CAC 40: Weekly Close Down Despite Stable Performance (March 7, 2025)

Table of Contents

Analyzing the CAC 40's Unexpected Weekly Decline

The CAC 40 index suffered a notable 1.5% decrease this week, closing at 7250 points on March 7th, 2025. This represents a significant downturn compared to the average weekly increase of 0.8% observed over the past month. Several factors contributed to this unexpected decline:

-

Global Market Influences: A slight downturn in the US tech sector and concerns regarding global inflation played a role in dampening investor enthusiasm, impacting the CAC 40's performance. This resulted in a 1% drop in the tech sub-index of the CAC 40.

-

Energy Sector Weakness: Fluctuations in oil prices and concerns about future energy demand negatively impacted energy companies listed on the CAC 40, contributing to the overall decline. The energy sector experienced a 2% decrease.

-

Specific Company News: Negative earnings reports from two major CAC 40 companies, leading to a sell-off in their shares, also contributed to the index's overall drop.

Despite the Dip: Positive Indicators Within the CAC 40

Despite the weekly decline, several positive indicators suggest underlying strength within the French economy and the CAC 40 itself.

-

Strong Performance of Specific CAC 40 Companies: While some sectors struggled, several companies within the CAC 40 demonstrated robust growth, indicating resilience within specific industries. Luxury goods companies, for example, showed continued strong performance, bucking the overall trend.

-

Positive Industry Trends: The French tourism sector continues to show promising growth, and forecasts predict a strong year for the industry, bolstering overall economic confidence.

-

Positive Economic Forecasts for France: Despite global uncertainties, recent forecasts suggest continued economic growth for France in 2025, supporting a positive long-term outlook for the CAC 40.

Expert Opinions on the CAC 40's Short-Term Outlook

Financial analysts offer mixed perspectives on the short-term outlook for the CAC 40.

-

Short-Term Correction: Some analysts view the recent decline as a short-term correction, predicting a recovery in the coming weeks as positive economic fundamentals prevail. "We believe this is a temporary setback," said [Analyst Name] at [Financial Institution Name]. [Link to source]

-

Cautious Optimism: Others express cautious optimism, highlighting the need to monitor global market conditions closely before predicting a sustained recovery. "The CAC 40 remains sensitive to global market sentiment," noted [Analyst Name] at [Financial Institution Name]. [Link to source]

The consensus among experts leans toward a cautious wait-and-see approach, emphasizing the importance of monitoring both domestic and international market developments.

Strategies for Investors in the Face of CAC 40 Volatility

The recent volatility in the CAC 40 underscores the importance of prudent investment strategies.

-

Diversification: Diversifying investments across different asset classes and sectors is crucial to mitigate risk and protect against market downturns.

-

Long-Term Investment Strategies: Focusing on a long-term investment strategy, rather than reacting to short-term market fluctuations, can help investors ride out periods of volatility.

-

Close Monitoring: Investors should continue to monitor the CAC 40 index closely, staying informed about relevant news and economic data to make informed investment decisions. [Link to relevant resource]

Conclusion: Understanding the CAC 40's Current Trajectory and Next Steps

The unexpected weekly decline of the CAC 40 highlights the complex interplay of global and domestic factors influencing market performance. While the short-term outlook remains uncertain, underlying positive indicators suggest a resilient French economy and the potential for future growth. Understanding the nuances of the CAC 40's performance requires careful analysis of various economic factors and expert opinions. Stay updated on the latest developments affecting the CAC 40 and make informed investment decisions. Continue monitoring the CAC 40 index for further insights.

Featured Posts

-

Daks 30 Tjawz Mstwa Mars W Afaq Nmw Alswq Alalmanyt

May 25, 2025

Daks 30 Tjawz Mstwa Mars W Afaq Nmw Alswq Alalmanyt

May 25, 2025 -

Heineken Revenue Surpasses Expectations Outlook Remains Strong Despite Trade Headwinds

May 25, 2025

Heineken Revenue Surpasses Expectations Outlook Remains Strong Despite Trade Headwinds

