Bullion's Rise Amidst Trade Wars: Analyzing The Gold Price Rally

Table of Contents

Trade Wars as a Catalyst for Gold Investment

Trade tensions and escalating protectionist policies have created a volatile global economic landscape. These trade wars inject significant uncertainty into the market, impacting investor confidence and fueling market volatility. This instability is a key driver behind the current gold price rally. Gold, throughout history, has served as a reliable hedge against inflation and geopolitical risks. When economic uncertainty rises, investors often seek the safety of gold, leading to increased demand and higher prices.

- Increased uncertainty leads to capital flight into safe-haven assets like gold. Investors move their assets from riskier investments into gold, perceived as a stable store of value.

- Weakening currencies due to trade disputes boost gold's value. As currencies fluctuate due to trade wars, the relative value of gold, priced in many currencies, increases.

- Government interventions and tariffs fuel concerns about global economic growth. These actions create uncertainty about future economic prospects, pushing investors toward the perceived safety of gold.

Analyzing the Factors Influencing Gold Prices

While trade wars are a significant factor, other macroeconomic elements also influence gold prices. Interest rates play a crucial role; low interest rates make gold more attractive since it doesn't yield interest. Similarly, high inflation erodes the purchasing power of fiat currencies, making gold a more appealing investment. The inverse relationship between the US dollar and gold prices is also noteworthy: a weakening dollar typically leads to a rise in gold prices. Central bank policies, especially quantitative easing, can also affect the gold market, influencing supply and demand dynamics.

- Low interest rates make gold more attractive as it doesn't yield interest. In low-interest environments, the opportunity cost of holding gold decreases.

- High inflation erodes the purchasing power of fiat currencies, increasing gold's appeal. Gold acts as an inflation hedge, preserving purchasing power during inflationary periods.

- Central bank gold reserves influence market dynamics. Central bank buying or selling of gold can significantly impact market prices.

Investing in Bullion During Times of Uncertainty: Strategies and Considerations

Investing in bullion offers various avenues. Investors can choose from physical gold, gold ETFs (Exchange Traded Funds), or mining stocks. Each option presents unique advantages and disadvantages. Physical gold offers tangible ownership but requires secure storage. Gold ETFs provide easier access and diversification, while mining stocks offer higher risk but potentially greater returns. A diversified approach is recommended to mitigate investment risk.

- Physical gold offers tangible ownership but requires secure storage. This method offers a sense of security but needs careful consideration of storage costs and security measures.

- Gold ETFs provide easier access and diversification. These funds offer exposure to gold without the need to store physical metal.

- Mining stocks offer higher risk but potentially greater returns. Investing in mining companies is more volatile but can offer potentially higher returns than direct gold investments.

- Diversification is key to mitigating investment risks. Spreading investments across different asset classes reduces overall portfolio volatility.

The Future Outlook for Gold and Bullion

Predicting future gold prices is inherently challenging. However, continued global uncertainty, including unresolved trade disputes and geopolitical risks, could support further gold price increases. Conversely, a resolution of trade disputes might lead to a price correction. The long-term outlook for gold remains positive, given its enduring appeal as a safe-haven asset. Demand is likely to remain robust due to concerns about currency devaluation and systemic financial risks.

- Continued global uncertainty could support further gold price increases. Increased geopolitical tensions and economic instability will likely bolster gold's safe-haven appeal.

- Resolution of trade disputes might lead to a price correction. Reduced uncertainty could cause some investors to shift funds away from gold.

- Long-term demand for gold is likely to remain strong. Gold's inherent properties as a store of value and hedge against inflation ensure long-term demand.

Conclusion: Navigating the Gold Market in a Turbulent World

The gold price rally is significantly influenced by trade wars and broader economic uncertainties. Bullion's role as a safe-haven asset is reinforced by these factors. Investors should carefully consider various investment strategies, balancing risk and reward, when considering bullion investments. Remember to diversify your portfolio and always conduct thorough research before making any investment decisions. Consult with a qualified financial advisor for personalized guidance. Learn more about how to strategically invest in bullion and capitalize on the potential of the gold price rally. Stay informed about the gold market and its connection to global trade wars.

Featured Posts

-

Gavin Newsoms Toxic Democrats Remark A Political Earthquake

Apr 26, 2025

Gavin Newsoms Toxic Democrats Remark A Political Earthquake

Apr 26, 2025 -

Nyt Spelling Bee Hints And Answers For February 3rd 2024 Puzzle 337

Apr 26, 2025

Nyt Spelling Bee Hints And Answers For February 3rd 2024 Puzzle 337

Apr 26, 2025 -

Cinema Con 2024 First Look At The Mission Impossible Dead Reckoning Part Two Standee

Apr 26, 2025

Cinema Con 2024 First Look At The Mission Impossible Dead Reckoning Part Two Standee

Apr 26, 2025 -

Navigating The Aftermath The Challenges Ahead For The Next Federal Reserve Chairman Under Trumps Presidency

