Trump's Tariff Revenue: A Realistic Replacement For Income Taxes?

Table of Contents

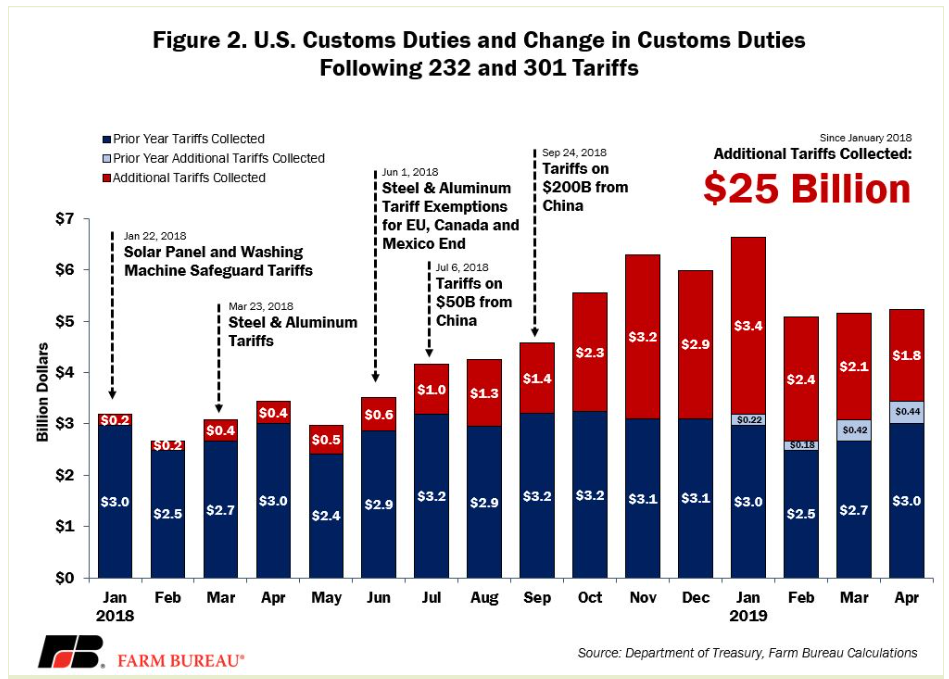

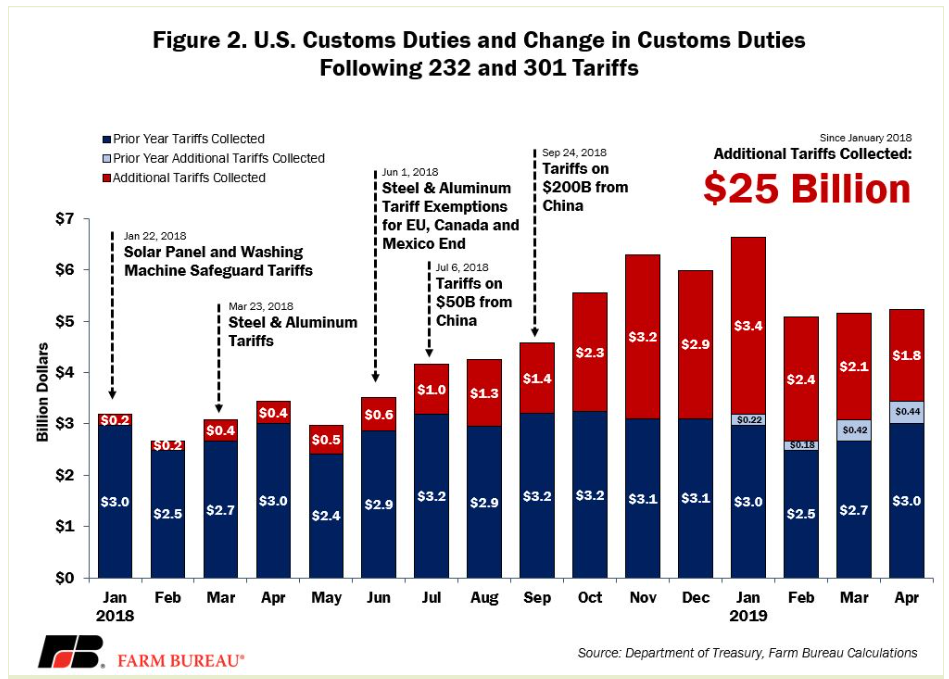

Analyzing Tariff Revenue Generated Under the Trump Administration

Understanding the potential of Trump's tariffs to replace income tax requires a thorough examination of the actual revenue generated. This involves analyzing data on tariff revenue, considering the impact of trade wars, and acknowledging fluctuations due to economic cycles.

-

Tariff Revenue Data: While the Trump administration did see increased tariff revenue compared to previous years, the amounts were significantly smaller than income tax revenue. For example, [Insert specific data and source citing official government reports on tariff revenue during the Trump presidency]. This data shows that even with increased tariffs, the revenue generated was a small fraction of total federal revenue.

-

Types of Goods and Revenue Contribution: The revenue generated varied significantly based on the types of goods subject to tariffs. Tariffs on certain goods, such as [Insert examples of goods with high tariffs and their contribution to revenue], contributed disproportionately to the overall total. Others generated significantly less revenue.

