Canadian Dollar Slump: Weakness Against Major Currencies Despite US Dollar Gains

Table of Contents

Factors Contributing to the Canadian Dollar's Weakness

Several interconnected factors contribute to the current weakness of the Canadian dollar in the currency exchange market. Understanding these factors is crucial for navigating the complexities of the CAD's fluctuating exchange rate.

Lower Commodity Prices

Canada's economy is heavily reliant on commodity exports, particularly oil and lumber. Fluctuations in global commodity prices directly impact the CAD's value. A decline in these prices reduces export revenue, weakening the demand for the Canadian dollar.

- Impact on oil prices: A significant drop in global oil prices, often driven by geopolitical events or changes in global demand, directly translates to lower Canadian export earnings. This decreased revenue negatively impacts the CAD. For example, a 10% decrease in oil prices can have a measurable effect on the CAD's value against the USD.

- Impact on other commodities (e.g., lumber, metals): Lower prices for lumber, potash, and various metals also contribute to the overall weakness of the Canadian dollar. These commodities are significant export earners for Canada, and reduced demand impacts the country's foreign exchange reserves.

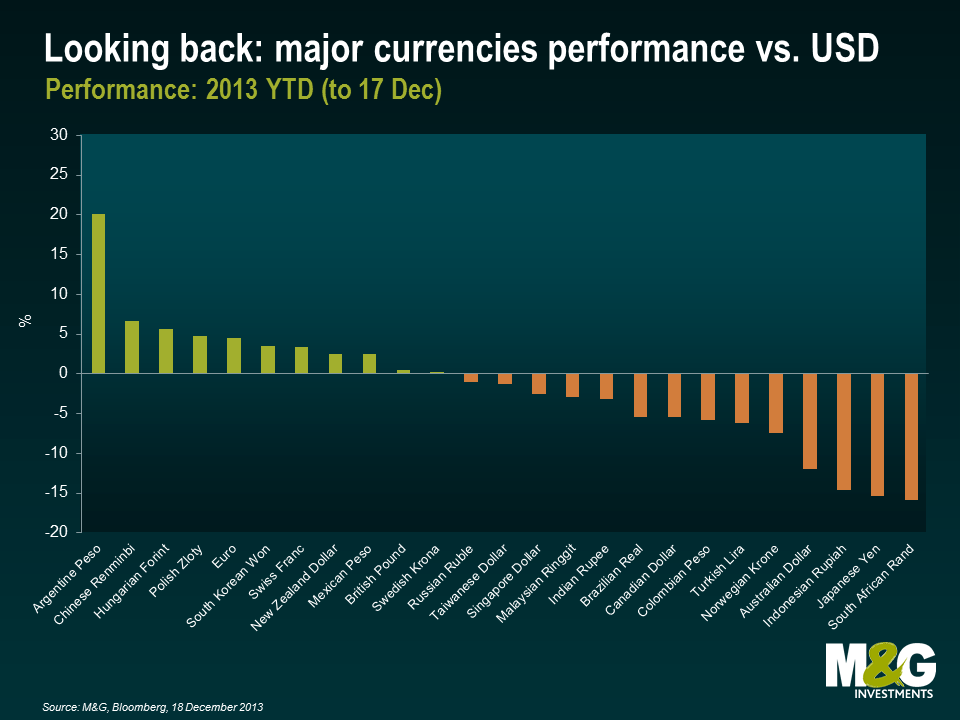

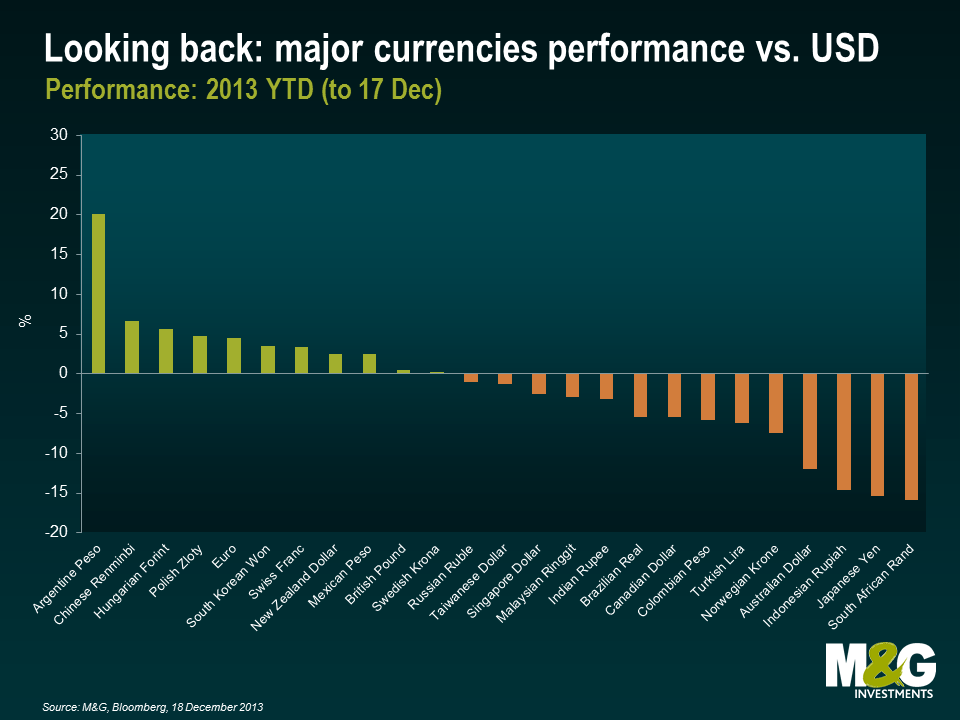

- Correlation between commodity prices and CAD: Historically, there is a strong positive correlation between commodity prices and the CAD exchange rate. When commodity prices rise, so does the CAD, and vice-versa. This relationship is a key factor influencing the CAD's performance in the foreign exchange market.

Interest Rate Differentials

Interest rate differentials between Canada and other major economies, particularly the United States, play a critical role in influencing currency exchange rates. Higher interest rates in another country attract foreign investment, increasing demand for that currency and consequently weakening the CAD.

- Comparison of Canadian interest rates with US rates: The Bank of Canada's monetary policy decisions directly influence interest rates. If US interest rates are significantly higher than Canadian rates, investors might move their capital to the US, putting downward pressure on the CAD.

- Impact of monetary policy decisions: The Bank of Canada's actions to manage inflation and economic growth significantly influence interest rates and, therefore, the CAD's value. Unexpected changes in monetary policy can cause volatility in the foreign exchange market.

