Canadian Dollar Dips Despite US Dollar Strength: What's Happening?

Table of Contents

The Impact of US Interest Rate Hikes on the Canadian Dollar

The strength of the US dollar is a significant factor influencing the Canadian dollar's performance. Increased US interest rates, a key tool employed by the Federal Reserve to combat inflation, significantly impact global capital flows. These hikes make US assets, such as government bonds, more attractive to international investors seeking higher returns.

- Increased US yields make US assets more attractive: Higher interest rates translate to higher yields on US investments, drawing capital away from countries offering lower returns.

- Capital flows out of Canada into the US: As investors seek better returns, they shift their investments from Canadian assets to US assets, increasing demand for the US dollar and decreasing demand for the Canadian dollar.

- Higher interest rate differential widens the gap between USD and CAD: The difference in interest rates between the US and Canada directly influences the exchange rate, pushing the Canadian dollar lower relative to the US dollar.

- This impacts currency exchange rates directly: The increased demand for USD and decreased demand for CAD directly impacts the exchange rate, leading to a depreciation of the loonie.

[Insert chart here illustrating the correlation between US interest rates and CAD performance over a specific period.]

Commodity Prices and their Influence on the Canadian Dollar

Canada's economy is heavily reliant on the export of commodities, including oil, lumber, and other natural resources. Fluctuations in global commodity prices directly impact the Canadian dollar's value. When commodity prices fall, the demand for the Canadian dollar weakens.

- Lower oil prices reduce demand for the Canadian dollar: As a major oil exporter, Canada's economy is sensitive to oil price changes. Lower oil prices reduce export revenue and decrease demand for the Canadian dollar.

- Global economic slowdown impacting demand for Canadian commodities: A global recession or slowdown reduces demand for various commodities, including those exported by Canada, further depressing the Canadian dollar.

- Supply chain disruptions affecting commodity exports: Disruptions to global supply chains can restrict the export of Canadian commodities, impacting the country's trade balance and the value of its currency.

- Volatility in global commodity markets: The inherent volatility in global commodity markets contributes to the instability of the Canadian dollar.

[Insert chart here displaying recent commodity price trends (e.g., oil, lumber) and their correlation with the CAD exchange rate.]

Bank of Canada Monetary Policy and its Role

The Bank of Canada's monetary policy plays a crucial role in managing inflation and influencing the Canadian dollar. Its actions, often in response to global economic conditions, directly affect interest rates and the overall attractiveness of the Canadian economy. These decisions are often compared and contrasted with those of the US Federal Reserve.

- Bank of Canada interest rate decisions and their timing: The Bank of Canada's interest rate decisions are carefully considered and timed to manage inflation and economic growth. These decisions directly impact the value of the Canadian dollar.

- Comparison with US Federal Reserve actions: A divergence in monetary policy between the Bank of Canada and the US Federal Reserve can amplify the effects on the Canadian dollar's exchange rate.

- Market reaction to Bank of Canada announcements: Market participants closely watch Bank of Canada announcements, and their reactions significantly influence the Canadian dollar's short-term movement.

- Potential future policy shifts and their implications for the CAD: Future changes in Bank of Canada monetary policy will continue to influence the value of the Canadian dollar, creating both opportunities and challenges for investors.

[Include links to official Bank of Canada statements and reports here.]

Geopolitical Factors Affecting the Canadian Dollar

Global geopolitical events, from international conflicts to trade tensions, create uncertainty in the global economy and significantly influence investor sentiment towards the Canadian dollar. This uncertainty often leads to capital flight and affects the CAD's exchange rate.

- Global economic uncertainty affecting investment flows: Geopolitical instability often leads to increased risk aversion among investors, reducing investment flows into Canada and weakening the Canadian dollar.

- Impact of specific geopolitical events on commodity markets: Geopolitical events can directly impact commodity markets, influencing Canadian exports and the demand for the Canadian dollar.

- Investor risk aversion leading to capital flight: Uncertainty created by geopolitical events can lead to capital flight from riskier assets, including the Canadian dollar.

- Shifting global trade dynamics impacting Canadian exports: Changes in global trade relationships and agreements can directly affect Canadian exports and the value of the Canadian dollar.

[Provide examples of recent geopolitical events and their effect on the Canadian dollar here.]

Conclusion

The recent dip in the Canadian dollar is a complex issue stemming from a confluence of factors: US interest rate hikes, fluctuating commodity prices, Bank of Canada monetary policy decisions, and prevailing geopolitical conditions. Understanding these interconnected elements is critical for navigating the current economic landscape.

Call to Action: Stay informed about the latest developments affecting the Canadian dollar. Monitor interest rate changes, commodity prices, and geopolitical events to make informed decisions regarding your investments and financial planning involving the Canadian dollar. Regularly check reliable financial news sources for updates on the Canadian Dollar and its future performance. Understanding the nuances of the Canadian dollar exchange rate is key to effective financial management.

