ETF Investors Dumped Leveraged Semiconductor Funds Before Surge: What Happened?

Table of Contents

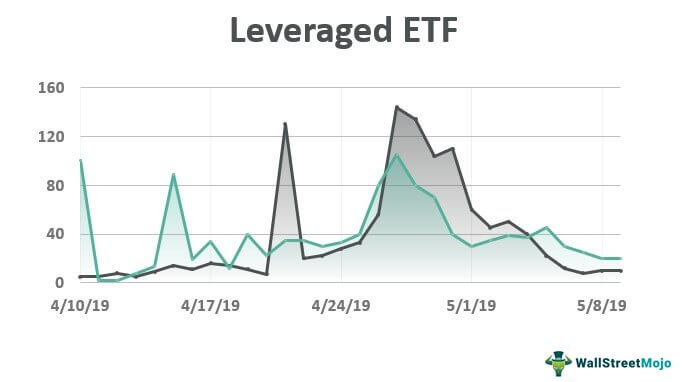

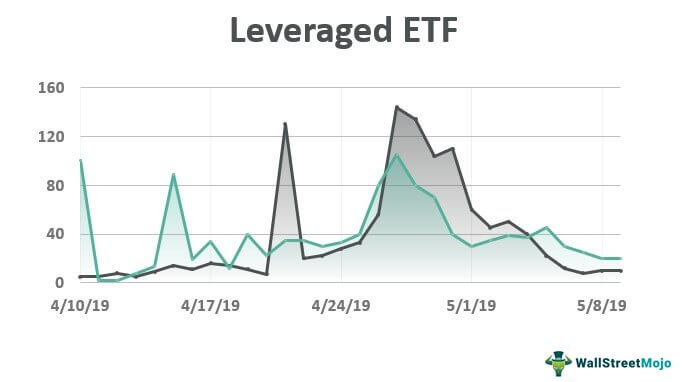

The Risks of Leveraged ETFs

Leveraged ETFs aim to deliver magnified returns based on the daily performance of an underlying index. However, this magnification applies to both gains and losses, creating significant risks for investors. Understanding these mechanics is crucial before investing in such products.

-

Daily Resetting of Leverage: Unlike traditional funds, leveraged ETFs reset their leverage daily. This means that the fund's returns are recalculated each day based on the previous day's performance. During periods of volatility, this daily resetting can lead to a compounding effect, significantly eroding returns over time, even if the underlying index eventually recovers. Imagine a 10% drop followed by a 10% rise; a 2x leveraged ETF might experience a larger net loss than a non-leveraged ETF.

-

Volatility Drag: Volatility drag is a significant factor that negatively impacts leveraged ETFs' performance, especially in turbulent markets. The daily resetting of leverage can create a significant drag on returns, even if the underlying index shows positive movement over longer periods. The more volatile the underlying asset, the more pronounced this effect becomes.

-

Higher Expense Ratios: Leveraged ETFs typically have higher expense ratios than their unleveraged counterparts due to the complexities of their investment strategies and the need for frequent rebalancing. These added costs further eat into potential profits.

-

Potential for Significant Capital Loss: The inherent magnification of both gains and losses in leveraged ETFs translates to a high potential for substantial capital loss. Investors can lose a significant portion of their investment if the underlying index moves against their position, particularly over extended periods.

Example: Let's say a semiconductor index drops 5% on Monday and then rises 5% on Tuesday. A 2x leveraged ETF would lose approximately 10% on Monday and gain approximately 10% on Tuesday. However, due to the compounding effect, this would still result in a net loss for the investor.

Market Sentiment and Investor Behavior

Before the recent semiconductor surge, prevailing market sentiment towards the sector was cautious. Several factors contributed to this negative outlook:

-

Geopolitical Uncertainty: International tensions and trade disputes created uncertainty about the future of global supply chains and demand for semiconductors.

-

Economic Slowdown Concerns: Fears of a global economic recession dampened investor confidence, leading to a sell-off in many sectors, including semiconductors.

-

Supply Chain Issues: Ongoing disruptions to global supply chains caused concerns about the availability and pricing of semiconductors.

This uncertainty fueled investor fear and a tendency to sell assets to avoid potential losses, even those with long-term growth potential. News cycles and analyst reports, often emphasizing short-term risks, further exacerbated this negative sentiment. The herd mentality, where investors mimic the actions of others, amplified selling pressure, contributing to outflows from leveraged semiconductor ETFs.

The Role of Algorithmic Trading and Programmatic Selling

Algorithmic trading plays a significant role in shaping market dynamics, particularly within leveraged ETFs.

-

Stop-Loss Orders: Many investors use stop-loss orders to automatically sell their holdings when the price falls below a predetermined threshold. In a volatile market, these orders can trigger a cascade of selling, accelerating downward price movements.

-

Risk Management Algorithms: Sophisticated algorithms are designed to manage risk and liquidate positions to mitigate potential losses. These algorithms may trigger selling in leveraged ETFs based on pre-defined risk parameters.

-

High-Frequency Trading: High-frequency trading (HFT) firms can execute trades at incredibly high speeds, exacerbating the impact of market movements on leveraged ETFs. Their actions can contribute to increased liquidity but also amplify volatility.

The speed and scale at which algorithmic trading operates can lead to rapid outflows from leveraged funds, even before fundamental changes in the market justify such large-scale selling.

Alternative Explanations and Further Considerations

Several other factors could have contributed to the outflows:

-

Tax-Loss Harvesting: Investors may have sold losing positions in leveraged semiconductor ETFs before the year-end to offset capital gains and reduce their tax liabilities.

-

Portfolio Rebalancing: Institutional investors might have rebalanced their portfolios, selling some leveraged ETFs to reallocate capital to other asset classes.

-

Sector-Specific Events: Specific news or events affecting the semiconductor industry, though not widely publicized, could have influenced investor decisions leading to outflows.

It's crucial to remember that past performance is not indicative of future results. The events leading to the outflows in leveraged semiconductor ETFs highlight the unpredictability of markets and the complexities of leveraged investing.

Conclusion

The unexpected outflows from leveraged semiconductor ETFs before their recent surge serve as a stark reminder of the risks associated with leveraged investment strategies. Market sentiment, investor behavior, algorithmic trading, and other unpredictable factors can significantly impact fund flows and lead to substantial losses. Understanding these dynamics is crucial for navigating the complexities of the investment landscape. Before investing in leveraged ETFs, especially in volatile sectors like semiconductors, carefully weigh the risks, diversify your portfolio, and consider seeking professional financial advice to ensure the investment aligns with your risk tolerance and long-term financial goals. Remember, understanding the intricacies of leveraged ETFs is crucial for mitigating risk and achieving your investment objectives.

Featured Posts

-

A Practical Guide To Life Cycle Learning With Campus Farm Animals

May 13, 2025

A Practical Guide To Life Cycle Learning With Campus Farm Animals

May 13, 2025 -

Leonardo Di Caprios New Spy Thriller Now On Netflix

May 13, 2025

Leonardo Di Caprios New Spy Thriller Now On Netflix

May 13, 2025 -

Community Mourns 15 Year Old After School Stabbing

May 13, 2025

Community Mourns 15 Year Old After School Stabbing

May 13, 2025 -

Nhl Draft Lottery A New Era Of Live Studio Drawings

May 13, 2025

Nhl Draft Lottery A New Era Of Live Studio Drawings

May 13, 2025 -

Salman Khans Unprofitable Ventures A Look At Films That Didnt Break Even

May 13, 2025

Salman Khans Unprofitable Ventures A Look At Films That Didnt Break Even

May 13, 2025