- Potential future rate changes: Market speculation about future interest rate changes in both Canada and the US can also affect the CAD's exchange rate, leading to periods of uncertainty and volatility in the currency exchange market.

Geopolitical Uncertainty

Global geopolitical uncertainty, including trade wars and political instability, creates risk aversion among investors. This often leads investors to move their capital towards safe-haven currencies like the US dollar, further weakening the CAD.

- Specific geopolitical events affecting the CAD: Events such as escalating trade tensions between major economies or political instability in key trading partners can negatively impact investor confidence in the Canadian economy, thus weakening the CAD.

- Investor sentiment and risk aversion: During periods of heightened global uncertainty, investors often reduce their exposure to riskier assets, including currencies of countries perceived as less stable. This flight to safety diminishes demand for the CAD.

- Flight to safety trends: The US dollar is often considered a safe-haven currency. During times of global uncertainty, investors tend to move their assets into USD, increasing demand and strengthening it relative to other currencies, including the CAD.

Impact of the Canadian Dollar's Weakness

The weakening Canadian dollar has significant ramifications across various sectors of the Canadian economy.

Increased Import Costs

A weaker CAD makes imports more expensive, potentially fueling inflation. This impacts the cost of living for Canadians and the competitiveness of domestic businesses.

- Examples of imported goods affected: Many everyday goods, from electronics and clothing to automobiles and food products, are imported. A weaker CAD increases the cost of these items, directly affecting consumers.

- Impact on consumer prices: Increased import costs translate to higher consumer prices, potentially leading to a decline in consumer spending and impacting overall economic growth.

- Inflation rate projections: The weakening CAD can contribute to inflationary pressures, requiring the Bank of Canada to adjust its monetary policy to control inflation.

Impact on Canadian Businesses

A weaker CAD presents both challenges and opportunities for Canadian businesses.

- Increased competitiveness of Canadian exports: Exporters benefit from a weaker CAD as their goods become more price-competitive in international markets. This can boost export sales and revenue.

