Bank Of Japan Cuts Growth Forecast Amidst Rising Trade Tensions

Table of Contents

Reasons Behind the Downgraded Growth Forecast

The BOJ's pessimistic revision of its growth forecast stems from a confluence of interconnected factors, all linked to the current climate of global uncertainty. These include:

-

Escalating Trade Disputes: The ongoing trade war, particularly between the US and China, is severely disrupting global supply chains. This uncertainty dampens investor confidence, hindering investment and economic growth. The resulting instability creates a ripple effect, impacting businesses worldwide, including those in Japan.

-

Weakening Global Demand: A slowdown in global demand has directly impacted Japanese exports, a cornerstone of the nation's GDP. Reduced orders from key trading partners translate to lower production levels, impacting employment and overall economic output. This export slowdown is a significant contributor to the revised forecast.

-

Sluggish Domestic Consumer Spending: Despite efforts to stimulate the economy, domestic consumer spending in Japan remains subdued. This lack of internal economic dynamism exacerbates the negative impact of external factors, further contributing to the overall economic slowdown.

-

Subdued Inflation and Deflationary Risks: While inflation remains relatively low, the BOJ is concerned that escalating trade tensions could push Japan towards deflation. This would represent a significant challenge, requiring even more aggressive monetary policy interventions.

-

Yen Appreciation: A strengthening yen against other major currencies makes Japanese exports less competitive in the global marketplace. This further diminishes export revenue and adds pressure on businesses operating in export-oriented industries.

Impact on the Japanese Economy

The BOJ's downgraded growth forecast paints a concerning picture for the Japanese economy in the coming quarters:

-

Slower GDP Growth: The revised forecast indicates a significantly slower pace of economic expansion than previously anticipated. This reduced growth rate translates to a less vibrant and dynamic economy.

-

Negative Impact on Corporate Profits: Reduced export demand directly impacts corporate profits, potentially leading to decreased investment and job losses across various sectors, particularly in export-oriented industries.

-

Reduced Investment and Employment: The uncertainty surrounding future trade policies discourages businesses from investing in new projects and expansions, leading to a further slowdown in economic activity and potential job losses.

-

Potential for Further Monetary Easing: To counter the economic slowdown, the BOJ may adopt further monetary easing measures. This could involve adjustments to interest rates and other monetary policy tools.

Potential for Further Monetary Easing

The BOJ's toolkit for stimulating economic activity includes several options, each with its own set of potential benefits and drawbacks:

