Broadcom's VMware Acquisition: AT&T Reports Extreme Price Surge

Table of Contents

The Broadcom-VMware Deal: A Deep Dive

Broadcom, a leading semiconductor company, finalized its acquisition of VMware, a virtualization and cloud infrastructure giant, in a deal valued at approximately $61 billion. This strategic move represents a significant expansion for Broadcom into the enterprise software market, significantly altering the competitive landscape.

- Acquisition Cost: The staggering $61 billion price tag underscores the strategic importance of VMware to Broadcom's future growth.

- Strategic Rationale: Broadcom aims to leverage VMware's robust software portfolio to complement its existing hardware offerings, creating a more comprehensive and integrated solution for its enterprise clients. This vertical integration strategy allows them to offer a complete end-to-end solution.

- Potential Benefits: Increased market share, diversification of revenue streams, and the ability to offer bundled solutions are key anticipated benefits for Broadcom.

- Potential Drawbacks: Integration challenges, regulatory hurdles, and potential antitrust concerns are potential drawbacks. The success of the merger hinges on seamless integration of two very different corporate cultures and technologies.

- Keywords: Broadcom acquisition, VMware, enterprise software, merger and acquisition, tech industry consolidation, vertical integration

AT&T's Unexpected Price Surge: Unpacking the Connection

Following the announcement of the Broadcom-VMware deal, AT&T's stock price experienced a significant and unexpected rise. While seemingly unrelated at first glance, several factors may explain this correlation:

- Magnitude of the Price Increase: The precise percentage increase needs to be noted here, referencing financial news sources for accurate data. (e.g., "AT&T's stock saw a X% increase in value within Y hours of the Broadcom-VMware announcement").

- Synergies and Potential Collaborations: The combined strength of Broadcom and VMware could create opportunities for enhanced network infrastructure and cloud-based services, potentially benefitting AT&T's operations. Improved data center virtualization and network management could lead to cost savings and efficiency gains for AT&T.

- Market Sentiment: The overall positive market reaction to the Broadcom-VMware deal might have created a ripple effect, boosting investor confidence across related sectors, including telecommunications. A positive market sentiment often leads to a broad-based increase in stock prices.

- Investor Speculation: Investors may be speculating on potential future partnerships or collaborations between AT&T and the newly merged Broadcom-VMware entity. This speculation, fueled by the potential synergies, could be driving the price increase.

- Keywords: AT&T stock, price increase, market reaction, investor sentiment, Broadcom VMware impact, stock market analysis, synergy, collaboration

Market Analysis and Future Predictions

The Broadcom-VMware acquisition has far-reaching implications for the telecommunications and technology sectors. This merger is a major event in the ongoing consolidation of the tech industry.

- Impact on the Telecommunications Industry: The increased efficiency and cost savings made possible by the integrated Broadcom-VMware solutions could lead to innovation in telecom services, potentially impacting pricing and service offerings.

- Impact on the Technology Sector: The combined entity poses a formidable competitor, potentially impacting innovation and competition within the enterprise software and hardware markets.

- Long-Term Effects: Increased market concentration could lead to both benefits (economies of scale, technological advancements) and drawbacks (reduced competition, higher prices).

- Expert Opinions: (Insert quotes or summaries of opinions from industry analysts regarding the long-term effects of the acquisition and its impact on AT&T.)

- Keywords: Market analysis, future predictions, telecommunications industry, technology sector, competitive landscape, industry forecast, market concentration

Conclusion: Broadcom's VMware Acquisition and the Future of AT&T

Broadcom's successful acquisition of VMware has undeniably shaken up the tech landscape. The unexpected and significant price surge in AT&T's stock highlights the interconnectedness of the tech and telecommunications industries. While the exact reasons for AT&T's price increase remain multifaceted, the potential for synergies and collaborations with the newly formed entity is a key factor. The long-term implications of this merger remain to be seen, but it is clear that this acquisition is a defining moment in the industry.

To stay informed on the evolving dynamics of this merger and its effects on AT&T and the broader market, continue monitoring the situation. Subscribe to our newsletter for updates on this and other significant tech industry mergers and acquisitions. Understanding the implications of the Broadcom VMware acquisition and its ripple effects is crucial for navigating the ever-changing tech landscape.

