Canada's Resource Sector Gets A Bulldog: Ex-Goldman Banker Steps In

Table of Contents

The Banker's Expertise and Track Record

The arrival of [Banker's Name], a former managing director at Goldman Sachs with over [Number] years of experience, marks a pivotal moment for the Canadian resource sector. Their extensive background encompasses key areas crucial to the industry's success.

Specific Experience in Mining and Energy

[Banker's Name]'s career at Goldman Sachs saw them spearhead numerous successful projects within the mining and energy sectors. This includes:

- Leading the financing of several major mining projects in [Specific region, e.g., Northern Ontario].

- Advising on mergers and acquisitions in the Canadian oil and gas industry.

- Developing sophisticated financial models for evaluating resource extraction projects.

This hands-on experience provides an invaluable understanding of the complexities of resource extraction, from exploration and development to production and market positioning.

- Financial Expertise: Proven ability in financial modeling, risk assessment, and capital allocation.

- Investment Strategies: A track record of identifying and capitalizing on high-growth investment opportunities.

- Resource Management: Deep understanding of resource management principles, including sustainable practices and efficient operations.

- Market Analysis: Expertise in analyzing market trends and predicting future demand for key resources.

Impact on Investment and Development in the Canadian Resource Sector

[Banker's Name]'s presence is expected to significantly impact investment and development within the Canadian resource sector. Their reputation and network within the global financial community are expected to attract considerable foreign investment.

Potential for Increased Foreign Investment

- Enhanced Credibility: The banker's association with Goldman Sachs lends credibility to Canadian resource projects, attracting international investors seeking secure and profitable ventures.

- Access to Capital: Their extensive network opens doors to significant capital inflows, facilitating the development of new projects and the expansion of existing ones.

- Strategic Partnerships: [Banker's Name]'s expertise could foster strategic partnerships between Canadian companies and international players, boosting the sector's competitiveness.

This influx of capital could revitalize exploration efforts, leading to the discovery of new resources and the creation of thousands of jobs across the country. Companies like [mention specific companies that might benefit] stand to gain considerably.

Addressing Challenges Facing the Canadian Resource Sector

The Canadian resource sector faces considerable challenges, including stringent environmental regulations, the need for improved Indigenous relations, and the inherent volatility of global commodity markets. [Banker's Name]'s experience can be instrumental in navigating these obstacles.

Sustainable Development and Responsible Resource Management

- Environmental Stewardship: Their understanding of sustainable development principles can help companies meet increasingly stringent environmental regulations while maintaining profitability.

- Indigenous Consultation: A focus on meaningful consultation with Indigenous communities will help ensure projects are developed responsibly and with respect for traditional lands and rights.

- Risk Mitigation: Their risk management skills will be critical in mitigating the risks associated with market fluctuations and environmental concerns.

By prioritizing sustainable practices and responsible stakeholder engagement, [Banker's Name] can help shape a more sustainable and equitable future for the Canadian resource sector.

The Future of the Canadian Resource Sector Under New Leadership

The long-term outlook for the Canadian resource sector under [Banker's Name]'s influence appears bright. Their arrival signals a potential for significant transformation, driven by increased investment, innovative technologies, and a renewed commitment to sustainability.

Long-Term Growth and Transformation

- Technological Innovation: The banker's experience could spur investment in technological advancements, improving efficiency and reducing environmental impact in resource extraction.

- Industry Collaboration: Their leadership might foster greater collaboration within the industry, leading to the development of best practices and shared solutions.

- Policy Influence: [Banker's Name]'s expertise could influence policy discussions, shaping a regulatory environment that balances environmental protection with economic development.

Conclusion: The Bulldog's Bite on Canada's Resource Sector

The arrival of [Banker's Name] represents a significant development for Canada's resource sector. Their expertise in finance, investment, and risk management, coupled with a deep understanding of the industry's intricacies, promises to attract substantial investment, foster sustainable development, and address key challenges. This "bulldog" approach is poised to revitalize the sector, driving innovation and long-term growth. Stay updated on the Canadian resource sector and explore investment opportunities in Canadian resources to learn more about the impact of [Banker's Name] on this dynamic industry.