Apr 26, 2025

Navigating The Aftermath The Challenges Ahead For The Next Federal Reserve Chairman Under Trumps Presidency

Apr 26, 2025 -

The Trump Factor Unifying Canada Ahead Of The Election

Apr 26, 2025

The Trump Factor Unifying Canada Ahead Of The Election

Apr 26, 2025

Latest Posts

-

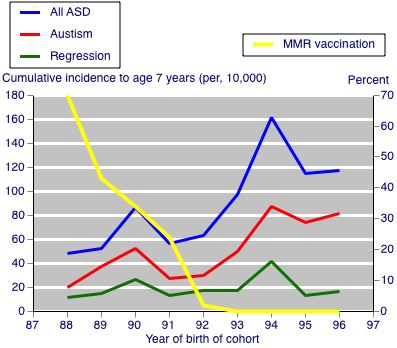

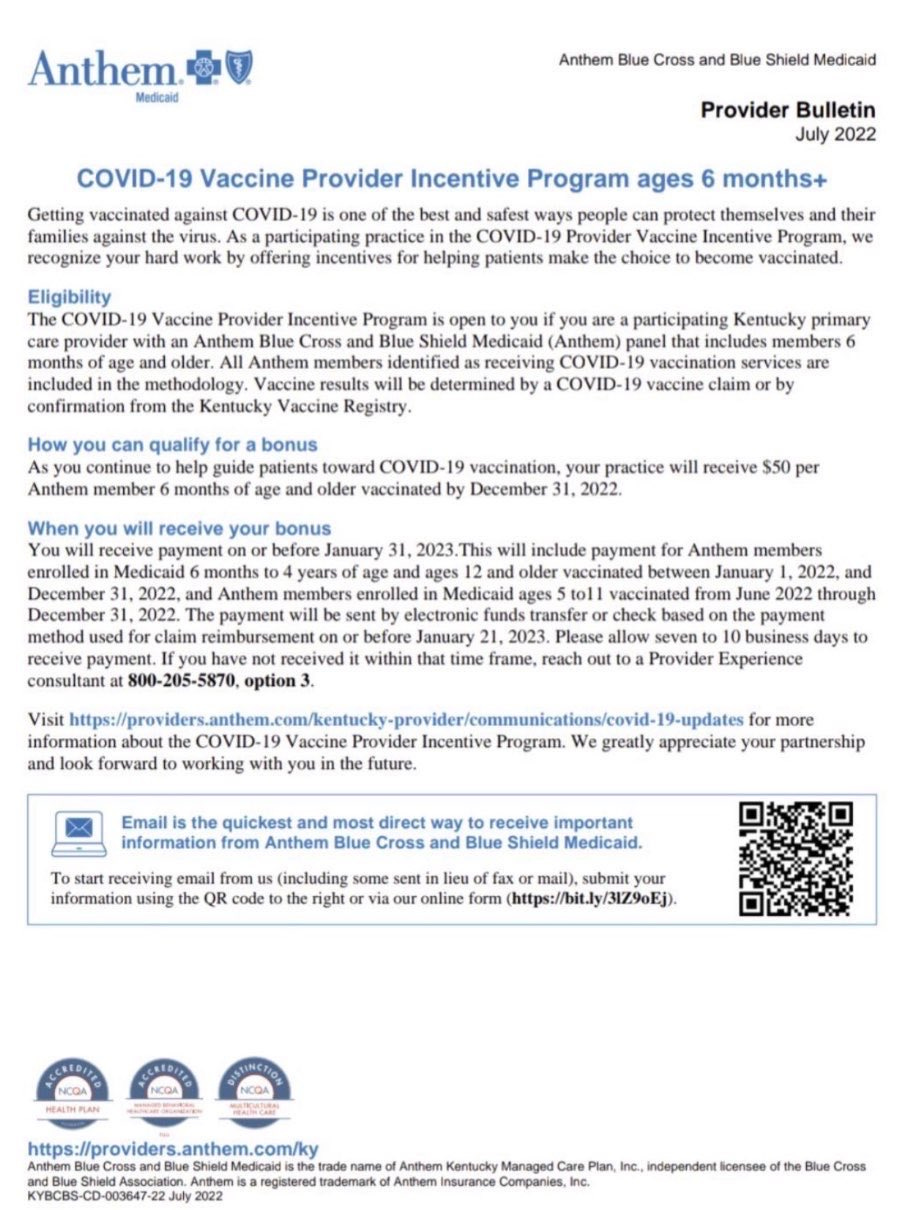

Nbc Chicago Hhs Taps Anti Vaccine Activist To Investigate Autism Vaccine Claims

Apr 27, 2025

Nbc Chicago Hhs Taps Anti Vaccine Activist To Investigate Autism Vaccine Claims

Apr 27, 2025 -

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025 -

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Discredited Autism Vaccine Link

Apr 27, 2025

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Discredited Autism Vaccine Link

Apr 27, 2025 -

Nbc 5 Dallas Fort Worth Reports Hhs Selects Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Nbc 5 Dallas Fort Worth Reports Hhs Selects Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025