Featured Posts

-

Leclercs Future At Ferrari Statement Ahead Of Imola

May 20, 2025

Leclercs Future At Ferrari Statement Ahead Of Imola

May 20, 2025 -

Visita De Michael Schumacher A Su Nieta Viaje En Helicoptero Desde Mallorca

May 20, 2025

Visita De Michael Schumacher A Su Nieta Viaje En Helicoptero Desde Mallorca

May 20, 2025 -

Maybank Fuels 545 Million Economic Zone Development

May 20, 2025

Maybank Fuels 545 Million Economic Zone Development

May 20, 2025 -

F1 Comeback Hope For Mick Schumacher Haekkinen Weighs In

May 20, 2025

F1 Comeback Hope For Mick Schumacher Haekkinen Weighs In

May 20, 2025 -

Festival Da Cunha Em Manaus Shows Cultura E Vivencias Amazonicas

May 20, 2025

Festival Da Cunha Em Manaus Shows Cultura E Vivencias Amazonicas

May 20, 2025

Latest Posts

-

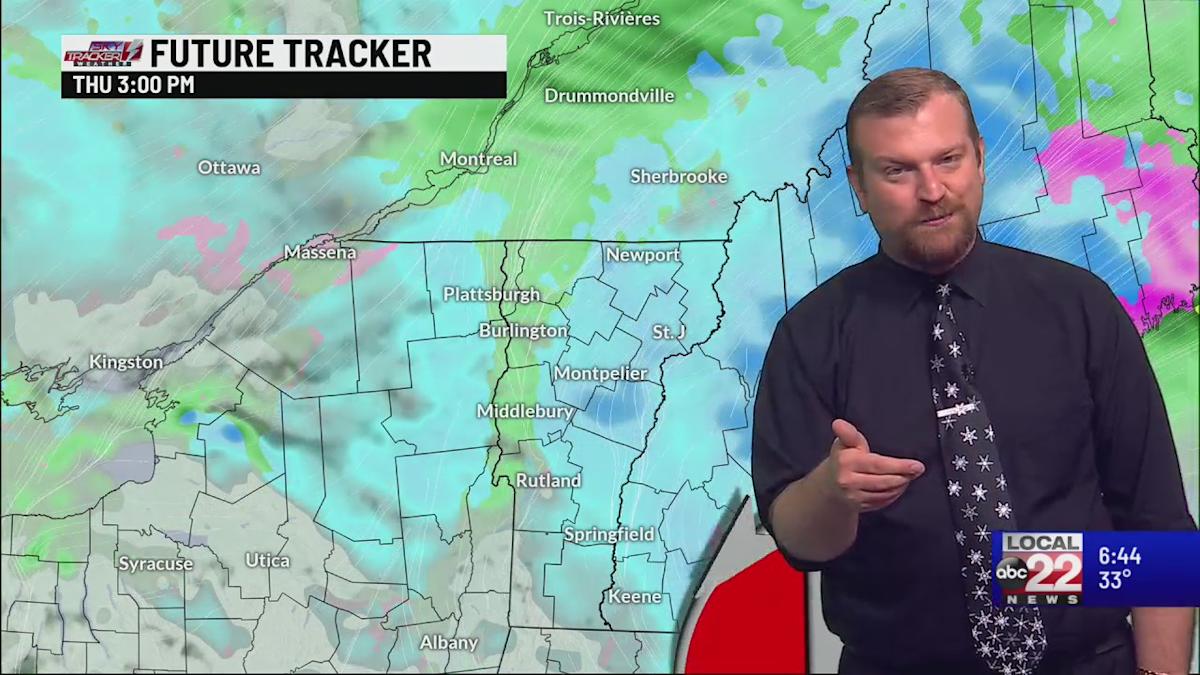

Understanding The Impacts Of A Wintry Mix Of Rain And Snow

May 20, 2025

Understanding The Impacts Of A Wintry Mix Of Rain And Snow

May 20, 2025 -

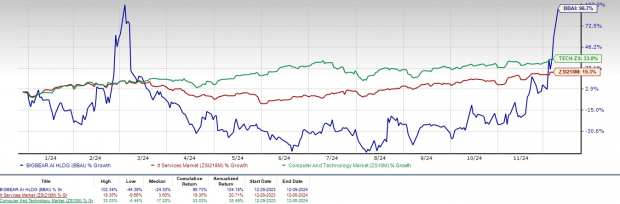

Investing In Big Bear Ai A Practical Guide For 2024

May 20, 2025

Investing In Big Bear Ai A Practical Guide For 2024

May 20, 2025 -

Preparing For A Wintry Mix Of Rain And Snow

May 20, 2025

Preparing For A Wintry Mix Of Rain And Snow

May 20, 2025 -

Big Bear Ai Should Investors Buy Sell Or Hold

May 20, 2025

Big Bear Ai Should Investors Buy Sell Or Hold

May 20, 2025 -

Wintry Mix Rain And Snow Forecast

May 20, 2025

Wintry Mix Rain And Snow Forecast

May 20, 2025