Featured Posts

-

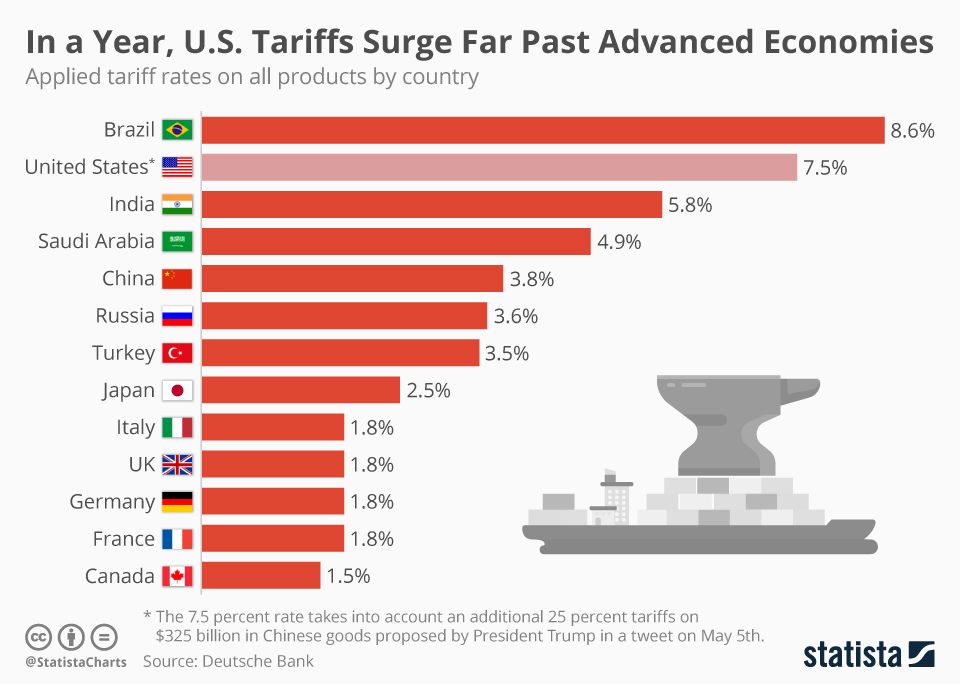

Reciprocal Tariffs Assessing Second Order Risks To Key Indian Sectors

May 15, 2025

Reciprocal Tariffs Assessing Second Order Risks To Key Indian Sectors

May 15, 2025 -

Reshaping Indias Insurance Landscape The Transformative Power Of Ind As 117

May 15, 2025

Reshaping Indias Insurance Landscape The Transformative Power Of Ind As 117

May 15, 2025 -

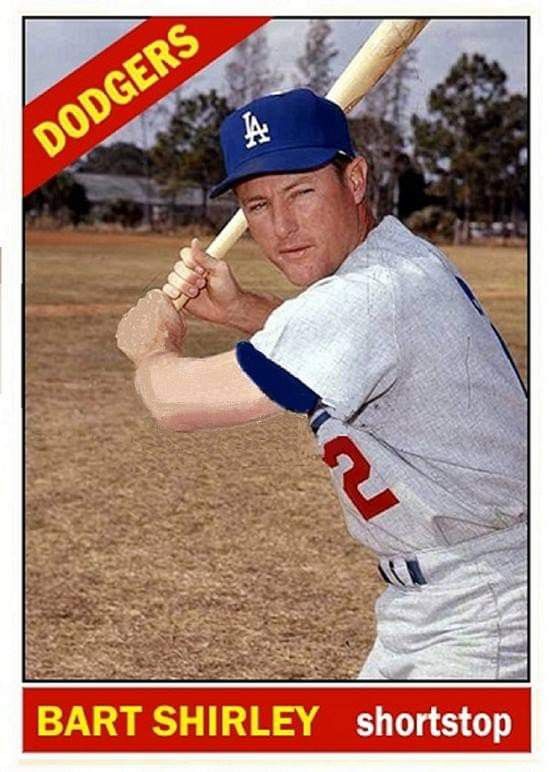

Can The Dodgers Left Handed Bats Turn Things Around

May 15, 2025

Can The Dodgers Left Handed Bats Turn Things Around

May 15, 2025 -

Paddy Pimblett Ufc 314 Prediction And Future Championship Aspirations

May 15, 2025

Paddy Pimblett Ufc 314 Prediction And Future Championship Aspirations

May 15, 2025 -

The Unraveling Of The King Of Davos A Comprehensive Analysis

May 15, 2025

The Unraveling Of The King Of Davos A Comprehensive Analysis

May 15, 2025

Latest Posts

-

Ovechkin I Leme Sravnenie Golov V Pley Off N Kh L

May 15, 2025

Ovechkin I Leme Sravnenie Golov V Pley Off N Kh L

May 15, 2025 -

Tre Kronor Imponerar Kanadensiska Stjaernor Och Pastrnak I Vm Fokus

May 15, 2025

Tre Kronor Imponerar Kanadensiska Stjaernor Och Pastrnak I Vm Fokus

May 15, 2025 -

Rekord Leme Po Golam V Pley Off N Kh L Pobit Ovechkinym

May 15, 2025

Rekord Leme Po Golam V Pley Off N Kh L Pobit Ovechkinym

May 15, 2025 -

Kanadensiska Stjaernor Vill Spela Vm Hockey Tre Kronors Lagbygge Och Tjeckiens Hopp Pastrnak

May 15, 2025

Kanadensiska Stjaernor Vill Spela Vm Hockey Tre Kronors Lagbygge Och Tjeckiens Hopp Pastrnak

May 15, 2025 -

Ovechkin Sravnyalsya S Leme Rekord Pley Off N Kh L

May 15, 2025

Ovechkin Sravnyalsya S Leme Rekord Pley Off N Kh L

May 15, 2025