Navigating The Aftermath: The Challenges Ahead For The Next Federal Reserve Chairman Under Trump's Presidency

Table of Contents

The next Federal Reserve Chairman will inherit a complex and challenging economic landscape, significantly shaped by the legacy of the Trump administration. Navigating the aftermath of these policies will require exceptional skill, foresight, and political acumen. This article will explore the significant hurdles the next chairman will face, analyzing the potential consequences for the US economy.

The Federal Reserve Chairman holds immense responsibility, steering monetary policy to maintain price stability and maximum employment. However, the unique circumstances inherited from the Trump era present unprecedented difficulties. The next chairman will not simply be managing the economy; they will be navigating a minefield of economic and political complexities.

Inherited Economic Conditions and Uncertainty

The Trump administration's economic policies left a mixed legacy. Aggressive tax cuts, increased fiscal spending, and deregulation initiatives stimulated short-term growth but also fueled a substantial increase in the national debt and potential long-term economic instability. The impact of these policies will significantly challenge the next Federal Reserve Chairman.

- Impact of trade wars on inflation and economic growth: The trade wars initiated during this period disrupted global supply chains, contributing to inflationary pressures and hindering economic growth. This created a volatile environment difficult to predict and manage.

- The national debt's effect on monetary policy: The significantly increased national debt limits the Federal Reserve's ability to respond to future economic downturns. Higher debt levels may necessitate higher interest rates, potentially hindering economic recovery.

- Long-term implications of deregulation on financial stability: Deregulation, while potentially boosting short-term economic activity, may have weakened financial oversight, increasing the risk of future financial crises. This necessitates a cautious approach to monetary policy.

The uncertainty surrounding future economic indicators – inflation, unemployment, and GDP growth – adds another layer of complexity. Predicting these with accuracy is crucial for effective monetary policy decisions, yet the post-Trump economic landscape makes accurate forecasting particularly challenging.

Navigating Political Pressure and Independence

The Federal Reserve's independence from political influence is paramount for its effectiveness. However, given President Trump's frequent criticisms of the Federal Reserve and his attempts to influence monetary policy decisions, the next chairman will face significant political pressure.

- Maintaining the Fed's independence despite political pressure: The next chairman must uphold the Fed's independence while also fostering constructive communication with the executive branch. This requires a delicate balancing act.

- Balancing economic goals with political considerations: Economic decisions should be driven by data and economic principles, not political expediency. The challenge lies in clearly communicating this to the public and policymakers.

- The role of transparency and communication in mitigating political tension: Open and transparent communication about the Fed's decision-making process can help mitigate political tension and build public trust. Clear articulation of the economic rationale behind policies is critical.

Strategies to preserve the Fed's autonomy might include emphasizing data-driven decision-making, proactively engaging in public discourse, and building strong bipartisan support for the institution's independence.

Addressing Inflation and Employment

The dual mandate of the Federal Reserve – maintaining price stability and maximum employment – presents a constant challenge, particularly when these goals appear to conflict. The current economic environment, with lingering supply chain issues and robust demand, exacerbates this challenge.

- The impact of supply chain disruptions on inflation: Supply chain bottlenecks continue to contribute to inflationary pressures, demanding careful monitoring and targeted policy responses.

- Balancing the need for job growth with controlling inflation: Raising interest rates to curb inflation can slow economic growth and job creation, requiring a nuanced approach to monetary policy.

- The effectiveness of various monetary policy tools in the current environment: The efficacy of traditional monetary policy tools, such as interest rate adjustments and quantitative easing, may be altered by the unique circumstances of the post-Trump economy.

The next chairman must carefully analyze various economic scenarios and adapt monetary policy accordingly, considering the potential trade-offs between inflation control and employment growth.

The Challenge of Long-Term Growth

Beyond immediate economic concerns, the next Federal Reserve Chairman must also address the challenges of fostering sustainable long-term economic growth.

- Addressing income inequality and its impact on economic stability: High levels of income inequality can hinder economic growth and create social instability. The Fed's role in promoting inclusive growth is crucial.

- Investing in infrastructure and human capital: Investments in infrastructure and education are essential for boosting productivity and long-term economic potential. The Fed can indirectly influence these investments through its monetary policy.

- Promoting innovation and technological advancement: A dynamic and innovative economy is critical for sustainable growth. The Fed can support this through policies that encourage investment and risk-taking.