-

Impact of Trade Wars: The trade wars initiated by the Trump administration, including retaliatory tariffs imposed by other countries, significantly impacted the overall revenue generated. These retaliatory measures often offset any gains from the initial tariffs, creating unpredictable fluctuations in revenue streams. [Insert data and source showing the impact of retaliatory tariffs on revenue].

-

Economic Cycle Fluctuations: Tariff revenue is highly sensitive to global economic cycles and shifts in international trade patterns. Economic downturns or changes in consumer demand can drastically reduce import volumes and consequently, tariff revenue. This inherent volatility makes it a highly unreliable source of government funding.

Comparing Tariff Revenue to Income Tax Revenue

To assess the feasibility of replacing income taxes with tariff revenue, a direct comparison of the total revenue generated is crucial. We must also consider the distribution of the tax burden under both systems.

-

Revenue Comparison: The data clearly shows a stark contrast. [Insert data comparing total income tax revenue to total tariff revenue for a specific period]. This illustrates the sheer magnitude of the difference, making a direct replacement practically impossible.

-

Tax Burden Distribution: Income taxes are generally progressive, meaning higher earners pay a larger percentage of their income in taxes. Tariffs, on the other hand, are often regressive, disproportionately impacting lower-income households who spend a larger percentage of their income on imported goods. This shift in tax burden could have significant social and economic consequences.

-

Impact on Economic Growth: A system solely reliant on tariffs for government revenue could negatively impact economic growth and investment. The increased cost of imported goods due to tariffs could lead to higher prices for consumers, reduced business competitiveness, and potentially job losses.

The Limitations of Tariff Revenue as a Sole Tax Source

Reliance on tariff revenue as the sole source of government funding presents significant limitations that would severely destabilize the US fiscal system.

-

Tax Base Volatility: International trade relations are inherently volatile and unpredictable. Geopolitical events, trade disputes, and changes in global economic conditions can all significantly impact tariff revenue, making it an unreliable and unsustainable funding mechanism.

-

Fiscal Risk: The high risk associated with relying on a single, unpredictable revenue stream presents significant fiscal risks. Sudden drops in tariff revenue could lead to severe budget deficits, forcing drastic cuts in government spending or potentially leading to a government shutdown.

-

Addressing Social Needs: Income taxes fund crucial social welfare programs like Social Security, Medicare, and Medicaid. Tariffs, by their nature, are not designed to address these specific social needs, highlighting the inadequacy of tariffs as a comprehensive replacement for income taxes.

The Economic and Political Implications of a Tariff-Based Tax System

Shifting to a tariff-based tax system would have far-reaching economic and political implications, both domestically and internationally.

-

International Trade Disputes: A heavy reliance on tariffs as a primary revenue source would almost certainly lead to increased international trade disputes and retaliatory measures from other countries. This could escalate into trade wars with significant negative consequences for the global economy.

-

Impact on Domestic Businesses and Consumers: Higher tariffs would increase the cost of imported goods, impacting businesses that rely on imported materials and consumers facing higher prices. This could lead to job losses in import-dependent industries and reduced consumer spending.

-

Political Ramifications: A complete shift away from a progressive income tax system to a tariff-based system would have profound political consequences. The regressive nature of tariffs would likely face significant opposition, leading to political instability.

Conclusion

This analysis demonstrates that while tariffs generate revenue, the amount pales in comparison to income tax revenue. Furthermore, the inherent volatility and limitations of tariff-based revenue make it an unsuitable replacement for the stability and breadth of income taxes. Relying solely on tariffs would pose significant economic and political risks. A tariff-based system would create instability, harm businesses and consumers, and severely limit the government's ability to fund vital social programs.

Call to Action: Understanding the complexities of tariff revenue and its role in a country's fiscal structure is crucial. Further research into alternative tax policies and a comprehensive understanding of the limitations of using Trump’s tariff revenue as an income tax replacement are necessary for sound economic decision-making. We must move beyond simplistic solutions and explore sustainable and equitable tax systems that benefit all citizens.

Featured Posts

-

Scotlands Six Nations Loss Frances Victory Under Ramoss Guidance

May 01, 2025

Scotlands Six Nations Loss Frances Victory Under Ramoss Guidance

May 01, 2025 -

Enexis Wachtlijst Limburgse Ondernemers Overstijgt 1000

May 01, 2025

Enexis Wachtlijst Limburgse Ondernemers Overstijgt 1000

May 01, 2025 -

Afa De Duelo La Perdida De Un Joven Talento

May 01, 2025

Afa De Duelo La Perdida De Un Joven Talento

May 01, 2025 -

Four Dead Children Among Victims In After School Camp Car Crash

May 01, 2025

Four Dead Children Among Victims In After School Camp Car Crash

May 01, 2025 -

Brtanwy Wzyr Aezm Kw Kshmyr Ke Msyle Pr Dstkht Shdh Drkhwast

May 01, 2025

Brtanwy Wzyr Aezm Kw Kshmyr Ke Msyle Pr Dstkht Shdh Drkhwast

May 01, 2025