Apple Stock Suffers Setback Due To Projected $900 Million Tariff

Table of Contents

The $900 Million Tariff: A Detailed Breakdown

The looming $900 million tariff on Apple products represents a substantial challenge to the company's financial health. Understanding the specifics is crucial for assessing the impact on Apple stock price and future investment strategies.

Specific Products Affected

The tariff specifically targets several key Apple product lines, impacting a significant portion of their revenue streams. While the exact breakdown might vary slightly depending on the source and the final implementation of the tariff, some of the most affected products include:

- iPhones: Multiple models, including the iPhone 13, iPhone 14, and potentially older models still in circulation, are expected to face tariff increases. The impact will vary depending on the model and its manufacturing location.

- AirPods: Both the standard AirPods and AirPods Pro are likely included, adding to the cost of these popular wireless earbuds.

- MacBooks: Various MacBook models, including the MacBook Air and MacBook Pro lines, are anticipated to be subject to the tariff, increasing their manufacturing costs.

- Apple Watch: This popular wearable is also projected to be affected, adding to its already relatively high price point.

Estimated Tariff Impact (Source: [Insert Citation - e.g., Official Government Document Link]): [Insert Data Here - e.g., A table showing estimated tariff percentage on each category]

Impact on Apple's Profitability

The $900 million tariff will undeniably impact Apple's profitability. The increased cost of production will likely squeeze profit margins, potentially leading to a reduction in quarterly and annual earnings.

- Potential decrease in quarterly earnings: [Insert estimated percentage or dollar amount based on available data]

- Potential decrease in annual earnings: [Insert estimated percentage or dollar amount based on available data]

- Price increases for consumers: Apple may absorb some of the increased costs, but it's highly likely that some price increases will be passed on to consumers. This could lead to decreased demand, further impacting profitability.

Apple's Response to the Tariff

Apple has yet to make an official statement regarding the specific measures they intend to take to mitigate the financial blow, but historical trends suggest several potential responses:

- Lobbying efforts: Apple is likely to engage in lobbying efforts to try and influence or repeal the tariffs.

- Supply chain diversification: Apple might explore diversifying its manufacturing base to reduce reliance on regions subject to tariffs.

- Price adjustments: Strategic price increases might be implemented to partially offset the increased production costs.

Wider Implications for the Tech Industry and Investors

The impact of this tariff extends beyond Apple, affecting investor sentiment in the tech sector and raising questions about the stability of global supply chains.

Ripple Effect on the Tech Sector

This $900 million tariff on Apple products serves as a warning sign for other tech companies heavily reliant on global supply chains. Similar tariffs could be imposed on other companies, causing a ripple effect across the sector.

- Other affected companies: Companies producing electronics and components that rely on similar supply chains could experience similar challenges.

- Global supply chain disruption: The incident underscores the vulnerability of global supply chains to geopolitical instability and protectionist trade policies.

Investor Sentiment and Stock Market Reaction

The news of the projected tariff has already negatively impacted investor sentiment regarding Apple stock. This is reflected in:

- Apple stock price decline: [Insert data on stock price fluctuations since the tariff announcement].

- Increased trading volume: Increased trading activity reflects heightened investor interest and uncertainty.

- Analyst rating downgrades: [Mention any changes in analyst ratings and predictions].

Investment Strategies in Light of the Tariff

Investors need to carefully assess the risks associated with Apple stock given this new development.

- Buy, Hold, or Sell? [Disclaimer: This is not financial advice. Consult a financial advisor before making investment decisions.] Based on current information, investors might consider holding their existing Apple stock, closely monitoring the situation, and potentially diversifying their portfolio.

- Alternative investment opportunities: Explore other opportunities within the tech sector that might be less vulnerable to tariff risks.

Conclusion

The projected $900 million tariff on Apple products poses a significant challenge, impacting the company's profitability and investor confidence. The ripple effects could be felt across the tech industry, highlighting the vulnerability of global supply chains. While Apple will likely employ various mitigation strategies, investors need to carefully weigh the long-term implications before making investment decisions concerning Apple stock. The situation remains fluid, and continued monitoring of the news and financial reports is crucial.

Call to Action: Stay informed about the evolving situation surrounding Apple stock and the ongoing impact of tariffs on the tech industry. Monitor news and financial reports closely to make well-informed decisions regarding your Apple stock investments. Consider consulting with a financial advisor before making any significant investment changes.