The Federal Reserve's role in promoting long-term economic prosperity extends beyond short-term stabilization. The next chairman must consider the long-term consequences of their actions and promote policies that foster sustainable and inclusive growth.

Conclusion

The next Federal Reserve Chairman faces a formidable set of challenges – navigating the economic aftermath of the Trump presidency requires a unique blend of economic expertise, political savvy, and unwavering commitment to the Fed's mandate. The complex interplay of inherited economic conditions, political pressures, and the need for long-term growth presents a significant test. Navigating these challenges effectively is crucial for maintaining the health and stability of the US economy. Understanding the complex issues surrounding navigating the economic aftermath of the Trump presidency is crucial for informed civic engagement. Learn more and participate in the conversation today!

Featured Posts

-

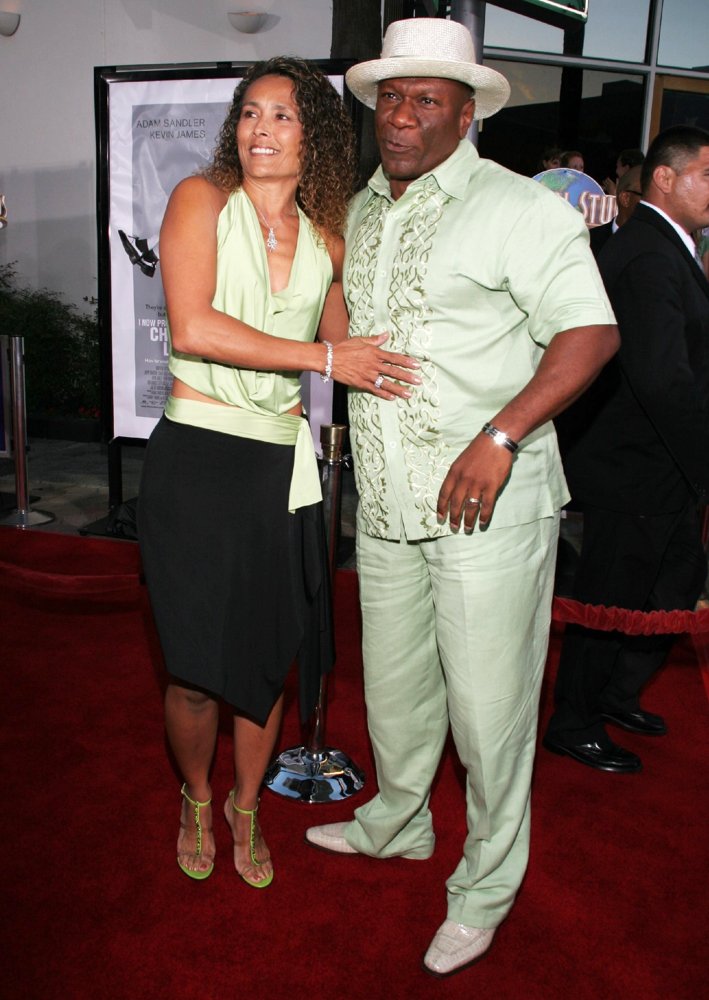

The Emotional Truth Behind Ving Rhames Near Death Experience In Mission Impossible

Apr 26, 2025

The Emotional Truth Behind Ving Rhames Near Death Experience In Mission Impossible

