Buying XRP (Ripple) At Under $3: Potential And Pitfalls

Table of Contents

Potential Upsides of Buying XRP Below $3

While the risks are undeniable, several factors could make buying XRP at under $3 a lucrative investment.

Ripple's Technological Advantages

RippleNet, Ripple's payment network, offers a compelling advantage. It's designed for speed and efficiency, facilitating cross-border transactions for financial institutions. This translates to faster settlement times and lower transaction fees compared to traditional methods and many other cryptocurrencies. This efficiency is a key driver of its potential for future growth.

- Financial Institution Adoption: Several major banks and financial institutions already utilize RippleNet, including Santander, SBI Holdings, and MoneyGram. This adoption demonstrates real-world utility and potential for wider integration.

- XRP's Technical Prowess: XRP boasts incredibly fast transaction speeds and minimal fees, making it a practical choice for large-scale payments.

- Future Partnerships: Potential collaborations with other financial institutions and technology companies could significantly increase XRP's demand and, consequently, its price.

Market Sentiment and Price Predictions

While predicting cryptocurrency prices is notoriously difficult, current market sentiment and expert opinions offer some insight. Many analysts believe that increased regulatory clarity or wider adoption could act as significant catalysts for price growth.

- Market Analysis: Several reputable market analysis firms have published reports predicting potential price increases for XRP based on various scenarios. (Note: These reports should be treated with caution and are not financial advice).

- Influencer Opinions: Key figures in the cryptocurrency space have expressed both optimistic and cautious views on XRP's future. Understanding these differing perspectives is crucial.

- Potential Price Targets: Some analysts suggest that XRP could reach significantly higher prices if certain conditions are met. However, these predictions are highly speculative and should be considered with a healthy dose of skepticism.

Long-Term Investment Strategy

A long-term investment approach can mitigate the risks associated with XRP's volatility. By holding XRP for an extended period, you reduce the impact of short-term price fluctuations and increase your chances of profiting from potential long-term growth.

- Long-Term Growth Potential: Investing in XRP for the long haul offers the potential for significant returns if the cryptocurrency gains widespread adoption.

- Diversification is Key: Never put all your eggs in one basket. Diversifying your investment portfolio across different asset classes reduces overall risk.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals (e.g., monthly) helps to mitigate risk by averaging your purchase price over time.

Risks and Pitfalls of Investing in XRP Under $3

Despite the potential upsides, significant risks are associated with investing in XRP. Understanding these risks is crucial before committing any funds.

Regulatory Uncertainty

The ongoing legal battle between Ripple Labs and the SEC casts a long shadow over XRP's future. The outcome of this lawsuit could significantly impact XRP's price and availability.

- Ripple vs. SEC Lawsuit: The lawsuit's outcome remains uncertain, and various scenarios could play out, each with potentially drastic consequences for XRP's price.

- Regulatory Landscape: The regulatory environment surrounding cryptocurrencies is constantly evolving and often unclear, posing significant risks for investors.

- Potential Outcomes: Depending on the court's decision, XRP could face severe restrictions, be declared a security, or even be delisted from exchanges.

Market Volatility and Price Fluctuations

The cryptocurrency market is known for its volatility. XRP's price can experience dramatic swings based on news events, market sentiment, and overall market conditions.

- Past Volatility: Historical XRP price charts clearly demonstrate its susceptibility to significant price fluctuations.

- Influencing Factors: News events (positive or negative), social media sentiment, and broader market trends can all impact XRP's price.

- Risk Management Strategies: Employing strategies such as stop-loss orders and diversifying your portfolio can help manage some of the risks associated with volatility.

Security Risks

Like all cryptocurrencies, XRP is susceptible to security risks. Holding XRP on insecure exchanges or in vulnerable wallets exposes you to potential theft or loss.

- Exchange Hacks: Cryptocurrency exchanges have been targeted by hackers in the past, resulting in significant losses for investors.