May 25, 2025 -

Royal Philips Details On The 2025 Shareholders Annual General Meeting

May 25, 2025

Royal Philips Details On The 2025 Shareholders Annual General Meeting

May 25, 2025 -

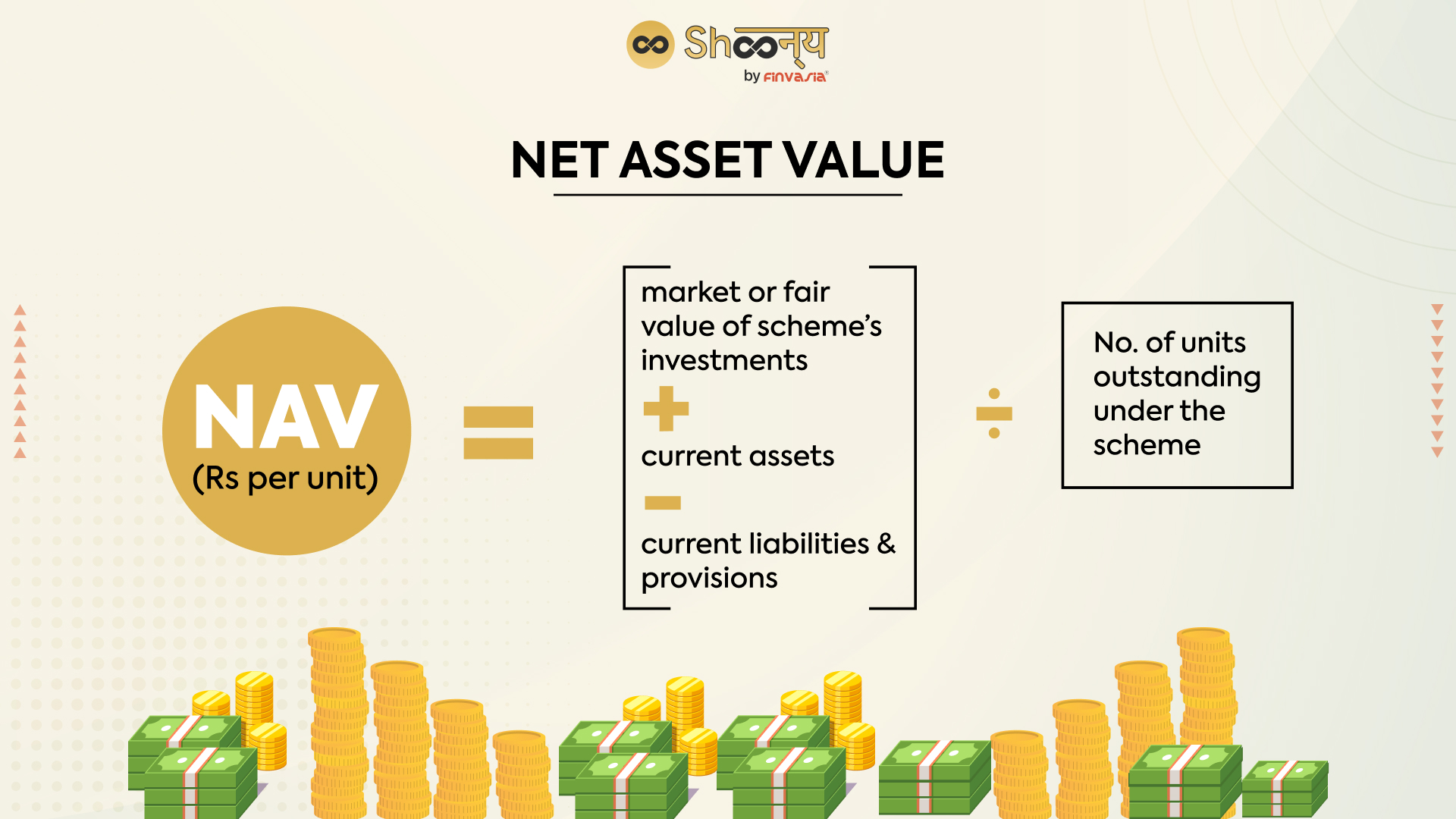

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc An Investors Guide

May 25, 2025

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc An Investors Guide

May 25, 2025 -

The Kyle Walker Situation Party Photos And Annie Kilners Reaction

May 25, 2025

The Kyle Walker Situation Party Photos And Annie Kilners Reaction

May 25, 2025

Latest Posts

-

Frank Sinatras Marital History Details On His Four Wives And Relationships

May 25, 2025

Frank Sinatras Marital History Details On His Four Wives And Relationships

May 25, 2025 -

Frank Sinatras Wives Exploring His Four Marriages And Love Life

May 25, 2025

Frank Sinatras Wives Exploring His Four Marriages And Love Life

May 25, 2025 -

The Mia Farrow Trump Dispute A Focus On Venezuelan Gang Member Deportations

May 25, 2025

The Mia Farrow Trump Dispute A Focus On Venezuelan Gang Member Deportations

May 25, 2025 -

Sean Penn Challenges Dylan Farrows Account Of Woody Allen Sexual Abuse

May 25, 2025

Sean Penn Challenges Dylan Farrows Account Of Woody Allen Sexual Abuse

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Closer Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Closer Look

May 25, 2025