Canadian Economy Slowdown: Businesses Cautious Amidst Global Instability

Table of Contents

Impact of Global Inflation on Canadian Businesses

The current inflationary environment is significantly impacting Canadian businesses. Rising prices for goods and services, coupled with increased borrowing costs, are squeezing profit margins and dampening investment.

Rising Interest Rates and Borrowing Costs

The Bank of Canada's efforts to combat inflation through interest rate hikes have increased the cost of borrowing for businesses. This makes securing financing for expansion, new equipment, or even day-to-day operations significantly more expensive.

- Increased borrowing costs: Businesses face higher interest payments on loans and lines of credit, reducing profitability.

- Reduced access to credit: Some businesses may find it difficult to secure loans altogether, hindering their ability to invest and grow.

- Postponement of capital expenditures: Many companies are delaying or scaling back major investments due to the increased financial burden.

This is particularly acute in sectors like real estate and construction, where borrowing plays a crucial role in project financing. The higher interest rates translate directly into reduced project viability and potentially stalled development.

Increased Input Costs and Supply Chain Disruptions

Inflation isn't just affecting borrowing costs; it's also driving up the price of essential inputs. Raw materials, energy, and transportation costs are all significantly higher, impacting businesses' operating expenses.

- Higher operating expenses: Businesses face increased costs across the board, from manufacturing to distribution.

- Price increases for consumers: To maintain profitability, many businesses are forced to pass these increased costs onto consumers through higher prices.

- Potential for reduced competitiveness: Canadian businesses may find themselves at a disadvantage compared to international competitors who face less severe inflationary pressures.

Data from Statistics Canada consistently shows inflation rates well above the Bank of Canada's target, exacerbating the challenges faced by businesses across various sectors. The food and beverage industry, for example, is experiencing substantial increases in the cost of raw ingredients and packaging.

Consumer Spending and Demand Slowdown

The Canadian economy slowdown isn't solely driven by inflationary pressures; weakening consumer confidence plays a significant role. As consumers tighten their belts, demand for goods and services declines, further impacting businesses.

Weakening Consumer Confidence

Falling consumer confidence translates directly into reduced spending, particularly on discretionary items. This has a ripple effect throughout the economy.

- Reduced discretionary spending: Consumers are prioritizing essential purchases, reducing spending on non-essential goods and services.

- Impact on retail sales: Retailers are experiencing a slowdown in sales as consumers become more cautious about their spending.

- Decreased demand for non-essential goods and services: Industries like hospitality and entertainment are particularly vulnerable to this decline in demand.

Statistics on consumer confidence indices clearly indicate a significant drop in optimism, reflecting the growing uncertainty surrounding the economy.

Impact on Different Sectors

The slowdown in consumer demand is not impacting all sectors equally. Some are more vulnerable than others.

- Job losses in affected sectors: Industries experiencing reduced demand are likely to see job losses and potential business closures.

- Business closures: Businesses with low margins or high debt levels may struggle to survive in a weaker economic climate.

- Increased competition: Businesses are facing increased competition as consumers become more price-sensitive.

The hospitality sector, for instance, is still recovering from the pandemic and is now facing added pressure from reduced consumer spending and increased operating costs.

Government Policies and Economic Outlook

The Canadian government is responding to the Canadian economy slowdown with a mix of fiscal and monetary policies, but the effectiveness of these measures remains to be seen.

Government Response to the Slowdown

The government is implementing various strategies aimed at mitigating the impact of the slowdown.

- Fiscal stimulus measures: Government spending aimed at boosting economic activity.

- Monetary policy adjustments: The Bank of Canada's interest rate adjustments to control inflation.

- Support programs for businesses: Government aid packages designed to help businesses navigate the challenging economic climate.

However, the effectiveness of these policies is subject to ongoing debate, with concerns about potential unintended consequences and varying opinions on their impact.

Predictions and Forecasts for the Canadian Economy

Economic forecasts for Canada vary, but most experts predict a period of slower growth in the coming months and years.

- GDP growth projections: Most forecasts point to a moderation in GDP growth, potentially leading to a period of stagnation.

- Employment forecasts: While job losses are expected in some sectors, the overall employment picture is anticipated to remain relatively stable, though slower growth is likely.

- Inflation expectations: Inflation is expected to gradually decline but remain above the Bank of Canada's target for some time.

The Bank of Canada's Monetary Policy Report and forecasts from organizations like the IMF provide valuable insights into the projected trajectory of the Canadian economy.

Conclusion

The Canadian economy slowdown is a multifaceted challenge driven by global inflation, weakening consumer confidence, and persistent supply chain issues. Canadian businesses are responding with caution, adapting their strategies to navigate this uncertain environment. Understanding the nuances of this slowdown is crucial for businesses to adapt and thrive. Stay informed about economic developments and utilize resources provided by the government and other reputable sources to develop strategies for navigating this challenging period. Proactive planning and adaptation are key to weathering the current Canadian economic slowdown and emerging stronger in the long term.

