Brookfield's US Manufacturing Plans Hampered By Tariffs

Table of Contents

The Impact of Tariffs on Brookfield's Investment Strategy

Tariffs represent a significant impediment to Brookfield's investment strategy in US manufacturing. The increased cost of imported goods directly affects project profitability, forcing the company to re-evaluate its approach to expansion. The tariff impact is multifaceted, affecting various aspects of the investment lifecycle:

-

Increased import costs for raw materials and components: Many US manufacturing projects rely on imported parts and raw materials. Tariffs inflate these costs, eating into profit margins and making projects less attractive. This "tariff impact" is particularly acute for industries with complex supply chains.

-

Higher prices for finished goods, reducing competitiveness: The increased cost of production translates into higher prices for finished goods. This reduces Brookfield's competitiveness in both domestic and international markets, hindering sales and overall project returns.

-

Delayed project timelines due to supply chain disruptions: Tariffs can disrupt established supply chains, leading to delays in obtaining necessary materials. This impacts project timelines, increases costs associated with delays, and potentially jeopardizes overall project viability.

-

Potential for reduced returns on investment: The cumulative effect of these factors—increased costs, reduced competitiveness, and project delays—significantly reduces the potential return on investment for Brookfield's US manufacturing ventures. This necessitates a careful reevaluation of investment opportunities and a greater focus on risk mitigation strategies. The challenges faced by Brookfield highlight the considerable risks associated with Brookfield investment strategy in a tariff-affected environment.

Specific US Manufacturing Sectors Affected by Brookfield's Delays

Brookfield's diverse portfolio spans several US manufacturing sectors, each uniquely impacted by tariffs. The delays and modifications to Brookfield's plans are particularly evident in:

-

Renewable energy: The manufacturing of solar panels and wind turbines often relies on imported components. Tariffs on these components directly translate into higher costs for renewable energy projects, potentially slowing down the transition to cleaner energy sources. Renewable energy tariffs are impacting Brookfield's ability to meet its sustainability goals and project deadlines.

-

Logistics: The logistics sector, vital for moving goods, is also affected. Tariffs can increase the cost of importing and exporting goods, impacting transportation and warehousing operations. Brookfield's logistics investments are facing challenges due to these increased costs and logistical complexities.

-

Examples of specific projects delayed or altered: While specific project details are often kept confidential due to competitive reasons, anecdotal evidence suggests that several projects within these sectors have experienced delays or cost overruns due to tariffs. Quantifiable data on cost increases is often not publicly available for competitive reasons, but the overall impact on project timelines is undeniable. Brookfield is exploring domestic sourcing as an alternative to mitigate the impact of tariffs.

Brookfield's Response to the Tariff Challenges

Brookfield, like other major investors, is actively responding to the challenges posed by tariffs. This response involves a multi-pronged approach:

-

Details on any public statements or actions taken by Brookfield regarding tariffs: Brookfield has not made extensive public statements directly addressing tariffs. However, their actions – such as exploring domestic sourcing and potentially adjusting project scope – indicate their awareness of the problem.

-

Mention any advocacy efforts undertaken by Brookfield to influence trade policy: While Brookfield's direct lobbying efforts may not be publicly available, their participation in industry groups advocating for more favorable trade policies is likely.

-

Analyze their potential strategies for mitigating tariff impacts – diversification of supply chains, price adjustments, etc.: Brookfield is likely exploring several strategies to mitigate tariff impacts. Diversifying supply chains by sourcing materials from multiple countries, including domestic sourcing, is a key strategy. Price adjustments, while impacting profitability, are another means of absorbing some of the tariff-related costs. This Brookfield tariff strategy will likely be a combination of several approaches adapted to specific projects and sectors.

The Broader Economic Implications of Brookfield's Experience

Brookfield's challenges are not isolated incidents. They highlight the broader economic implications of tariffs on US manufacturing and the overall economy:

-

Impact on job creation in the affected sectors: Higher costs and project delays can lead to reduced investment and slower job growth in US manufacturing sectors. This hampers overall economic growth.

-

Potential effects on consumer prices: Increased production costs due to tariffs are often passed on to consumers in the form of higher prices for goods, impacting household budgets and reducing consumer purchasing power.

-

The overall impact on US competitiveness in global markets: Higher production costs reduce the competitiveness of US-made goods in international markets, potentially leading to a loss of market share and reduced export revenue. This impacts the overall balance of trade and the US's global economic standing. The experience of Brookfield underscores the significant risks associated with US manufacturing competitiveness in a highly tariff-affected global trade environment.

Conclusion

Brookfield's struggle to expand its US manufacturing operations underscores the significant impact of tariffs on investment decisions and economic growth. The increased costs of materials, supply chain disruptions, and reduced competitiveness directly affect Brookfield's investment strategy and potentially hinder its ability to create jobs and contribute to the US economy. The broader economic implications, including higher consumer prices and reduced competitiveness, are undeniable. Understand the full impact of Brookfield US manufacturing tariffs and their implications for the US economy by staying informed about trade policies and their effect on major investors and the manufacturing sector. Further research into Brookfield's official statements and industry analyses will provide a more complete understanding of the challenges and responses to these issues.