- Challenges faced by import-dependent businesses: Businesses reliant on imported goods face increased costs, potentially impacting their profitability and competitiveness. They may need to adjust pricing strategies or seek alternative suppliers.

Tourism and Travel

The weaker CAD has a dual impact on the tourism sector.

- Impact on inbound and outbound tourism: While it makes Canada a cheaper destination for international tourists, boosting inbound tourism, it makes international travel more expensive for Canadians, potentially reducing outbound tourism.

- Potential benefits and drawbacks: The net effect on the tourism sector depends on the balance between increased inbound tourism and decreased outbound tourism.

Predictions and Outlook for the Canadian Dollar

Predicting the future performance of any currency, including the CAD, is inherently complex and uncertain.

Short-Term Forecasts

Short-term forecasts for the CAD's value vary depending on the analyst and their assessment of the current market conditions.

- Predictions from financial analysts: Numerous financial institutions provide short-term forecasts for the CAD's exchange rate, based on their analysis of the economic and political landscape. These predictions often differ based on the weighting given to various factors.

- Potential catalysts for changes: Significant shifts in commodity prices, unexpected changes in monetary policy, or major geopolitical events can act as catalysts for significant short-term fluctuations in the CAD's value.

Long-Term Outlook

The long-term outlook for the Canadian dollar is influenced by various factors that are difficult to predict with certainty.

- Economic growth projections: Sustained strong economic growth in Canada would typically support a stronger CAD. However, external factors can still influence its exchange rate.

- Long-term interest rate expectations: Long-term interest rate expectations in Canada relative to other major economies will play a crucial role in shaping the CAD's value.

- Potential shifts in commodity prices: Long-term shifts in commodity demand and supply, driven by technological changes or demographic trends, could significantly affect the CAD's performance.

Conclusion

The recent Canadian dollar slump is a multifaceted issue with implications for various aspects of the Canadian economy. Factors such as lower commodity prices, interest rate differentials, and geopolitical uncertainty contribute to the CAD's weakness. The impact is felt across import costs, businesses, and the tourism sector. While short-term forecasts remain uncertain, understanding these underlying factors is crucial for making informed decisions. Stay informed about the Canadian dollar and its fluctuations to make sound financial decisions and effectively navigate the complexities of the foreign exchange market. Monitor developments closely for the latest updates on the Canadian dollar and its impact on your financial planning.

Featured Posts

-

Sadie Sinks Mysterious Role In The New Spider Man Movie

Apr 25, 2025

Sadie Sinks Mysterious Role In The New Spider Man Movie

Apr 25, 2025 -

Planning Your Stagecoach 2025 Trip Essential Information And What To Expect

Apr 25, 2025

Planning Your Stagecoach 2025 Trip Essential Information And What To Expect

Apr 25, 2025 -

Ftc Probe Into Open Ai Implications For Chat Gpt And The Future Of Ai

Apr 25, 2025

Ftc Probe Into Open Ai Implications For Chat Gpt And The Future Of Ai

Apr 25, 2025 -

Hollywood Production Grinds To Halt As Actors And Writers Strike

Apr 25, 2025

Hollywood Production Grinds To Halt As Actors And Writers Strike

Apr 25, 2025 -

Dallas Cowboys Draft Could Matthew Golden Be A Round One Pick

Apr 25, 2025

Dallas Cowboys Draft Could Matthew Golden Be A Round One Pick

Apr 25, 2025

Latest Posts

-

Pakistan Stock Market Crisis Operation Sindoor Triggers 6 Index Plunge

May 10, 2025

Pakistan Stock Market Crisis Operation Sindoor Triggers 6 Index Plunge

May 10, 2025 -

Dakota Johnsons Figure Hugging Dress Steals The Show At Materialists

May 10, 2025

Dakota Johnsons Figure Hugging Dress Steals The Show At Materialists

May 10, 2025 -

Operation Sindoor Pakistan Stock Market Plunges Kse 100 Trading Halted

May 10, 2025

Operation Sindoor Pakistan Stock Market Plunges Kse 100 Trading Halted

May 10, 2025 -

Securing Your Future Identifying A Real Safe Bet

May 10, 2025

Securing Your Future Identifying A Real Safe Bet

May 10, 2025 -

What Is A Real Safe Bet And How To Find It

May 10, 2025

What Is A Real Safe Bet And How To Find It

May 10, 2025