Addressing Stock Market Valuation Anxiety: A BofA Viewpoint

Table of Contents

The rollercoaster ride of the stock market can leave even seasoned investors feeling anxious about valuations. This uncertainty, what we’ll call Stock Market Valuation Anxiety, is a common feeling in today's volatile economic climate. At Bank of America (BofA), we understand these concerns and offer a wealth of expertise to help navigate these challenging times. This article will explore key factors contributing to stock market valuation anxiety and offer strategies for navigating these challenges from a BofA perspective.

<h2>Understanding the Sources of Stock Market Valuation Anxiety</h2>

Several factors contribute to the unease many investors feel regarding current stock market valuations. Let's delve into the key culprits.

<h3>Inflation's Impact on Valuations</h3>

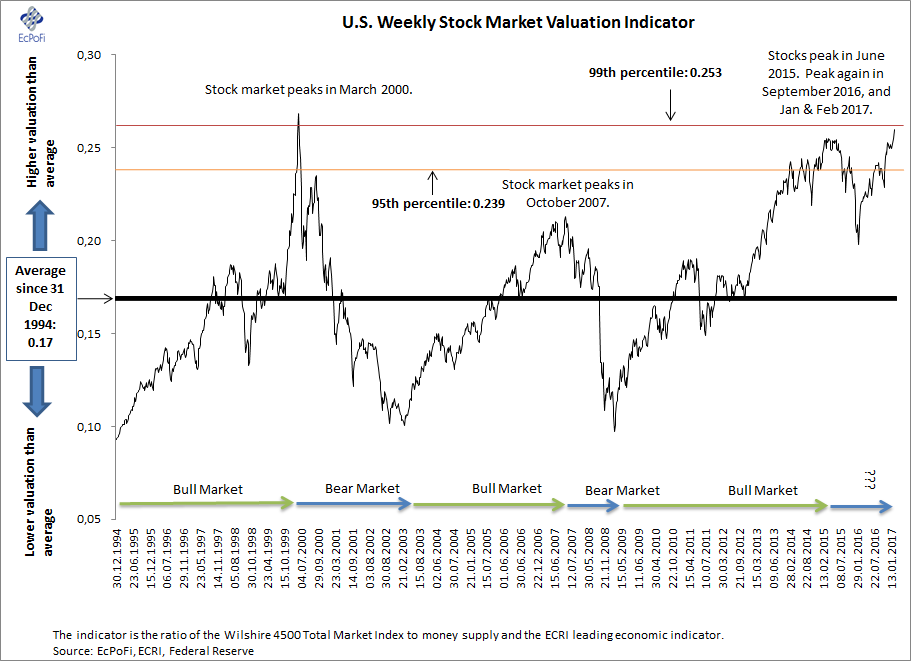

Inflation and stock valuations have an inverse relationship. When inflation rises, the purchasing power of money decreases, impacting future corporate earnings. This, in turn, reduces the present value of future cash flows, leading to lower stock valuations. Rising interest rates, often a response to inflation, further influence investor sentiment. Higher rates make bonds more attractive, diverting investment away from stocks and decreasing demand, thus impacting valuation multiples.

For example, sectors heavily reliant on consumer discretionary spending, such as retail and travel, are particularly vulnerable to inflationary pressures. Reduced consumer spending directly impacts their profitability and, consequently, their stock prices.

- Increased borrowing costs for companies hamper expansion and investment.

- Reduced consumer spending shrinks demand and revenue streams.

- Erosion of future earnings potential lowers the attractiveness of stocks.

<h3>Geopolitical Uncertainty and Market Volatility</h3>

Global events significantly influence market sentiment and valuations. Geopolitical risk introduces uncertainty, making it difficult to predict future economic conditions and company performance. Unexpected events, such as wars, political instability, or major international disputes, can trigger sharp market corrections.

Recent examples include the war in Ukraine, which disrupted global supply chains and energy markets, and rising tensions between major world powers. These events increase market volatility and contribute to stock market valuation anxiety.

- Supply chain disruptions lead to higher production costs and shortages.

- Energy price volatility increases the cost of doing business for many companies.