Featured Posts

-

Mariage Macron Des Confidences Intimes Apres De Nombreuses Annees

May 03, 2025

Mariage Macron Des Confidences Intimes Apres De Nombreuses Annees

May 03, 2025 -

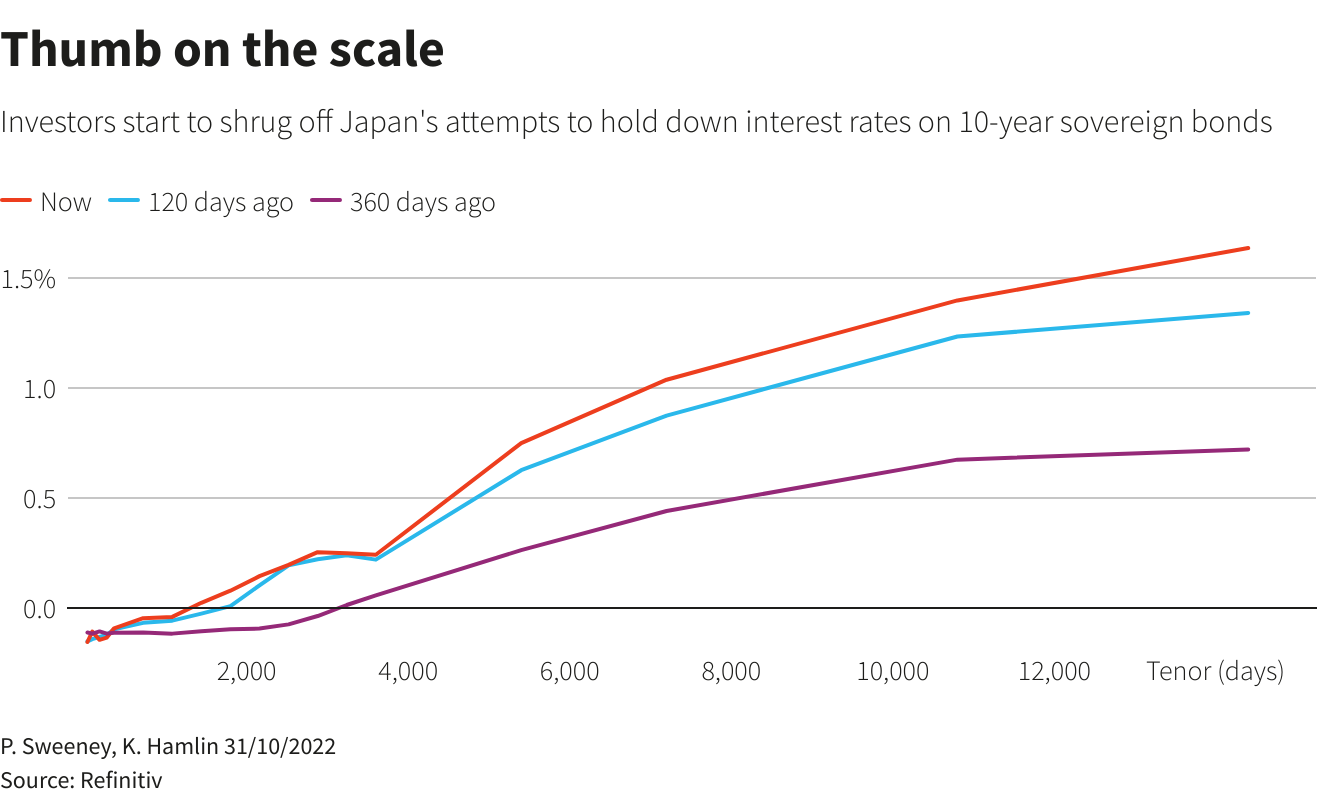

Bank Of Japan Cuts Growth Forecast Amidst Rising Trade Tensions

May 03, 2025

Bank Of Japan Cuts Growth Forecast Amidst Rising Trade Tensions

May 03, 2025 -

Todays Lotto Results Check Lotto Lotto Plus 1 And Lotto Plus 2 Numbers

May 03, 2025

Todays Lotto Results Check Lotto Lotto Plus 1 And Lotto Plus 2 Numbers

May 03, 2025 -

Fortnite Down Checking Server Status For Chapter 6 Season 3

May 03, 2025

Fortnite Down Checking Server Status For Chapter 6 Season 3

May 03, 2025 -

Les Tuche 5 A Qui S Adresse Ce Nouvel Opus

May 03, 2025

Les Tuche 5 A Qui S Adresse Ce Nouvel Opus

May 03, 2025