-

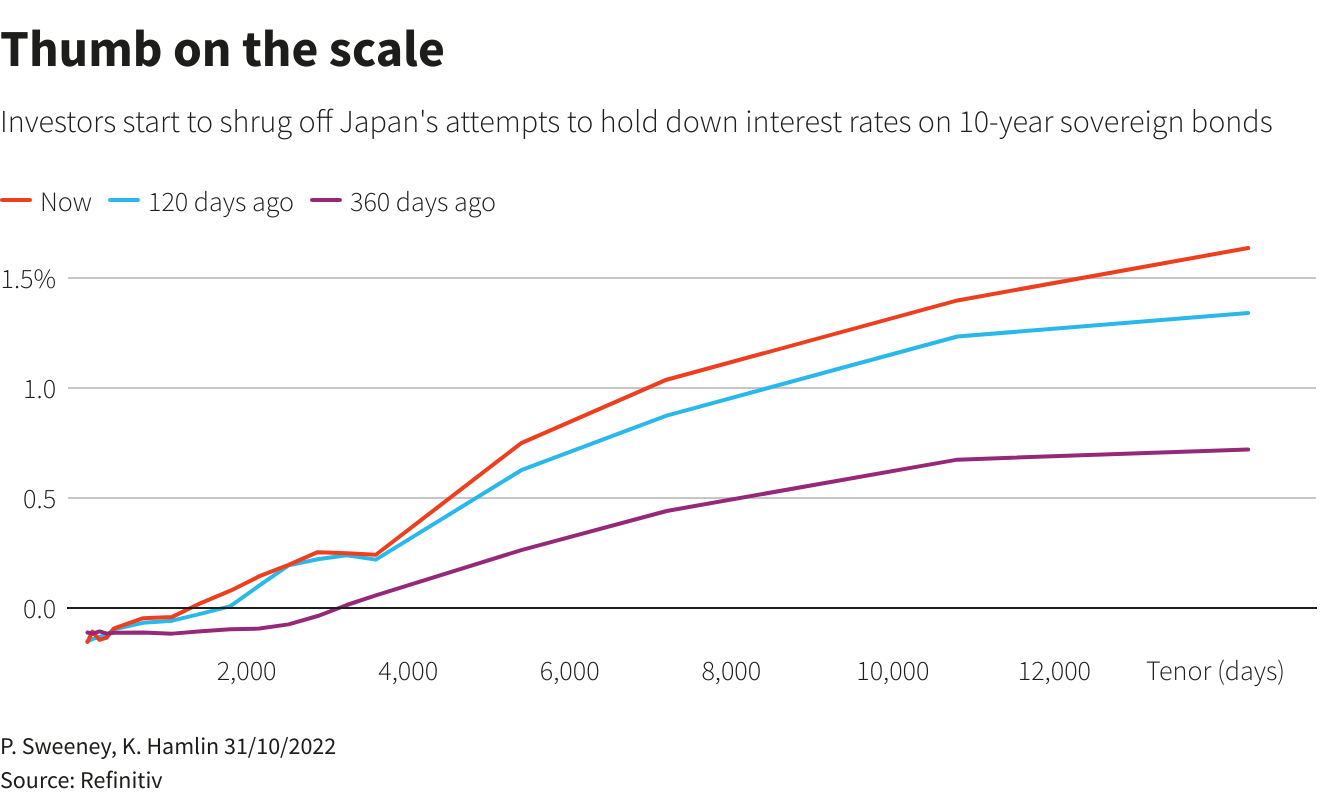

Quantitative Easing (QE): Expanding the QE program involves injecting more liquidity into the market by purchasing government bonds and other assets. This aims to lower long-term interest rates and encourage borrowing and investment.

-

Negative Interest Rates: Further reductions in negative interest rates could be considered, although the effectiveness of this approach is debated, with diminishing returns and potential side effects on financial institutions.

-

Yield Curve Control (YCC): Adjustments to YCC policies might be implemented to manage long-term interest rates and encourage borrowing and investment.

Global Implications of the BOJ's Decision

The implications of the BOJ's revised forecast extend far beyond Japan's borders:

-

Ripple Effects on the Global Economy: Given Japan's significant role in international trade, a slowdown in its economy will inevitably have ripple effects across the global economy, impacting global growth.

-

Increased Investor Risk Aversion: Concerns about global economic growth, fueled by the BOJ's actions, might lead to increased risk aversion among investors, potentially impacting global financial markets and investment flows.

-

Influence on Other Central Banks: The BOJ's actions and policy decisions could influence monetary policy decisions in other countries, creating a domino effect in global monetary policy.

-

Interconnectedness of Global Economies: This situation underscores the interconnectedness of global economies and the vulnerability of even strong economies to external shocks, such as trade wars and global economic slowdowns.

Conclusion

The Bank of Japan's downward revision of its growth forecast serves as a stark reminder of the significant impact of rising trade tensions on both the Japanese and global economies. Weakening global demand, sluggish domestic consumption, and a strengthening yen are all contributing to this slowdown. The BOJ's potential response, involving further monetary easing, highlights the challenges in navigating this complex economic landscape. Careful monitoring of global trade dynamics and their implications for future economic growth is crucial. Stay informed about the evolving situation by regularly checking for updates on the Bank of Japan’s monetary policy and its impact on the global economy. Understanding the intricacies of the Bank of Japan's growth forecast is crucial for making informed financial decisions in these turbulent times.

Featured Posts

-

Improving Mental Healthcare In Ghana Tackling The Psychiatrist Deficit

May 03, 2025

Improving Mental Healthcare In Ghana Tackling The Psychiatrist Deficit

May 03, 2025 -

Marcus Rashford To Aston Villa Souness Offers Insight

May 03, 2025

Marcus Rashford To Aston Villa Souness Offers Insight

May 03, 2025 -

Poppy Atkinson Schoolgirls Funeral Following Fatal Car Accident In Manchester

May 03, 2025

Poppy Atkinson Schoolgirls Funeral Following Fatal Car Accident In Manchester

May 03, 2025 -

The Future Of Buy Canadian Loblaws Perspective

May 03, 2025

The Future Of Buy Canadian Loblaws Perspective

May 03, 2025 -

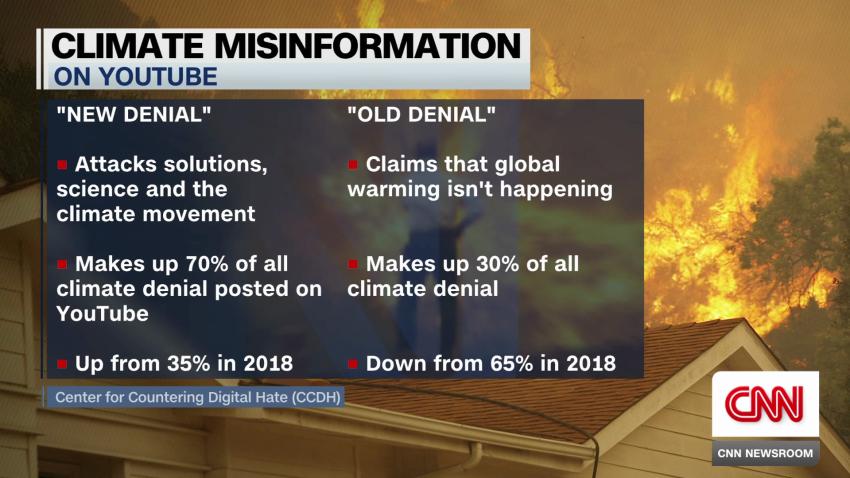

Why Facts Alone Dont Defeat Misinformation Insights From Cnn Experts

May 03, 2025

Why Facts Alone Dont Defeat Misinformation Insights From Cnn Experts

May 03, 2025