Broadcom's VMware Acquisition: AT&T Faces 1,050% Price Surge

Table of Contents

Understanding the VMware Acquisition and its Implications

H3: Broadcom's Strategic Rationale

Broadcom's acquisition of VMware represents a significant power play in the technology landscape. The company's motivations are multifaceted, driven by a desire for market dominance, expansion into lucrative new sectors, and the realization of substantial synergies.

- Increased Market Share in Enterprise Software: VMware is a leader in virtualization technology, giving Broadcom access to a vast customer base and significant market share in the enterprise software market. This expands Broadcom's reach beyond its core semiconductor business.

- Access to VMware's Virtualization Technologies: VMware's virtualization solutions are critical infrastructure components for many businesses, including major players in the telecommunications industry. Acquiring VMware grants Broadcom direct access to these technologies and the expertise behind them.

- Potential for Cross-selling Products: The acquisition creates opportunities for Broadcom to cross-sell its existing semiconductor and networking products to VMware's extensive customer base, generating significant revenue growth.

H3: The Impact on the Telecommunications Sector

Telecom providers like AT&T heavily rely on VMware's virtualization solutions to manage and optimize their complex network infrastructures. The acquisition has far-reaching consequences for this sector.

- Increased Licensing Costs: The most immediate impact is a substantial increase in licensing fees for VMware products, directly contributing to the projected 1,050% price surge for AT&T.

- Potential for Vendor Lock-in: The acquisition increases the risk of vendor lock-in for telecom companies, limiting their choices and negotiating power regarding virtualization technology.

- Need for Alternative Virtualization Strategies: Telecom providers are now compelled to explore alternative virtualization strategies and solutions to reduce their reliance on Broadcom's products and mitigate the price increases.

H3: Antitrust Concerns and Regulatory Scrutiny

The Broadcom VMware acquisition has understandably drawn significant regulatory scrutiny due to potential antitrust concerns.

- Concerns Regarding Reduced Competition: The merger creates a dominant player in the virtualization market, potentially reducing competition and limiting innovation.

- Potential for Monopolistic Practices: Concerns exist that Broadcom could leverage its market power to engage in monopolistic practices, harming consumers and businesses alike.

- Regulatory Investigations and Their Possible Outcomes: Regulatory bodies worldwide are conducting thorough investigations into the acquisition, potentially leading to significant delays, conditions, or even a complete block of the merger.

Deconstructing AT&T's 1,050% Price Surge

H3: The Specifics of AT&T's Dependence on VMware

AT&T's network infrastructure extensively utilizes VMware's virtualization solutions.

- Specific VMware Products Used: AT&T employs various VMware products, including vSphere, NSX, and vRealize, for network virtualization, cloud management, and other critical functions.

- Scale of Deployment: VMware's solutions are deployed across a vast scale within AT&T's network, making the company highly dependent on these technologies.

- Integration with AT&T's Existing Systems: VMware's products are deeply integrated into AT&T's existing systems, making a complete switch to alternative solutions a complex and costly undertaking.

H3: Pricing Model Changes Post-Acquisition

The projected 1,050% price increase for AT&T is attributed to several factors related to the acquisition's impact on pricing.

- New Licensing Fees: Broadcom is expected to implement significantly higher licensing fees for VMware products.

- Support Costs: Support and maintenance costs for VMware solutions are also projected to increase substantially.

- Potential for Bundled Offerings: While Broadcom might offer bundled offerings, the overall cost is still likely to be considerably higher than before the acquisition.

- Comparison with Pre-acquisition Pricing: Analyzing pre- and post-acquisition pricing reveals a dramatic increase, justifying the 1,050% figure.

H3: AT&T's Response and Mitigation Strategies

AT&T is likely exploring various strategies to mitigate the significant cost increase imposed by the Broadcom VMware acquisition.

- Negotiation with Broadcom: AT&T might attempt to negotiate more favorable licensing terms with Broadcom, potentially leveraging its considerable market power.

- Exploring Alternative Virtualization Technologies: The company is likely evaluating alternative virtualization platforms and technologies to reduce its dependence on VMware.