Featured Posts

-

Captain America Brave New World When Can You Stream It On Disney

May 14, 2025

Captain America Brave New World When Can You Stream It On Disney

May 14, 2025 -

Tommy Furys Risky Stage Appearance A Look At The Fallout With Molly Mae

May 14, 2025

Tommy Furys Risky Stage Appearance A Look At The Fallout With Molly Mae

May 14, 2025 -

Tommy Furys Revelation Molly Mae Hague Fan Reaction Explodes

May 14, 2025

Tommy Furys Revelation Molly Mae Hague Fan Reaction Explodes

May 14, 2025 -

Disneys Improved Approach To Snow White In Future Live Action Adaptations

May 14, 2025

Disneys Improved Approach To Snow White In Future Live Action Adaptations

May 14, 2025 -

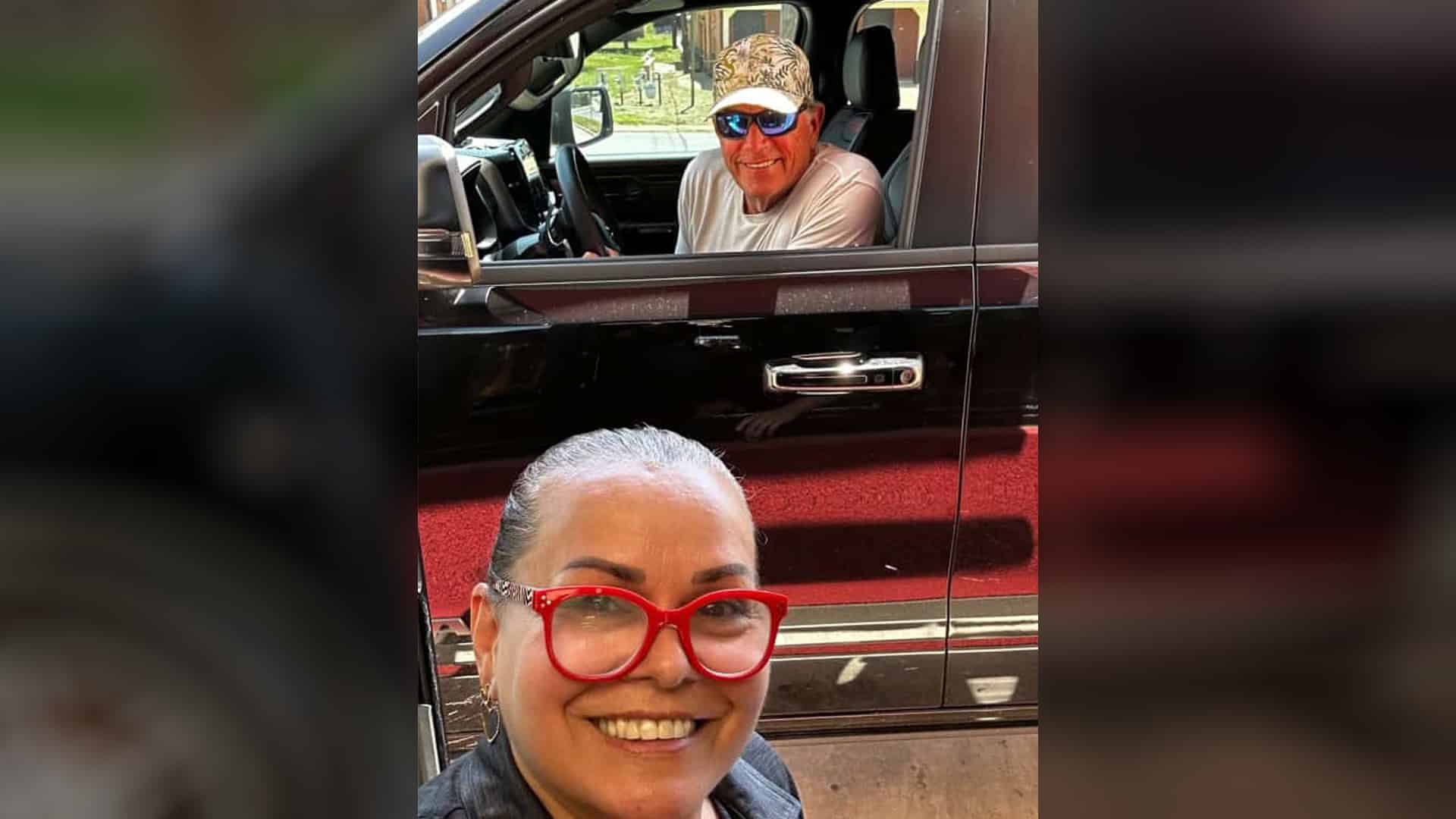

George Strait Spotted At Dairy Queen A Simple Act Big Fan Reaction

May 14, 2025

George Strait Spotted At Dairy Queen A Simple Act Big Fan Reaction

May 14, 2025

Latest Posts

-

Diversity And Inclusion At The Forefront Of Basels Eurovision Bid

May 14, 2025

Diversity And Inclusion At The Forefront Of Basels Eurovision Bid

May 14, 2025 -

Basels Eurovision Hope Navigating Tensions With A Focus On Diversity

May 14, 2025

Basels Eurovision Hope Navigating Tensions With A Focus On Diversity

May 14, 2025 -

Eurovision 2024 In Basel Promoting Diversity And Inclusion Amidst Tensions

May 14, 2025

Eurovision 2024 In Basel Promoting Diversity And Inclusion Amidst Tensions

May 14, 2025 -

Basels Eurovision Bid A Focus On Diversity And Inclusion

May 14, 2025

Basels Eurovision Bid A Focus On Diversity And Inclusion

May 14, 2025 -

Soaring Swiss Franc A Financial Headache For Eurovision Attendees

May 14, 2025

Soaring Swiss Franc A Financial Headache For Eurovision Attendees

May 14, 2025