Apr 26, 2025 -

Nyt Spelling Bee Answers And Help For February 5th Puzzle 339

Apr 26, 2025

Nyt Spelling Bee Answers And Help For February 5th Puzzle 339

Apr 26, 2025 -

Deion Sanders Weighs In On Shedeur Sanders Nfl Prospects And Team Interest

Apr 26, 2025

Deion Sanders Weighs In On Shedeur Sanders Nfl Prospects And Team Interest

Apr 26, 2025 -

Why Deion Sanders Is Proud Of Shedeurs Football Skills Despite Lack Of His Speed

Apr 26, 2025

Why Deion Sanders Is Proud Of Shedeurs Football Skills Despite Lack Of His Speed

Apr 26, 2025 -

La Wildfires A Reflection Of Societal Attitudes Towards Disaster And Gambling

Apr 26, 2025

La Wildfires A Reflection Of Societal Attitudes Towards Disaster And Gambling

Apr 26, 2025

Latest Posts

-

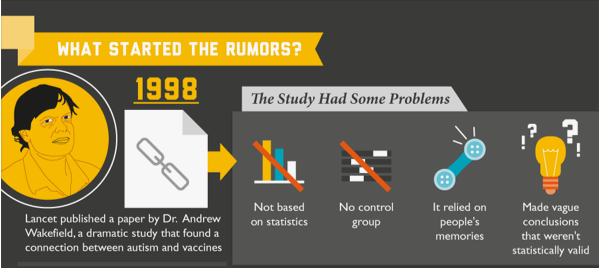

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025 -

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025 -

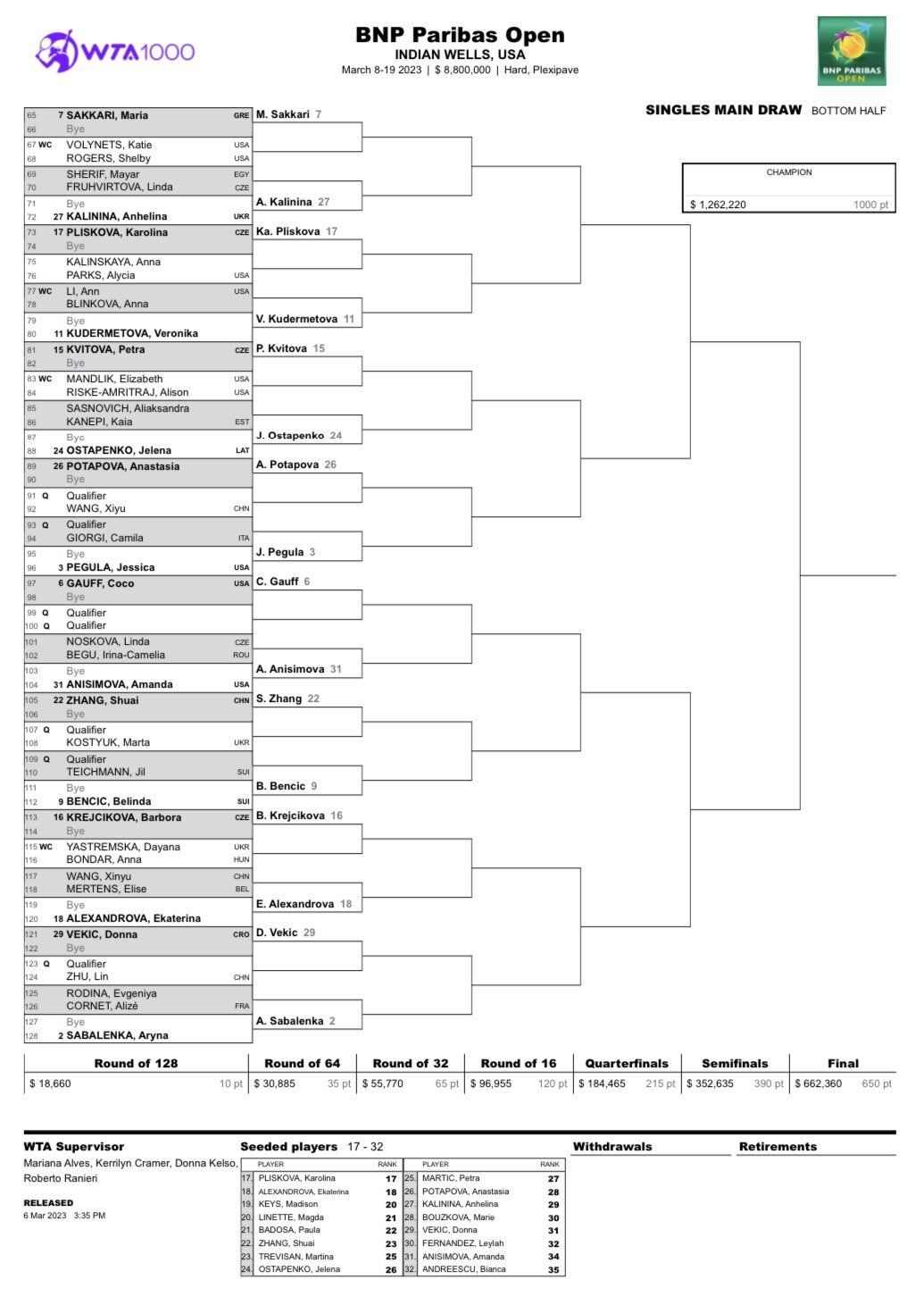

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025 -

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025