Brazil's Banking Sector: BRB's Strategic Move To Challenge The Giants

Table of Contents

BRB's Current Position and Market Share

BRB, while a significant player in the Brasília region, holds a relatively smaller market share compared to the national banking behemoths. Its strength lies in its deep roots within the public sector and its strong regional dominance in the Federal District and surrounding areas. However, its national presence and brand recognition are significantly less than its larger competitors.

- Market share compared to major competitors: BRB's market share lags behind Itaú, Bradesco, and Santander, which control a substantial portion of the Brazilian banking market. Precise figures fluctuate, but BRB's share generally remains in the single digits nationally.

- Strengths: BRB boasts strong relationships with the public sector in Brasília, providing a stable base of clients and consistent revenue streams. Its regional dominance allows it to deeply understand the local market and tailor its services effectively.

- Weaknesses: Limited national reach is a major constraint. Expanding beyond its regional stronghold requires significant investment and strategic planning. Brand recognition nationwide pales in comparison to the established giants, impacting customer acquisition efforts.

BRB's Strategic Initiatives for Growth

BRB's growth strategy hinges on a multi-pronged approach focused on technological innovation and market expansion. The bank is aggressively investing in digital infrastructure and expanding its digital banking capabilities to compete effectively with larger players.

- Investment in digital infrastructure and mobile banking apps: BRB is heavily investing in state-of-the-art digital banking platforms, including user-friendly mobile apps and online banking portals. This aims to enhance customer experience and attract tech-savvy individuals and businesses.

- Expansion into new market segments: The bank is targeting new customer segments, including small and medium-sized enterprises (SMEs) and individual customers beyond its traditional public sector base. This diversification strategy is crucial for driving growth.

- Partnerships with fintech companies for innovative financial solutions: BRB is actively seeking collaborations with fintech companies to develop and offer cutting-edge financial products and services. These partnerships accelerate innovation and provide access to new technologies.

- Focus on customer experience and personalized services: BRB recognizes the importance of superior customer service. By prioritizing personalized service and tailoring solutions to individual needs, the bank seeks to build customer loyalty.

Analysis of BRB's Competitive Advantages

Despite facing giants, BRB possesses certain competitive advantages that could enable it to disrupt the market. Its agility, niche expertise, and strong regional brand loyalty provide a unique platform for growth.

- Faster decision-making processes: Compared to larger, more bureaucratic institutions, BRB’s smaller size allows for quicker decisions and faster adaptation to market changes. This agility is crucial in a dynamic banking environment.

- Specialized knowledge and services: BRB's deep understanding of the public sector and its regional market allows it to offer specialized financial products and services catering to specific customer needs.

- Strong regional brand loyalty and community engagement: BRB benefits from strong brand loyalty in its core market. Its commitment to community engagement fosters positive brand perception and strengthens customer relationships.

- Cost-effectiveness and operational efficiency: Streamlined operations and a leaner structure enable BRB to achieve greater cost-effectiveness compared to larger banks.

Challenges and Potential Risks Facing BRB

While BRB's strategic moves are promising, it faces considerable challenges in its ambition to challenge established players in Brazil's banking sector.

- Intense competition from established banks: Competing against banks with vast resources, extensive networks, and established brand recognition is a significant hurdle.

- Regulatory changes and compliance requirements: The Brazilian banking sector is subject to rigorous regulations and compliance requirements. Navigating these complexities adds to the operational challenges.

- Economic fluctuations and their impact on loan portfolios and customer spending: Economic downturns can significantly impact loan portfolios and customer spending, creating financial risks for BRB.

- Attracting and retaining top talent: In a competitive market, attracting and retaining skilled employees is crucial for success. BRB needs to offer competitive compensation and development opportunities to attract the best talent.

Conclusion

BRB's strategic move to challenge the giants in Brazil's banking sector represents a significant development. By leveraging technology, focusing on specific market segments, and capitalizing on its unique advantages, BRB is attempting to gain a larger market share. While significant challenges remain, BRB's ambition and innovative approach make its future trajectory worthy of close observation. The success of its strategies will determine its impact on the competitive dynamics within Brazil's banking sector. To stay updated on BRB’s progress and its impact on the broader Brazilian banking sector, continue following our analysis of BRB's strategic moves and its evolving position within Brazil's banking sector.

