Canadian Dollar: Potential For A Drop With A Minority Government

Political Instability and Currency Volatility

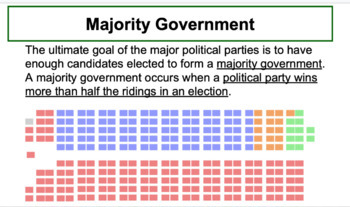

Minority governments, by their nature, are characterized by inherent instability. Their reliance on the support of other parties to pass legislation creates an unpredictable policy environment. This lack of clear direction significantly impacts investor confidence, a cornerstone of a strong and stable currency. Foreign investment, a key driver of economic growth and CAD strength, becomes hesitant in the face of political uncertainty. A minority government increases the risk profile for Canada, potentially leading to capital flight.

- Increased likelihood of snap elections: The constant threat of early elections creates volatility, making long-term planning difficult for businesses and investors.

- Difficulty passing key economic legislation: Essential economic reforms and budgets can be delayed or watered down due to protracted negotiations and compromises among various parties.

- Potential for gridlock and delayed policy implementation: This can stifle economic growth and further erode investor confidence in the Canadian economy, negatively impacting the CAD.

- Impact on business investment decisions: Uncertainty surrounding future policies can lead businesses to postpone or cancel investments, slowing economic expansion and weakening the CAD.

Impact on Key Economic Sectors

A minority government's impact extends far beyond general investor sentiment; it directly affects key Canadian economic sectors. The resource sector, a significant contributor to the CAD, is particularly vulnerable. Manufacturing, finance, and even the consumer sector all feel the ripple effects of political instability.

- Energy sector vulnerability to policy changes: Changes in environmental regulations, taxation policies, or pipeline approvals can significantly impact oil and gas production and exports, directly affecting the CAD.

- Impact on commodity prices and exports: Uncertainty surrounding government policies can lead to fluctuations in commodity prices, affecting Canada's export earnings and the CAD's value.

- Effect on interest rates and borrowing costs: Political instability can influence the Bank of Canada's monetary policy decisions, affecting interest rates and borrowing costs for businesses and consumers.

- Potential for decreased consumer confidence: Uncertainty about the future can lead to reduced consumer spending, negatively impacting economic growth and the CAD.

The Resource Sector and CAD Fluctuations

The resource sector's fortunes are intrinsically linked to the CAD. Fluctuations in global commodity prices (oil, lumber, potash) directly influence the currency's value. Furthermore, government policies regarding resource extraction and environmental regulations play a critical role.

- Impact of global commodity prices on the CAD: When commodity prices fall, Canada's export earnings decrease, putting downward pressure on the CAD.

- Influence of environmental policies on resource production and exports: Stricter environmental regulations can increase production costs and potentially limit exports, impacting the CAD negatively.

- Government regulation and its effects on foreign investment in resource extraction: Uncertain regulatory environments can deter foreign investment in the resource sector, weakening the CAD.

International Market Reactions and the CAD

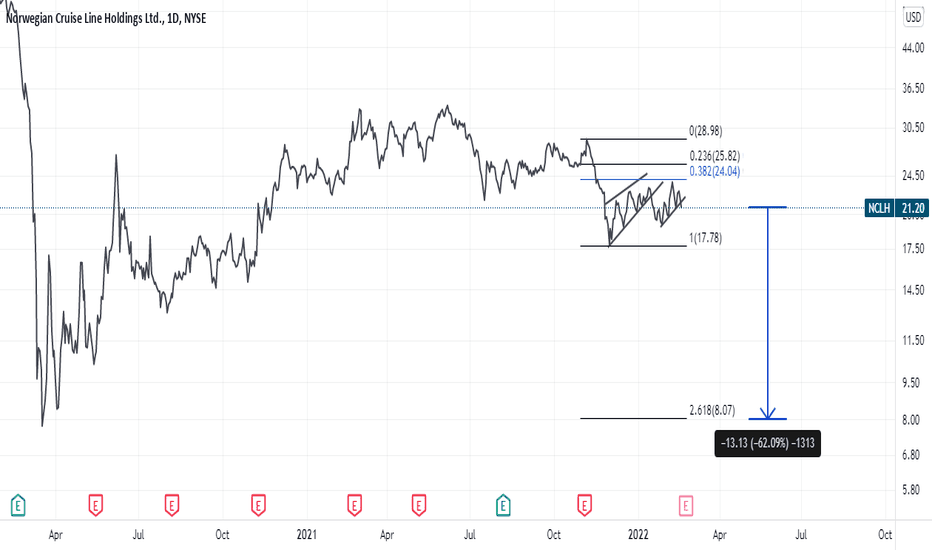

Global markets closely monitor political developments in Canada. During periods of minority government, investors might adopt a "wait-and-see" approach, potentially leading to a flight to safety and a weakening of the CAD against other major currencies like the USD and EUR.

- Flight to safety during political instability: Investors may move their funds to perceived safer havens, like the US dollar, reducing demand for the CAD.

- Impact of global economic conditions: Global economic downturns can exacerbate the negative impact of political instability on the CAD.

- The role of the Bank of Canada in managing interest rates: The Bank of Canada plays a crucial role in mitigating the effects of political uncertainty by adjusting interest rates to stabilize the CAD, although this is not always successful in the face of severe political instability.

Understanding the Risks and Opportunities for the Canadian Dollar

A minority government poses considerable risks to the Canadian dollar. The inherent political instability, potential for policy gridlock, and its impact on key economic sectors all contribute to increased currency volatility. It's crucial to closely monitor political developments and key economic indicators to understand the potential impact on the CAD.

For investors and businesses operating in Canada, proactive risk management is essential. This includes diversifying investments to mitigate potential losses, closely monitoring the Canadian dollar exchange rate, and seeking professional financial advice to navigate this complex environment. Stay informed about developments impacting the Canadian Dollar, understand the implications of CAD fluctuations, and consult experts to create a robust strategy for managing the risks and opportunities presented by a minority government. Don't underestimate the importance of monitoring the Canadian dollar exchange rate to make informed decisions.

How Domaine Carneros Achieved Energy Self Sufficiency With A Microgrid

How Domaine Carneros Achieved Energy Self Sufficiency With A Microgrid

Car Crash Kills Four Including Children At After School Program

Car Crash Kills Four Including Children At After School Program

Timberwolves Triumph Edwards Leadership Secures Victory Against Nets

Timberwolves Triumph Edwards Leadership Secures Victory Against Nets

Ameliorer La Securite Routiere L Efficacite Des Glissieres De Securite

Ameliorer La Securite Routiere L Efficacite Des Glissieres De Securite

Nclh Outperforms Expectations Sending Shares Up

Nclh Outperforms Expectations Sending Shares Up