

Market Reactions and Industry Analysis

The market’s response to Cenovus's announcement has been varied. Stock prices for both Cenovus and MEG Energy fluctuated initially, reflecting investor uncertainty. Analyst commentary has been divided, with some praising Cenovus's prudent financial management and others questioning the missed opportunity to acquire MEG Energy.

The current oil and gas industry M&A landscape is characterized by a mix of consolidation and cautious approaches. The energy transition and volatile oil prices continue to shape corporate strategies. Cenovus's decision highlights a trend towards more selective M&A activity, with companies focusing on deals that offer strategic synergies and enhance long-term value creation. The broader implication for the energy sector is a shift towards sustainable internal growth strategies.

The Future of Cenovus and its Organic Growth Strategy

Cenovus’s future performance will depend heavily on the success of its organic growth strategy. While the approach carries lower risk than acquisitions, challenges remain. These include potential unforeseen operational hurdles, fluctuations in oil and gas prices, and the need for continuous innovation to maintain competitiveness. The long-term sustainability and profitability of this approach will depend on the company’s ability to execute its plans efficiently and adapt to the ever-changing energy market.

Conclusion

Cenovus Energy's decision to forgo a bid for MEG Energy and prioritize organic growth marks a significant strategic shift in the Canadian oil and gas industry. This decision reflects a focus on debt reduction, operational efficiency, and internal expansion. While the implications for MEG Energy remain to be seen, Cenovus’s commitment to organic growth offers a potentially rewarding, albeit riskier, path to long-term success. The success of this strategy will be key to Cenovus Energy’s future, and its impact on the energy sector deserves continued observation. Stay informed about Cenovus Energy's progress and the ongoing developments in the oil and gas sector. Follow [link to Cenovus investor relations or news page] for updates on Cenovus’s organic growth strategy and future announcements. Learn more about the evolving landscape of oil and gas mergers and acquisitions by subscribing to [link to relevant news source]. Keep your eye on the impact of Cenovus’s decisions on the future of the energy industry.

Featured Posts

-

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 25, 2025

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 25, 2025 -

Apple Stock Suffers Setback Due To Projected 900 Million Tariff

May 25, 2025

Apple Stock Suffers Setback Due To Projected 900 Million Tariff

May 25, 2025 -

Real Madrid In Doert Yildizi Hakkinda Uefa Sorusturmasi Basladi

May 25, 2025

Real Madrid In Doert Yildizi Hakkinda Uefa Sorusturmasi Basladi

May 25, 2025 -

Herstel Op Beurzen Aex Fondsen Klimmen Na Trump Uitstel

May 25, 2025

Herstel Op Beurzen Aex Fondsen Klimmen Na Trump Uitstel

May 25, 2025 -

Lewis Hamilton And Former Team Mate A Touching Moment Caught On Camera During Testing

May 25, 2025

Lewis Hamilton And Former Team Mate A Touching Moment Caught On Camera During Testing

May 25, 2025

Latest Posts

-

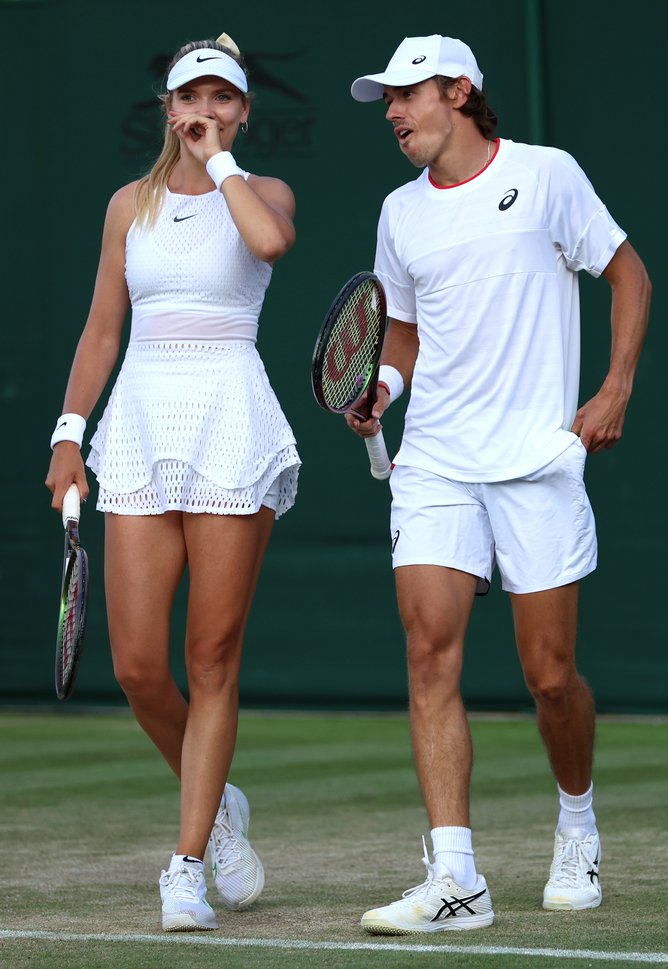

Alex Eala Targets Strong French Open Debut

May 25, 2025

Alex Eala Targets Strong French Open Debut

May 25, 2025 -

Gauff Advances To Italian Open Third Round Alongside Sabalenka

May 25, 2025

Gauff Advances To Italian Open Third Round Alongside Sabalenka

May 25, 2025 -

Gauffs Grit Reaching The Italian Open Third Round

May 25, 2025

Gauffs Grit Reaching The Italian Open Third Round

May 25, 2025 -

Swiateks Winning Streak Continues Madrid Open Victory Over Keys De Minaurs Loss

May 25, 2025

Swiateks Winning Streak Continues Madrid Open Victory Over Keys De Minaurs Loss

May 25, 2025 -

Madrid Open Results De Minaurs Early Exit And Swiateks Dominant Win

May 25, 2025

Madrid Open Results De Minaurs Early Exit And Swiateks Dominant Win

May 25, 2025