Featured Posts

-

Porsche Indonesia Classic Art Week 2025 Sebuah Perayaan Budaya

May 25, 2025

Porsche Indonesia Classic Art Week 2025 Sebuah Perayaan Budaya

May 25, 2025 -

Porsche Macan Rafmagnsutgafa Upplysingar Og Eiginleikar

May 25, 2025

Porsche Macan Rafmagnsutgafa Upplysingar Og Eiginleikar

May 25, 2025 -

Royal Philips Details On The 2025 Shareholders Annual General Meeting

May 25, 2025

Royal Philips Details On The 2025 Shareholders Annual General Meeting

May 25, 2025 -

Cac 40 Weekly Performance Shows Stability Despite Friday Drop

May 25, 2025

Cac 40 Weekly Performance Shows Stability Despite Friday Drop

May 25, 2025 -

Vozrast Geroev Filma O Bednom Gusare Zamolvite Slovo Podrobniy Analiz

May 25, 2025

Vozrast Geroev Filma O Bednom Gusare Zamolvite Slovo Podrobniy Analiz

May 25, 2025

Latest Posts

-

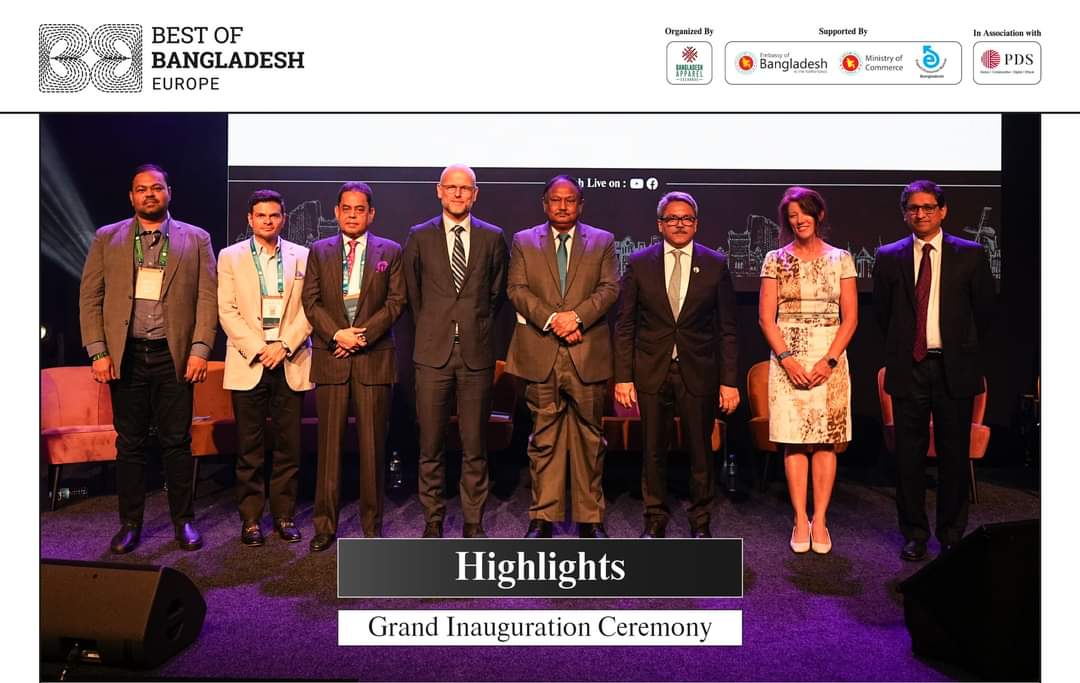

Boosting Collaboration Bangladeshs Strategic Return To Europe

May 25, 2025

Boosting Collaboration Bangladeshs Strategic Return To Europe

May 25, 2025 -

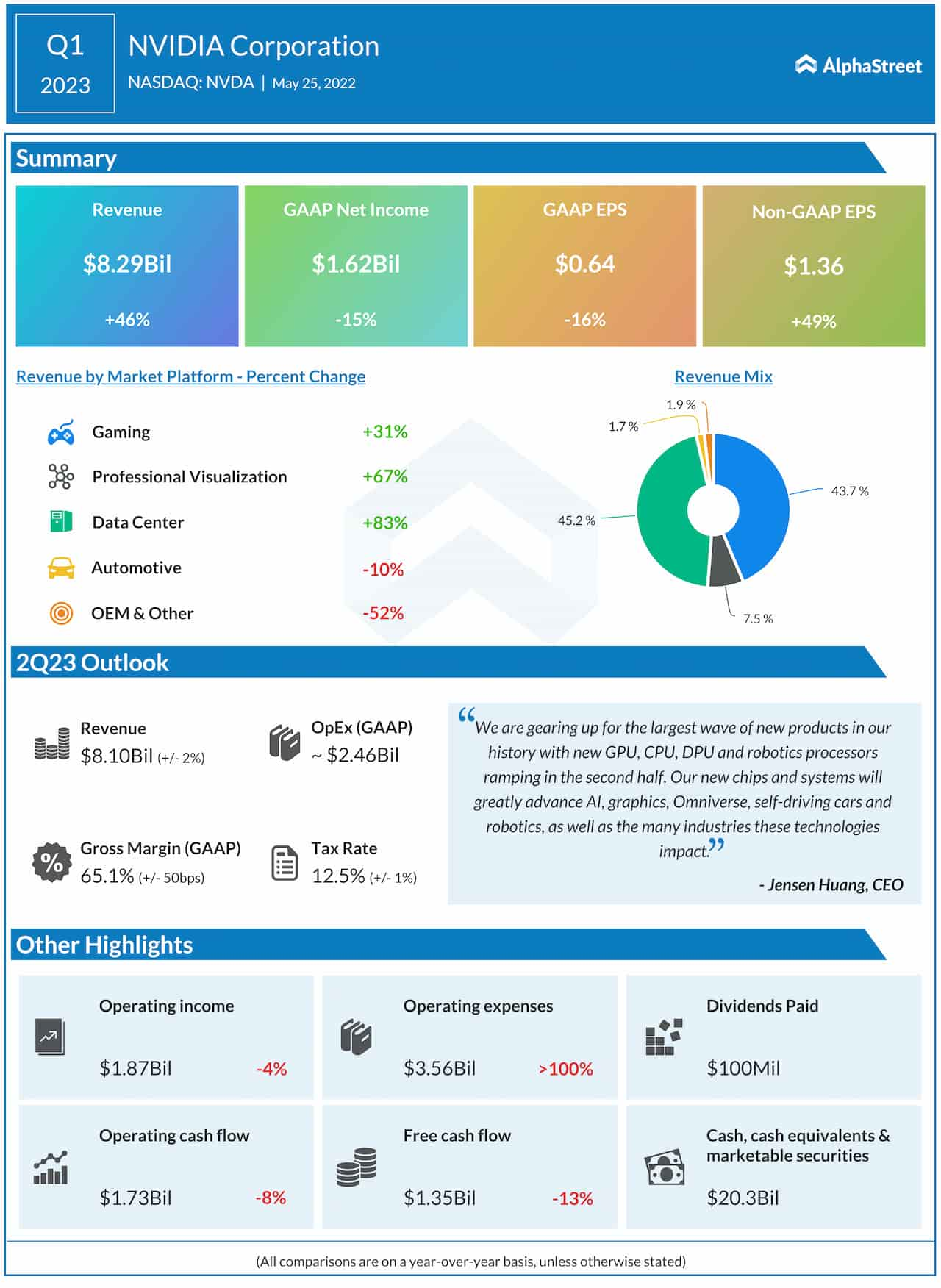

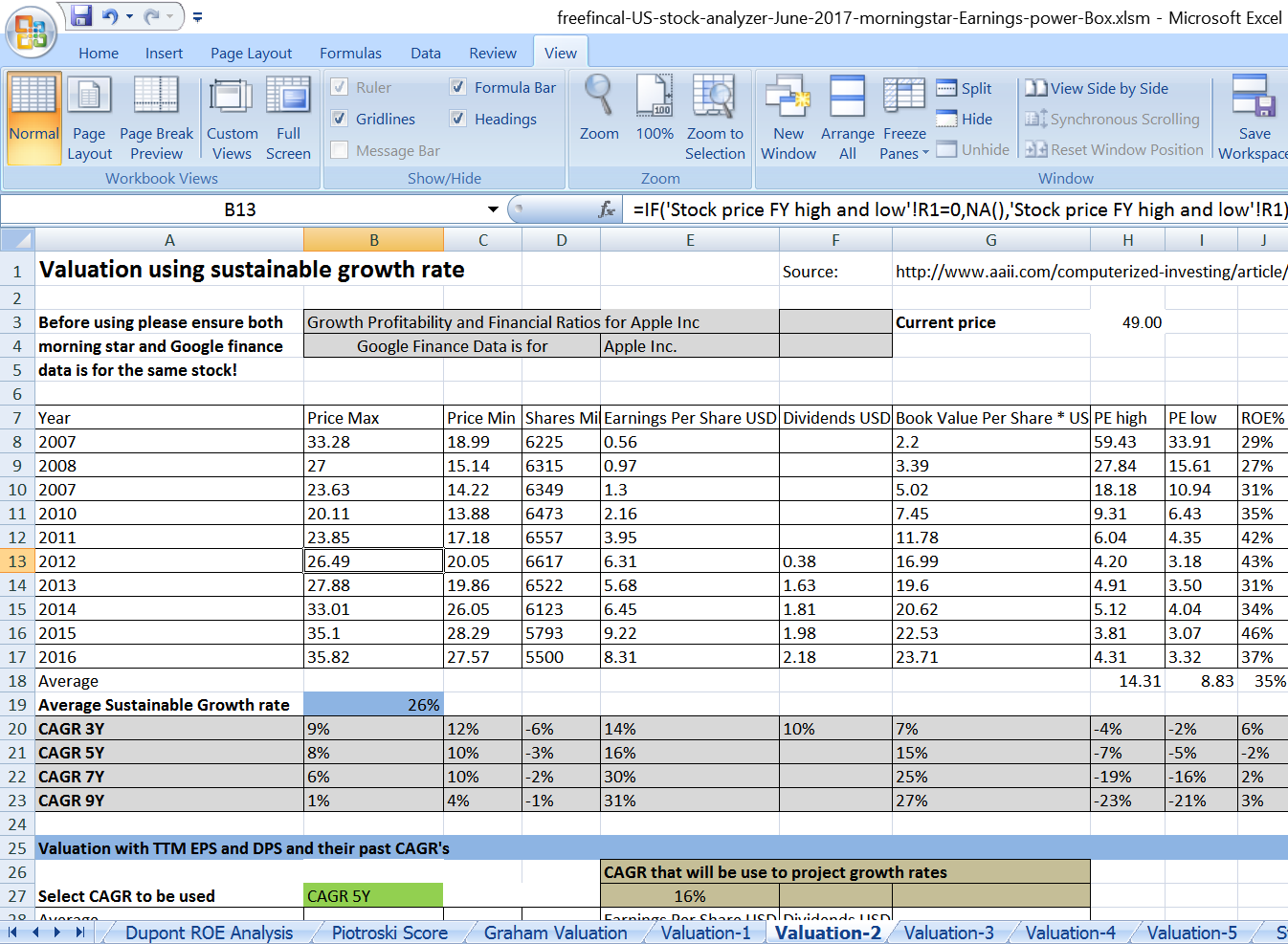

Apple Stock Decline Impact Of Announced Tariffs

May 25, 2025

Apple Stock Decline Impact Of Announced Tariffs

May 25, 2025 -

Apple Stock Outlook Post Q2 Earnings Report

May 25, 2025

Apple Stock Outlook Post Q2 Earnings Report

May 25, 2025 -

Europe And Bangladesh A Focus On Economic Growth Through Collaboration

May 25, 2025

Europe And Bangladesh A Focus On Economic Growth Through Collaboration

May 25, 2025 -

Apple Stock Investment Analysis Of Q2 Financial Results

May 25, 2025

Apple Stock Investment Analysis Of Q2 Financial Results

May 25, 2025