- Increased market uncertainty makes it harder for investors to assess risk and make informed decisions.

<h3>Interest Rate Hikes and Their Effect on Stock Prices</h3>

Interest rate hikes by central banks, such as the Federal Reserve, directly affect stock valuations. Higher interest rates increase the discount rate used to calculate the present value of future earnings, leading to lower valuations. Quantitative tightening (QT), where central banks reduce their balance sheets, further impacts market liquidity, potentially exacerbating price declines in certain asset classes.

- Higher discount rates for future earnings reduce the present value of stocks.

- Increased cost of capital for companies makes borrowing more expensive, hindering growth.

- Shift in investor preferences towards fixed income (bonds) reduces demand for stocks.

<h2>BofA's Strategies for Managing Stock Market Valuation Anxiety</h2>

Navigating stock market valuation anxiety requires a proactive and well-informed approach. BofA offers several strategies to help mitigate risk and build long-term financial security.

<h3>Diversification as a Risk Mitigation Strategy</h3>

Diversification is a cornerstone of sound investment strategy. Spreading investments across various asset classes reduces the impact of any single investment's underperformance. A well-diversified portfolio includes a mix of:

- Stocks (domestic and international, across different sectors and market caps).

- Bonds (government and corporate bonds with varying maturities and credit ratings).

- Alternative investments (real estate, commodities, private equity – depending on risk tolerance).

This approach significantly reduces overall portfolio volatility and helps manage stock market valuation anxiety.

<h3>Long-Term Investing vs. Short-Term Market Timing</h3>

A long-term investment strategy is crucial for weathering market fluctuations. Attempting to time the market – buying low and selling high – is exceptionally difficult and often unsuccessful. Instead, focus on:

- Ignoring short-term market fluctuations.

- Focusing on long-term growth potential of your investments.

- Regularly rebalancing your portfolio to maintain your desired asset allocation.

This disciplined approach allows you to ride out market downturns and benefit from long-term growth.

<h3>Utilizing BofA's Financial Planning Resources</h3>

BofA provides comprehensive resources to support your investment journey. We offer:

- Access to experienced financial advisors who can provide personalized guidance.

- Cutting-edge investment research and analysis to inform your decisions.

- Robust portfolio management tools to help you track your investments and make informed adjustments.

Leveraging these resources can significantly reduce your stock market valuation anxiety by providing you with the knowledge and support you need.

<h2>Addressing Stock Market Valuation Anxiety – A Final Thought from BofA</h2>

Stock market valuation anxiety stems from several factors: inflation's impact on earnings, geopolitical uncertainty, and the effects of interest rate hikes. However, by employing strategies like diversification, adopting a long-term investment horizon, and utilizing BofA's comprehensive financial planning resources, you can effectively manage these concerns. A well-defined investment plan, tailored to your individual needs and risk tolerance, coupled with professional financial guidance, is key to achieving your long-term financial goals.

Don't let stock market valuation anxiety control your financial decisions. Contact a BofA financial advisor today to develop a personalized strategy that addresses your concerns and helps you achieve your long-term financial goals. [Link to BofA financial advisor page] [Link to BofA investment resources page]

Featured Posts

-

New Uk Immigration Laws Fluent English Essential For Residency

May 10, 2025

New Uk Immigration Laws Fluent English Essential For Residency

May 10, 2025 -

Wifes Reaction To Bert Kreischers Netflix Sex Jokes A Candid Look

May 10, 2025

Wifes Reaction To Bert Kreischers Netflix Sex Jokes A Candid Look

May 10, 2025 -

How To Be A Better Ally This International Transgender Day Of Visibility

May 10, 2025

How To Be A Better Ally This International Transgender Day Of Visibility

May 10, 2025 -

Nonbinary Pioneers Untimely Death A Look At The Life And Legacy Of Name

May 10, 2025

Nonbinary Pioneers Untimely Death A Look At The Life And Legacy Of Name

May 10, 2025 -

Wildfires And Wagers Exploring The Los Angeles Betting Landscape

May 10, 2025

Wildfires And Wagers Exploring The Los Angeles Betting Landscape

May 10, 2025