- Secure Wallets: Using reputable and secure wallets is paramount to protecting your XRP holdings.

- Avoiding Scams: Be wary of scams and fraudulent schemes promising unrealistic returns.

Conclusion

Buying XRP at under $3 presents a potentially rewarding but risky opportunity. The technological advantages of RippleNet and the potential for future growth are balanced by the significant regulatory uncertainty and inherent market volatility. Thorough research, a comprehensive risk assessment, and diversification are essential before considering an investment in XRP. Remember, this is not financial advice. Make informed decisions about buying XRP by conducting your own research and understanding both the potential and pitfalls. Learn more before buying XRP to protect your investment.

Featured Posts

-

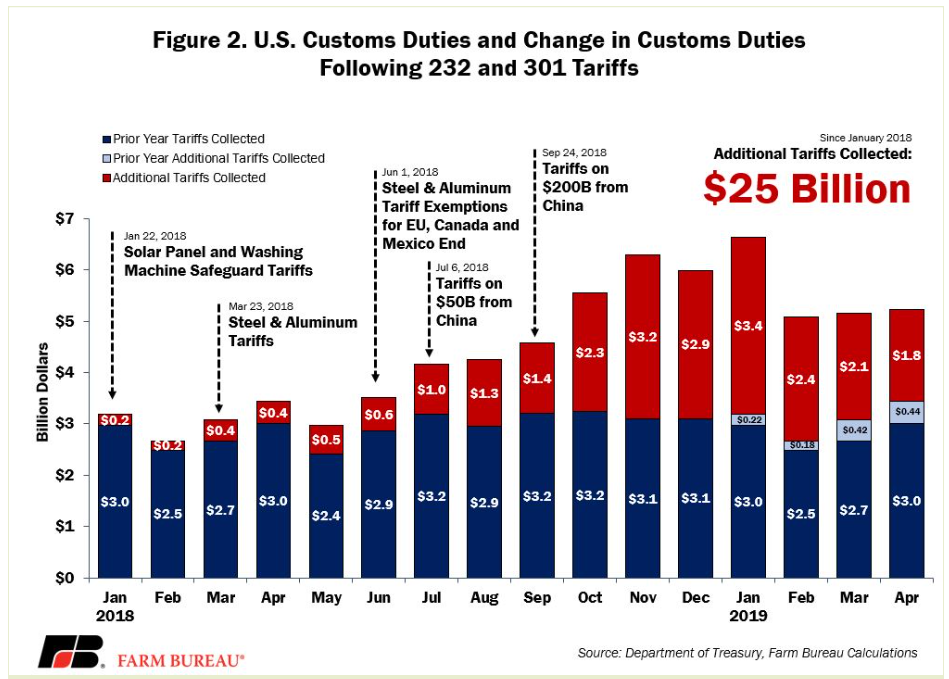

Trumps Tariff Revenue A Realistic Replacement For Income Taxes

May 01, 2025

Trumps Tariff Revenue A Realistic Replacement For Income Taxes

May 01, 2025 -

Arc Raider Tech Test 2 Sign Ups Open Console Release Confirmed

May 01, 2025

Arc Raider Tech Test 2 Sign Ups Open Console Release Confirmed

May 01, 2025 -

France Vs England Six Nations Dalys Try Decides Tight Contest

May 01, 2025

France Vs England Six Nations Dalys Try Decides Tight Contest

May 01, 2025 -

Juridische Strijd Kampen Eist Aansluiting Op Stroomnet Van Enexis

May 01, 2025

Juridische Strijd Kampen Eist Aansluiting Op Stroomnet Van Enexis

May 01, 2025 -

Xrp Price Prediction Could Xrp Hit 10 Ripples Dubai License And Resistance Breakout

May 01, 2025

Xrp Price Prediction Could Xrp Hit 10 Ripples Dubai License And Resistance Breakout

May 01, 2025