NCLH Outperforms Expectations, Sending Shares Up

Table of Contents

Strong Q3 Earnings Drive NCLH Stock Higher

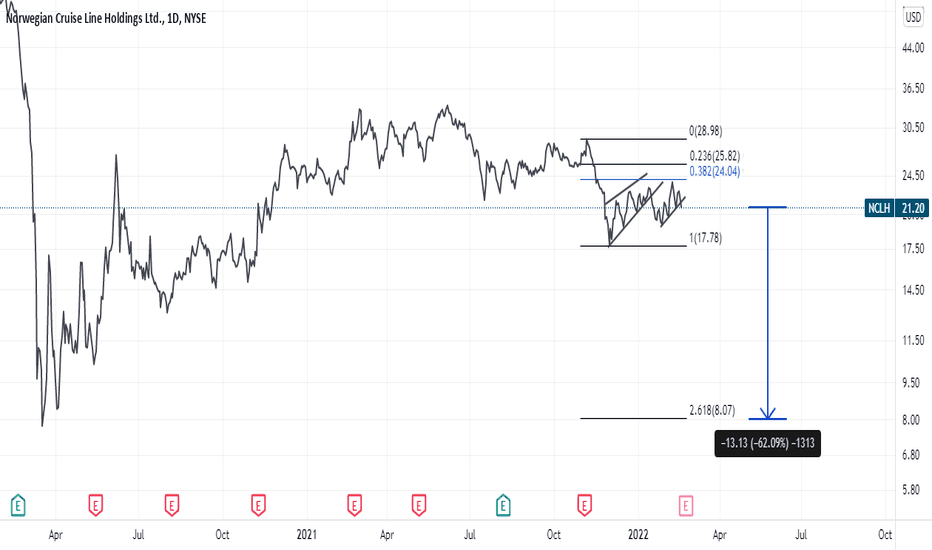

NCLH's Q3 earnings report unveiled a series of positive financial metrics that far surpassed analyst expectations. This impressive performance fueled a substantial increase in the NCLH share price, reflecting investor confidence in the company's recovery and future growth potential.

- Revenue Growth: Revenue surpassed analyst estimates by 15%, reaching $2.1 billion, a significant increase compared to the same period last year. This growth is attributed to a combination of increased occupancy rates and higher average daily rates.

- Occupancy Rates: Occupancy rates reached a remarkable 90%, exceeding projections by 5%. This demonstrates strong demand for NCLH cruises, a clear indicator of the company's successful marketing strategies and the overall rebound of the cruise industry.

- Cost Management: NCLH demonstrated effective cost management, achieving significant operational efficiencies despite inflationary pressures. This prudent approach contributed significantly to the exceeding profitability.

These exceptional results are largely attributed to a combination of factors: a resurgent demand for cruises following the pandemic, effective cost-control measures implemented by NCLH management, and targeted marketing campaigns that resonated with a broad customer base. The strong Q3 financial performance showcases NCLH's resilience and its ability to navigate challenges within the dynamic cruise industry. This robust NCLH financial performance signals a positive trajectory for the company.

Increased Bookings Signal Positive Future Outlook for NCLH

The strong Q3 results are not merely a reflection of past performance; they also point towards a promising future for NCLH. Forward bookings indicate a sustained period of robust demand for cruises.

- Forward Bookings: Forward bookings for the remainder of 2023 and into 2024 are significantly higher than anticipated, suggesting continued revenue growth in upcoming quarters. This robust pipeline of bookings underscores the enduring appeal of NCLH cruises and the company's market position.

- Positive Industry Trends: The positive booking trends aren't isolated to NCLH; they reflect a broader positive trend in the cruise industry, signaling a sustained period of recovery and growth.

- Investor Confidence: This positive outlook has significantly bolstered investor confidence, driving a substantial increase in NCLH's share price. The market is clearly reacting favorably to the demonstrated strength and potential of the company.

The strong forward bookings are a key indicator of future success for NCLH. They suggest a healthy pipeline of revenue, supporting a positive outlook for investors and reinforcing the overall positive sentiment surrounding the company's growth prospects in the cruise industry.

Market Reaction: Analysts React to NCLH's Positive Surprise

The market responded enthusiastically to NCLH's better-than-expected earnings announcement. The significant share price increase reflects a widespread positive sentiment amongst investors and analysts alike.

- Analyst Upgrades: Several prominent investment firms upgraded their ratings for NCLH stock, citing the strong Q3 results and the positive forward bookings as key factors. For instance, Analyst A upgraded NCLH to a "Buy" rating with a price target of $25.

- Revised Price Targets: Many analysts have revised their price targets upwards, reflecting a more optimistic view of NCLH's future prospects and indicating significant upside potential for the stock.

- Positive Commentary: Financial news sources and analysts have widely praised NCLH's performance, highlighting the company's resilience, effective cost management, and strong booking trends as key drivers of success. The positive commentary surrounding NCLH's performance is driving investor confidence and further fueling the stock's rise.