Featured Posts

-

La Condena De Kevin Malouf Se Pagaran Los Q6 Millones Y Se Hara Justicia

Apr 25, 2025

La Condena De Kevin Malouf Se Pagaran Los Q6 Millones Y Se Hara Justicia

Apr 25, 2025 -

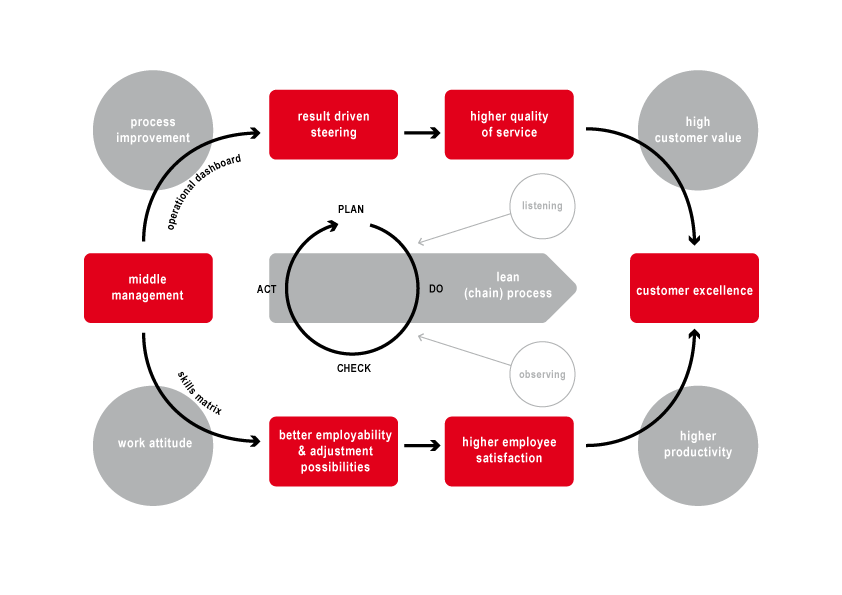

How Middle Management Drives Company Performance And Employee Satisfaction

Apr 25, 2025

How Middle Management Drives Company Performance And Employee Satisfaction

Apr 25, 2025 -

Spider Man 4 Casting News Sadie Sink As Jean Grey

Apr 25, 2025

Spider Man 4 Casting News Sadie Sink As Jean Grey

Apr 25, 2025 -

Stagecoach 2025 Country Music Pop Acts And Desert Nights

Apr 25, 2025

Stagecoach 2025 Country Music Pop Acts And Desert Nights

Apr 25, 2025 -

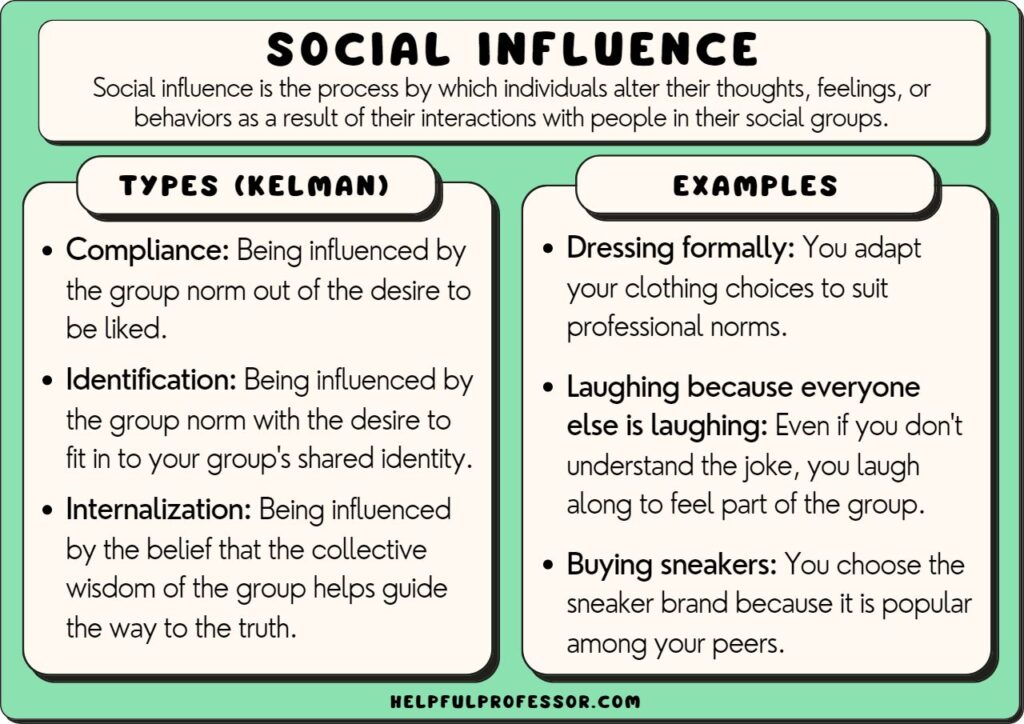

Understanding You Tubes Influence A Comprehensive Guide

Apr 25, 2025

Understanding You Tubes Influence A Comprehensive Guide

Apr 25, 2025

Latest Posts

-

Politicheskaya Izolyatsiya Zelenskogo Analiz Sobytiy 9 Maya

May 10, 2025

Politicheskaya Izolyatsiya Zelenskogo Analiz Sobytiy 9 Maya

May 10, 2025 -

First Up Imf To Review Pakistans 1 3 Billion Loan Package And Other Top News

May 10, 2025

First Up Imf To Review Pakistans 1 3 Billion Loan Package And Other Top News

May 10, 2025 -

Germaniya Ugroza Novogo Potoka Bezhentsev Iz Ukrainy Rol S Sh A

May 10, 2025

Germaniya Ugroza Novogo Potoka Bezhentsev Iz Ukrainy Rol S Sh A

May 10, 2025 -

Den Pobedy Vladimir Zelenskiy Bez Podderzhki Soyuznikov

May 10, 2025

Den Pobedy Vladimir Zelenskiy Bez Podderzhki Soyuznikov

May 10, 2025 -

Pakistan Economic Crisis Imfs 1 3 Billion Package Under Review

May 10, 2025

Pakistan Economic Crisis Imfs 1 3 Billion Package Under Review

May 10, 2025