Featured Posts

-

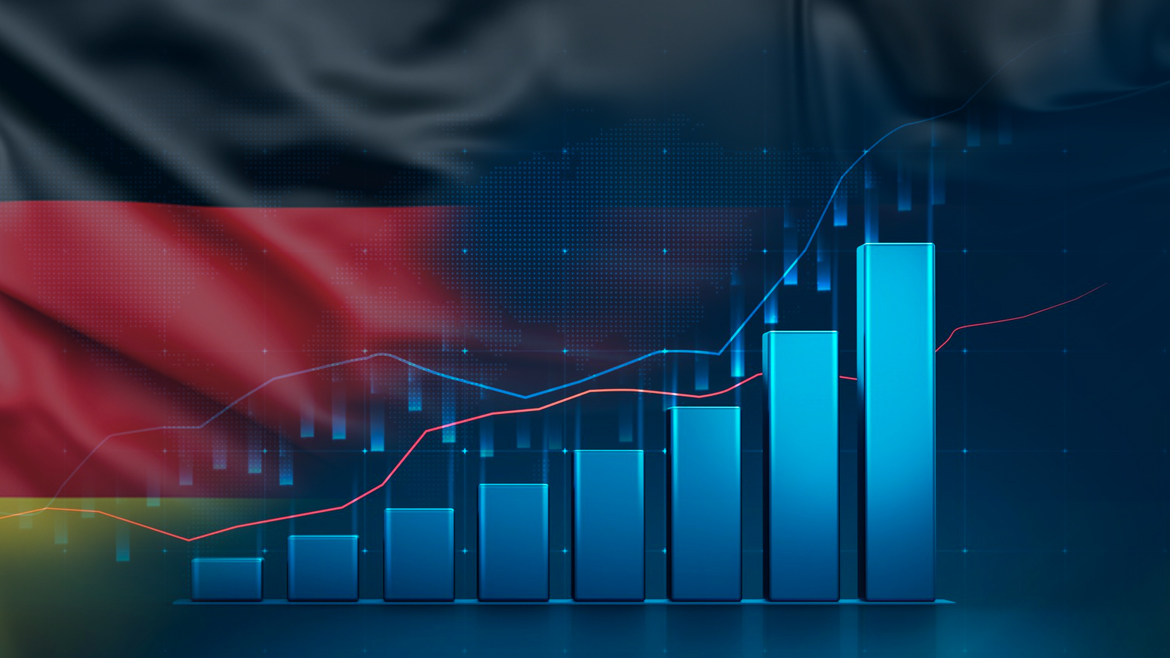

Prepad Na Trhu Prace V Nemecku Najvaecsie Spolocnosti Redukuju Stavy

May 25, 2025

Prepad Na Trhu Prace V Nemecku Najvaecsie Spolocnosti Redukuju Stavy

May 25, 2025 -

16 Nisan 2025 Avrupa Borsalari Duesues Yasadi Stoxx Europe 600 Ve Dax 40 Analizi

May 25, 2025

16 Nisan 2025 Avrupa Borsalari Duesues Yasadi Stoxx Europe 600 Ve Dax 40 Analizi

May 25, 2025 -

Frank Sinatras Wives Exploring His Four Marriages And Love Life

May 25, 2025

Frank Sinatras Wives Exploring His Four Marriages And Love Life

May 25, 2025 -

Live Euro Voorbij 1 08 Impact Van Stijgende Kapitaalmarktrentes

May 25, 2025

Live Euro Voorbij 1 08 Impact Van Stijgende Kapitaalmarktrentes

May 25, 2025 -

Volatiliteit Op Wall Street Aex Toont Veerkracht

May 25, 2025

Volatiliteit Op Wall Street Aex Toont Veerkracht

May 25, 2025

Latest Posts

-

Turning Poop Into Prose An Ai Powered Podcast Revolution

May 25, 2025

Turning Poop Into Prose An Ai Powered Podcast Revolution

May 25, 2025 -

Investigating The Connections Presidential Seals Luxury Goods And Exclusive Afterparties

May 25, 2025

Investigating The Connections Presidential Seals Luxury Goods And Exclusive Afterparties

May 25, 2025 -

The I O And Io Battleground How Google And Open Ai Are Shaping The Future Of Tech

May 25, 2025

The I O And Io Battleground How Google And Open Ai Are Shaping The Future Of Tech

May 25, 2025 -

The Symbolism Of Power Presidential Seals Expensive Watches And Elite Gatherings

May 25, 2025

The Symbolism Of Power Presidential Seals Expensive Watches And Elite Gatherings

May 25, 2025 -

The Trump Factor Influencing Republican Negotiations

May 25, 2025

The Trump Factor Influencing Republican Negotiations

May 25, 2025