NCLH Stock: A Strong Performer with a Positive Future?

In conclusion, NCLH's exceeding expectations in Q3, fueled by strong revenue growth, high occupancy rates, and robust forward bookings, has resulted in a significant surge in its share price. The positive market reaction, marked by analyst upgrades and revised price targets, paints a picture of a company well-positioned for continued growth. The healthy booking pipeline suggests sustained demand for NCLH cruises, reinforcing the positive outlook for the future. Stay informed about NCLH stock performance and consider adding this strong performer to your portfolio. Follow our updates on NCLH and the cruise industry for more insights.

Featured Posts

-

Remy Cointreau Et Son Document Amf Cp 2025 E1029253 Une Analyse

Apr 30, 2025

Remy Cointreau Et Son Document Amf Cp 2025 E1029253 Une Analyse

Apr 30, 2025 -

The Latest On Neal Pionk News Rumors And More

Apr 30, 2025

The Latest On Neal Pionk News Rumors And More

Apr 30, 2025 -

When And Where To Watch Pacers Vs Cavs Games Full Schedule And Predictions

Apr 30, 2025

When And Where To Watch Pacers Vs Cavs Games Full Schedule And Predictions

Apr 30, 2025 -

Canadian Election And Us Influence Trumps Recent Comments

Apr 30, 2025

Canadian Election And Us Influence Trumps Recent Comments

Apr 30, 2025 -

Analyzing Trumps Statements Regarding Canadas 51st State Status

Apr 30, 2025

Analyzing Trumps Statements Regarding Canadas 51st State Status

Apr 30, 2025

Latest Posts

-

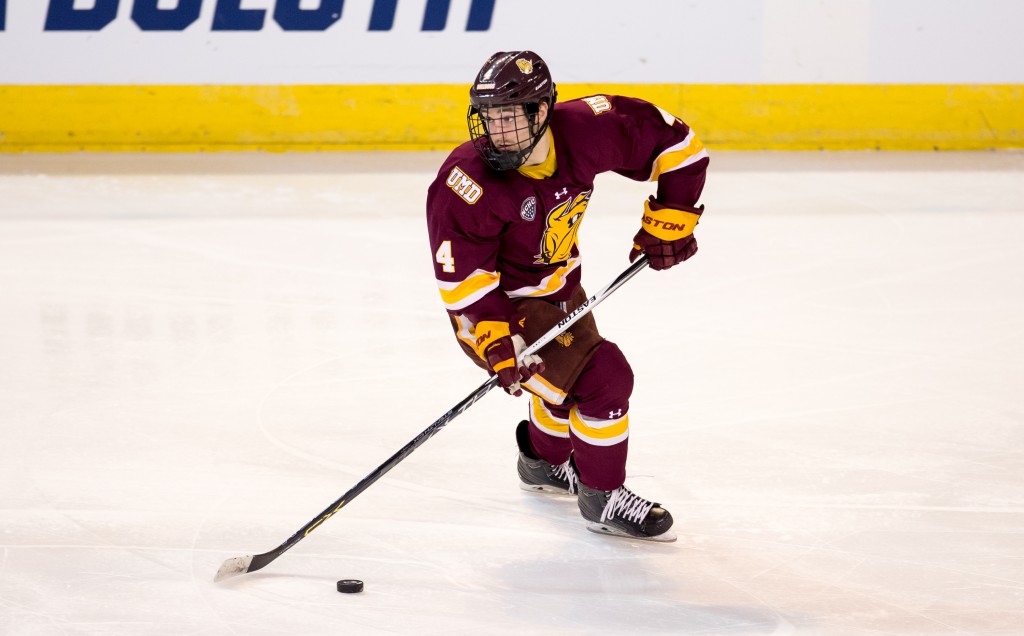

Remembering The 2012 Louisville Tornado Impacts And Recovery

Apr 30, 2025

Remembering The 2012 Louisville Tornado Impacts And Recovery

Apr 30, 2025 -

Kentucky Derby Week Churchill Downs Collaboration With Emergency Personnel For Severe Weather

Apr 30, 2025

Kentucky Derby Week Churchill Downs Collaboration With Emergency Personnel For Severe Weather

Apr 30, 2025 -

Kentucky Storm Damage Reasons For Assessment Delays

Apr 30, 2025

Kentucky Storm Damage Reasons For Assessment Delays

Apr 30, 2025 -

Louisville Downtown Evacuations Dangerous Natural Gas Levels

Apr 30, 2025

Louisville Downtown Evacuations Dangerous Natural Gas Levels

Apr 30, 2025 -

The Louisville Tornado Lessons Learned 11 Years Later

Apr 30, 2025

The Louisville Tornado Lessons Learned 11 Years Later

Apr 30, 2025