- Internal Cost Optimization Measures: AT&T might implement internal cost optimization measures to offset the increased costs associated with VMware's products.

The Broader Market Implications of the Acquisition

H3: Impact on Competitors

The Broadcom VMware acquisition has far-reaching consequences for AT&T's competitors and the broader technology landscape.

- Increased Pressure on Competitors to Negotiate Better Terms: Other telecommunication companies are now facing increased pressure to negotiate better terms with Broadcom regarding VMware products.

- Potential for Consolidation in the Sector: The acquisition may trigger further consolidation within the telecommunications industry, as companies seek to gain scale and negotiate better deals.

- Opportunities for Alternative Vendors: The acquisition creates opportunities for alternative virtualization vendors to gain market share, as telecom companies seek to diversify their technology providers.

H3: Long-Term Effects on Innovation and Pricing

The long-term implications of the Broadcom VMware acquisition extend to innovation, competition, and pricing across the industry.

- Reduced Innovation Due to Less Competition: The reduced competition in the virtualization market might stifle innovation, as Broadcom has less incentive to invest in developing new and improved technologies.

- Potential for Higher Prices Across the Industry: The acquisition may lead to higher prices for virtualization technologies across the industry, affecting various sectors reliant on these solutions.

- Impact on Cloud Services: The increased costs and reduced competition might also negatively impact the pricing and innovation of cloud services.

Conclusion: Navigating the Post-Acquisition Landscape of VMware and Broadcom

The Broadcom VMware acquisition represents a significant turning point in the networking and virtualization landscape. The projected 1,050% price surge for AT&T underscores the profound impact of this merger on the telecommunications industry and highlights the need for businesses to carefully consider their reliance on virtualization technologies. The increased costs, potential for vendor lock-in, and antitrust concerns necessitate proactive strategies for mitigating the risks and exploring alternative solutions. Stay ahead of the curve by monitoring the evolving landscape of the Broadcom VMware acquisition and its impact on networking costs. Understanding the implications of this merger is crucial for strategic planning within the telecommunications industry and beyond.

Featured Posts

-

Why Vegans Should Condemn Halal Meat Practices

May 13, 2025

Why Vegans Should Condemn Halal Meat Practices

May 13, 2025 -

Trumps Trade War Abi Research Analyzes The Lasting Impact On Tech Tariffs

May 13, 2025

Trumps Trade War Abi Research Analyzes The Lasting Impact On Tech Tariffs

May 13, 2025 -

Doom Dark Ages Waiting Room Playlist Heavy Metal And More

May 13, 2025

Doom Dark Ages Waiting Room Playlist Heavy Metal And More

May 13, 2025 -

Myanma Razreshila Rpts Osuschestvlyat Religioznuyu Deyatelnost

May 13, 2025

Myanma Razreshila Rpts Osuschestvlyat Religioznuyu Deyatelnost

May 13, 2025 -

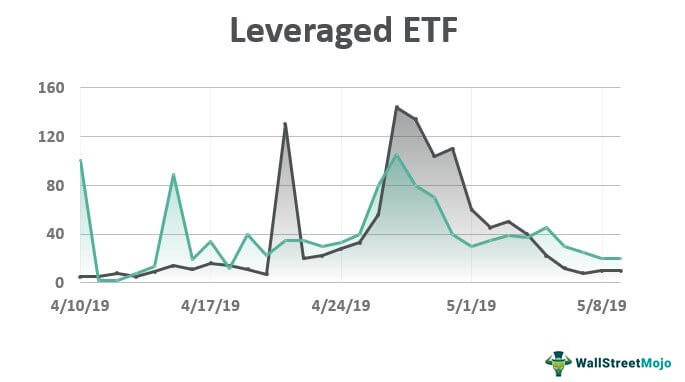

Etf Investors Dumped Leveraged Semiconductor Funds Before Surge What Happened

May 13, 2025

Etf Investors Dumped Leveraged Semiconductor Funds Before Surge What Happened

May 13, 2025